Hi, I need help solving this question about the case study below. Can anyone help me out?

Question: What would you assess as the fundamental strength of the competitive forces that Beyond Meat faces? Also, how would you conduct a five-forces analysis in chronological order of the steps while making sure it can support your answer?

Case Study:

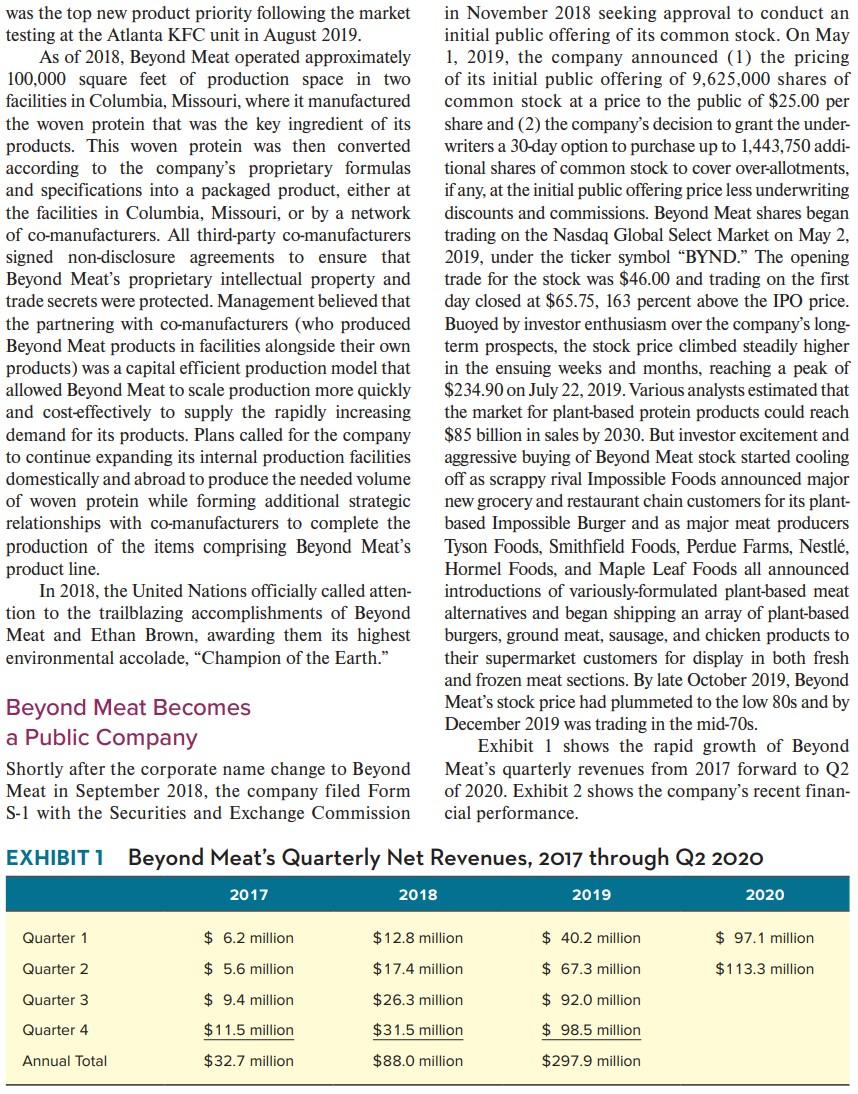

