Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I have these exercises from my investment class which has its results but I need to know where each of those results comes from.

Hi, I have these exercises from my investment class which has its results but I need to know where each of those results comes from. could help me? thanks.

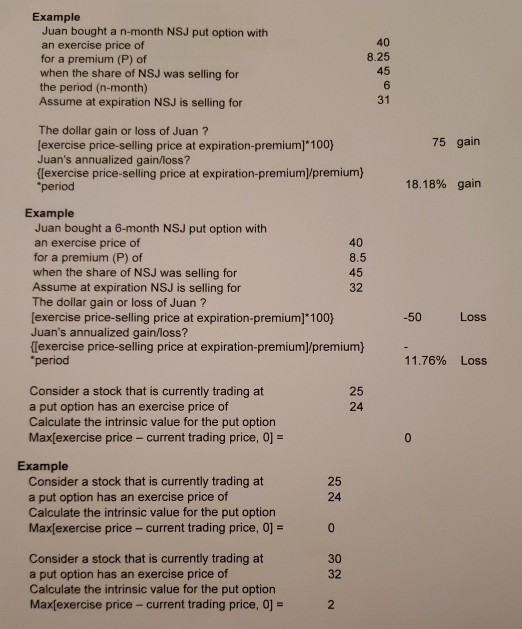

Example Juan bought a n-month NSJ put option with an exercise price of for a premium (P) of when the share of NSJ was selling for the period (n-month) Assume at expiration NSJ is selling for 75 gain The dollar gain or loss of Juan? [exercise price-selling price at expiration-premium)*100) Juan's annualized gain/loss? {[exercise price-selling price at expiration-premium premium) period 18.18% gain 8.5 Example Juan bought a 6-month NSJ put option with an exercise price of for a premium (P) of when the share of NSJ was selling for 45 Assume at expiration NSJ is selling for 32 The dollar gain or loss of Juan? [exercise price-selling price at expiration-premium)*100) Juan's annualized gain/loss? {[exercise price-selling price at expiration-premium]/premium) period -50 Loss 11.76% Loss Consider a stock that is currently trading at a put option has an exercise price of Calculate the intrinsic value for the put option Max[exercise price - current trading price, 0] = Example Consider a stock that is currently trading at a put option has an exercise price of Calculate the intrinsic value for the put option Max[exercise price - current trading price, 0] = Consider a stock that is currently trading at a put option has an exercise price of Calculate the intrinsic value for the put option Max[exercise price-current trading price, 0] =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started