Answered step by step

Verified Expert Solution

Question

1 Approved Answer

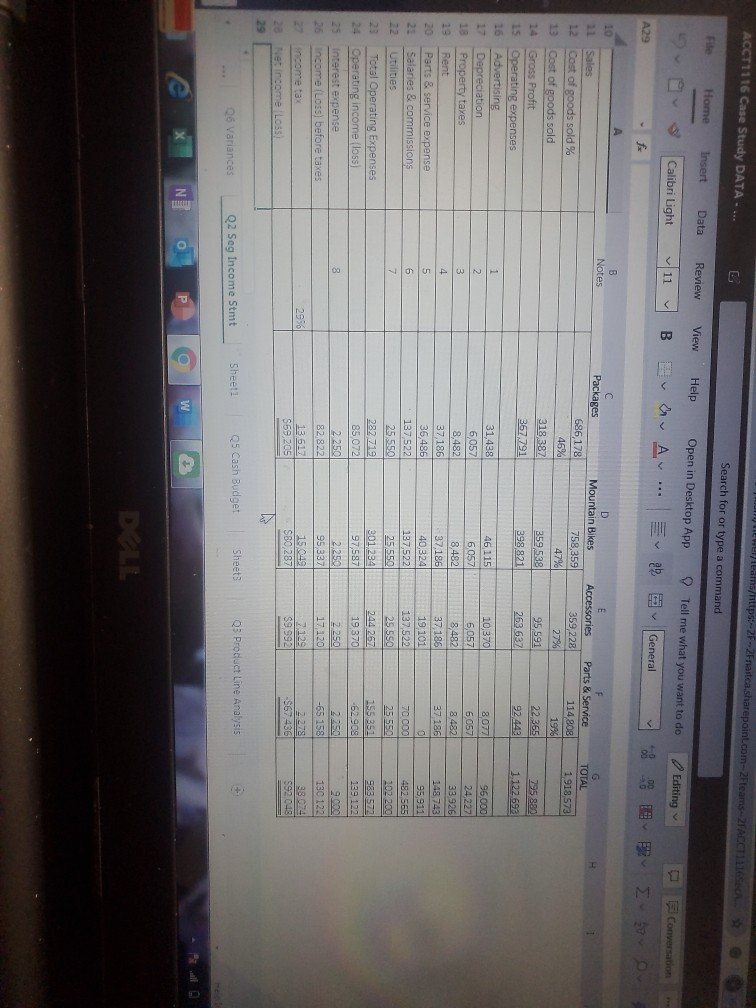

Hi i just want help with part b. The first picture is of seg income statement. Thanks in advance Jewellems/tips--2F-2Fnatca sharepoint.com-2Fteams-2FACCT116 ACCT1116 Case Study DATA-...

Hi i just want help with part b. The first picture is of seg income statement. Thanks in advance

