Answered step by step

Verified Expert Solution

Question

1 Approved Answer

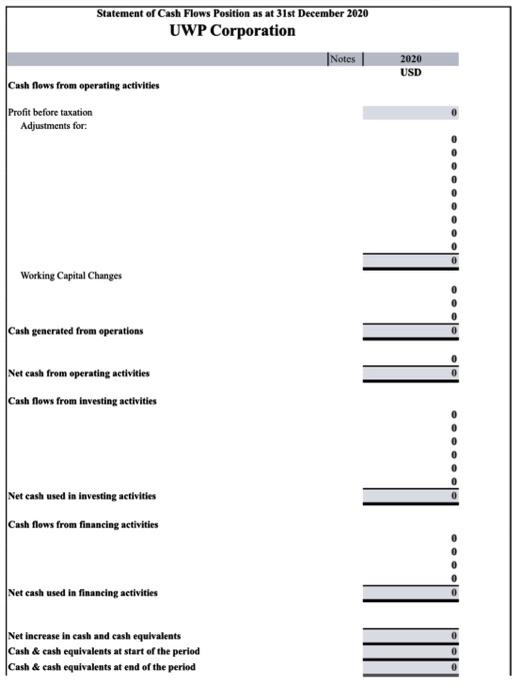

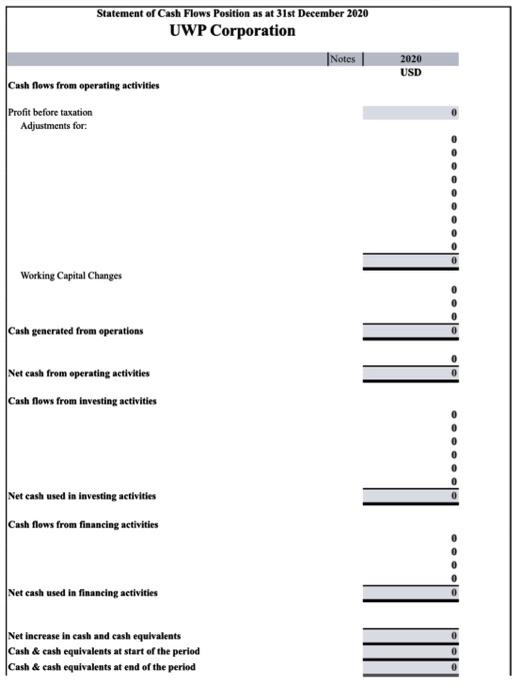

Hi! I need help figuring out this statement of cash flows. Statement of Cash Flows Position as at 31st December 2020 UWP Corporation Cash flows

Hi! I need help figuring out this statement of cash flows.

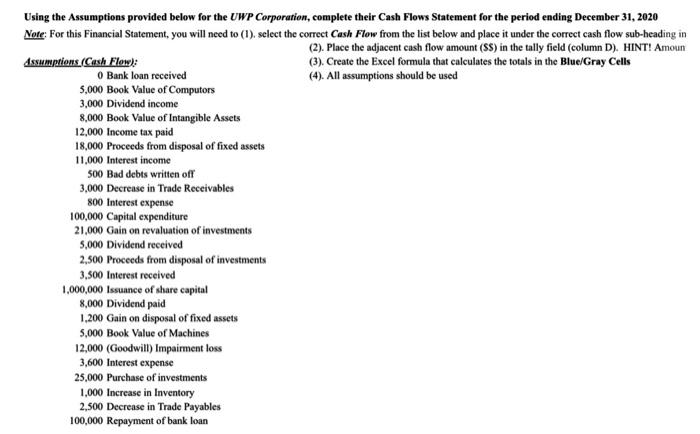

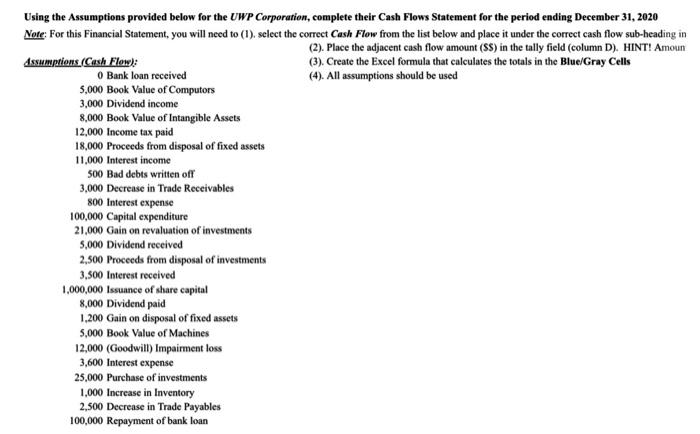

Statement of Cash Flows Position as at 31st December 2020 UWP Corporation Cash flows from operating activities Profit before taxation Adjustments for: Working Capital Changes \begin{tabular}{l|l} |Notes & 2020 \\ & USD \end{tabular} Cash generated from operations Net cash from operating activities Cash flows from investing activities Net eash used in investing activities Cash flows from financing activities \begin{array}{l} 0 \\ 0 \\ 0 \\ 0 \\ 0 \\ 0 \\ 0 \\ 0 \\ 0 \\ 0 \\ \hline 0 \\ \hline 0 \\ \hline 0 \\ \hline 0 \\ \hline\end{array} \begin{tabular}{l} 0 \\ 0 \\ 0 \\ 0 \\ 0 \\ 0 \\ \hline \end{tabular} Net cash used in financing activities Net increase in cash and cash equivalents Cash \& cash equivalents at start of the peried Cash \& cash equivalents at end of the period Using the Assumptions provided below for the UWP Corporation, complete their Cash Flows Statement for the period ending December 31,2020 Note: For this Financial Statement, you will need to (1), select the correct Cash Flow from the list below and place it under the correct cash flow sub-heading in (2). Place the adjacent cash flow amount (SS) in the tally field (column D). HINT! Amoun (3). Create the Excel formula that calculates the totals in the Blue/Gray Cells (4). All assumptions should be used 5,000 Book Value of Computors 3,000 Dividend income 8,000 Book Value of Intangible Assets 12,000 Income tax paid 18,000 Proceeds from disposal of fixed assets 11,000 Interest income 500 Bad debts written off 3,000 Decrease in Trade Receivables 800 Interest expense 100,000 Capital expenditure 21,000 Gain on revaluation of investments 5,000 Dividend received 2,500 Proceeds from disposal of investments 3,500 Interest received 1,000,000 Issuance of share capital 8,000 Dividend paid 1,200 Gain on disposal of fixed assets 5,000 Book Value of Machines 12,000 (Goodwill) Impairment loss 3,600 Interest expense 25,000 Purchase of investments 1,000 Increase in Inventory 2,500 Decrease in Trade Payables 100,000 Repayment of bank loan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started