HI,

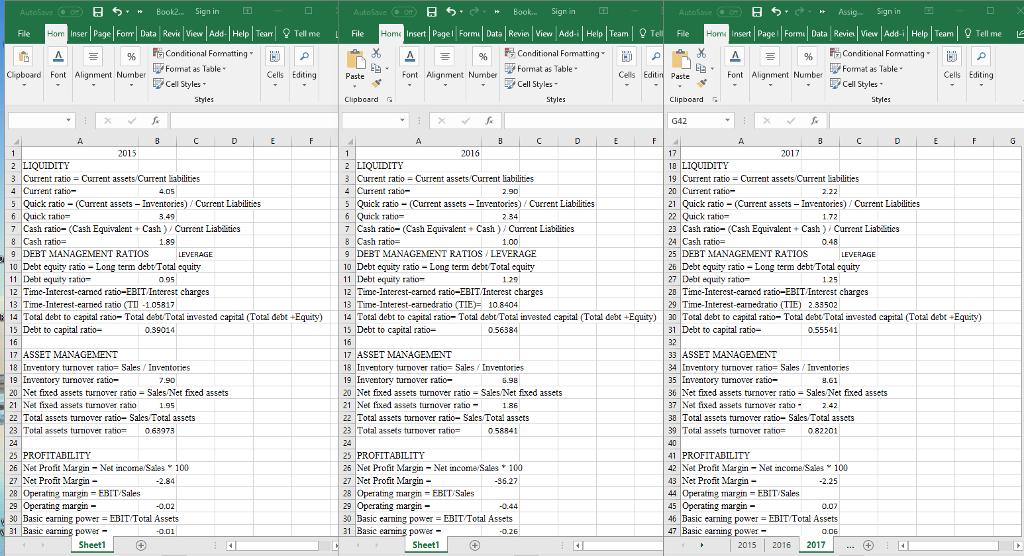

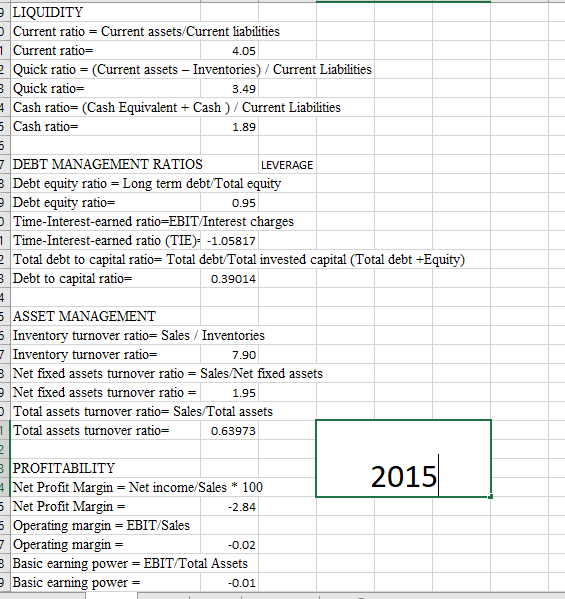

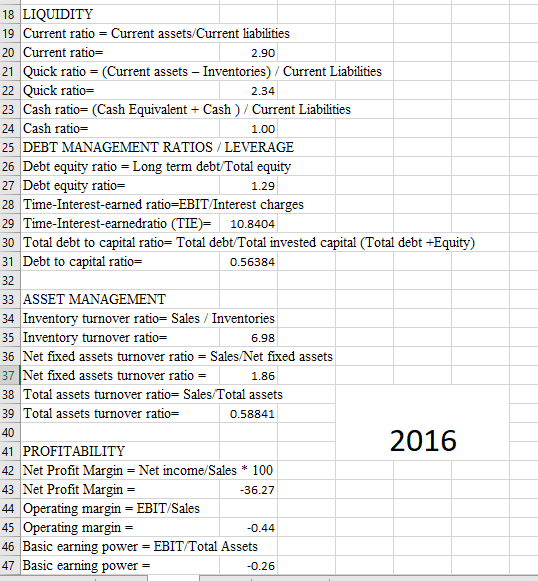

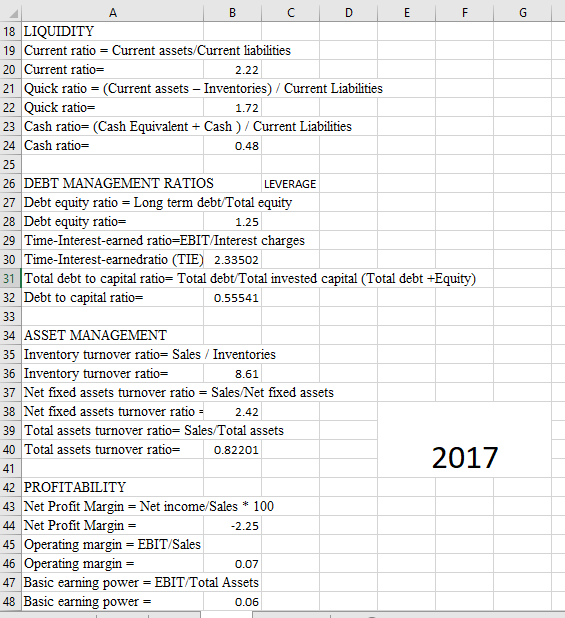

I need help, I have an assignment about Financial Analysis which we have just starting to learn in class!

