Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! I need help in both parts. Will be really grateful. thanks Additional information: 1. The inventory has a net realizable value of $212,000. The

Hi! I need help in both parts. Will be really grateful. thanks

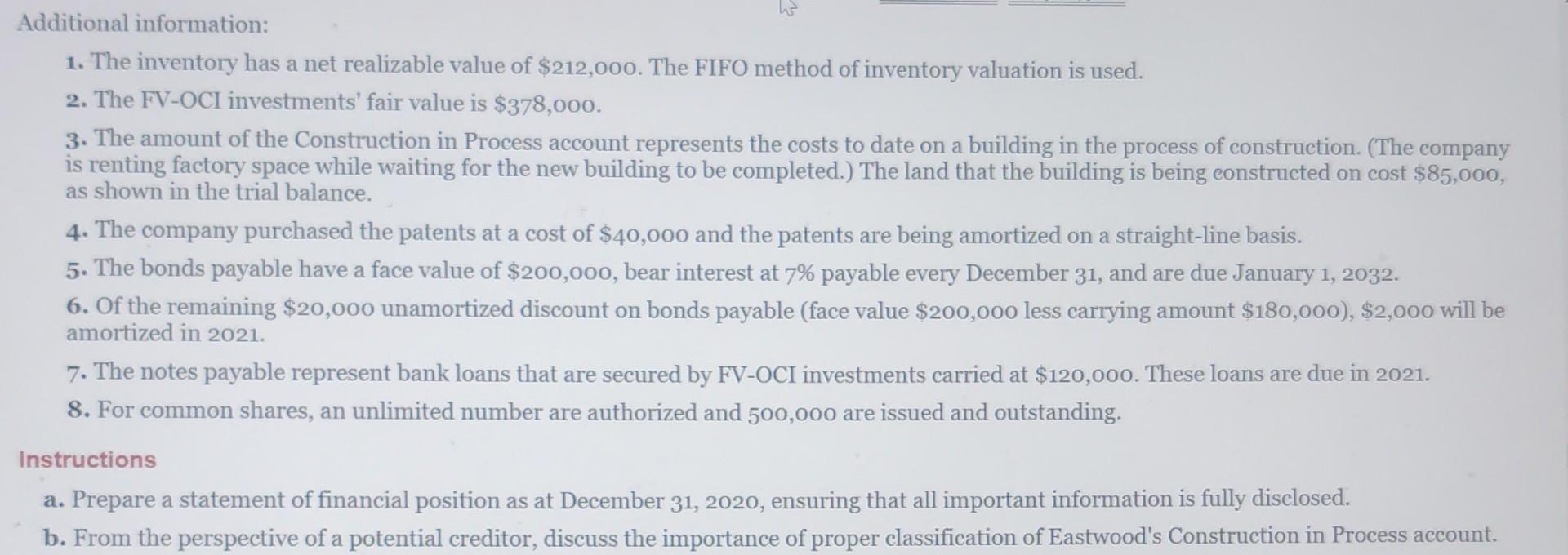

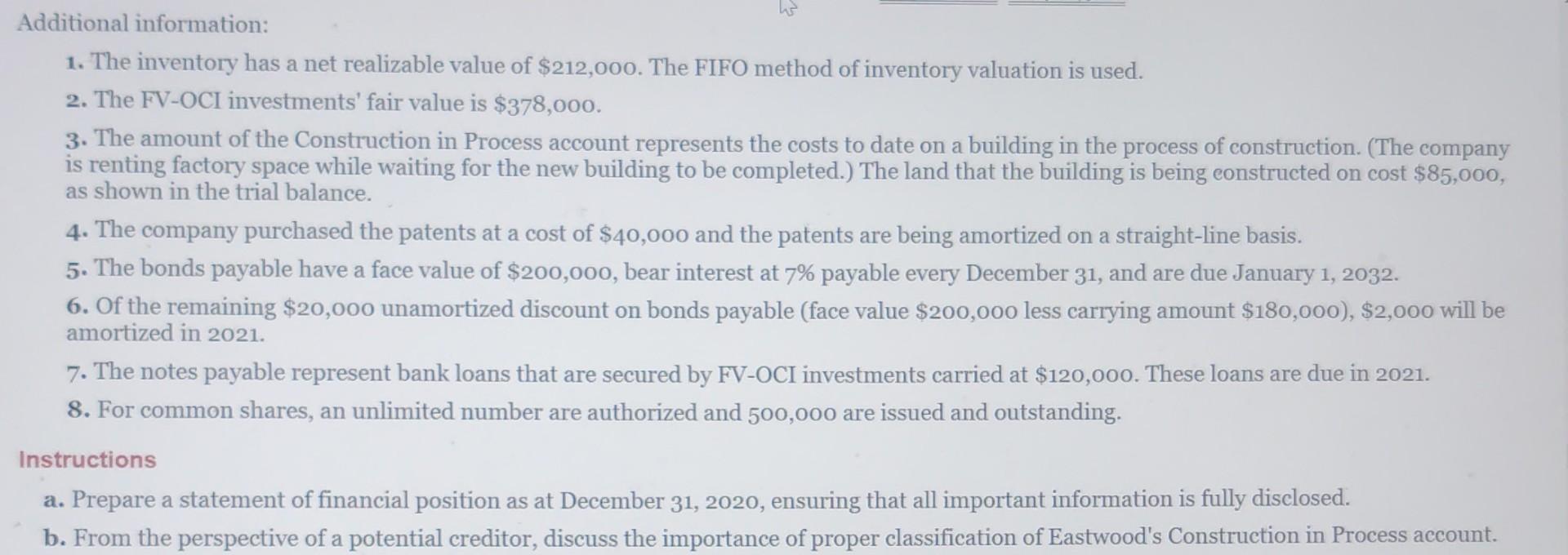

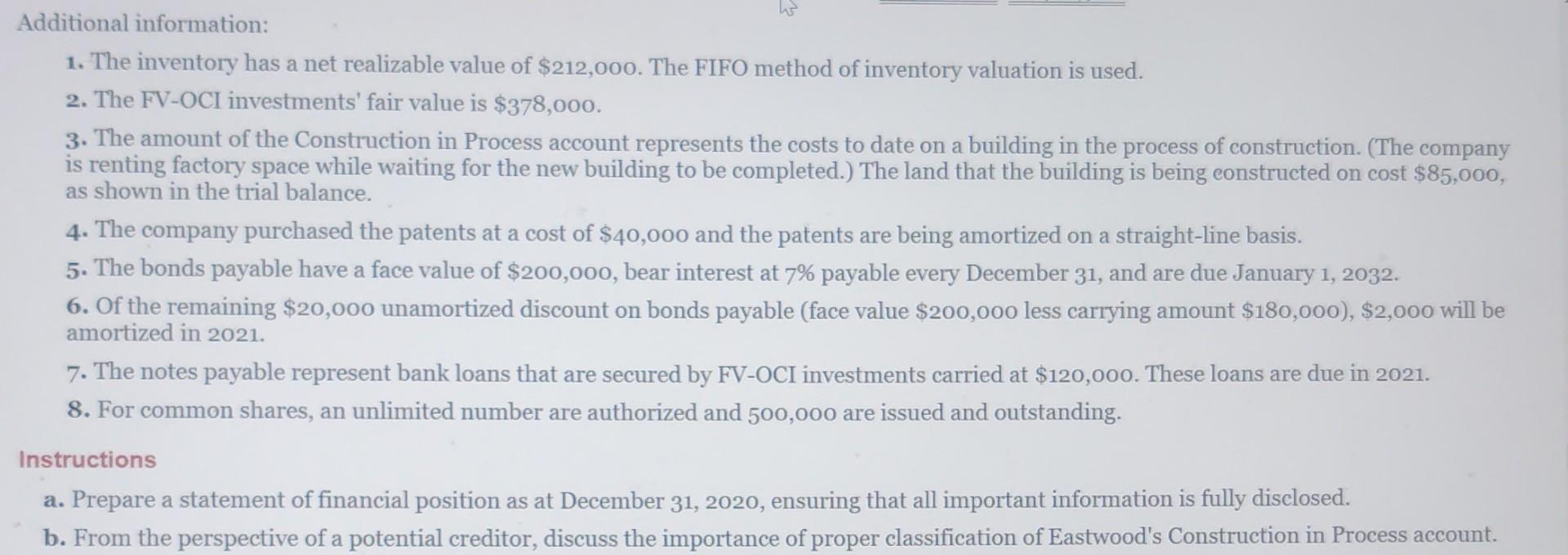

Additional information: 1. The inventory has a net realizable value of $212,000. The FIFO method of inventory valuation is used. 2. The FV-OCI investments' fair value is $378,000. 3. The amount of the Construction in Process account represents the costs to date on a building in the process of construction. (The company is renting factory space while waiting for the new building to be completed.) The land that the building is being constructed on cost $85,000, as shown in the trial balance. 4. The company purchased the patents at a cost of $40,000 and the patents are being amortized on a straight-line basis. 5. The bonds payable have a face value of $200,000, bear interest at 7% payable every December 31, and are due January 1, 2032. 6. Of the remaining $20,000 unamortized discount on bonds payable (face value $200,000 less carrying amount $180,000), $2,000 will be amortized in 2021. 7. The notes payable represent bank loans that are secured by FV-OCI investments carried at $120,000. These loans are due in 2021. 8. For common shares, an unlimited number are authorized and 500,000 are issued and outstanding. Instructions a. Prepare a statement of financial position as at December 31, 2020, ensuring that all important information is fully disclosed. b. From the perspective of a potential creditor, discuss the importance of proper classification of Eastwood's Construction in Process account. Additional information: 1. The inventory has a net realizable value of $212,000. The FIFO method of inventory valuation is used. 2. The FV-OCI investments' fair value is $378,000. 3. The amount of the Construction in Process account represents the costs to date on a building in the process of construction. (The company is renting factory space while waiting for the new building to be completed.) The land that the building is being constructed on cost $85,000, as shown in the trial balance. 