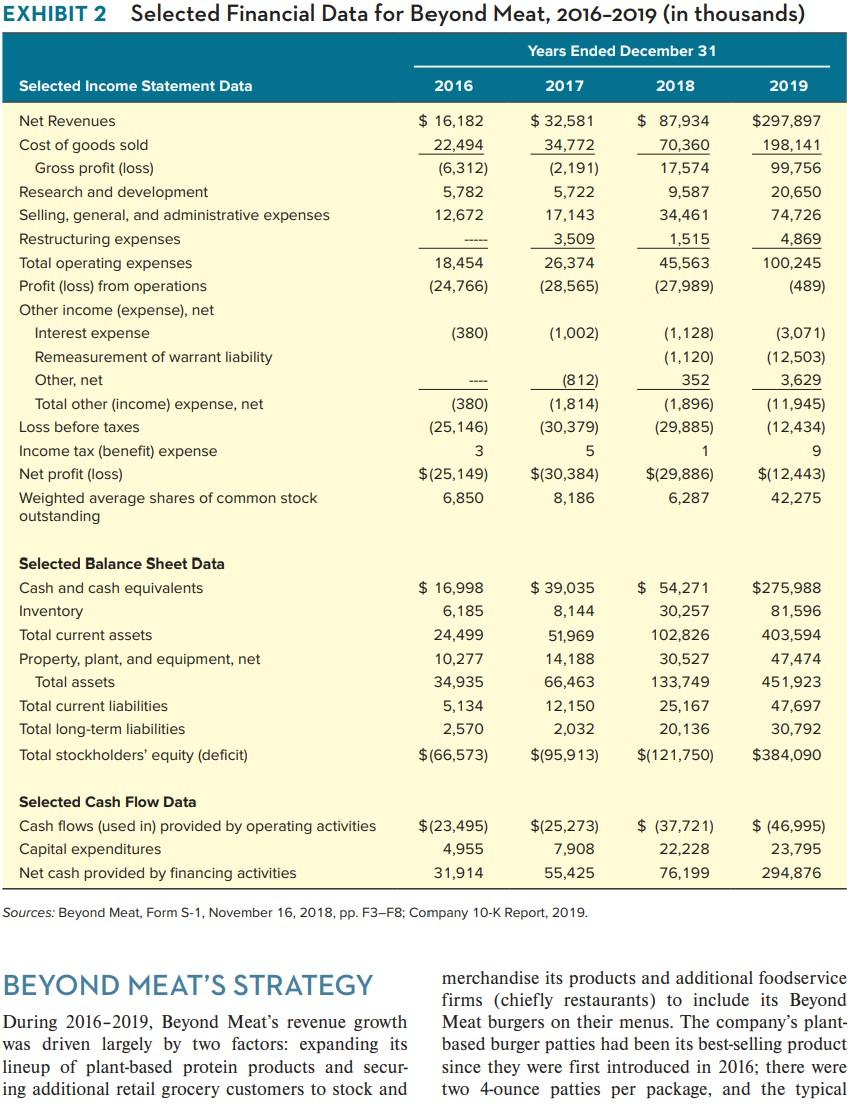

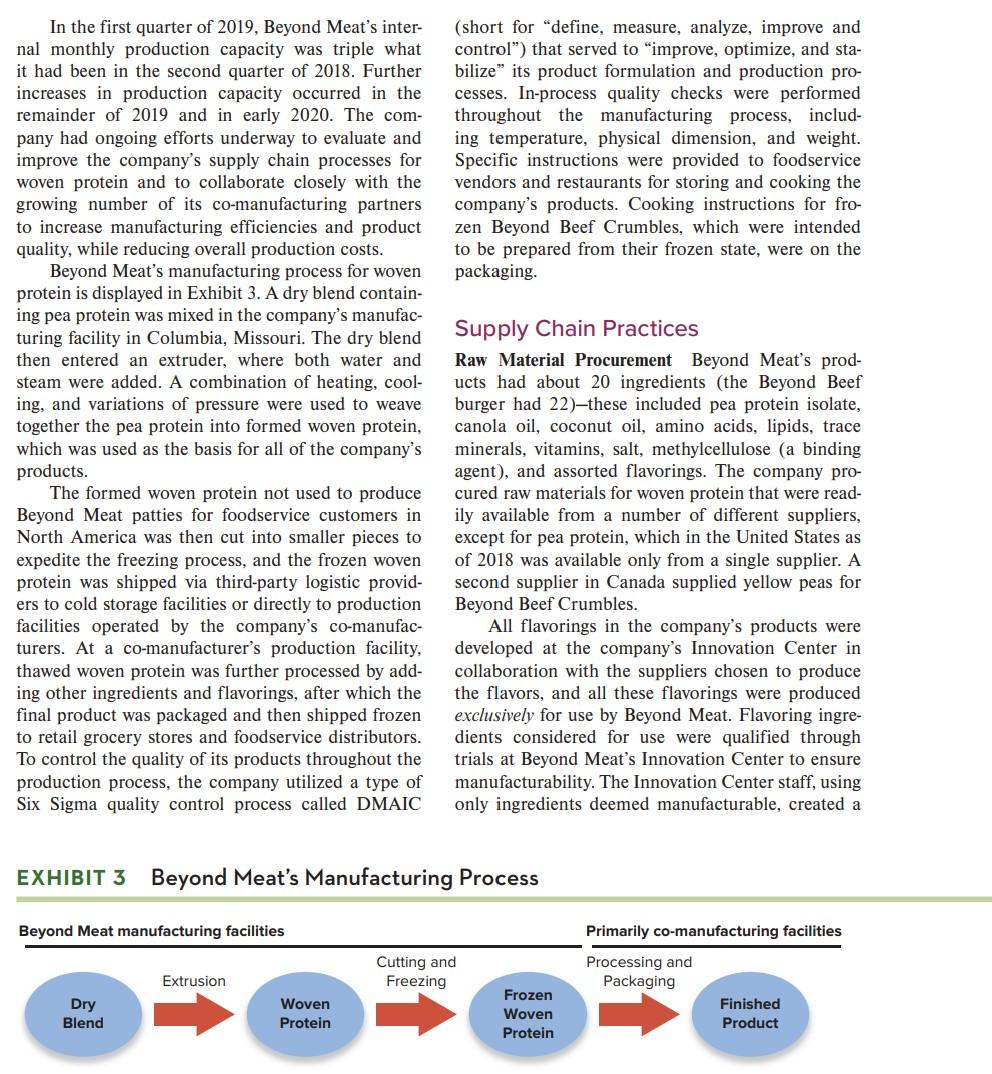

