Hi! I am sooooo stuck on this question. Everything I have so far says it is correct when I check my work but I am stuck.

Here are the list of actions I have to take on the ledger:

-

1

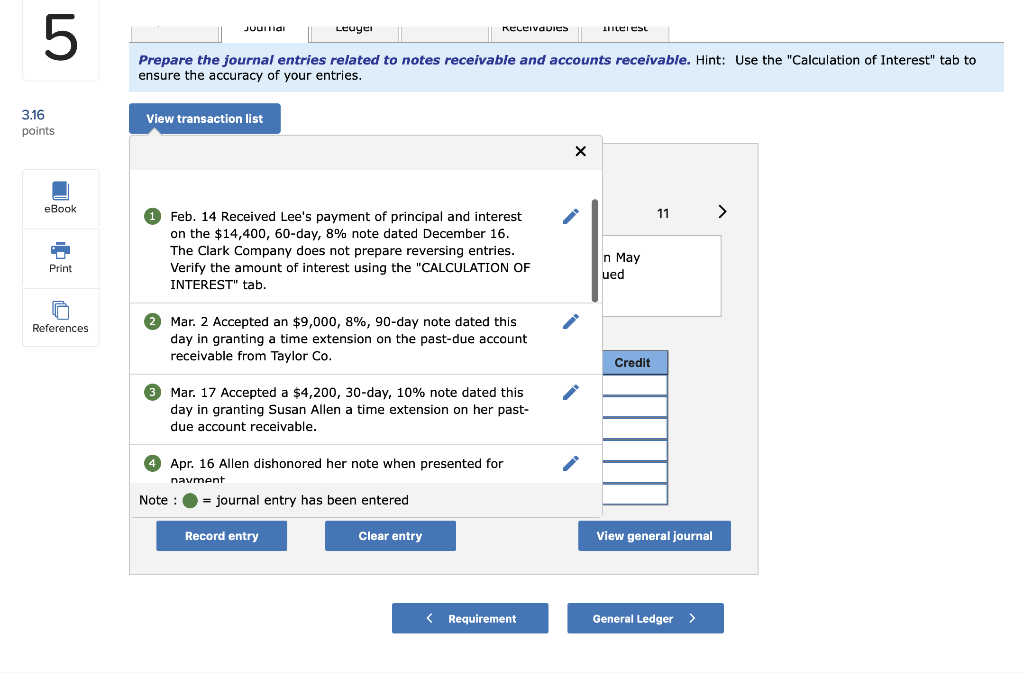

Feb. 14 Received Lee's payment of principal and interest on the $14,400, 60-day, 8% note dated December 16. The Clark Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab.

-

2

Mar. 2 Accepted an $9,000, 8%, 90-day note dated this day in granting a time extension on the past-due account receivable from Taylor Co.

-

3

Mar. 17 Accepted a $4,200, 30-day, 10% note dated this day in granting Susan Allen a time extension on her past-due account receivable.

-

4

Apr. 16 Allen dishonored her note when presented for payment.

-

5

May 31 Taylor Co. refuses to pay the note that was due to Clark Co. on May 31. Prepare the journal entry to charge the dishonored note plus accrued interest to Taylor Co.'s accounts receivable.

-

6

Jul. 16 Received payment from Taylor Co. for the maturity value of its dishonored note plus interest for 46 days beyond maturity at 8%. (Round interest to the nearest whole dollar.)

-

7

Aug. 7 Accepted a(n) $12,000, 90-day, 12% note dated this day in granting a time extension on the past-due account receivable of Carter Co.

-

8

Sept. 3 Accepted a $5,400, 60-day, 10% note dated this day in granting June Taylor a time extension on his past-due account receivable.

-

9

Nov. 2 Received payment of principal plus interest from Taylor for the September 3 note.

-

10

Nov. 5 Received payment of principal plus interest from Carter for the August 7 note.

-

11

Dec. 1 Wrote off the Allen account against Allowance for Doubtful Accounts. No additional interest was accrued.

