Hi, I just need the answer for question 2! Thank you!

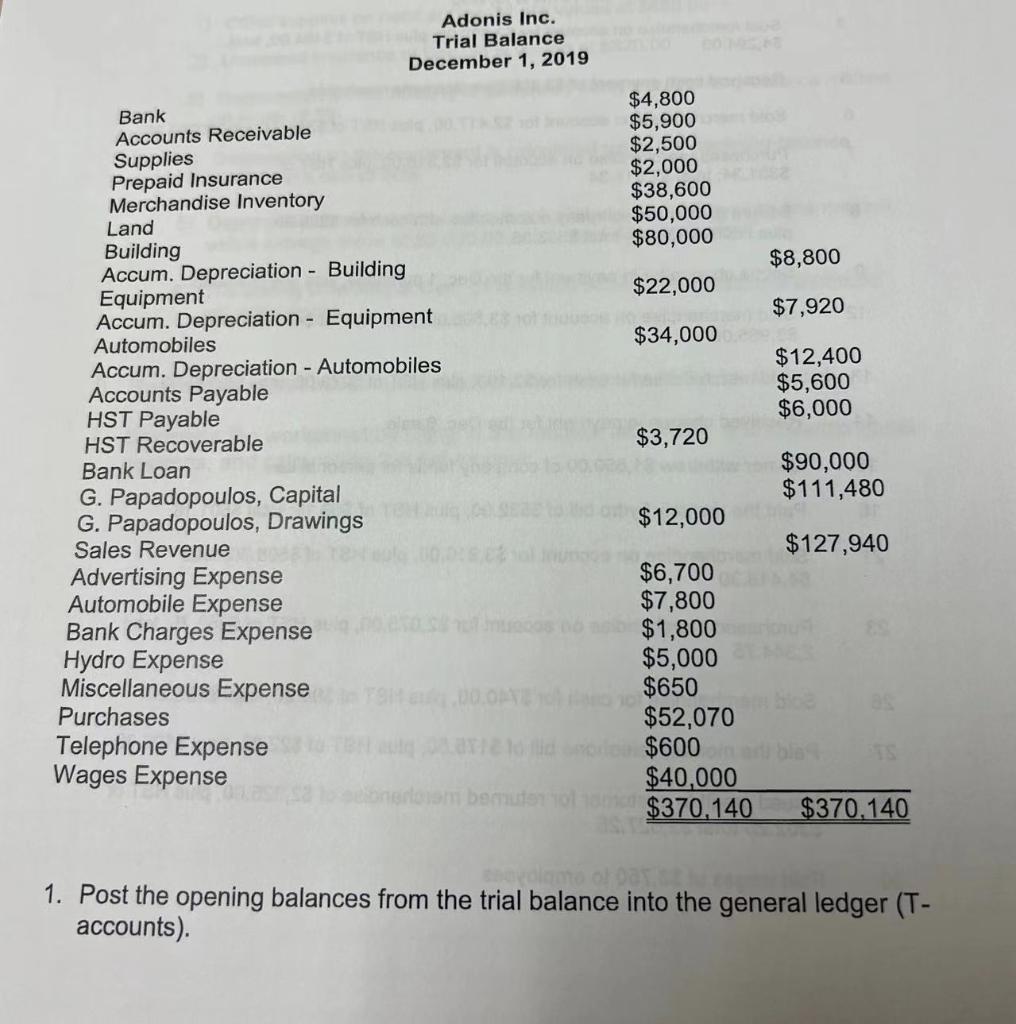

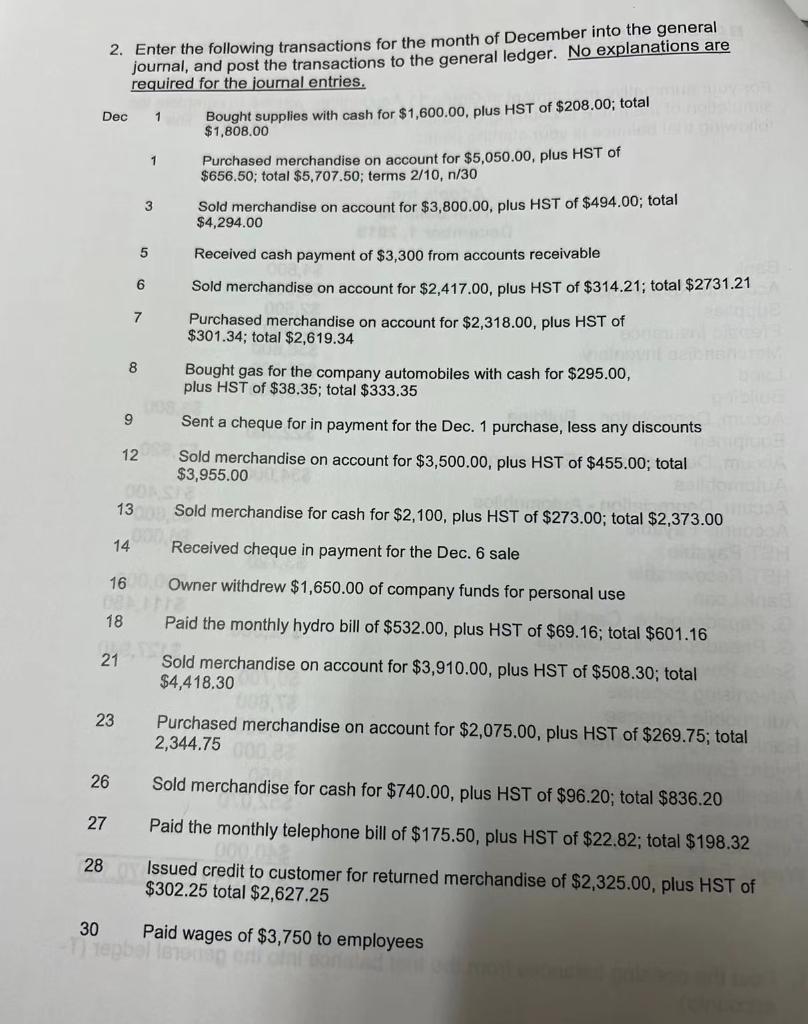

Adonis Inc. Trial Balance December 1, 2019 $4,800 $5,900 $2,500 $2,000 $38,600 $50,000 $80,000 $22,000 $34,000 $3,720 $12,000 $6,700 $7,800 $1,800 $5,000 $650 $52,070 $600 on a bla $40,000 Bank Accounts Receivable Supplies Prepaid Insurance Merchandise Inventory Land Building Accum. Depreciation - Building Equipment Accum. Depreciation - Equipment Automobiles Accum. Depreciation - Automobiles Accounts Payable HST Payable HST Recoverable Bank Loan G. Papadopoulos, Capital G. Papadopoulos, Drawings Sales Revenue Advertising Expense Automobile Expense Bank Charges Expense Hydro Expense Miscellaneous Expense Purchases 00.0PT Telephone Expense Wages Expense nem bemuter 101 1m $370,140 $370.140 soyolame of Day. 1. Post the opening balances from the trial balance into the general ledger (T- accounts). $8,800 $7,920 $12,400 $5,600 $6,000 $90,000 $111,480 $127,940 2. Enter the following transactions for the month of December into the general journal, and post the transactions to the general ledger. No explanations are required for the journal entries. 