Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi i have reposted it as well but have attached again for your help. Melerial - 4sk of inks beriataturi +15s a ker us cene

Hi i have reposted it as well but have attached again for your help.

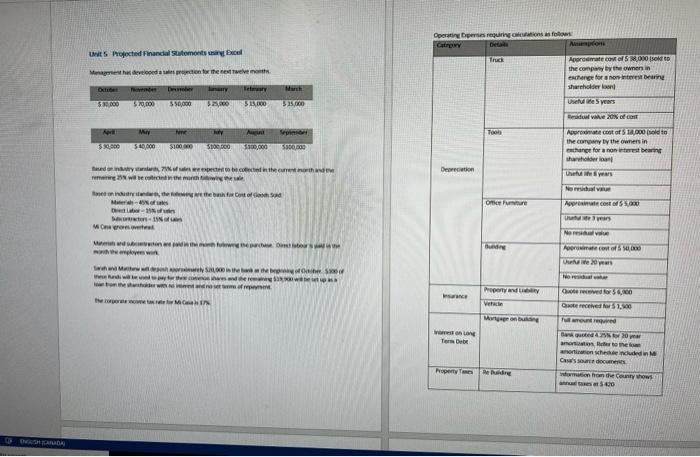

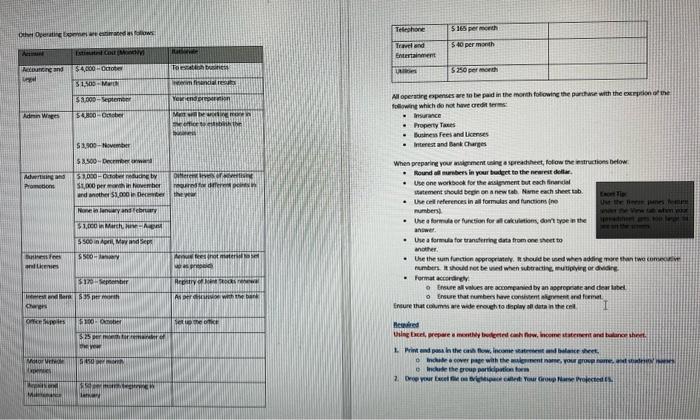

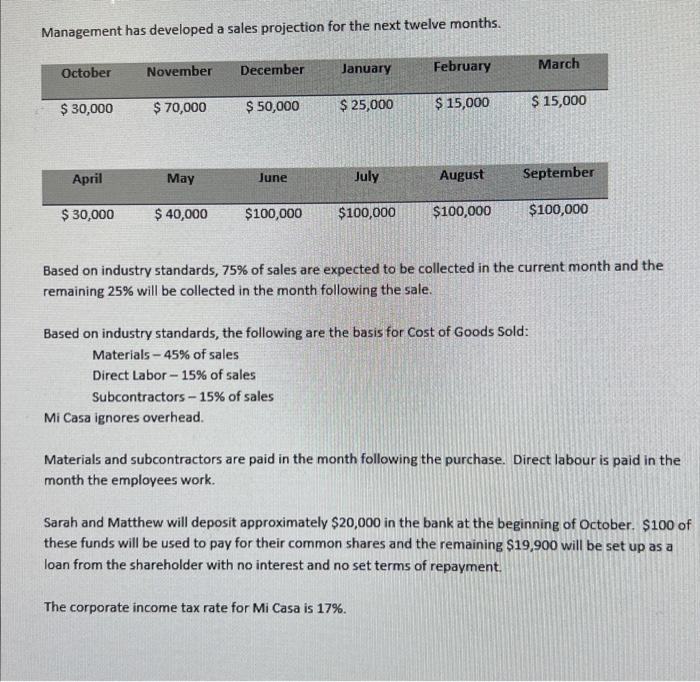

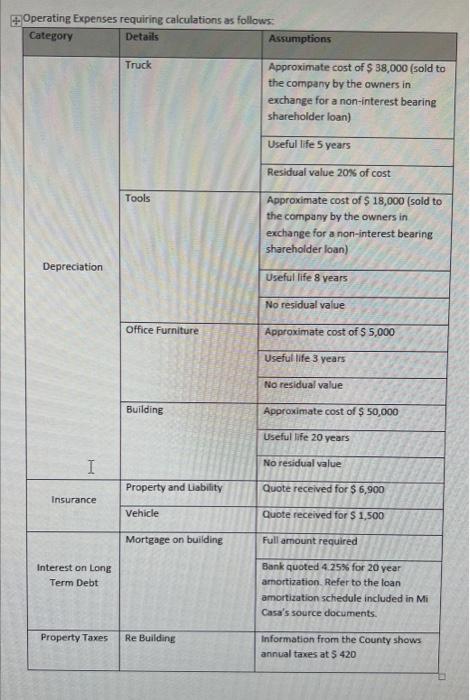

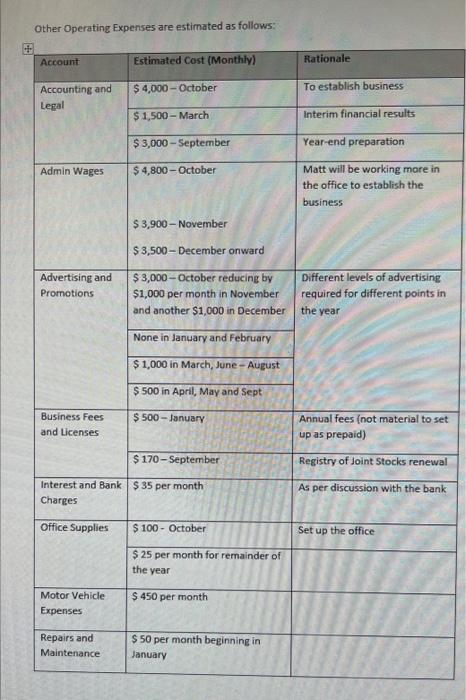

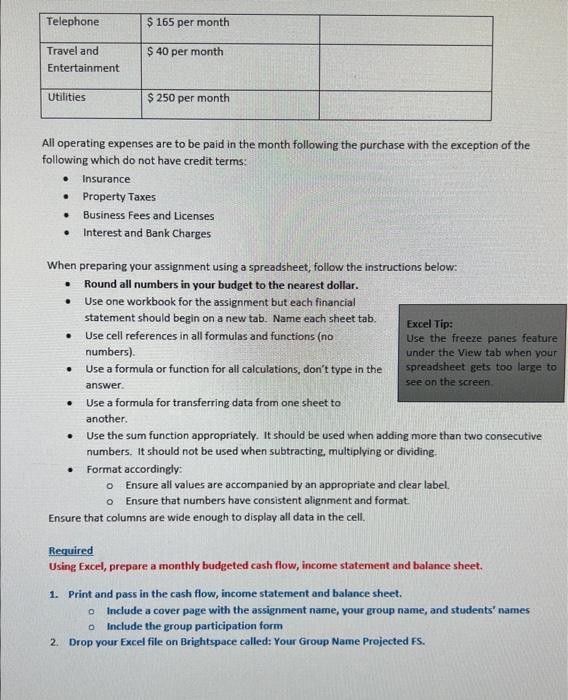

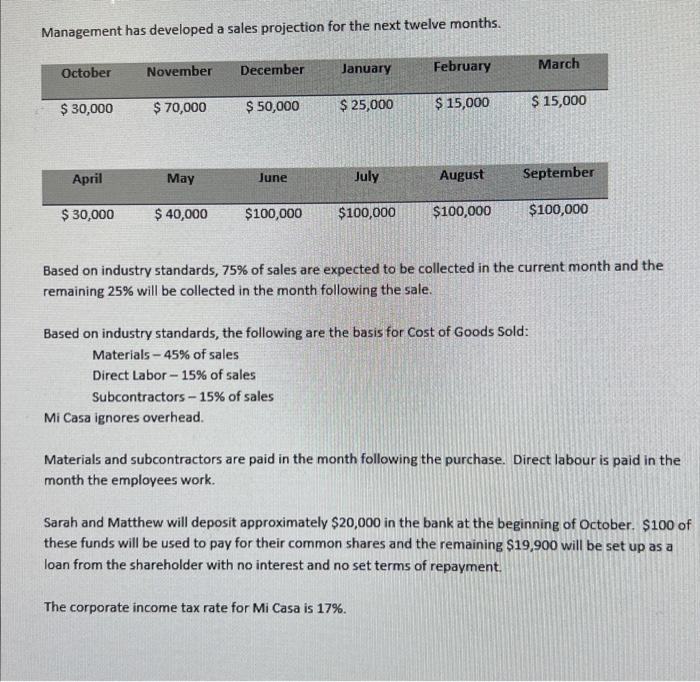

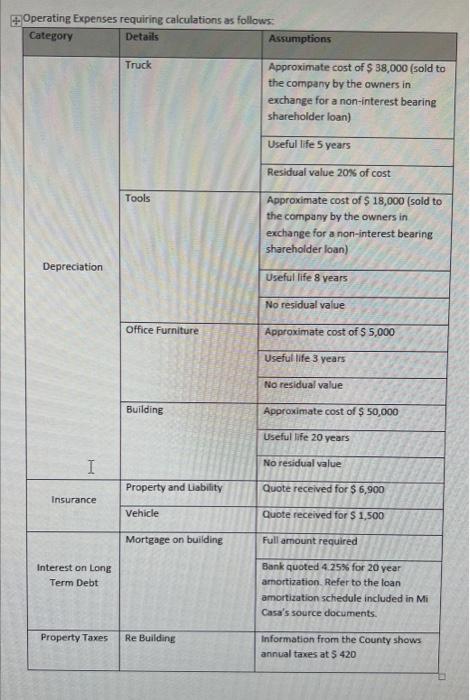

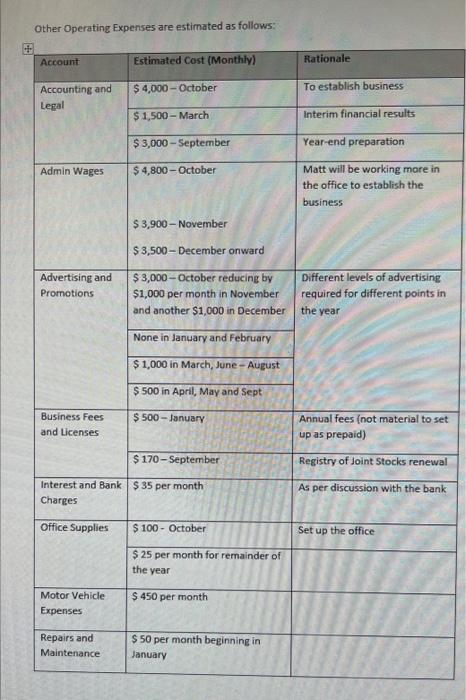

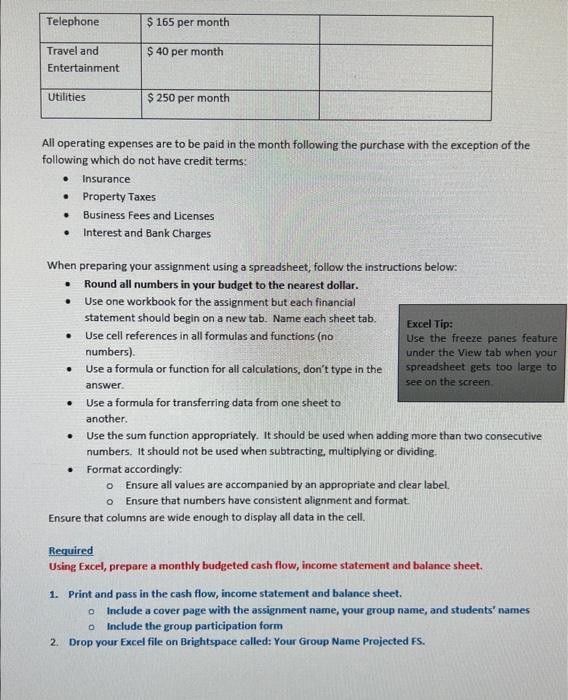

Melerial - 4sk of inks beriataturi +15s a ker us cene crees ieneteat \begin{tabular}{|l|l|l||} \hline TElishone & 5165 per moreh & \\ \hline Trart and Entertainment & \\ \hline Ivicien & 540 permonth & \\ \hline \end{tabular} A oceratire eopenses are an be pad in the month followine the partike with the corryiso of the followint which do not harue dectit ser 1 :s: * Insurance - Froperty Taxes - Hutiness feei and Lceroes - Interest and kink Charges Whes preparing your migment eahe s sereadthect, folow ne intruations betow: - Round at monbers in your budzet to the nrarest dottir. - Use one worbook for the ansigwment but esch finarial thetement thould bepr an a new tab. Nine cach shees tab. - Whe cell references in all formulas and functions (ne) numberit. - Whe a formila er furstion for alf crkiletiom, doan tyoe in the antwel. - Vue a formula for transtering data from one sheet to andther. - Uhe the with function acprogrately, A thould be usod whes addice more than two comocievr number. it thoud rot te vied when subtraitizs, mutipivere or didare. - Format acteridirefy. o. troure all vabues are acmerpanied by an aspreposte and dear tated. friure that coomm are wide enouch to ifiplay all data in the cel. Hewhied 6. Indule the grop partipipation firn Management has developed a sales projection for the next twelve months. Based on industry standards, 75% of sales are expected to be collected in the