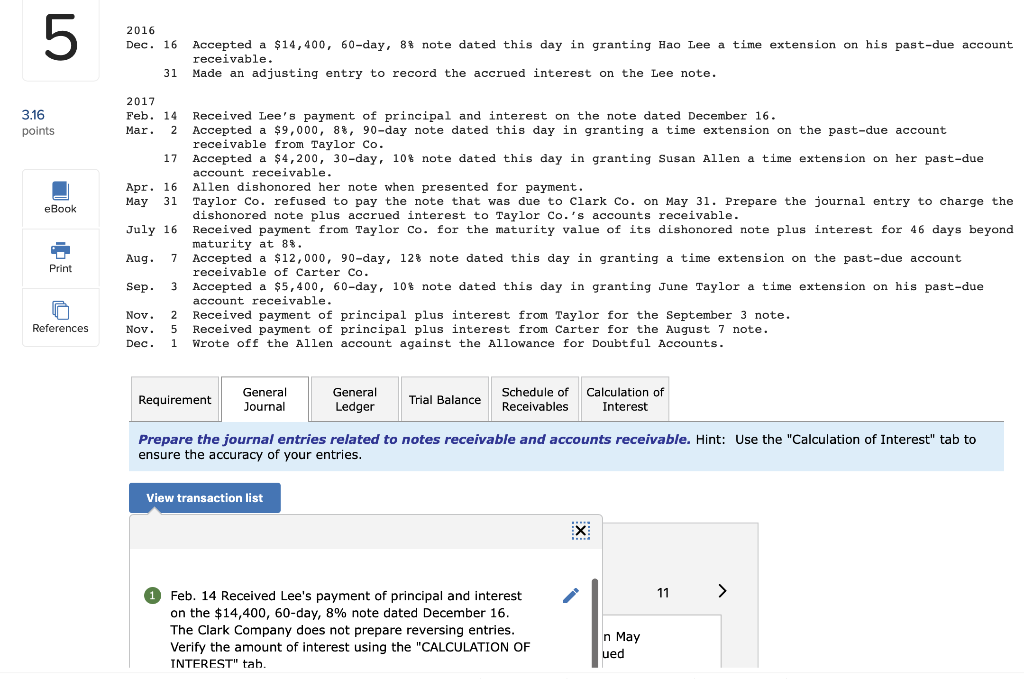

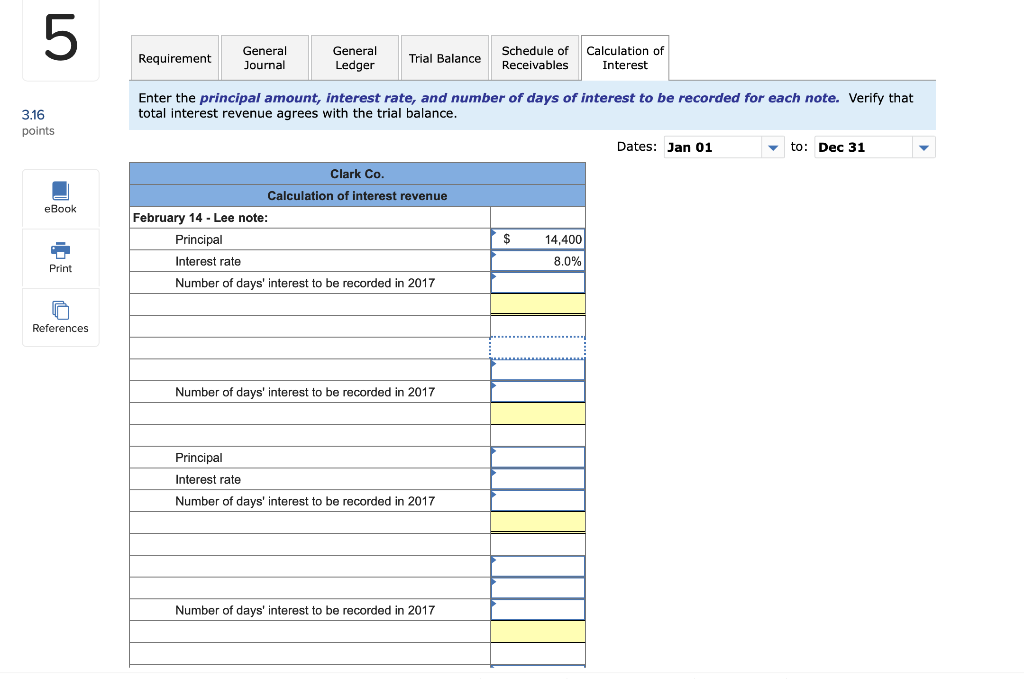

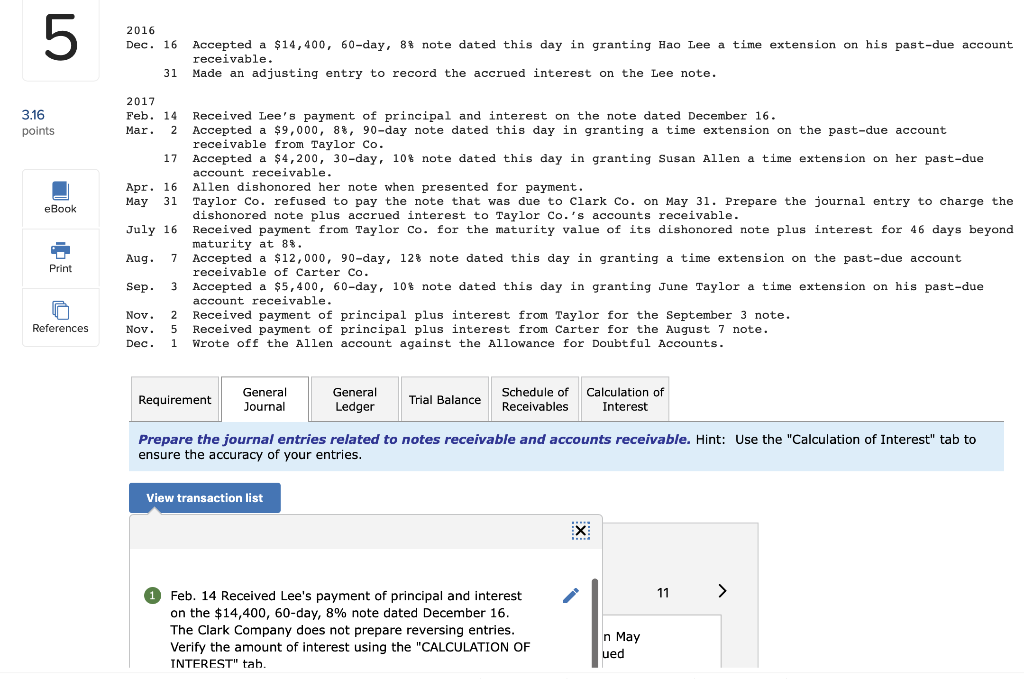

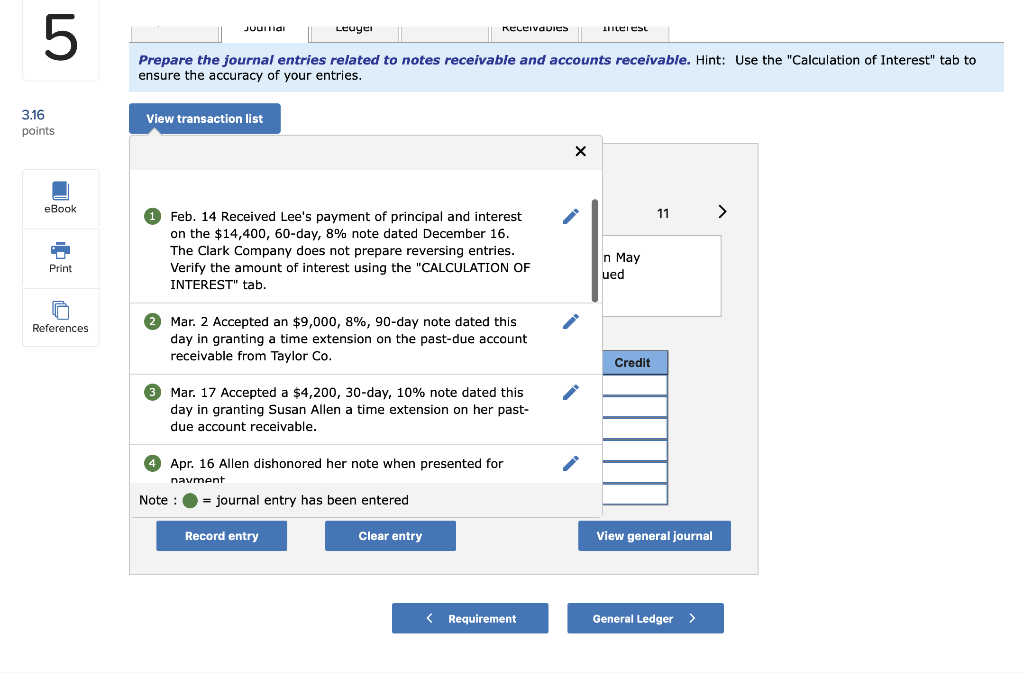

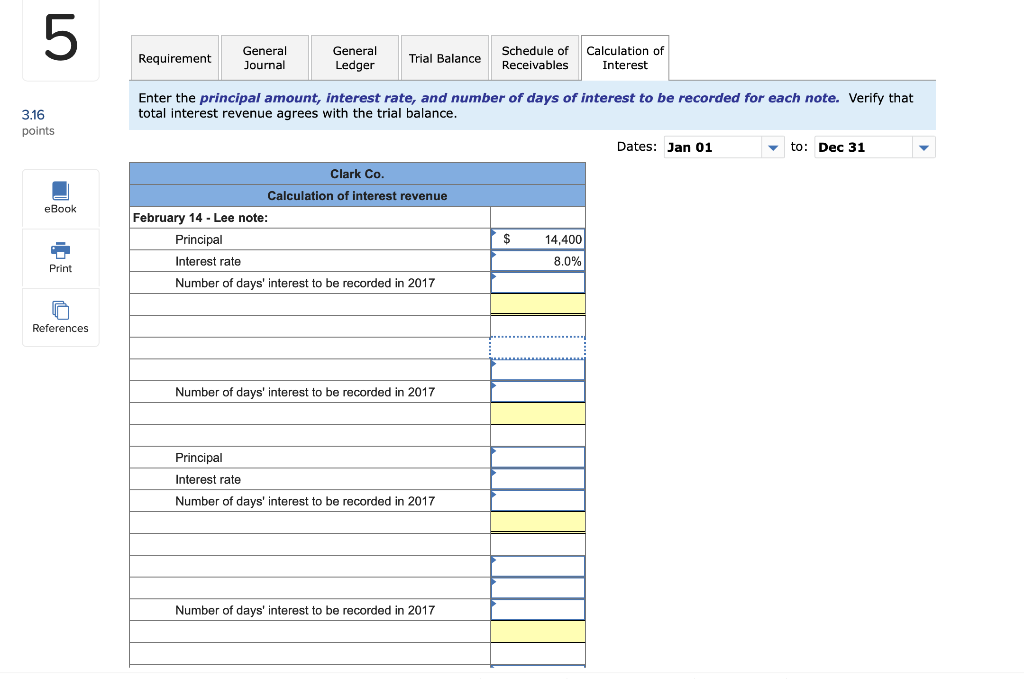

2016 Dec. 16 Accepted a $14,400, 60-day, 8% note dated this day in granting Hao Lee a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Lee note. 3.16 points eBook 2017 Feb. 14 Received Lee's payment of principal and interest on the note dated December 16. Mar. 2 Accepted a $9,000, 88, 90-day note dated this day in granting a time extension on the past-due account receivable from Taylor Co. 17 Accepted a $4,200, 30-day, 108 note dated this day in granting Susan Allen a time extension on her past-due account receivable. Apr. 16 Allen dishonored her note when presented for payment. May 31 Taylor Co. refused to pay the note that was due to Clark Co. on May 31. Prepare the journal entry to charge the dishonored note plus accrued interest to Taylor Co.'s accounts receivable. July 16 Received payment from Taylor Co. for the maturity value of its dishonored note plus interest for 46 days beyond maturity at 8%. Aug. 7 Accepted a $12,000, 90-day, 12% note dated this day in