Hi! i just need help solving requirements 3 and 4

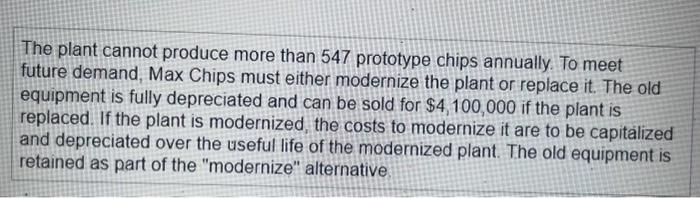

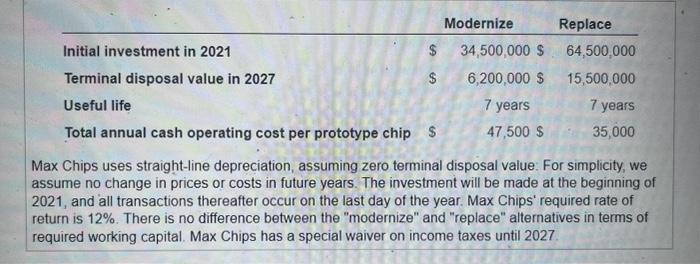

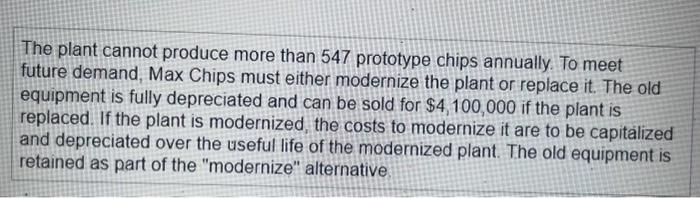

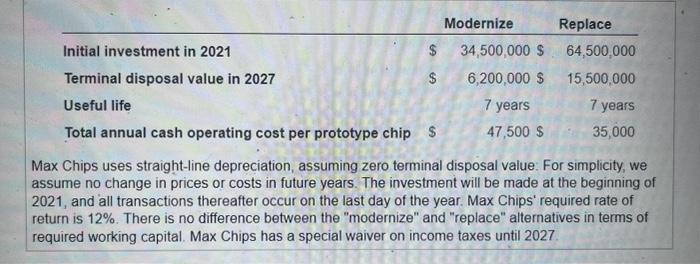

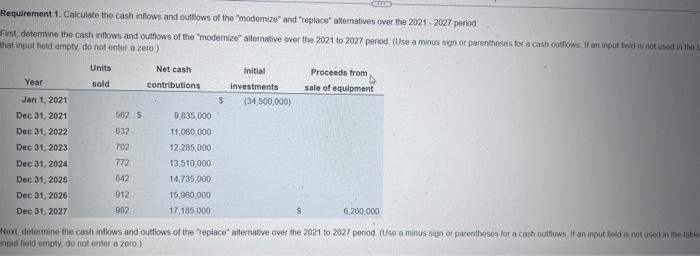

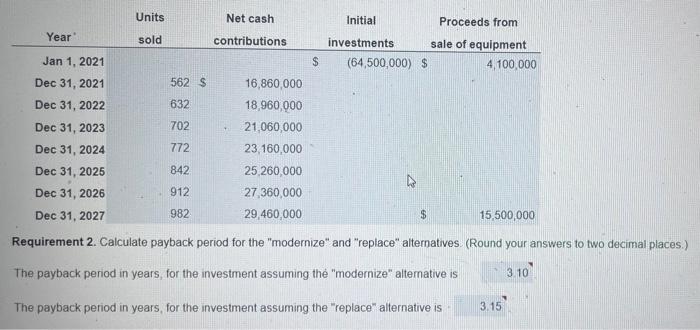

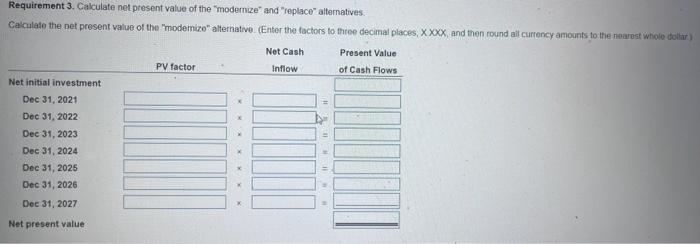

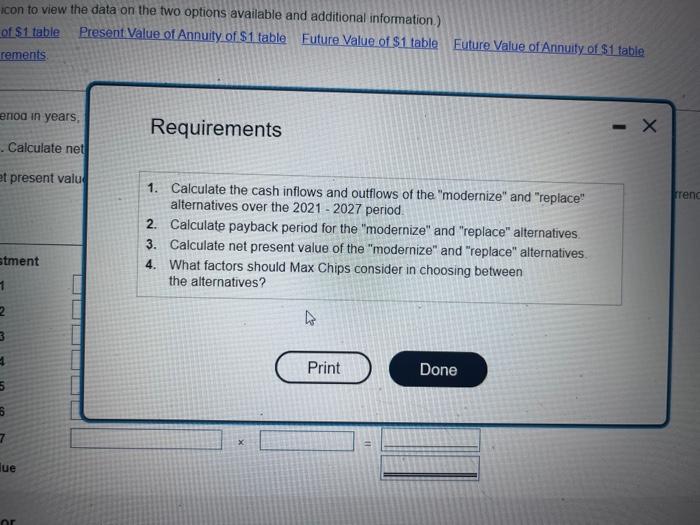

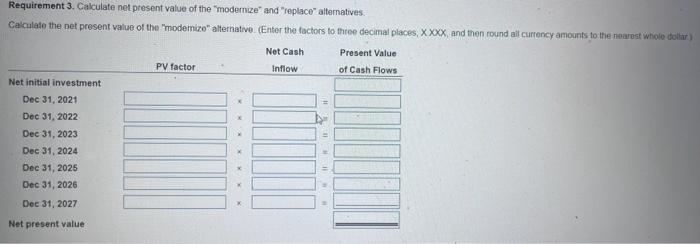

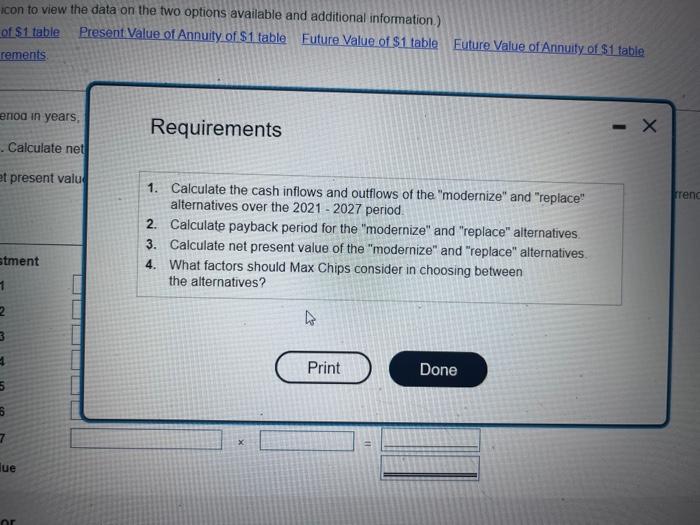

lorecasts growith of 70 protobpo chaps per wear triough 2027 . That ss, Gemand wil be 562 in 2021,632 in 2022,702in2027, mod so 50 . (Click tie icon to vow additional intaimation) The folowing dald on the two cotoons are avalatle (Cick the icon to vere the datar cin the tho options walable and addtional infomation) The plant cannot produce more than 547 prototype chips annually. To meet future demand, Max Chips must either modernize the plant or replace it. The old equipment is fully depreciated and can be sold for $4,100,000 if the plant is replaced. If the plant is modernized, the costs to modernize it are to be capitalized and depreciated over the useful life of the modernized plant. The old equipment is retained as part of the "modernize" alternative Max Chips uses straight-line depreciation, assuming zero terminal disposal value: For simplicity, we assume no change in prices or costs in future years. The investment will be made at the beginning of 2021, and all transactions thereafter occur on the last day of the year. Max Chips' required