I finally got all the number (I think) and now I need to do the analysis but I am lost. I need to compare the ratios for all 3 years, but my teacher does not want a short or quick answer..

Instructions of my teacher...

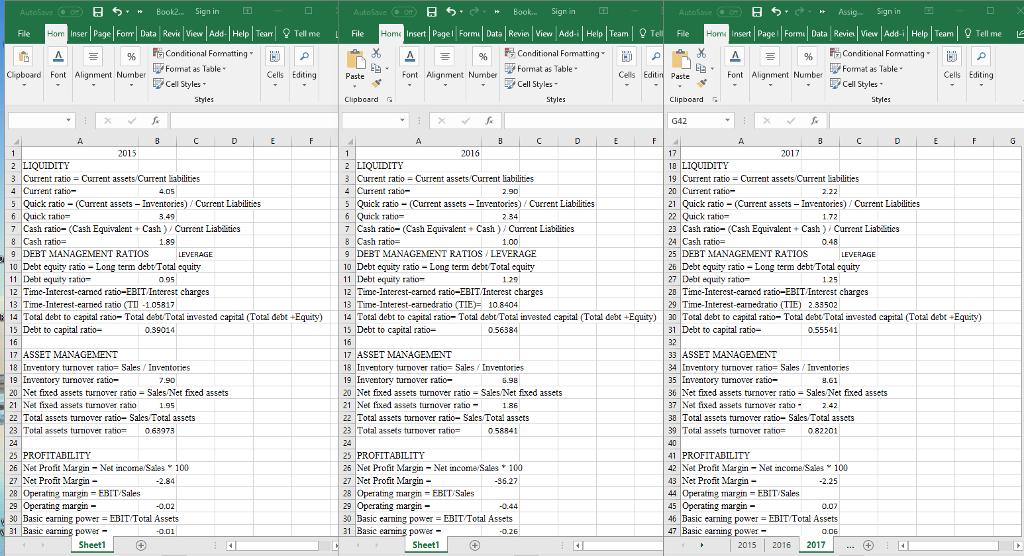

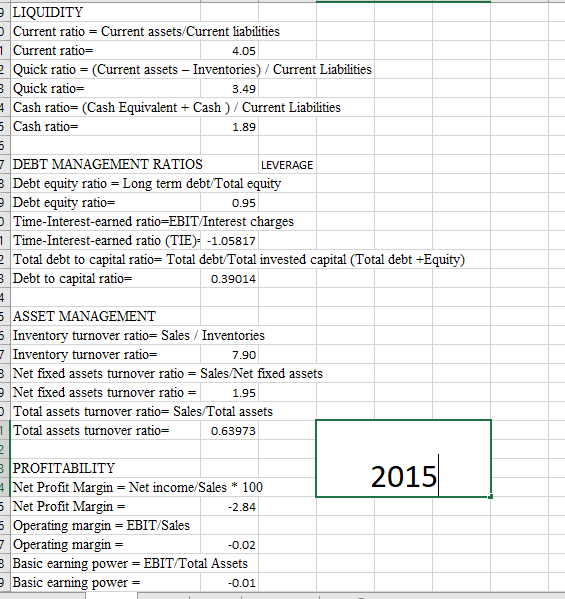

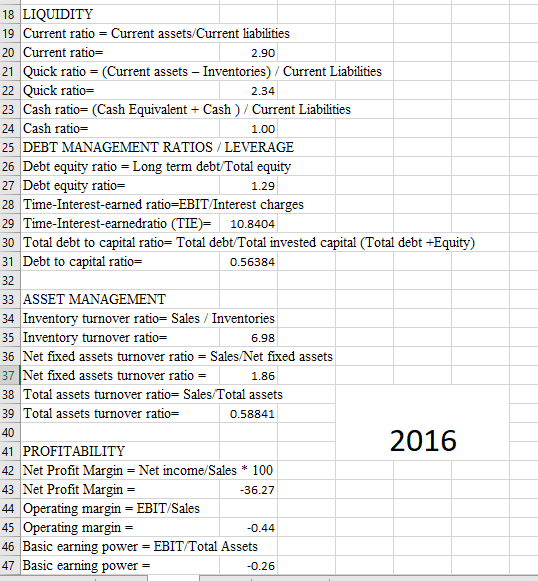

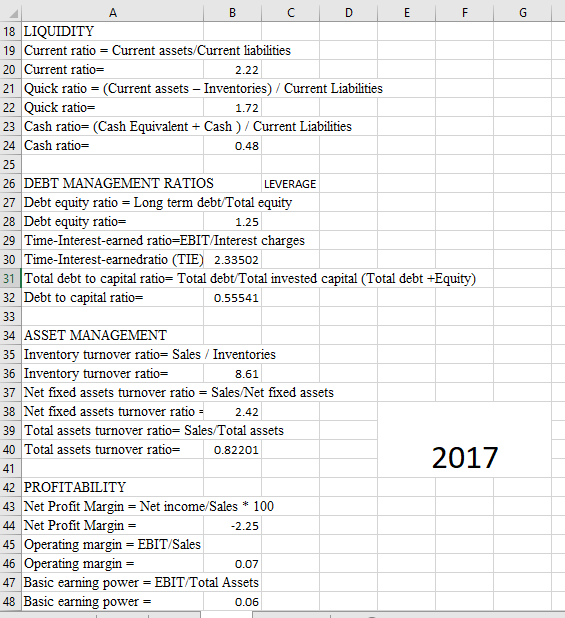

Perform a financial analysis using at least three ratios from each category (WHICH I DID) Your analysis should include calculation of the ratios for at least three years. Then, using the calculated data, perform a trend analysis (THIS IS WHERE I NEED HELP WITH) where you interpret the results.

So, what I need is perform a trend analysis of the ratios, interpreting the results.

Again, as always, a better than, worse than, improving or deteriorating analysis is not a substantive conclusion. Explain what is happening and why!

Finally, utilizing the Altman Z-score (see Course Content), determine if your selected company is at risk for bankruptcy. Explain why or why not. (I think I did this one correctly)

