Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! I need a, b, and c answered but with step by step explanations using a financial calculator (NO excel) Thank you! Company M is

Hi! I need a, b, and c answered but with step by step explanations using a financial calculator (NO excel) Thank you!

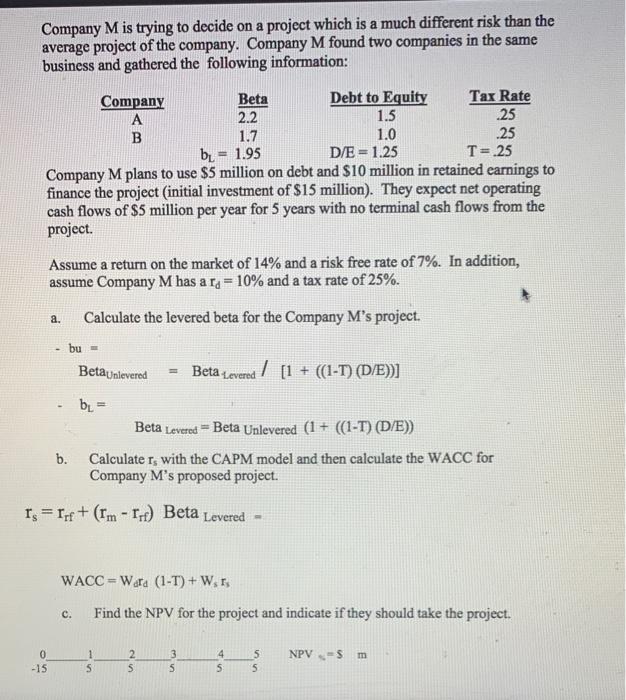

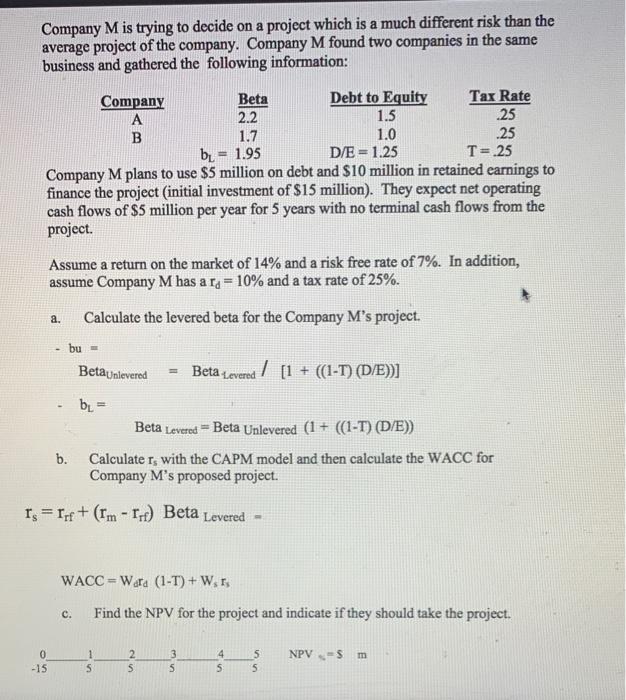

Company M is trying to decide on a project which is a much different risk than the average project of the company. Company M found two companies in the same business and gathered the following information: 1.7 Company Beta Debt to Equity Tax Rate A 2.2 1.5 .25 B 1.0 .25 bu = 1.95 D/E= 1.25 T= 25 Company M plans to use $5 million on debt and $10 million in retained earnings to finance the project initial investment of $15 million). They expect net operating cash flows of $5 million per year for 5 years with no terminal cash flows from the project. Assume a return on the market of 14% and a risk free rate of 7%. In addition, assume Company M has a ra = 10% and a tax rate of 25%. a. Calculate the levered beta for the Company M's project. bu- Betaunlevered = Beta 1.cvered / [1 + ((I-T) (D/E)] bu = b. Beta Levered = Beta Unlevered (1 + ((1-T) (D/E)) Calculate r, with the CAPM model and then calculate the WACC for Company M's proposed project. Is=18+ (Im - 1.) Beta Levered WACC = Wara (1-1) + W., C. Find the NPV for the project and indicate if they should take the project. NPV 0 -15 1 S 2 S m 3 5 4 5 5 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started