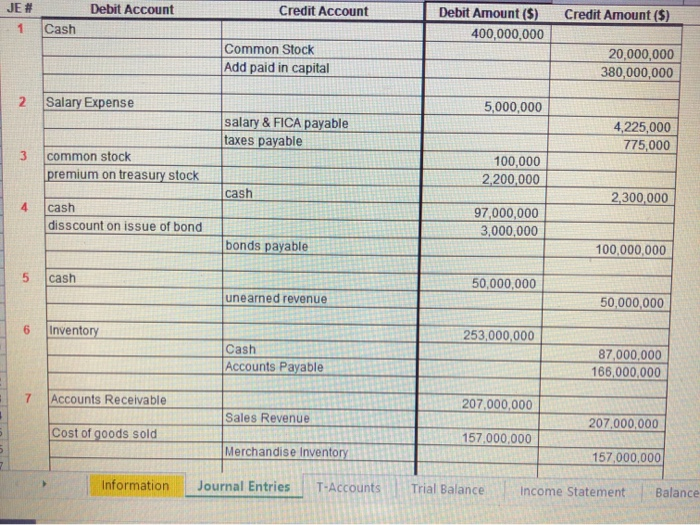

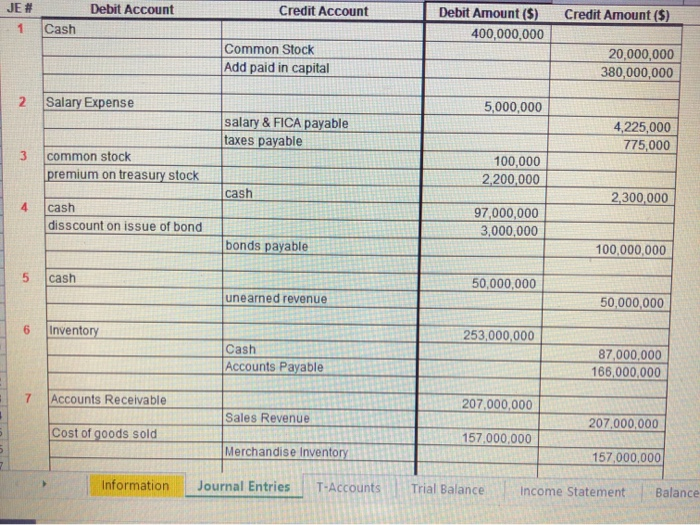

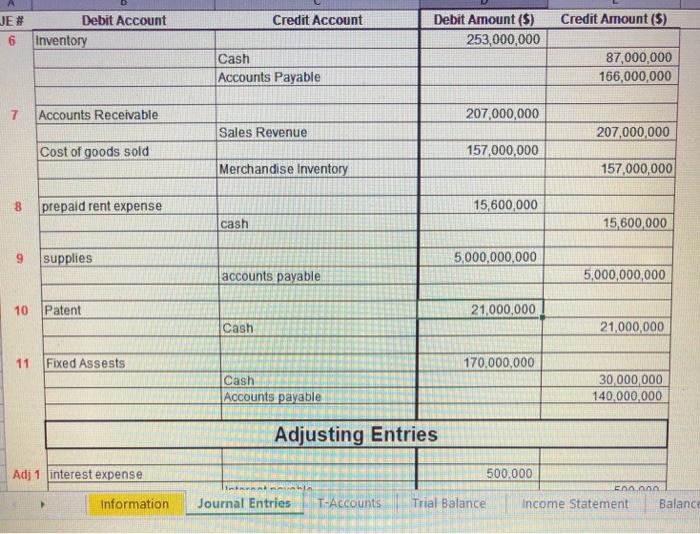

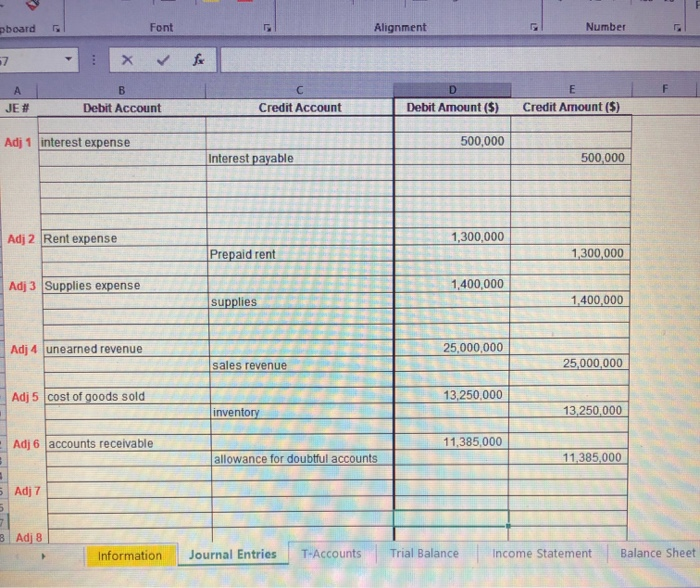

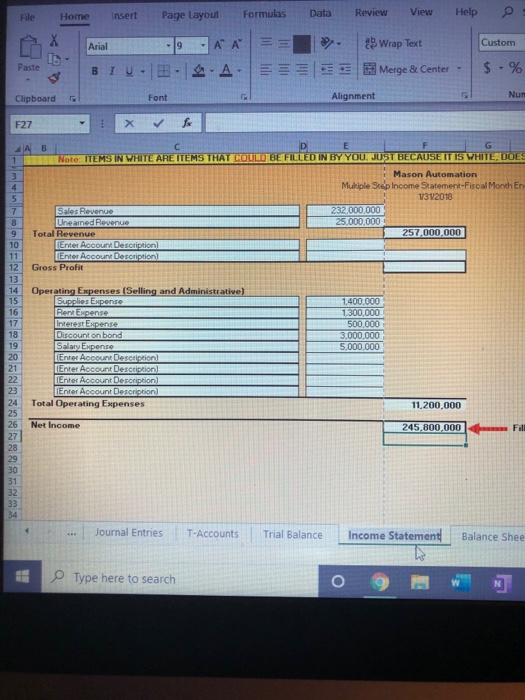

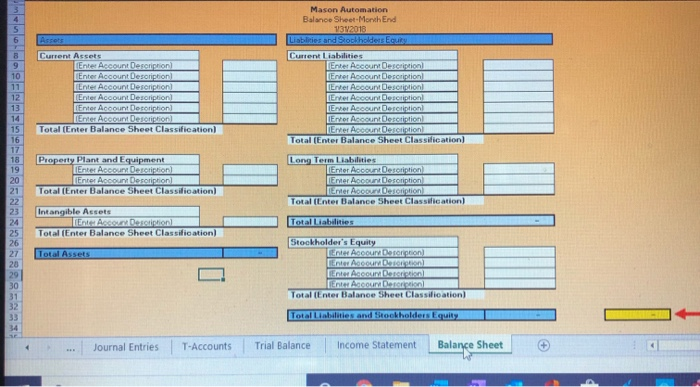

Hi, i just need some help with a balance sheet. (first 2 pics journal entry) (3rd pic adjusting entries) (4th pic income statement).