107 Dec 1 Bought supplies with cash for $1,600.00, plus HST of $208.00; total $1,808.00 Purchased merchandise on account for $5,050.00, plus HST of $656.50; total $5,707.50; terms 2/10, n/30 Sold merchandise on account for $3,800.00, plus HST of $494.00; total $4,294.00 5 Received cash payment of $3,300 from accounts receivable 6 Sold merchandise on account for $2,417.00, plus HST of $314.21; total $2731.21 7 Purchased merchandise on account for $2,318.00, plus HST of $301.34; total $2,619.34 BODE UTM Bought gas for the company automobiles with cash for $295.00, plus HST of $38.35; total $333.35 9 Sent a cheque for in payment for the Dec. 1 purchase, less any discounts 12 Sold merchandise on account for $3,500.00, plus HST of $455.00; total $3,955.00 00%SE holis 1300 Sold merchandise for cash for $2,100, plus HST of $273.00; total $2,373.00 14 Received cheque in payment for the Dec. 6 sale Owner withdrew $1,650.00 of company funds for personal use Paid the monthly hydro bill of $532.00, plus HST of $69.16; total $601.16 Sold merchandise on account for $3,910.00, plus HST of $508.30; total $4,418.30 Purchased merchandise on account for $2,075.00, plus HST of $269.75; total 2,344.75 26 Sold merchandise for cash for $740.00, plus HST of $96.20; total $836.20 27 Paid the monthly telephone bill of $175.50, plus HST of $22.82; total $198.32 Issued credit to customer for returned merchandise of $2,325.00, plus HST of $302.25 total $2,627.25 28 30 Paid wages of $3,750 to employees lenous eni cint 21 8 23 1 16 CREDFIE 18 3