Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi I cannot fingure out Part C, all of the other parts are correct. additional seting and general expenses related to the dinoseurs bt 553,000

Hi I cannot fingure out Part C, all of the other parts are correct.

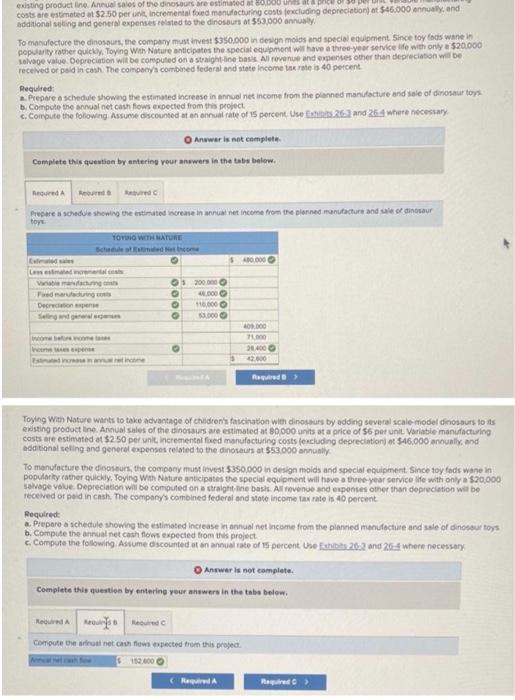

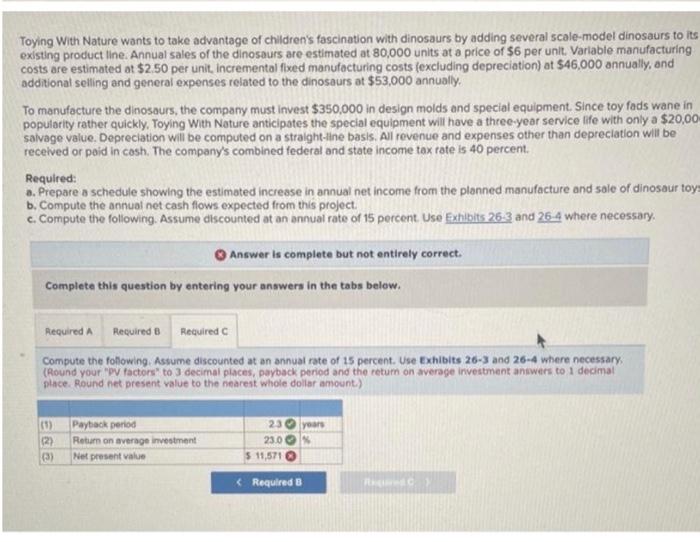

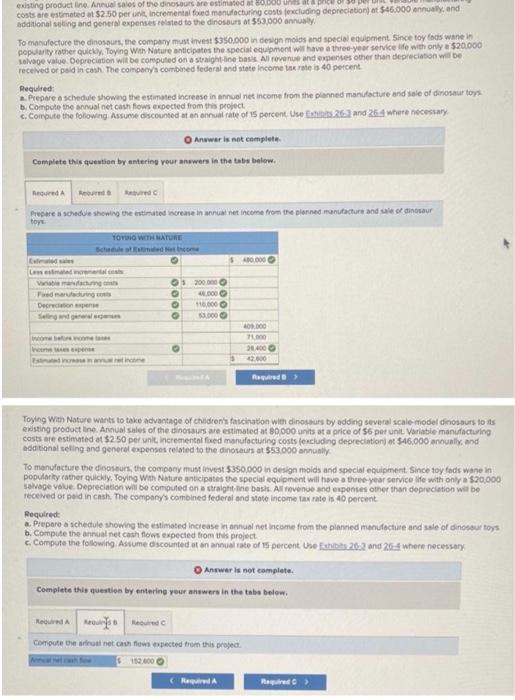

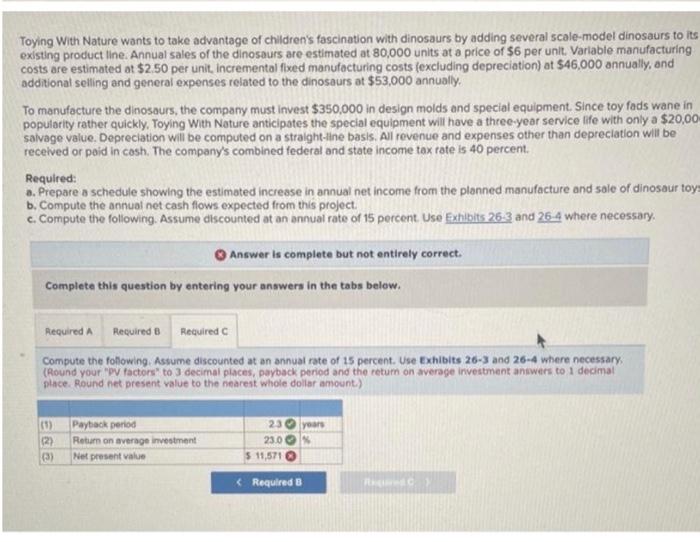

additional seting and general expenses related to the dinoseurs bt 553,000 annualy. To maculocture the dinosourh, the compony must envent 5350,000 in design moigs and special equpment Since toy Gbds wane in popuarity rather quickly. Toying Wah Nature anticipates the speciat equpmont will harve a three-yeer service life with ony a 520000 rolvage value Deprecietion wit be computed on a straight lioe bass All reve nue and expenses other than depreciason wil be rectived or poid in cash. The compecys combined federal and state income tas rate is 40 percent Requiled: a. Prepare a schedule thoweng the estmated increese in annuel net income from the pianned manufocture and sale of dinosaur tops. b. Compule the annual net canh fows expected from this peolect. c. Compute the following Assume dscounted of an onnuli rate of 15 percent. Use fothith. 25.3 and 26.4 where hecestary: Anwwer is ant chmpleta. Complete this quentien by entering reur anwers in the tabs below. Fiegore a achedue shening the entimates inorease in arnual net income from the plonned munutacture and wie or dinosaur tope Toying With Nature warts to take advantage of chidrenis faccination with dinothurs by adding several scale model dinosours to as exsting product ine. Arnual sales of the dinossurs are estimoted at 80.000 unts at a price of 56 per unit variable manufacturing costs are estimated at $2.50 per unit incremental ficed manufacturing costs (exeluding depreciation) at $46.000 anoually, and abditional tefling and generel expeoses related to the dinosaus at 5.53 .000 annoally. To manulacture the dinoseurs, the compocy must invest 5350.000 in design moids and special equipment. Since toy fods wane in popularliy cather ouichly, Foying Whh Nipture anticipates the special equlpment will hove a three-year service life with only a 570,000 . savage value. Depreciation wili be computed on a stalght