Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! I have the solution already to the question. I just have no idea how the anwers came out. Can someone please explain? Please see

Hi! I have the solution already to the question. I just have no idea how the anwers came out. Can someone please explain? Please see the attached question with the answer underneath, as well as the table given.

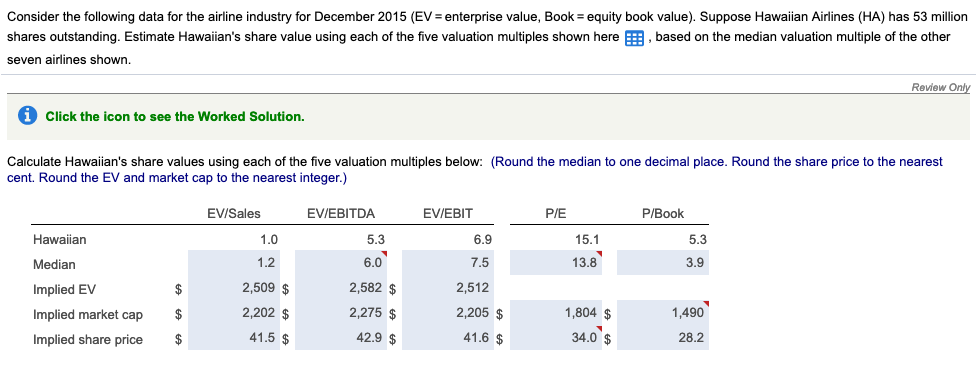

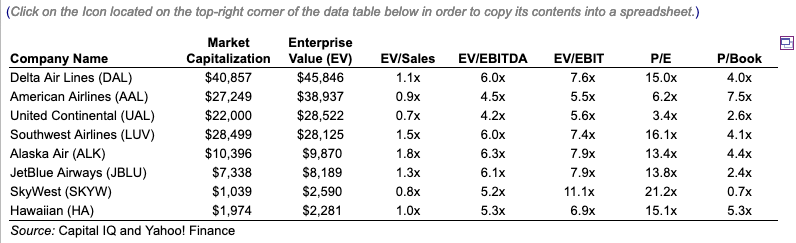

Consider the following data for the airline industry for December 2015 (EV enterprise value, Book- equity book value). Suppose Hawaiian Airlines (HA) has 53 million shares outstanding. Estimate Hawaiian's share value using each of the five valuation multiples shown here , based on the median valuation multiple of the other seven airlines shown. Review Click the icon to see the Worked Solution. Calculate Hawaiian's share values using each of the five valuation multiples below: (Round the median to one decimal place. Round the share price to the nearest cent. Round the EV and market cap to the nearest integer.) EVISales EVIEBITDA EVIEBIT P/E P/Book 6.9 15.1 5.3 Hawaiian Median Implied EV Implied market cap $ Implied share price $ 5.3 6.0 2,582 $ 2,275 $ 42.9 $ 7.5 13.8 3.9 1.2 2,509 $ 2,202 $ 41.5 $ 2,512 1,804 $ 34.0 $ 2,205 $ 1,490 41.6 $ 28.2 Consider the following data for the airline industry for December 2015 (EV enterprise value, Book- equity book value). Suppose Hawaiian Airlines (HA) has 53 million shares outstanding. Estimate Hawaiian's share value using each of the five valuation multiples shown here , based on the median valuation multiple of the other seven airlines shown. Review Click the icon to see the Worked Solution. Calculate Hawaiian's share values using each of the five valuation multiples below: (Round the median to one decimal place. Round the share price to the nearest cent. Round the EV and market cap to the nearest integer.) EVISales EVIEBITDA EVIEBIT P/E P/Book 6.9 15.1 5.3 Hawaiian Median Implied EV Implied market cap $ Implied share price $ 5.3 6.0 2,582 $ 2,275 $ 42.9 $ 7.5 13.8 3.9 1.2 2,509 $ 2,202 $ 41.5 $ 2,512 1,804 $ 34.0 $ 2,205 $ 1,490 41.6 $ 28.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started