4. The company purchased the patents at a cost of $40,000 and the patents are being amortized on a straight-line basis. 5. The bonds payable have a face value of $200,000, bear interest at 7% payable every December 31, and are due January 1, 2032. 6. Of the remaining $20,000 unamortized discount on bonds payable (face value $200,000 less carrying amount $180,000), $2,000 will be amortized in 2021. 7. The notes payable represent bank loans that are secured by FV-OCI investments carried at $120,000. These loans are due in 2021. 8. For common shares, an unlimited number are authorized and 500,000 are issued and outstanding. Instructions a. Prepare a statement of financial position as at December 31, 2020, ensuring that all important information is fully disclosed. b. From the perspective of a potential creditor, discuss the importance of proper classification of Eastwood's Construction in Process account. Additional information: 1. The inventory has a net realizable value of $212,000. The FIFO method of inventory valuation is used. 2. The FV-OCI investments' fair value is $378,000. 3. The amount of the Construction in Process account represents the costs to date on a building in the process of construction. (The company is renting factory space while waiting for the new building to be completed.) The land that the building is being constructed on cost $85,000, as shown in the trial balance. 4. The company purchased the patents at a cost of $40,000 and the patents are being amortized on a straight-line basis. 5. The bonds payable have a face value of $200,000, bear interest at 7% payable every December 31, and are due January 1, 2032. 6. Of the remaining $20,000 unamortized discount on bonds payable (face value $200,000 less carrying amount $180,000), $2,000 will be amortized in 2021. 7. The notes payable represent bank loans that are secured by FV-OCI investments carried at $120,000. These loans are due in 2021. 