current month and the remaining 25% will be collected in the month following the sale. Based on industry standards, the following are the basis for Cost of Goods Sold: Materials 45% of sales Direct Labor - 15% of sales Subcontractors 15% of sales Mi Casa ignores overhead. Materials and subcontractors are paid in the month following the purchase. Direct labour is paid in the month the employees work. Sarah and Matthew will deposit approximately $20,000 in the bank at the beginning of October. $100 of these funds will be used to pay for their common shares and the remaining $19,900 will be set up as a loan from the shareholder with no interest and no set terms of repayment. The corporate income tax rate for Mi Casa is 17%. Operating Expenses requiring calculations as follows: Other Operating Expenses are estimated as follows: All operating expenses are to be paid in the month following the purchase with the exception of the following which do not have credit terms: - Insurance - Property Taxes - Business Fees and Licenses - Interest and Bank Charges When preparing your assignment using a spreadsheet, follow the instructions below: - Round all numbers in your budget to the nearest dollar. - Use one workbook for the assignment but each financial statement should begin on a new tab. Name each sheet tab. - Use cell references in all formulas and functions (no Excel Tip: numbers). Use the freeze panes feature - Use a formula or function for all calculations, don't type in the under the View tab when your answer. spreadsheet gets too larse to - Use a formula for transferring data from one sheet to another. - Use the sum function appropriately. It should be used when adding more than two consecutive numbers. It should not be used when subtracting. multiplying or dividing. - Format accordingly: - Ensure all values are accompanied by an appropriate and clear label. Ensure that numbers have consistent alignment and format. Ensure that columns are wide enough to display all data in the cell. Required Using Excel, prepare a monthly budgeted cash flow, income statement and balance sheet. 