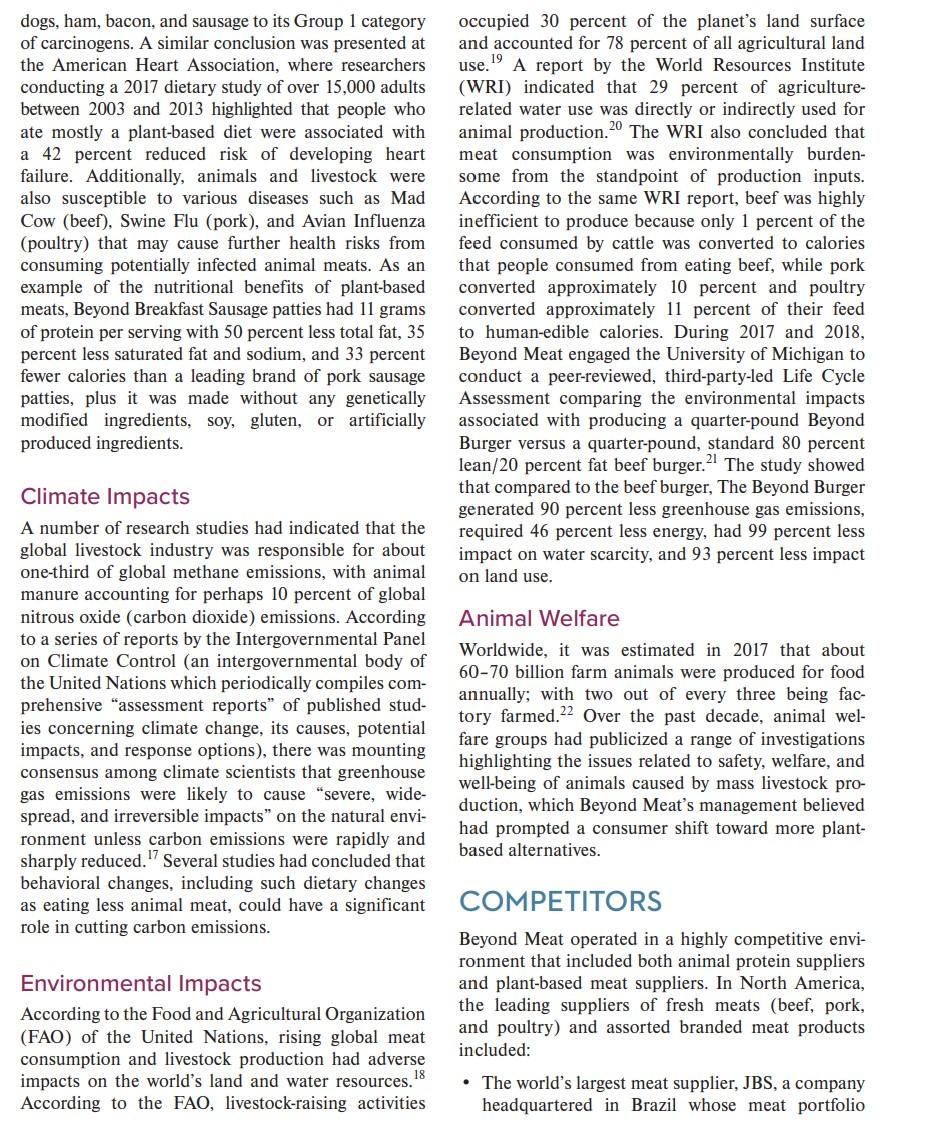

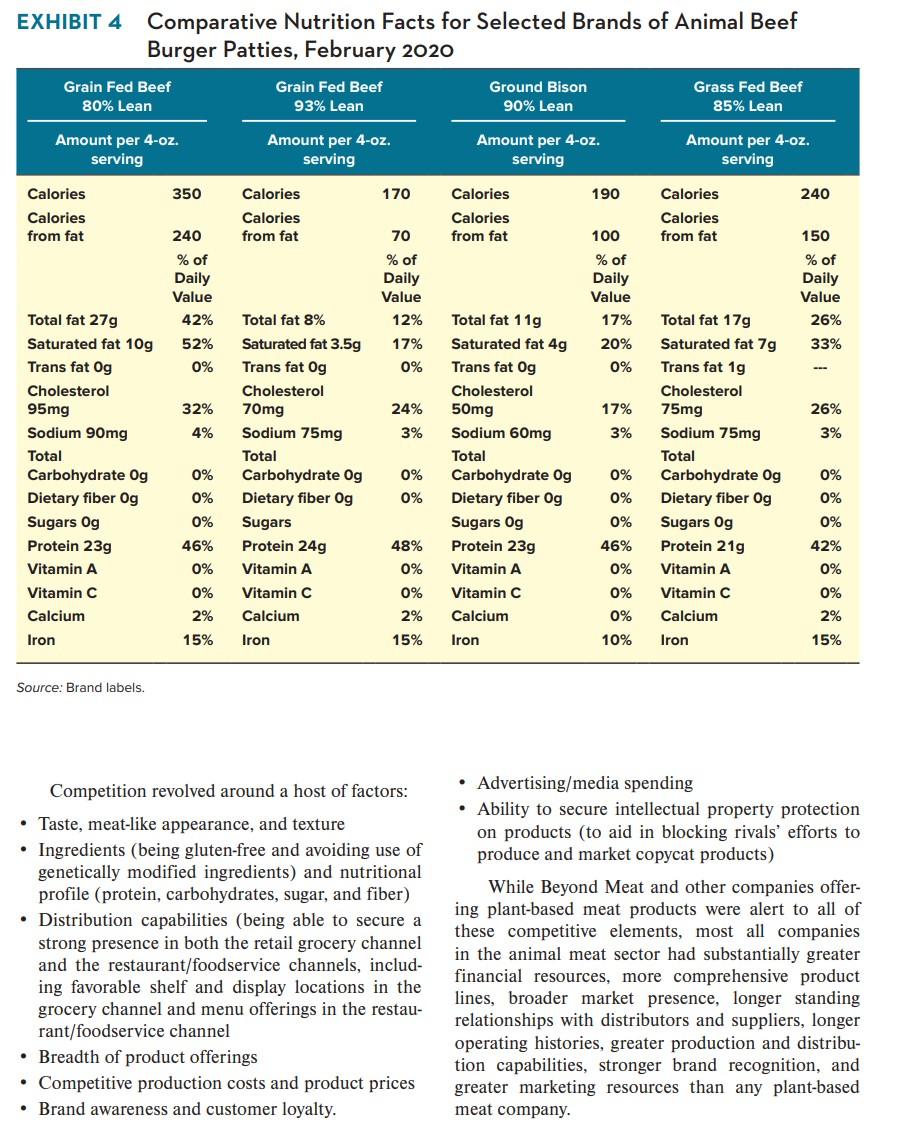