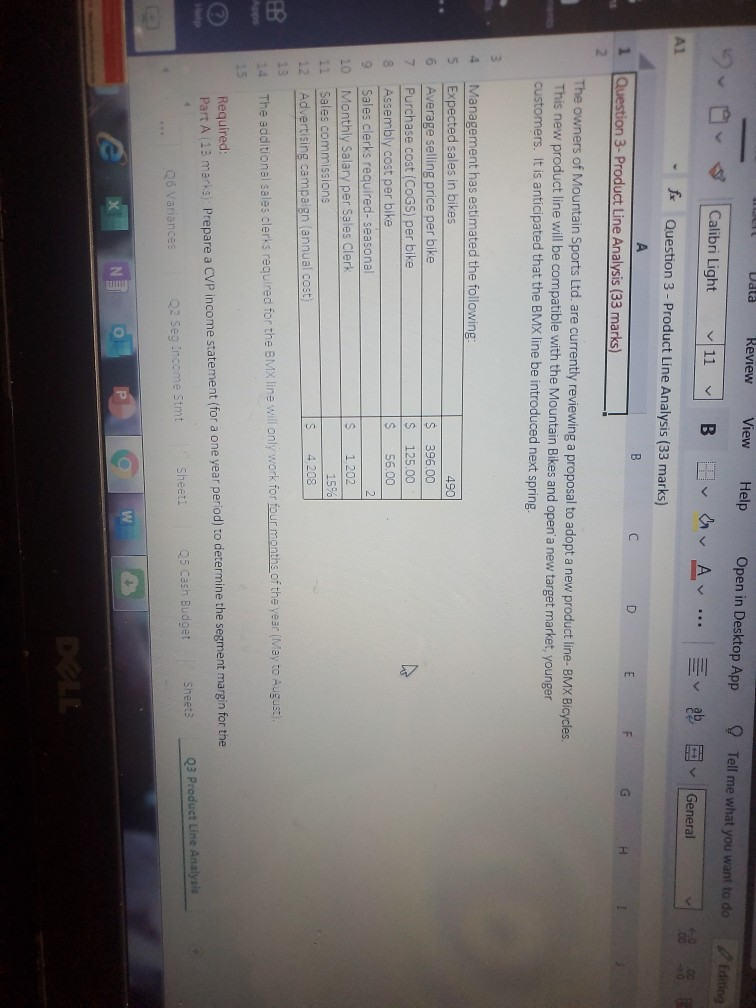

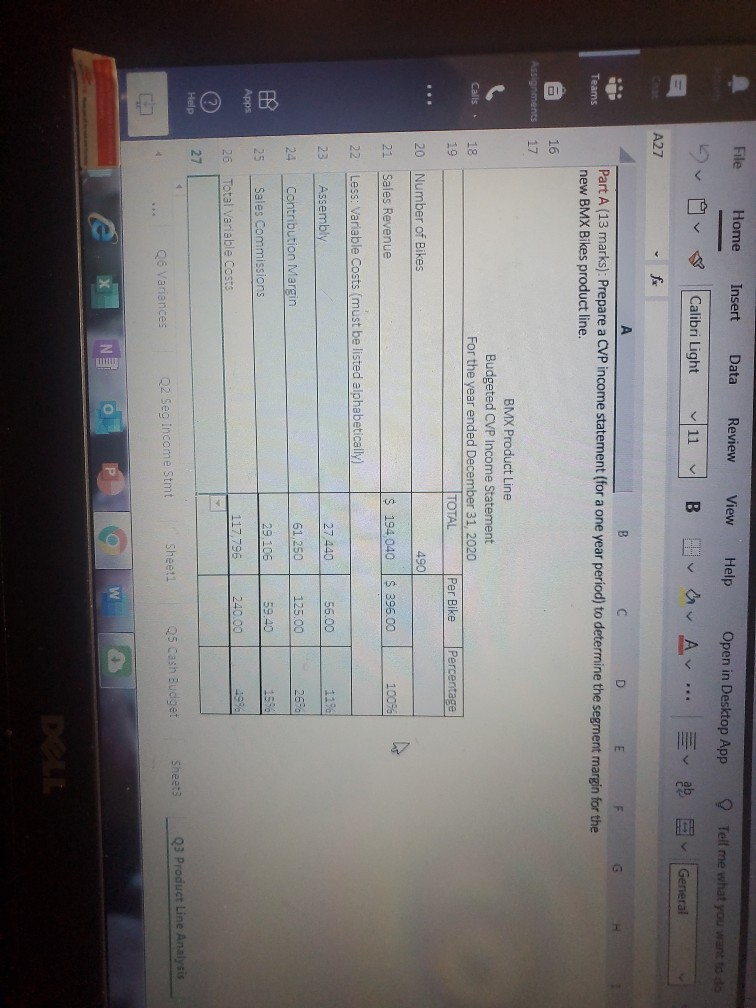

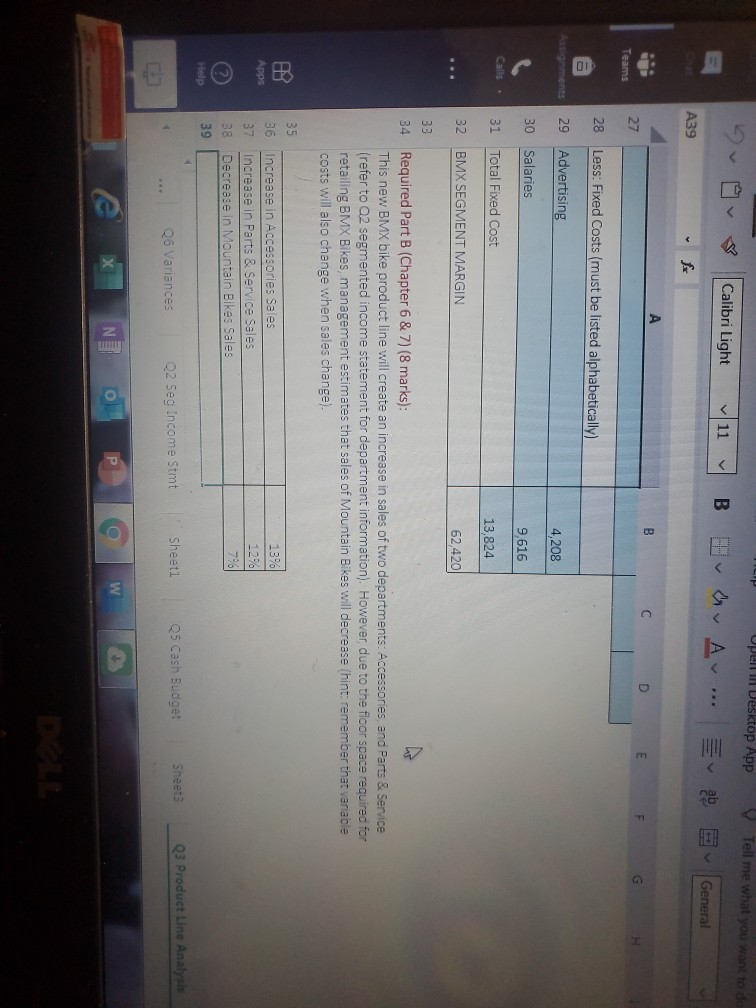

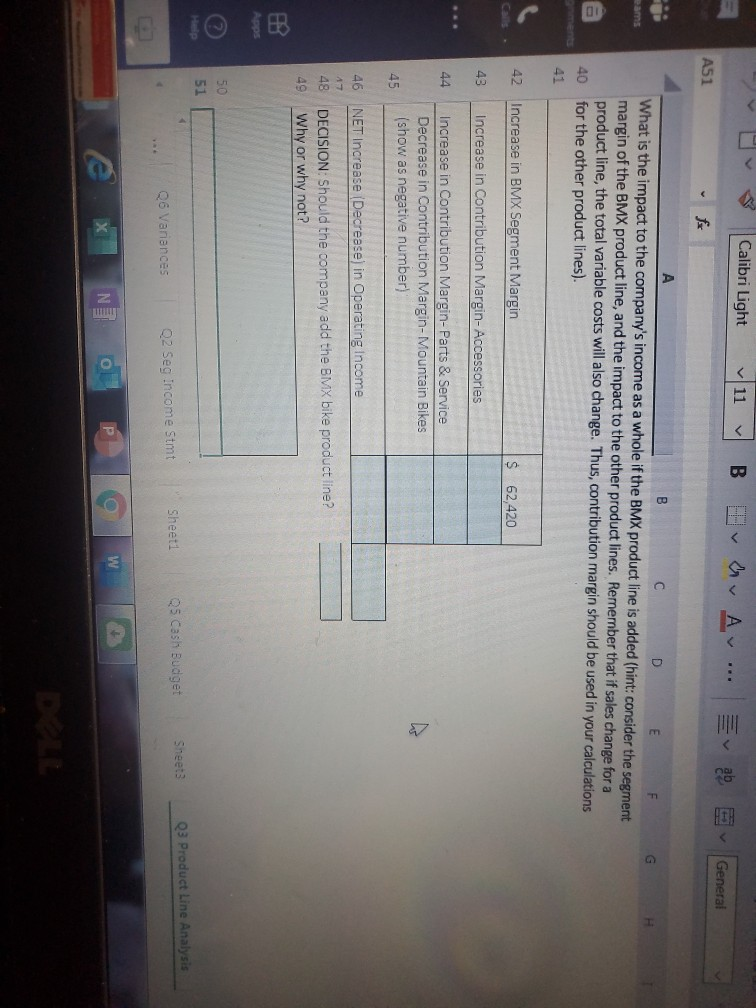

Jewellems/tips--2F-2Fnatca sharepoint.com-2Fteams-2FACCT116 ACCT1116 Case Study DATA-... Search for or type a command me Home Insert Data Calibri Light Review View Help 11 YB Dva A Open in Desktop App 2 Tell me what you want to do General Editing Conversation A29 B c Notes TOTAL 1918 573 Packages 686,178 46% 318 387 367,791 Mountain Bikes 758,359 47% 359,538 398,821 Accessories 359,228 27% 95591 263.637 Parts & Service 114808 1996 22 365 92 443 795890 1 122 599 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 96.000 24227 Sales Cost of goods sold % Cost of goods sold Gross Profit Operating expenses Advertising Depreciation Property taxes Rent Parts & service expense Salaries & commissions Utilities Total Operating Expenses Operating income (loss) interest expense income (Loss) before taxes 8077 6057 8.482 37186 NOWN- 33 926 148 743 31,438 6,057 8,482 37186 36,486 137522 25.550 282 719 85072 2.250 82.822 13617 559,205 46 115 6,0576 8.4828 37.186 40,324 137,522 25550 301,234 9 7,587 2.250 95,337 15043 S80 287 10,370 ,057 ,482 37,186 19 101 137 522 25 550 244 267 19 370 2.250 17, 120 7.129 59992 70 000 25550 155352 -62.908 2250 -65 158 95 911 482.565 102 200 983 572 139 122 130 122 88022 income tax 2920 so 592048 Net income Loss) Q6 Variances Q2 Seg Income Stmt Sheet1 Q5 Cash Budget Sheet3 Q3 Product Line Analysis DLL e Data Review View Help Open in Desktop App Tell me what you want to do 2 0 $ Calibri Light Edit 11 y B a Av... 26 General Al fx Question 3 - Product Line Analysis (33 marks) 1 Question 3- Product Line Analysis (33 