1. Print and pass in the cash flow, income statement and balance sheet. - Include a cover page with the assignment name, your group name, and students' names - Include the group participation form 2. Drop your Excel file on Brightspace called: Your Group Name Projected FS. Melerial - 4sk of inks beriataturi +15s a ker us cene crees ieneteat \begin{tabular}{|l|l|l||} \hline TElishone & 5165 per moreh & \\ \hline Trart and Entertainment & \\ \hline Ivicien & 540 permonth & \\ \hline \end{tabular} A oceratire eopenses are an be pad in the month followine the partike with the corryiso of the followint which do not harue dectit ser 1 :s: * Insurance - Froperty Taxes - Hutiness feei and Lceroes - Interest and kink Charges Whes preparing your migment eahe s sereadthect, folow ne intruations betow: - Round at monbers in your budzet to the nrarest dottir. - Use one worbook for the ansigwment but esch finarial thetement thould bepr an a new tab. Nine cach shees tab. - Whe cell references in all formulas and functions (ne) numberit. - Whe a formila er furstion for alf crkiletiom, doan tyoe in the antwel. - Vue a formula for transtering data from one sheet to andther. - Uhe the with function acprogrately, A thould be usod whes addice more than two comocievr number. it thoud rot te vied when subtraitizs, mutipivere or didare. - Format acteridirefy. o. troure all vabues are acmerpanied by an aspreposte and dear tated. friure that coomm are wide enouch to ifiplay all data in the cel. Hewhied 6. Indule the grop partipipation firn Management has developed a sales projection for the next twelve months. Based on industry standards, 75% of sales are expected to be collected in the current month and the remaining 25% will be collected in the month following the sale. Based on industry standards, the following are the basis for Cost of Goods Sold: Materials 45% of sales Direct Labor - 15% of sales Subcontractors 15% of sales Mi Casa ignores overhead. Materials and subcontractors are paid in the month following the purchase. Direct labour