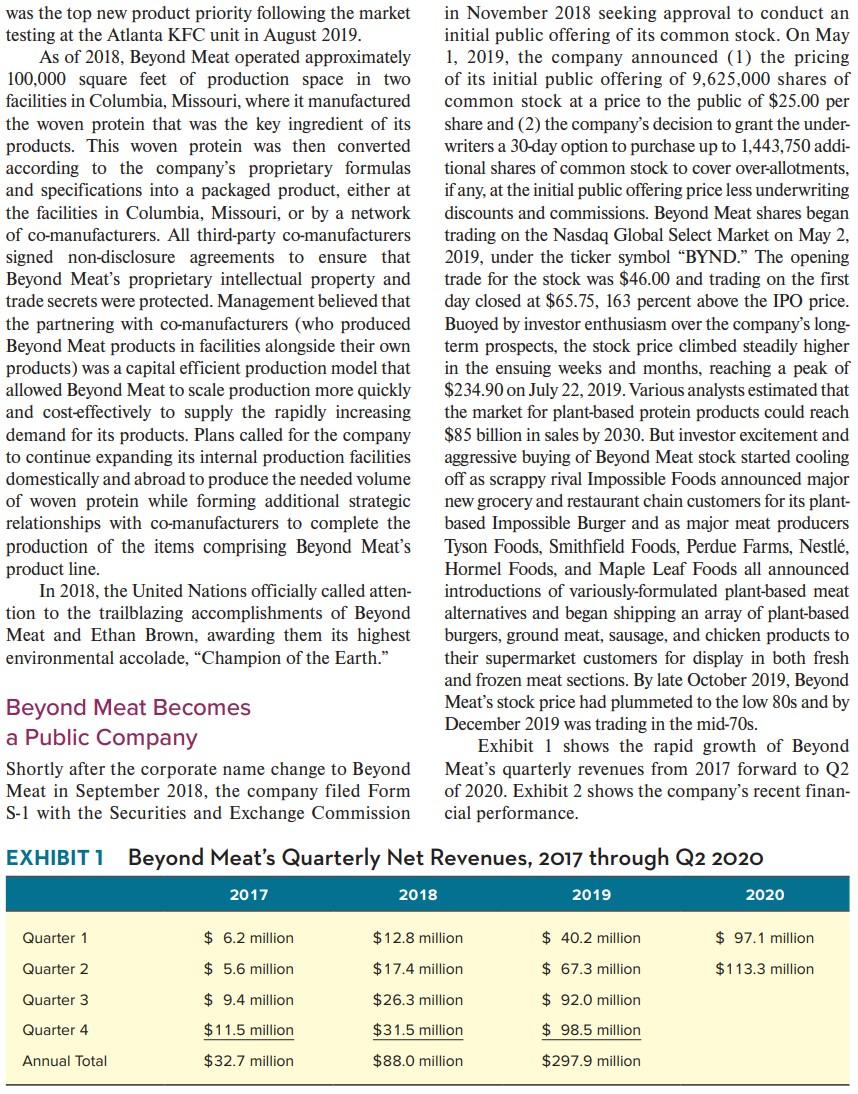

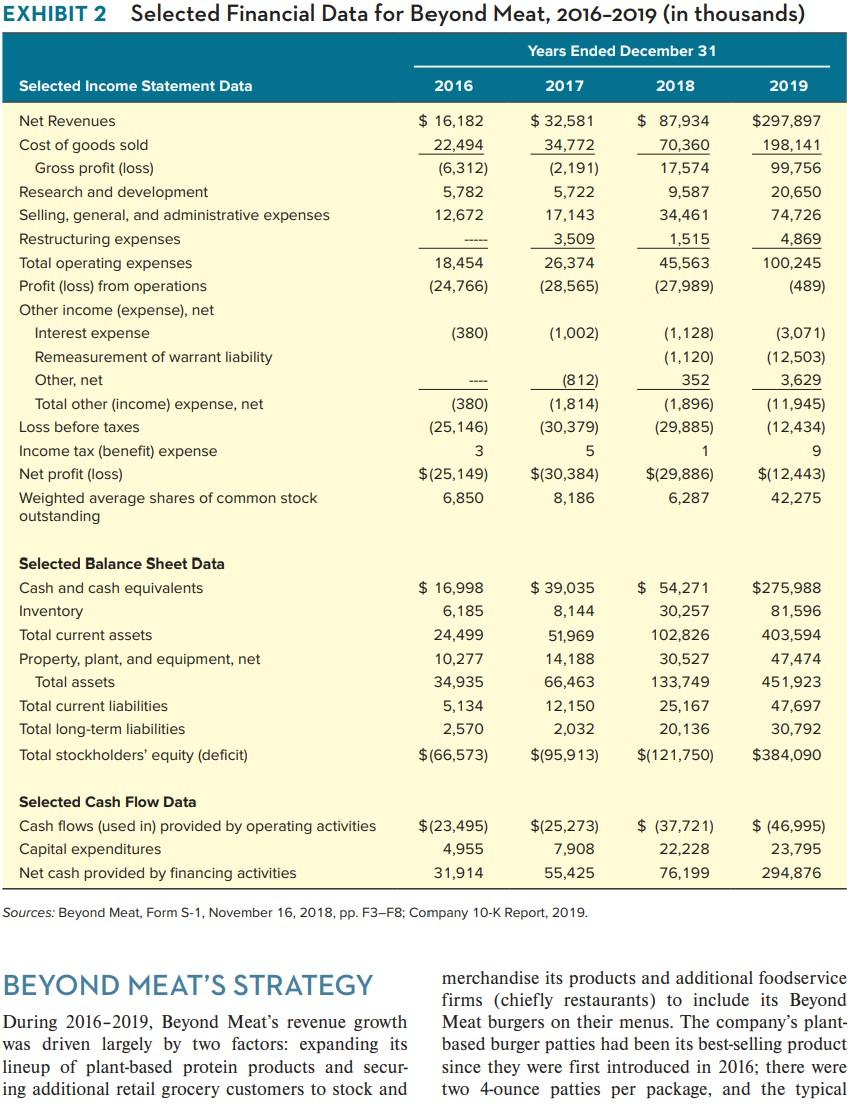

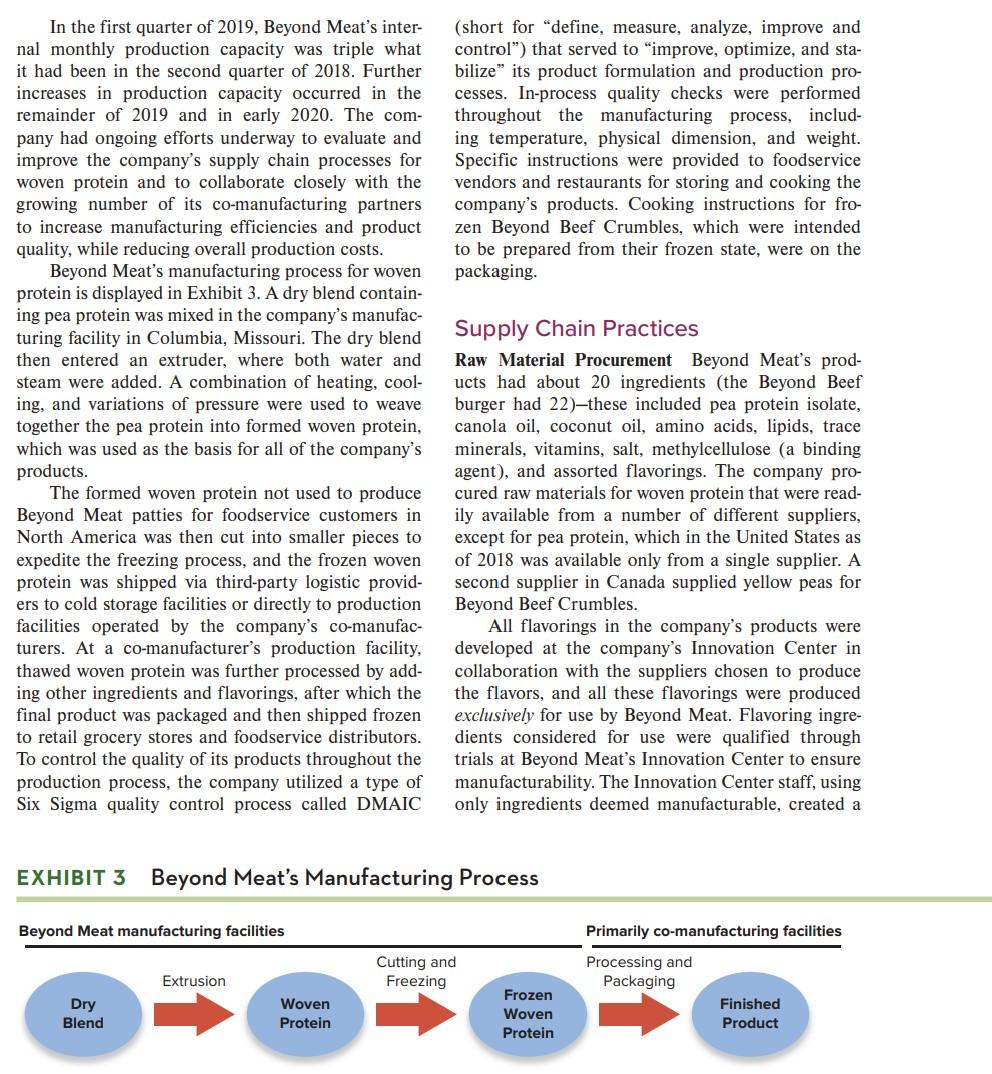