8. For common shares, an unlimited number are authorized and 500,000 are issued and outstanding. Instructions a. Prepare a statement of financial position as at December 31, 2020, ensuring that all important information is fully disclosed. b. From the perspective of a potential creditor, discuss the importance of proper classification of Eastwood's Construction in Process account. Additional information: 1. The inventory has a net realizable value of $212,000. The FIFO method of inventory valuation is used. 2. The FV-OCI investments' fair value is $378,000. 3. The amount of the Construction in Process account represents the costs to date on a building in the process of construction. (The company is renting factory space while waiting for the new building to be completed.) The land that the building is being constructed on cost $85,000, as shown in the trial balance. 4. The company purchased the patents at a cost of $40,000 and the patents are being amortized on a straight-line basis. 5. The bonds payable have a face value of $200,000, bear interest at 7% payable every December 31, and are due January 1, 2032. 6. Of the remaining $20,000 unamortized discount on bonds payable (face value $200,000 less carrying amount $180,000), $2,000 will be amortized in 2021. 7. The notes payable represent bank loans that are secured by FV-OCI investments carried at $120,000. These loans are due in 2021. 8. For common shares, an unlimited number are authorized and 500,000 are issued and outstanding. Instructions a. Prepare a statement of financial position as at December 31, 2020, ensuring that all important information is fully disclosed. b. From the perspective of a potential creditor, discuss the importance of proper classification of Eastwood's Construction in Process account. Additional information: 1. The inventory has a net realizable value of $212,000. The FIFO method of inventory valuation is used. 2. The FV-OCI investments' fair value is $378,000. 3. The amount of the Construction in Process account represents the costs to date on a building in the process of construction. (The company is renting factory space while waiting for the new building to be completed.) The land that the building is being constructed on cost $85,000, as shown in the trial balance. 4. The company purchased the patents at a cost of $40,000 and the patents are being amortized on a straight-line basis. 