marks) The owners of Mountain Sports Ltd. are currently reviewing a proposal to adopt a new product line-BMX Bicycles. This new product line will be compatible with the Mountain Bikes and open a new target market, younger customers. It is anticipated that the BMX line be introduced next spring. 4 5 6 Management has estimated the following: Expected sales in bikes Average selling price per bike Purchase cost (COGS) per bike Assembly cost per bike Sales clerks required-seasonal Monthly Salary per Sales Clerk Sales commissions Advertising campaign (annual cost) $ $ $ 490 396.00 125,00 56.00 10 S 1.202 15% S4208 The additional sales clerks required for the BMX line will only work for four months of the year (May to August Required: Part A 13 marks) Prepare a CVP income statement (for a one year period) to determine the segment margin for the Q3 Product Line Analysis Sheeti Sheets Q2 Seg Income Stmt Q5 Cash Budget Q6 Variances File Home O Insert Data Calibri Light Review View Help 11 y BB O Open in Desktop App Tell me what you want to do A ... 23 General A27 Teams Part A (13 marks): Prepare a CVP income statement for a one year period) to determine the segment margin for the new BMX Bikes product line. Assignments Calls . BMX Product Line Budgeted CVP Income Statement For the year ended December 31, 2020 TOTAL Per Bike Percentage Number of Bikes 490 Sales Revenue $ 194 040 $ 396.00 10070 Less: Variable Costs must be listed alphabetically) 23 Assembly 27.440 56.00 Contribution Margin 61,250 125.00 2 29.106 59.40 Sales Commissions 117,796 240.00 Total variable Costs Q6 Variances SheetI Sheets Q2 seg income stmt Q 5 Cash Budget 03 Product Line Analysis HILIP Opent in Desktop App Tell me what you want to do 9 0 Calibri Light 11 BE C A ... 