granting a time extension on the past-due account receivable of Carter Co. Sep. 3 Accepted a $5,400, 60-day, 108 note dated this day in granting June Taylor a time extension on his past-due account receivable. Nov. 2 Received payment of principal plus interest from Taylor for the September 3 note. Nov. 5 Received payment of principal plus interest from Carter for the August 7 note. Dec. 1 wrote off the Allen account against the Allowance for Doubtful Accounts. Print References Requirement General Journal General Ledger Trial Balance Schedule of Receivables Calculation of Interest Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation of Interest" tab to ensure the accuracy of your entries. View transaction list 11 > Feb. 14 Received Lee's payment of principal and interest on the $14,400, 60-day, 8% note dated December 16. The Clark Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. n May ued Jouillai | Leuyer Rectivavies Lei SL Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation of Interest" tab to ensure the accuracy of your entries. 3.16 points View transaction list eBook 11 > Feb. 14 Received Lee's payment of principal and interest on the $14,400, 60-day, 8% note dated December 16. The Clark Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Print n May ued References Mar. 2 Accepted an $9,000, 8%, 90-day note dated this day in granting a time extension on the past-due account receivable from Taylor Co. Credit Mar. 17 Accepted a $4,200, 30-day, 10% note dated this day in granting Susan Allen a time extension on her past- due account receivable. Apr. 16 Allen dishonored her note when presented for navment Note : = journal entry has been entered Record entry Clear entry View general journal Requirement General Journal General Ledger Trial Balance Schedule of Receivables Calculation of Interest 3.16 points Enter the principal amount, interest rate, and number of days of interest to be recorded for each note. Verify that total interest revenue agrees with the trial balance. Dates: Jan 01 to: Dec 31 eBook Clark Co. Calculation of interest revenue February 14 - Lee note: Principal Interest rate Number of days' interest to be recorded in 2017 $ 14,400 8.0% Print References Number of days' interest to be recorded in 2017 Principal Interest rate Number of days' interest to be recorded in 2017 Number of days' interest to be recorded in 2017