is paid in the month the employees work. Sarah and Matthew will deposit approximately $20,000 in the bank at the beginning of October. $100 of these funds will be used to pay for their common shares and the remaining $19,900 will be set up as a loan from the shareholder with no interest and no set terms of repayment. The corporate income tax rate for Mi Casa is 17%. Operating Expenses requiring calculations as follows: Other Operating Expenses are estimated as follows: All operating expenses are to be paid in the month following the purchase with the exception of the following which do not have credit terms: - Insurance - Property Taxes - Business Fees and Licenses - Interest and Bank Charges When preparing your assignment using a spreadsheet, follow the instructions below: - Round all numbers in your budget to the nearest dollar. - Use one workbook for the assignment but each financial statement should begin on a new tab. Name each sheet tab. - Use cell references in all formulas and functions (no Excel Tip: numbers). Use the freeze panes feature - Use a formula or function for all calculations, don't type in the under the View tab when your answer. spreadsheet gets too larse to - Use a formula for transferring data from one sheet to another. - Use the sum function appropriately. It should be used when adding more than two consecutive numbers. It should not be used when subtracting. multiplying or dividing. - Format accordingly: - Ensure all values are accompanied by an appropriate and clear label. Ensure that numbers have consistent alignment and format. Ensure that columns are wide enough to display all data in the cell. Required Using Excel, prepare a monthly budgeted cash flow, income statement and balance sheet. 1. Print and pass in the cash flow, income statement and balance sheet. - Include a cover page with the assignment name, your group name, and students' names - Include the group participation form 2. Drop your Excel file on Brightspace called: Your Group Name Projected FS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started