Hi, I just need the last question please, I last person put it wrong.

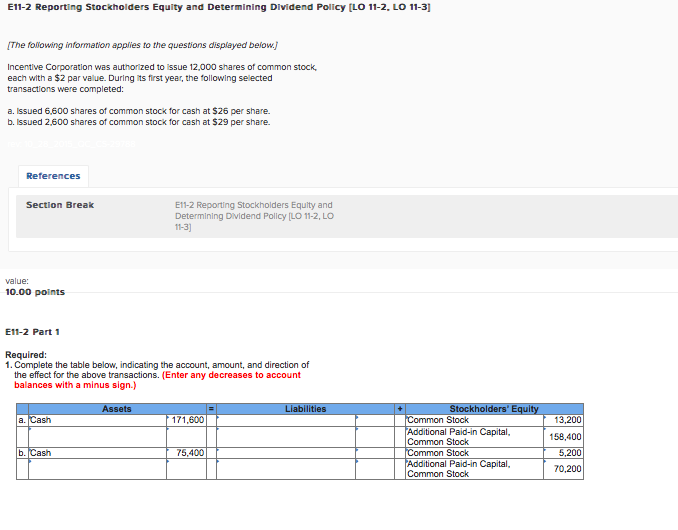

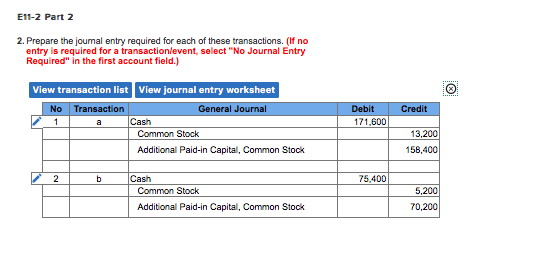

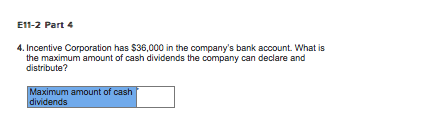

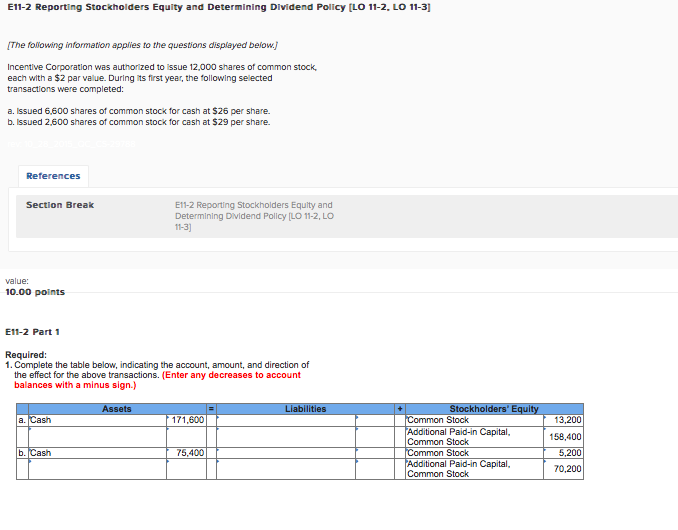

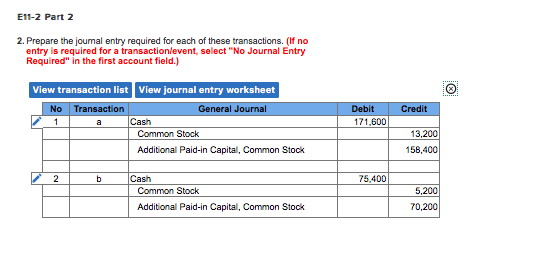

E11-2 Reporting Stockholders Equity and Determining Dividend Policy [L0 11-2. LO 11-3] The tolowing information applies to the questions displayed below. Incentive Corporation was authorized to issue 12,000 shares of common stock each with a $2 par value. During ts first year, the tollowing selected transactions were completed: a. Issued 6,600 shares of common stock for cash at $26 per share. b. Issued 2,600 shares of common stock for cash at $29 per share. Section Break E11-2 Reporting Stockholders Equity and Determining Dividend Polilcy [LO 11-2, LO 11-3) value: 10.00 points E11-2 Part 1 Required: 1. Complete the table below, indicating the account, amount, and direction of the effect for the above transactions. (Enter any decreases to account balances with a minus sign.) 171,600 nStock 13,200 158,400 5,200 70,200 Additional Paid-in Capital, Common Stock 5,400 Stock Additional Paid-in Capital, Common Stock E11-2 Part 2 2. Prepare the journal entry required for each of these transactions. (If no entry is required for a transactionlevent, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet Debit 171,600 No Transaction General Journal Credit Cash Common Stock 13,200 158,400 Additional Paid-in Capital, Common Stock Cash 75.400 Common Stock 5,200 70,200 Additional Paid-in Capital, Common Stock E11-2 Part 4 4. Incentive Corporation has $36,000 in the company's bank account. What is distribute? Max mum amount of casn ividends E11-2 Reporting Stockholders Equity and Determining Dividend Policy [L0 11-2. LO 11-3] The tolowing information applies to the questions displayed below. Incentive Corporation was authorized to issue 12,000 shares of common stock each with a $2 par value. During ts first year, the tollowing selected transactions were completed: a. Issued 6,600 shares of common stock for cash at $26 per share. b. Issued 2,600 shares of common stock for cash at $29 per share. Section Break E11-2 Reporting Stockholders Equity and Determining Dividend Polilcy [LO 11-2, LO 11-3) value: 10.00 points E11-2 Part 1 Required: 1. Complete the table below, indicating the account, amount, and direction of the effect for the above transactions. (Enter any decreases to account balances with a minus sign.) 171,600 nStock 13,200 158,400 5,200 70,200 Additional Paid-in Capital, Common Stock 5,400 Stock Additional Paid-in Capital, Common Stock E11-2 Part 2 2. Prepare the journal entry required for each of these transactions. (If no entry is required for a transactionlevent, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet Debit 171,600 No Transaction General Journal Credit Cash Common Stock 13,200 158,400 Additional Paid-in Capital, Common Stock Cash 75.400 Common Stock 5,200 70,200 Additional Paid-in Capital, Common Stock E11-2 Part 4 4. Incentive Corporation has $36,000 in the company's bank account. What is distribute? Max mum amount of casn ividends