5. The bonds payable have a face value of $200,000, bear interest at 7% payable every December 31, and are due January 1, 2032. 6. Of the remaining $20,000 unamortized discount on bonds payable (face value $200,000 less carrying amount $180,000), $2,000 will be amortized in 2021. 7. The notes payable represent bank loans that are secured by FV-OCI investments carried at $120,000. These loans are due in 2021. 8. For common shares, an unlimited number are authorized and 500,000 are issued and outstanding. Instructions a. Prepare a statement of financial position as at December 31, 2020, ensuring that all important information is fully disclosed. b. From the perspective of a potential creditor, discuss the importance of proper classification of Eastwood's Construction in Process account. Additional information: 1. The inventory has a net realizable value of $212,000. The FIFO method of inventory valuation is used. 2. The FV-OCI investments' fair value is $378,000. 3. The amount of the Construction in Process account represents the costs to date on a building in the process of construction. (The company is renting factory space while waiting for the new building to be completed.) The land that the building is being constructed on cost $85,000, as shown in the trial balance. 4. The company purchased the patents at a cost of $40,000 and the patents are being amortized on a straight-line basis. 5. The bonds payable have a face value of $200,000, bear interest at 7% payable every December 31, and are due January 1, 2032. 6. Of the remaining $20,000 unamortized discount on bonds payable (face value $200,000 less carrying amount $180,000), $2,000 will be amortized in 2021. 7. The notes payable represent bank loans that are secured by FV-OCI investments carried at $120,000. These loans are due in 2021. 8. For common shares, an unlimited number are authorized and 500,000 are issued and outstanding. Instructions a. Prepare a statement of financial position as at December 31, 2020, ensuring that all important information is fully disclosed. b. From the perspective of a potential creditor, discuss the importance of proper classification of Eastwood's Construction in Process accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started