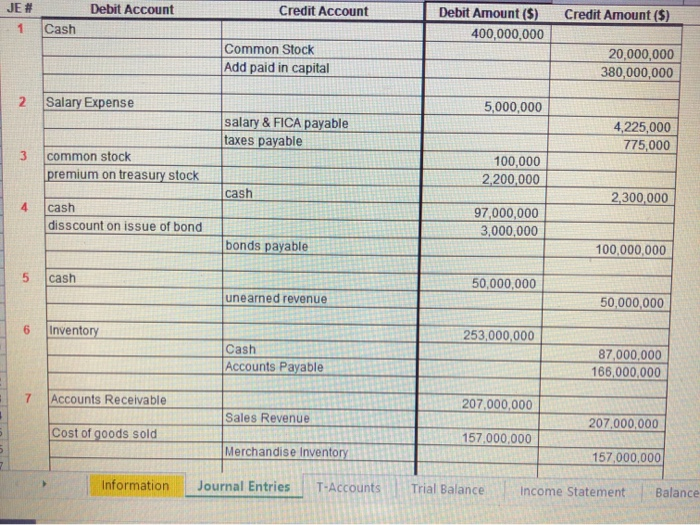

Debit Account Credit Account Credit Amount ($) Debit Amount ($) 400,000,000 Cash Common Stock Add paid in capital 20,000,000 380,000,000 Salary Expense 5,000,000 salary & FICA payable taxes payable 4,225,000 775,000 common stock premium on treasury stock 100,000 2,200,000 cash 2.300,000 cash disscount on issue of bond E 97,000,000 3,000,000 bonds payable 100,000,000 cash 50,000,000 unearned revenue 50,000,000 Inventory 253,000,000 Cash Accounts Payat 87,000,000 166,000,000 Accounts Receivable 207,000,000 Sales Revenue 207,000,000 Cost of goods sold 157.000.000 Merchandise inventory 157,000,000 Information Journal Entries T-Accounts Trial Balance income Statement Balance JE# Debit Account Credit Account Credit Amount ($) Debit Amount ($) 253,000,000 Inventory Cash Accounts Payable 87,000,000 166,000,000 7 Accounts Receivable 207,000,000 Sales Revenue 207,000,000 Cost of goods sold 157,000,000 Merchandise Inventory 157,000,000 prepaid rent expense 15,600,000 A cash 15,600,000 supplies 5,000,000,000 accounts payable 5,000,000,000 10 Patent 21,000,000! Cash 21,000,000 Fixed Assests 170,000,000 A VAR ATT Cash Accounts payable 30,000,000 140,000,000 Adjusting Entries Adj 1 interest expense 500.000 Information Journal Entries nts Trial Balance Income Statement Balance board Font Alignment Number Debit Account Credit Account Debit Amount ($) Credit Amount (5) Adj 1 interest expense DL 500,000 Interest payable 500,000 1 Adj 2 Rent expense 1,300,000 Prepaid rent 1,300,000 Adj 3 Supplies expense 1,400,000 supplies 1,400,000 Adj 4 unearned revenue 25,000,000 sales revenue 25,000,000 Adj 5 cost of goods sold 13,250,000 inventory 13,250,000 Adj 6 accounts receivable 11,385,000 allowance for doubtful accounts | 385.000 Adj 7 3 Adj 8 Information Journal Entries T-Accounts Trial Balance Income Statement Balance Sheet File Data Review View Help Home Insert Page Layout Formulas Arial -19-AA== BIU.E. A. Wrap Text Merge & Center. Custom $ - % Clipboard Font Alignment Nun F27 - x & fx AB Note: ITEMS IN WHITE ARE ITEMS THAT COULD BE FILLED IN BY YOU JUST BECAUSE IT IS WHITE, DOES Mason Automation Multiple Step Income Statement-Fiscal Month En 1312018 Sales Revenue 232,000,000 Unearned Revenue 25 000 000 Total Revenue 257,000,000 Enter Account Description Enter Account Description] Gross Profit 12 Operating Expenses (Selling and Administrative) Supplies Expenso Rent Expense s Interest Expense Discount on bond Salary Empense Enter Account Description) Enter Account Description Enter Account Description) Enter Account Description Total Operating Expenses 1400 000 1,300,000 500.000 3.000.000 5.000.000 11,200.000 Net Income 245,800.000 Journal Entries T-Accounts Trial Balance Income Statement Balance Shee * Type here to search Enter Account Description) Enter Account Desoription! Tente Account Description] Enter Account Description Enter Account Detonghon) Enter Account Description] Total (Enter Balance Sheet Classification) Mason Automation Balance Sheet-Month End 1312018 Lalities and Stockholders Equity Current Liabilities Enter Account Description] Enter Account Description Tente Account Description Enter Account Description Enter Account Description Error Account Description! Errer Account Description Total (Enter Balance Sheet Classification) Property Plant and Equipment Enter Account Description [Entor Account Decongion) Total Enter Balance Sheet Classification Long Term Liabilities Enter Account Description) Enter Account Deroption Enter Account Description) Total (Enter Balance Sheet Classification) Intangible Assets Ente ACCOUN Description Total (Enter Balance Sheet Classification) Total Liabilities Total Assets Stockholder's Equity Enter Account Decorpion TEAccount Decoration Enter Account Description) TER Account Doronion Total Enter Balance Sheet Classification) Total Liabilities and Stockholders Equity Journal Entries T-Accounts Trial Balance Income Statement Balance Sheet