Help please, thanks

Added better pictures

AutoSave (..." Book2'" Sign in Fil HomI | % Conditional Formatting .C." Insert Pagel Form Data Revie View Add-i Help Team Autosse (.om Book." Sign n Inser Page Fom Data Revic View Add- Help TearTell me File Hom I Tell File Homnsert Page!| Forma Data Revie View Add-il Help Team Tell me , E) Conditional Form artin9" , Fri Conditional Formatting, EJ | Ea Font Alignment NubFormat as Table Alignment NumberFormat as Table Clipboard Font Alignment Number Font styles Styles styles 2015 2016 10 3 Current ratio Current assets Current Labilities Current assetsCurrent Labilities 3 Current ratio Current assets Curreat liabilities 5 Quick ratio Curret assets Inveatories) Cuerent Liabilities 7 Cash ratio- (Cash EquivalentCash) Curreat Liabilities 19 Current ratio Quick ratio- (Current assets Inventories) Curreut Liabilities 7 Cash ratio- (Cash Equvalent Cash)Current Liabities 9 DEBT MANAGEMENT RATIOS 1 Quick ratio (Current asseIventocies) Current Liabilities 22 Quick Tatio- 23 Cash ratio- (Cash EquvalenCash)Current Liablities DEBT MANAGEMENT RATIOS LEVERAGE 25 DEBT MANAGEMENT RATIOS 10 Debt equity ratio Long term debt Total equity 11 Debt equity ratio 12 Time-Interest-carned ratio-EBIT Interest charges 13 Time-Interest-earned ratio (TI -1.05817 14 Total debt to capital rato-Total debt Total invested capital (Total debt+Equity) 14 Total debt to capital ratio- Total debt Total invested captal (Total debt +Equity 30 Total debt to capital ratio- Total debt Total invested capital (Total debt +Equity) 10 Debt equity ratio Long term debt Total equity 11 Debt ecuty ration- 2 Time-Interest-carned ratio-EBIT Interest charges 26Debt equity ratio Long term debt Total equity 27] Debt equity ratio- 28 Time-Interest-caraed ratio-EBIT Interest charges 29 Time-Interest-eaedrato (TIE) 2.33502 Time-Interest-carnedratio (TIE108404 Debt to capital ratio- 16 7 ASSET MANAGEMENT 18 Inventory turnover ratio= Sales Inventories 0.55541 17 ASSET MANAGEMENT 18 Inventory turnover ratio- SalesInventories 33 ASSET MANAGEMENT 4 Inventory turnmover ratio Sales Inventories 20 Net fixed assets turnover ratio Sales Net frxed assets 21 Net fixed assets turnover ratio 22 Total assets tumover ratio-Sales Total assets 23 Total assets turnover ratio 0.63973 s/Net fixed assets 20 Net fixed assets turnover ratio Sales 21 Net fixed assets turnover ratio- 22 Total assets turnover ratio-Sales Total assets 36 Net fixed assets turnover ratio-SalesNet fixed assets 37 Net fixed assets turnover rato-2.42 38 Total assets tumover ratio-Sales Total asscts 39 Total assets turnover ratio 23 Total assets turnover ratio- 0.82201 25 PROFITABILITY 26 Net Profit Margin-Net incomals100 27 Net Profit Margin- 28 Operating margin EBIT Sales 29 25 PROFITABILITY 26 Net Profit Margin Net income Sales 100 27 Net Profit Margin- 8 Operatimg margin EBIT Sales 9 Operating margin 42 Net Profit Margin-Net incomeales100 43 Net Profit Margin- 44 Operating margin EBIT Sales 45 Operating margin 46 Basic earning power EBIT Total Assets 0.07 Opcrating margin Basic earning power EBIT Total Assets ic earning power EBIT/Total Assets 2015 2016 2017.. + AutoSave (..." Book2'" Sign in Fil HomI | % Conditional Formatting .C." Insert Pagel Form Data Revie View Add-i Help Team Autosse (.om Book." Sign n Inser Page Fom Data Revic View Add- Help TearTell me File Hom I Tell File Homnsert Page!