Hi,

I don't understand the answer provided in the image (the end, with all the discounts ... = 349,045). For example, I don't get why we discount by 1,1^5 for while we buy the warehouse in t + 4 or why the last year is discounted for 9 year instead of 8.

Could you please help me on that ? Thanks

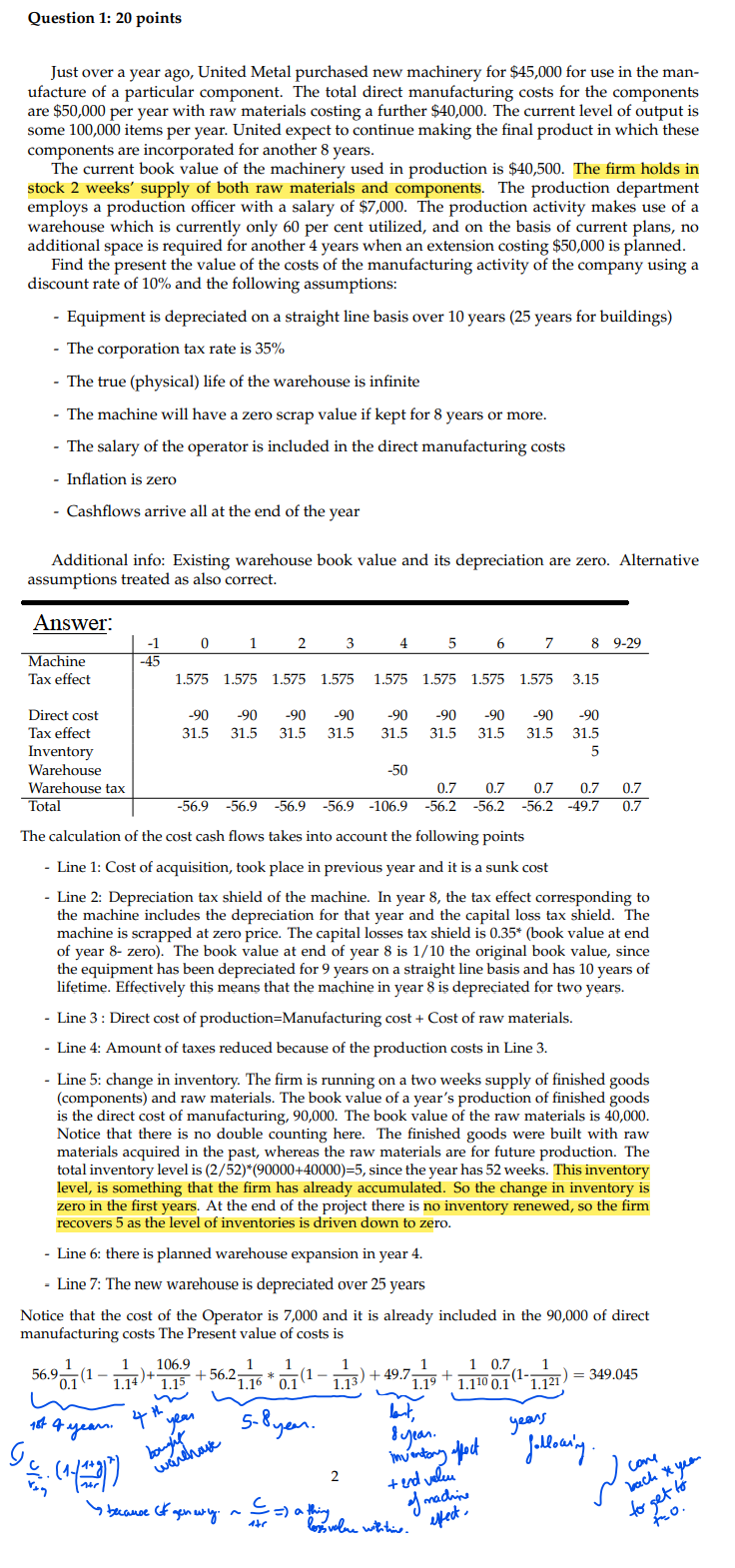

Question 1: 20 points Just over a year ago, United Metal purchased new machinery for $45,000 for use in the man- ufacture of a particular component. The total direct manufacturing costs for the components are $50,000 per year with raw materials costing a further $40,000. The current level of output is some 100,000 items per year. United expect to continue making the final product in which these components are incorporated for another 8 years. The current book value of the machinery used in production is $40,500. The firm holds in stock 2 weeks' supply of both raw materials and components. The production department employs a production officer with a salary of $7,000. The production activity makes use of a warehouse which is currently only 60 per cent utilized, and on the basis of current plans, no additional space is required for another 4 years when an extension costing $50,000 is planned. Find the present the value of the costs of the manufacturing activity of the company using a discount rate of 10% and the following assumptions: - Equipment is depreciated on a straight line basis over 10 years (25 years for buildings) - The corporation tax rate is 35% - The true (physical) life of the warehouse is infinite - The machine will have a zero scrap value if kept for 8 years or more. - The salary of the operator is included in the direct manufacturing costs - Inflation is zero - Cashflows arrive all at the end of the year Additional info: Existing warehouse book value and its depreciation are zero. Alternative assumptions treated as also correct. Answer: - 1 0 2 3 4 5 6 7 8 9-29 Machine Tax effect 1.575 1.575 1.575 1.575 1.575 1.575 1.575 1.575 3.15 Direct cost -90 -90 -90 -90 -90 -90 -90 -90 -90 Tax effect 31.5 31.5 31.5 31.5 31.5 31.5 31.5 31.5 31.5 Inventory 5 Warehouse -50 Warehouse tax 0.7 0.7 0.7 0.7 0.7 Total -56.9 -56.9 -56.9 -56.9 -106.9 -56.2 -56.2 -56.2 -49.7 0.7 The calculation of the cost cash flows takes into account the following points - Line 1: Cost of acquisition, took place in previous year and it is a sunk cost - Line 2: Depreciation tax shield of the machine. In year 8, the tax effect corresponding to the machine includes the depreciation for that year and the capital loss tax shield. The machine is scrapped at zero price. The capital losses tax shield is 0.35* (book value at end of year 8- zero). The book value at end of year 8 is 1/10 the original book value, since the equipment has been depreciated for 9 years on a straight line basis and has 10 years of lifetime. Effectively this means that the machine in year 8 is depreciated for two years. - Line 3 : Direct cost of production=Manufacturing cost + Cost of raw materials. - Line 4: Amount of taxes reduced because of the production costs in Line 3. - Line 5: change in inventory. The firm is running on a two weeks supply of finished goods (components) and raw materials. The book value of a year's production of finished goods is the direct cost of manufacturing, 90,000. The book value of the raw materials is 40,000. Notice that there is no double counting here. The finished goods were built with raw materials acquired in the past, whereas the raw materials are for future production. The total inventory level is (2/52)*(90000+40000)=5, since the year has 52 weeks. This inventory level, is something that the firm has already accumulated. So the change in inventory is zero in the first years. At the end of the project there is no inventory renewed, so the firm recovers 5 as the level of inventories is driven down to zero. Line 6: there is planned warehouse expansion in year 4. - Line 7: The new warehouse is depreciated over 25 years Notice that the cost of the Operator is 7,000 and it is already included in the 90,000 of direct manufacturing costs The Present value of costs is 56.9 1 1 106.9 + 56.2 1 1 1 0.7 1 1.14+- 1.15 1.16 *0.1 (1 - 1.13 )+ 49.7- "1 19 1.110 0.1 1,121) = 349.045 4 # " year bout 18+ 4 years. 5- 8 year . years bought 8 year . inventory affect ( 1 - / 1 + 3 ) ? come 2 + end vellu back * year of machine to get to because (F gen wy ~ -= ) a thing lopvalue wittie . effect . to