26 General Teams 28 Less: Fixed Costs (must be listed alphabetically) Advertising 4,208 30 Salaries 9,616 31 Total Fixed Cost 13,824 32 BMX SEGMENT MARGIN 62,420 34 Required Part B (Chapter 6 & 7)(8 marks): This new BMX bike product line will create an increase in sales of two departments: Accessories and Parts & Service (refer to 2 segmented income statement for department information). However, due to the floor space required for retailing BMX Bikes, management estimates that sales of Mountain Bikes will decrease (hint: remember that variable costs will also change when sales change). 36 Increase in Accessories Sales Increase in Parts & Service Sales Decrease in Mountain Bikes Sales Sheets Q6 Variances Sheeti Q3 Product Line Analysis Q2 Seg Income Stmt Q5 Cash Budget ExN POW * Calibri Light 11 B A 29 General A51 eams B C D E F What is the impact to the company's income as a whole if the BMX product line is added (hint: consider the segment margin of the BMX product line, and the impact to the other product lines. Remember that if sales change for a product line, the total variable costs will also change. Thus, contribution margin should be used in your calculations for the other product lines). 40 Increase in BMX Segment Margin $ 62,420 Increase in Contribution Margin-Accessories Increase in Contribution Margin-Parts & Service Decrease in Contribution Margin-Mountain Bikes (show as negative number) NET Increase (Decrease) in Operating Income DECISION: Should the company add the BMX bike product line? Why or why not? Sheet1 Sheet3 Q5 Cash Budget Q3 Product Line Analysis Q2 Seg Income Stmt Q6 VariancesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started