Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, i have a question about taxation and form 940 and scheduled A. I'll appreciate it of someone helps me. I dont know how to

Hi, i have a question about taxation and form 940 and scheduled A. I'll appreciate it of someone helps me.

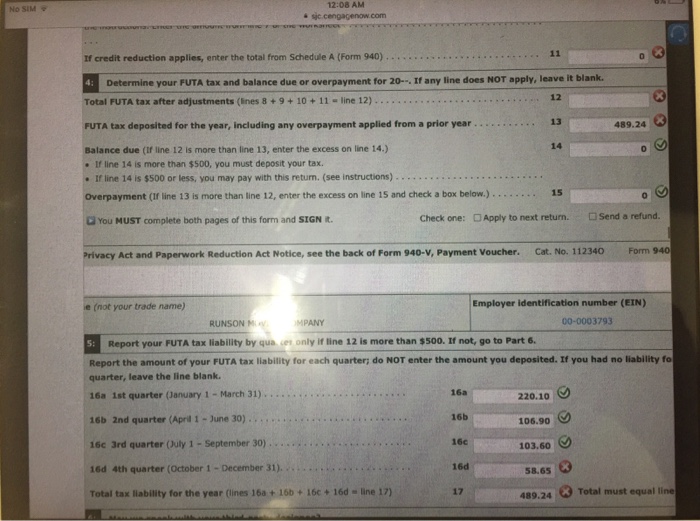

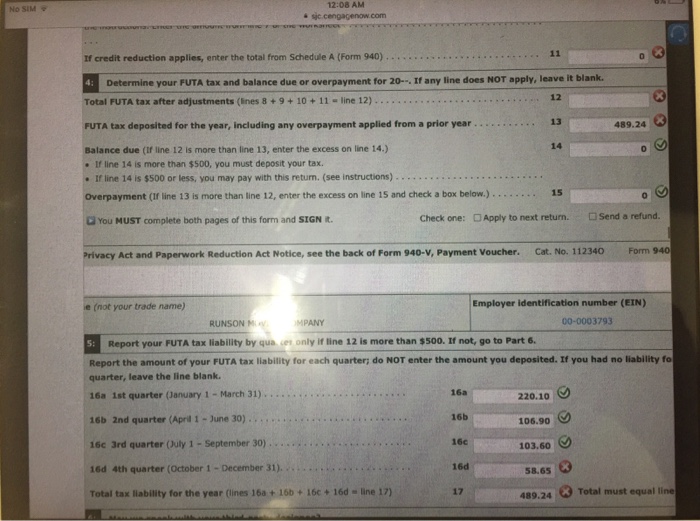

I dont know how to calculate part 3 line 11 " if credit reduction applies, enter the total from schedule A" and part 5 line 16 "16d 4th quarter (October 1 December 31). . . . . . . . . . . . . . . . . . . . . . ."

Note: For this edition, the 2014 federal income tax tables, FICA rates, OASDI rate of 6.2% on wages up to $117,000 and the employee and employer HI rate of 1.45% on all wages was used.

Unless instructed otherwise, click here to calculate hourly rate and overtime rates.

Note: For this textbook edition the rate 0.6% was used for the FUTA tax rate for employers.

As the accountant for Runson Moving Company, you are preparing the company's annual return, Form 940 and Schedule A. Use the following information to complete Form 940 and Schedule A.

The net FUTA tax liability for each quarter of 2015 was as follows: 1st, $220.10; 2nd, $106.90; 3rd, $103.60; and 4th, $58.64 plus the credit reduction.

Since the net FUTA tax liability did not exceed $500 until the 4th quarter, the company was required to make its first deposit of FUTA taxes on February 2, 2016. Assume that the electronic payment was made on time.

a. One of the employees performs all of his duties in another state-Arizona.

b. Total payments made to employees during calendar year 2015:

California $103,170

Arizona 19,100

Total $122,270

c. Employer contributions in California into employees' 401(k) retirement plan: $3,570.

d. Payments made to employees in excess of $7,000: $37,160 ($12,100 from Arizona and $25,060 from California).

e. Form is to be signed by Mickey Vixon, Vice President.

f. Phone number - (219) 555-8310.

If an input box does not require an entry, leave it blank. When required, round amounts to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started