Answered step by step

Verified Expert Solution

Question

1 Approved Answer

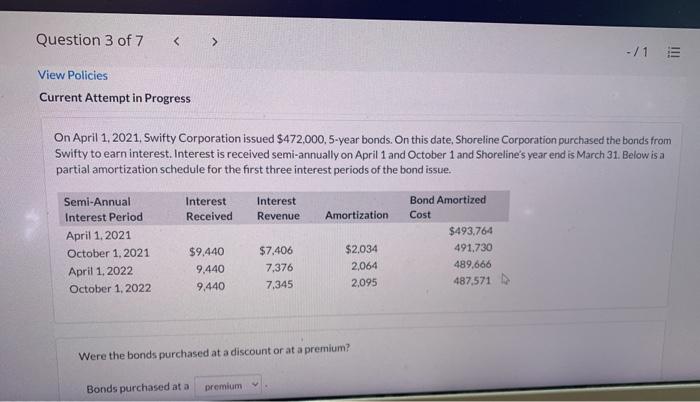

Hi, I don't know how to solve this question... Below more, please.. How can I get answers to interest revenue as 7,406 , 7,376 and

Hi, I don't know how to solve this question...

Below more, please..

How can I get answers to interest revenue as 7,406 , 7,376 and 7,345??? is that just given numbers?

Also, How about Amortization..

and Bond Amortized cost / how can I get these answers??

I found by my self these answers.

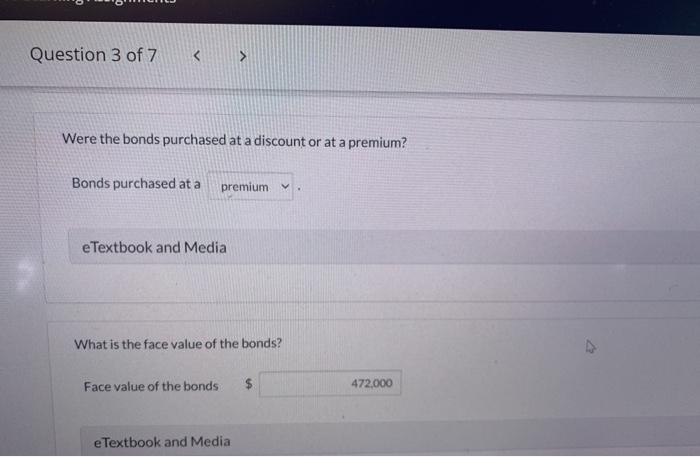

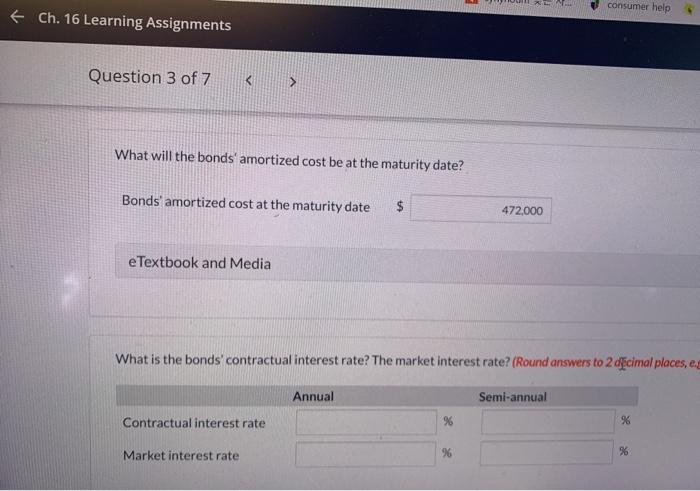

I don't know how to get answers for contractual interest rate and Market interest rate.

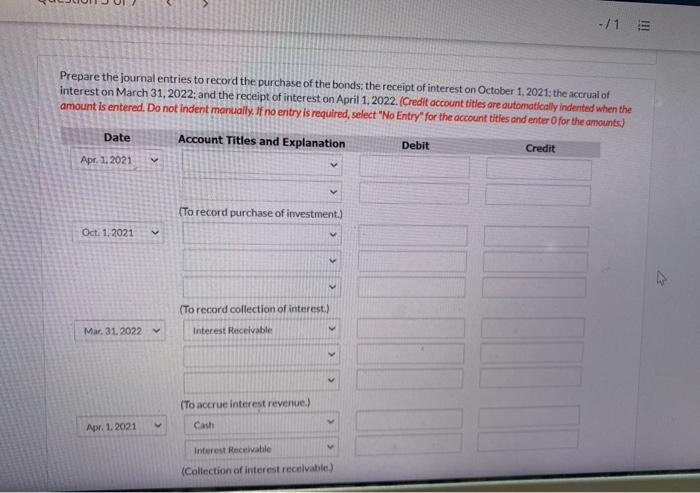

Lastly, this journal entries.

I will lookforward to seeing solutions

Thank you !

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started