Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi I just wanted some assistance in figuring if the answers I did to these questions were correct or not, if there were any errors

Hi I just wanted some assistance in figuring if the answers I did to these questions were correct or not, if there were any errors would you please say which ones and how to properly do them thanks.

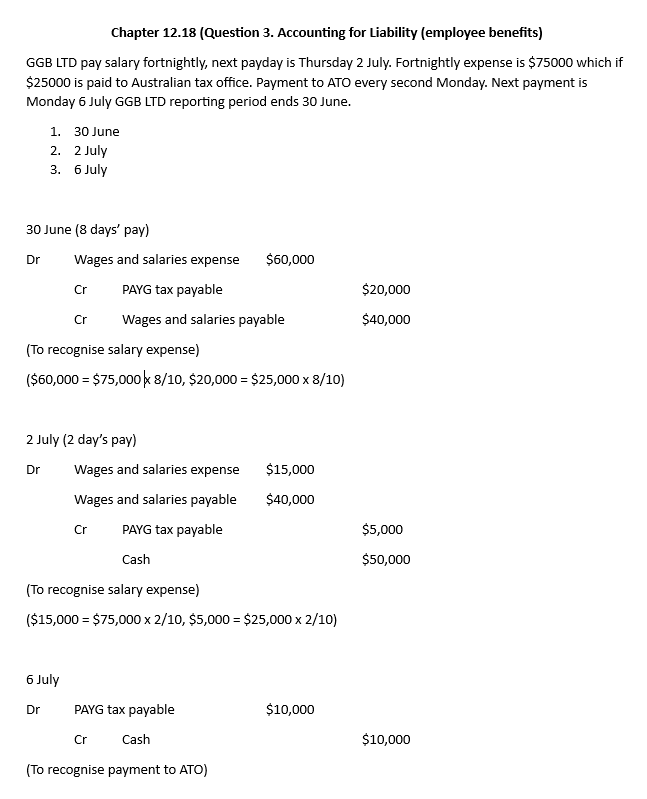

Chapter 12.18 (Question 3. Accounting for Liability (employee benefits) GGB LTD pay salary fortnightly, next payday is Thursday 2 July. Fortnightly expense is $75000 which if $25000 is paid to Australian tax office. Payment to ATO every second Monday. Next payment is Monday 6 July GGB LTD reporting period ends 30 June. 1. 30 June 2. 2 July 3. 6 July 30 June ( 8 days' pay) (To recognise salary expense) ($60,000=$75,0008/10,$20,000=$25,0008/10) (To recognise salary expense) ($15,000=$75,0002/10,$5,000=$25,0002/10)

Chapter 12.18 (Question 3. Accounting for Liability (employee benefits) GGB LTD pay salary fortnightly, next payday is Thursday 2 July. Fortnightly expense is $75000 which if $25000 is paid to Australian tax office. Payment to ATO every second Monday. Next payment is Monday 6 July GGB LTD reporting period ends 30 June. 1. 30 June 2. 2 July 3. 6 July 30 June ( 8 days' pay) (To recognise salary expense) ($60,000=$75,0008/10,$20,000=$25,0008/10) (To recognise salary expense) ($15,000=$75,0002/10,$5,000=$25,0002/10) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started