hne bask. All revenue and eupeotes other than depreciation wal be recelved of no d in cash. The comparys combined federai and state income tax rate is 40 percent: Required a. Piepore a schedule showing the estimated inciease in annual net incame from the planned manufocture and sale of dinossur tors b. Compute the annual net cash flows expected trom this project c. Compute the folowing. Assume discounted ot an annual rate of 15 percent. Use Eathats 262 and 26.4 where necessory Answer is not eomplete. Complete this auestien by entering reur answers in the tabe belew. Compute bie artrual net cark fluwi apected foen this orogect. Toying With Nature wants to take advantage of children's fascination with dinosaurs by adding several scale-model dinosaurs to its existing product line. Annual sales of the dinosaurs are estimated at 80,000 units at a price of $6 per unit. Variable manufacturing costs are estimated at $2.50 per unit, incremental fixed manufacturing costs (excluding depreciation) at $46,000 annually, and additional selling and general expenses related to the dinosaurs at $53,000 annually. To manufacture the dinosaurs, the company must invest $350,000 in design molds and special equipment. Since toy fads wane in popularity rather quickly. Toying With Nature anticipates the special equipment will have a three-year service life with only a $20,00 salvage value. Depreciation will be computed on a straight-line basis. Al revenue and expenses other than depreciation wili be recelved or poid in cosh. The company's combined federal and state income tax rate is 40 percent. Required: a. Prepare a schedule showing the estimated increase in annual net income from the planned manufacture and sale of dinosaur toy b. Compute the annual net cash flows expected from this project. c. Compute the following. Assume discounted at an annual rate of 15 percent. Use and 264 where necessary. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute the following. Assume discounted at an annual rate of 15 percent. Use Exhibits 26-3 and 26-4 where necessary (Round your "py tactors" to 3 decimal places, payback period and the retum on average investment ankwers to 1 decima! place. Round net present value to the nearest whole doliar amount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started