| Forma Data Revie View Add-il Help Team Tell me , E) Conditional Form artin9" , Fri Conditional Formatting, EJ | Ea Font Alignment NubFormat as Table Alignment NumberFormat as Table Clipboard Font Alignment Number Font styles Styles styles 2015 2016 10 3 Current ratio Current assets Current Labilities Current assetsCurrent Labilities 3 Current ratio Current assets Curreat liabilities 5 Quick ratio Curret assets Inveatories) Cuerent Liabilities 7 Cash ratio- (Cash EquivalentCash) Curreat Liabilities 19 Current ratio Quick ratio- (Current assets Inventories) Curreut Liabilities 7 Cash ratio- (Cash Equvalent Cash)Current Liabities 9 DEBT MANAGEMENT RATIOS 1 Quick ratio (Current asseIventocies) Current Liabilities 22 Quick Tatio- 23 Cash ratio- (Cash EquvalenCash)Current Liablities DEBT MANAGEMENT RATIOS LEVERAGE 25 DEBT MANAGEMENT RATIOS 10 Debt equity ratio Long term debt Total equity 11 Debt equity ratio 12 Time-Interest-carned ratio-EBIT Interest charges 13 Time-Interest-earned ratio (TI -1.05817 14 Total debt to capital rato-Total debt Total invested capital (Total debt+Equity) 14 Total debt to capital ratio- Total debt Total invested captal (Total debt +Equity 30 Total debt to capital ratio- Total debt Total invested capital (Total debt +Equity) 10 Debt equity ratio Long term debt Total equity 11 Debt ecuty ration- 2 Time-Interest-carned ratio-EBIT Interest charges 26Debt equity ratio Long term debt Total equity 27] Debt equity ratio- 28 Time-Interest-caraed ratio-EBIT Interest charges 29 Time-Interest-eaedrato (TIE) 2.33502 Time-Interest-carnedratio (TIE108404 Debt to capital ratio- 16 7 ASSET MANAGEMENT 18 Inventory turnover ratio= Sales Inventories 0.55541 17 ASSET MANAGEMENT 18 Inventory turnover ratio- SalesInventories 33 ASSET MANAGEMENT 4 Inventory turnmover ratio Sales Inventories 20 Net fixed assets turnover ratio Sales Net frxed assets 21 Net fixed assets turnover ratio 22 Total assets tumover ratio-Sales Total assets 23 Total assets turnover ratio 0.63973 s/Net fixed assets 20 Net fixed assets turnover ratio Sales 21 Net fixed assets turnover ratio- 22 Total assets turnover ratio-Sales Total assets 36 Net fixed assets turnover ratio-SalesNet fixed assets 37 Net fixed assets turnover rato-2.42 38 Total assets tumover ratio-Sales Total asscts 39 Total assets turnover ratio 23 Total assets turnover ratio- 0.82201 25 PROFITABILITY 26 Net Profit Margin-Net incomals100 27 Net Profit Margin- 28 Operating margin EBIT Sales 29 25 PROFITABILITY 26 Net Profit Margin Net income Sales 100 27 Net Profit Margin- 8 Operatimg margin EBIT Sales 9 Operating margin 42 Net Profit Margin-Net incomeales100 43 Net Profit Margin- 44 Operating margin EBIT Sales 45 Operating margin 46 Basic earning power EBIT Total Assets 0.07 Opcrating margin Basic earning power EBIT Total Assets ic earning power EBIT/Total Assets 2015 2016 2017.. +