Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! i need help on my school assignment which graded me very high % ! this is one part of my assignment: Here is the

Hi! i need help on my school assignment which graded me very high % ! this is one part of my assignment: Here is the background story given

Question 1 (WEALTH GROUNDING FOUNDATIONAL PART) (a) (i) What is Darrens total investment asset to net worth ratio? (6 marks) (ii) What are the TWO (2) primary considerations in determining Darrens ability to handle debt? (6 marks)

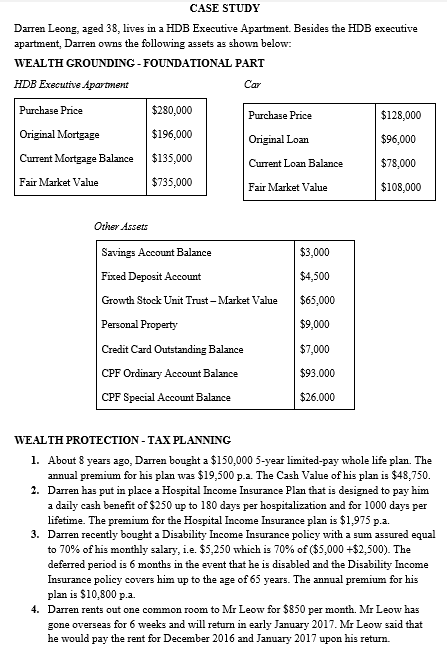

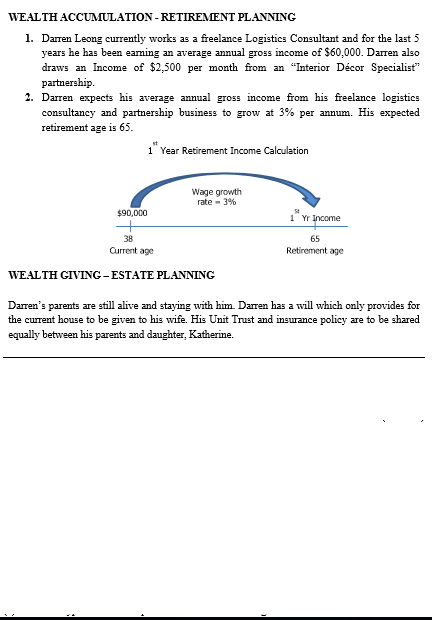

CASE STUDY Darren Leong, aged 38, lives in a HDB Executive Apartment. Besides the HDB executive apartment, Darren owns the following assets as shown below: WEALTH GROUNDING-FOUNDATIONAL PART HDB Executive iparment $280,000 Purchase Price $128,000 Purchase Price $196,000 Original Mortgage $96,000 Original Loan Current Mortgage Balance $135,000 Current Loan Balance $78,000 Fair Market Value $735,000 Fair Market Value $108,000 Other Assets $3,000 Savings Account Balance Fixed Deposit Account $4,500 Growth Stock Unit Trust-Market Value $65,000 $9,000 Personal Property $7,000 credit card outstanding Balance $93.000 CPF Ordinary Account Balance CPF Special Account Balance $26.000 WEALTH PROTECTION TA PLANNING 1. About 8 years ago, Darren bought a$150,000 5-year limited-pay whole life plan. The annual premium for his plan was $19,500 p-a. The Cash Value of his plan is $48,750. 2. Darren has put in place a Hospital Income Insurance Plan that is designed to pay him a daily cash benefit of $250 up to 180 days per hospitalization and for 1000 days per lifetime. The premium for the Hospital Income Insurance plan is $1,975 p.a. 3. Darren recently bought a Disability Income Insurance policy with a sum assured equal to 70% of his monthly salary, i e. $5,250 which is 70% of ($5,000 +$2,500). The deferred period is 6 months in the event that he is disabled and the Disability Income Insurance policy covers him up to the age of 65 years. The annual premium for his plan is $10,800 p.a. 4. Darren rents out one common room to Mr Leow for $850 per month. Mr Leow has gone overseas for 6 weeks and will return in early January 2017. Mr Leow said that he would pay the rent for December 2016 and January 2017 upon his retum. CASE STUDY Darren Leong, aged 38, lives in a HDB Executive Apartment. Besides the HDB executive apartment, Darren owns the following assets as shown below: WEALTH GROUNDING-FOUNDATIONAL PART HDB Executive iparment $280,000 Purchase Price $128,000 Purchase Price $196,000 Original Mortgage $96,000 Original Loan Current Mortgage Balance $135,000 Current Loan Balance $78,000 Fair Market Value $735,000 Fair Market Value $108,000 Other Assets $3,000 Savings Account Balance Fixed Deposit Account $4,500 Growth Stock Unit Trust-Market Value $65,000 $9,000 Personal Property $7,000 credit card outstanding Balance $93.000 CPF Ordinary Account Balance CPF Special Account Balance $26.000 WEALTH PROTECTION TA PLANNING 1. About 8 years ago, Darren bought a$150,000 5-year limited-pay whole life plan. The annual premium for his plan was $19,500 p-a. The Cash Value of his plan is $48,750. 2. Darren has put in place a Hospital Income Insurance Plan that is designed to pay him a daily cash benefit of $250 up to 180 days per hospitalization and for 1000 days per lifetime. The premium for the Hospital Income Insurance plan is $1,975 p.a. 3. Darren recently bought a Disability Income Insurance policy with a sum assured equal to 70% of his monthly salary, i e. $5,250 which is 70% of ($5,000 +$2,500). The deferred period is 6 months in the event that he is disabled and the Disability Income Insurance policy covers him up to the age of 65 years. The annual premium for his plan is $10,800 p.a. 4. Darren rents out one common room to Mr Leow for $850 per month. Mr Leow has gone overseas for 6 weeks and will return in early January 2017. Mr Leow said that he would pay the rent for December 2016 and January 2017 upon his retumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started