rate of return is 12%. There is no difference between the "modernize" and "replace" alternatives in terms of required working capital. Max Chips has a special waiver on income taxes until 2027. Requirement 1. Calculate the cash infliows and outflows of the "modernize" and "replaco" allematives over the 2021 - 2027 period Frst; determine the cash inflows and outfows of the "modernize" allemative over the 2021 to 2027 peniod (Use a manus sign or parentheses for a cash outions if an input frid is niot uset in that that input fietd empty, da not entor a zero) hepuf faidid ontety do not ontar a zoro.). Requirement 2. Calculate payback period for the "modernize" and "replace" alternatives. (Round your answers to two decimal places.) The payback period in years, for the investment assuming the "modernize" alternative is The payback period in years, for the investment assuming the "replace" alternative is Requirement 3. Cakculate net present value of the "modernize" and "replace" alternatives. Cakculate the net present value of the "modemizo" alternative. (Enter the factors to throe decimal places, X, and then round all currency amounts to the nearest whiole doititr) Requirements 1. Calculate the cash inflows and outflows of the "modernize" and "replace" alternatives over the 2021-2027 period 2. Calculate payback period for the "modernize" and "replace" alternatives 3. Calculate net present value of the "modernize" and "replace" alternatives 4. What factors should Max Chips consider in choosing between the alternatives