Question

Hi! I need help answering these questions. I attached a page of the work I've done so far, but I'm not sure if I'm on

Hi! I need help answering these questions. I attached a page of the work I've done so far, but I'm not sure if I'm on the right track or not and need some help. I'm also stuck on how you would know whether or not to exercise an option. Thank you!

(I used the historical table lookup on www.xe.com to find the relevant spot rates to the GBP)

________

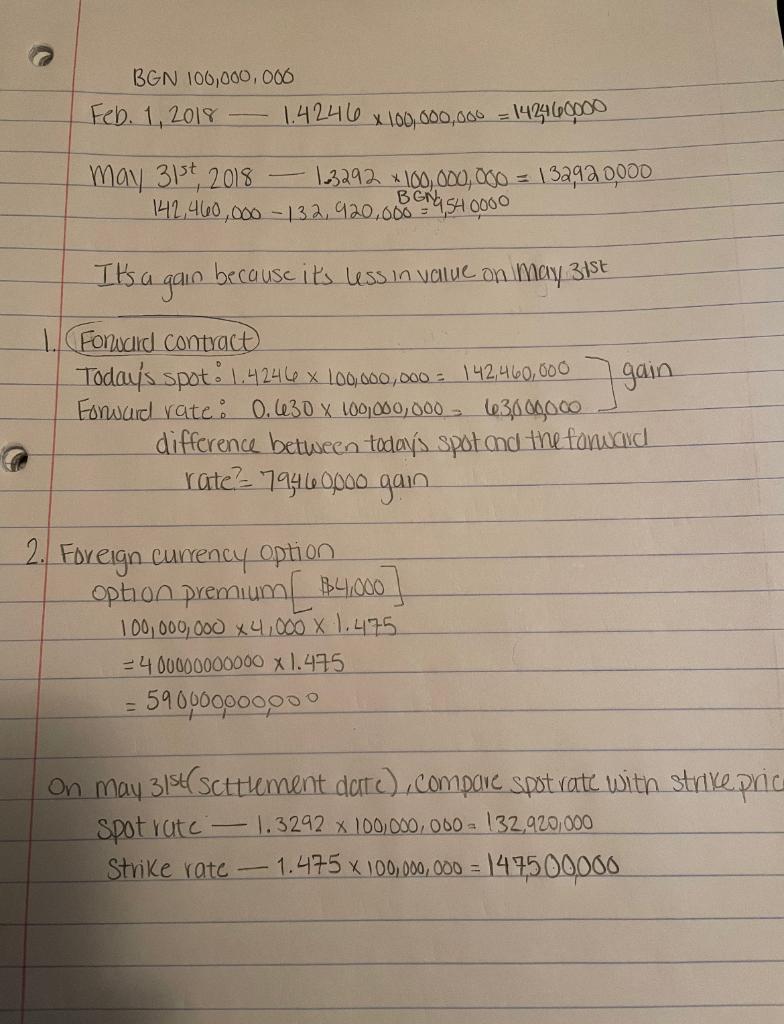

Chase Corporation, a U.S. enterprise, sold product to a customer in Bulgaria on February 1, 2018 for BGN 100,000,000 with payment required on May 31, 2018. Chase agreed to accept payment in Bulgarian Lev on that date. Relevant exchange rates to the BGN are:

| Spot rate (USD / BGN) | |

| February 1, 2018 | |

| May 31, 2018 |

Additionally, on February 1 Chase found a contract with a settlement date of 5/31 and a $0.630/BGN forward rate.

Required:

- Assume that Chase did not hedge this transaction. Determine the amount of exchange gain or loss from foreign currency transactions that would be recognized in the 2018 income statements.

- Assume Chase entered into a forward contract to hedge the foreign currency denominated accounts receivable and accounts for the hedge as a fair value hedge. Determine the net gain or loss from foreign currency transactions that would be recognized in the 2018 income statements.

- In hindsight, was Chase better off without hedging or with the hedging strategy?

Eximco sold product to a European buyer agreeing to accept 2,000,000 60 days later. At the time of the sale the spot rate was USD$1.50/1.00. At the settlement date the spot rate on the cash-flow date is USD$1.48/1.00.

Required:

Determine net gain or loss from the unhedeged transaction.

Starting with the same facts as above, assume Eximco decided to hedge the transaction with a 60-day put option carrying a $4,000 option premium and a strike price of $1.475/1.00 as determined by the bank.

Required:

Determine net gain or loss from the hedged transaction.

BGN 100,000,000 Feb. 1, 2018 1:4246 x 100,000,000 = 142460000 may 31st, 2018 113292 *100,000,000 = 132920,000 142,460,000 - 132,920.000 BENGSH 0000 It's a gain because it's less in value on May 31st Fonward contract Today's spot: 1.4246 x 100,000,000 - 142,460,000 gain Forward rate: 0.630 X 100,000,000 - 63,000,000 difference between today's spot and the forward rate? 7946000o gain 2. Foreign currency option option premium [ 34.000] 100,000,000 x 4,000 x 1.475 - 400000000000 x 1.475 5900000oopoo on may 31st scttlement date).compare spot rate with strike prio Spot rate 1.3292 x 100,000,000 = 132,920,000 Strike rate - 1.475 x 100,000,000 = 147500000 BGN 100,000,000 Feb. 1, 2018 1:4246 x 100,000,000 = 142460000 may 31st, 2018 113292 *100,000,000 = 132920,000 142,460,000 - 132,920.000 BENGSH 0000 It's a gain because it's less in value on May 31st Fonward contract Today's spot: 1.4246 x 100,000,000 - 142,460,000 gain Forward rate: 0.630 X 100,000,000 - 63,000,000 difference between today's spot and the forward rate? 7946000o gain 2. Foreign currency option option premium [ 34.000] 100,000,000 x 4,000 x 1.475 - 400000000000 x 1.475 5900000oopoo on may 31st scttlement date).compare spot rate with strike prio Spot rate 1.3292 x 100,000,000 = 132,920,000 Strike rate - 1.475 x 100,000,000 = 147500000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started