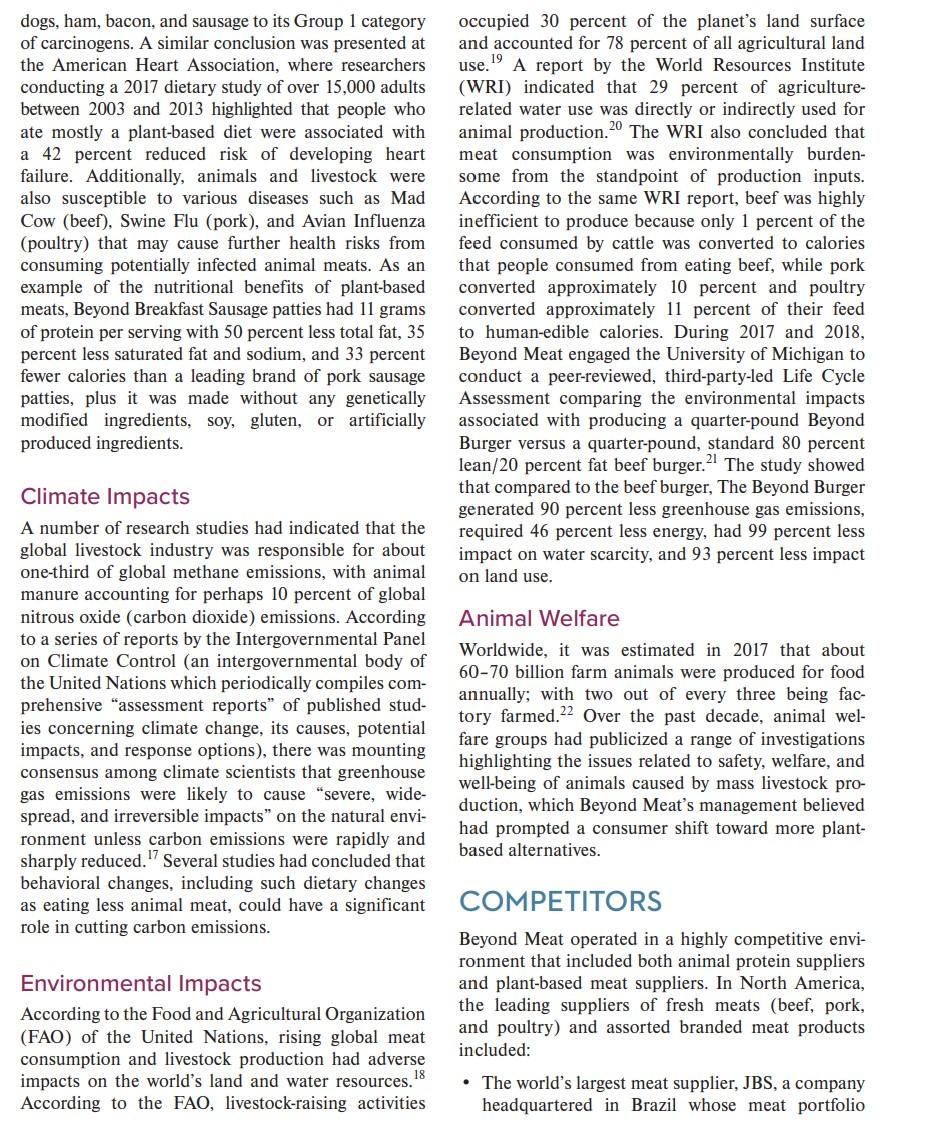

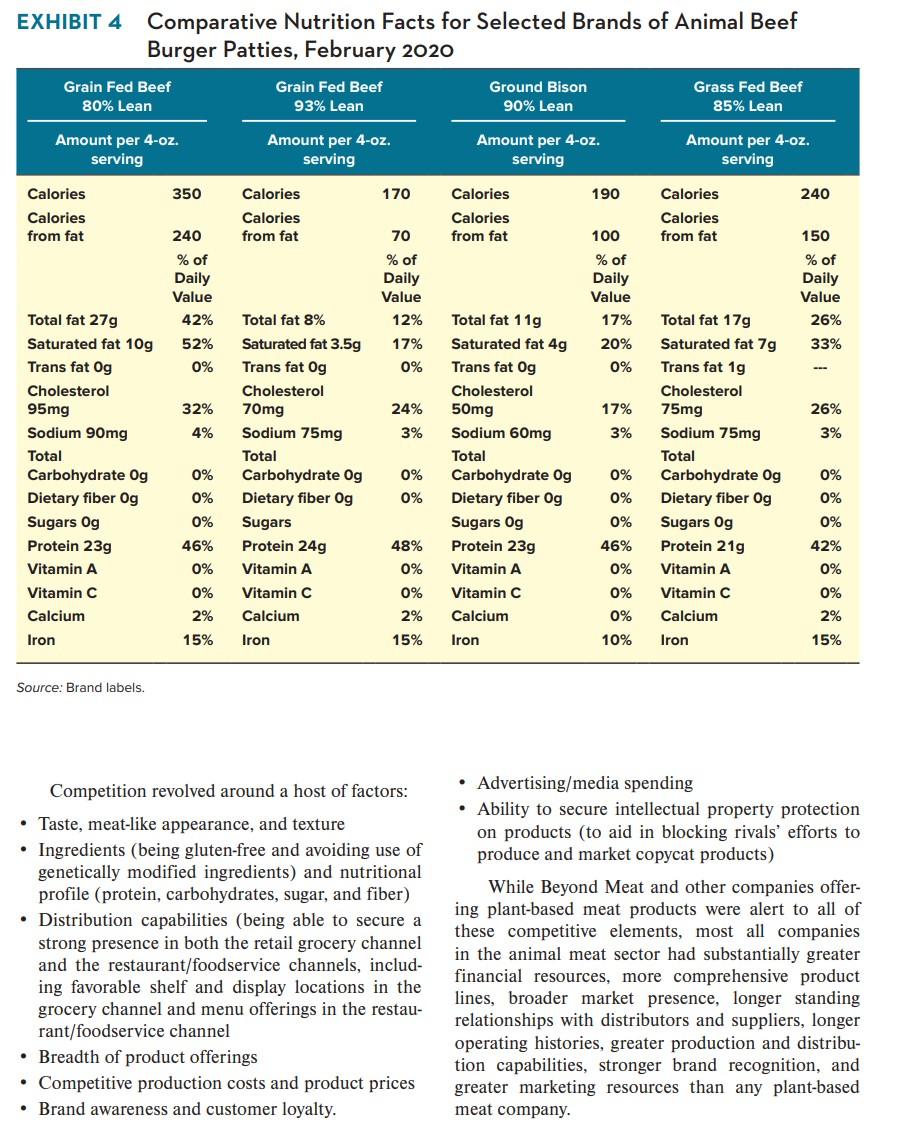

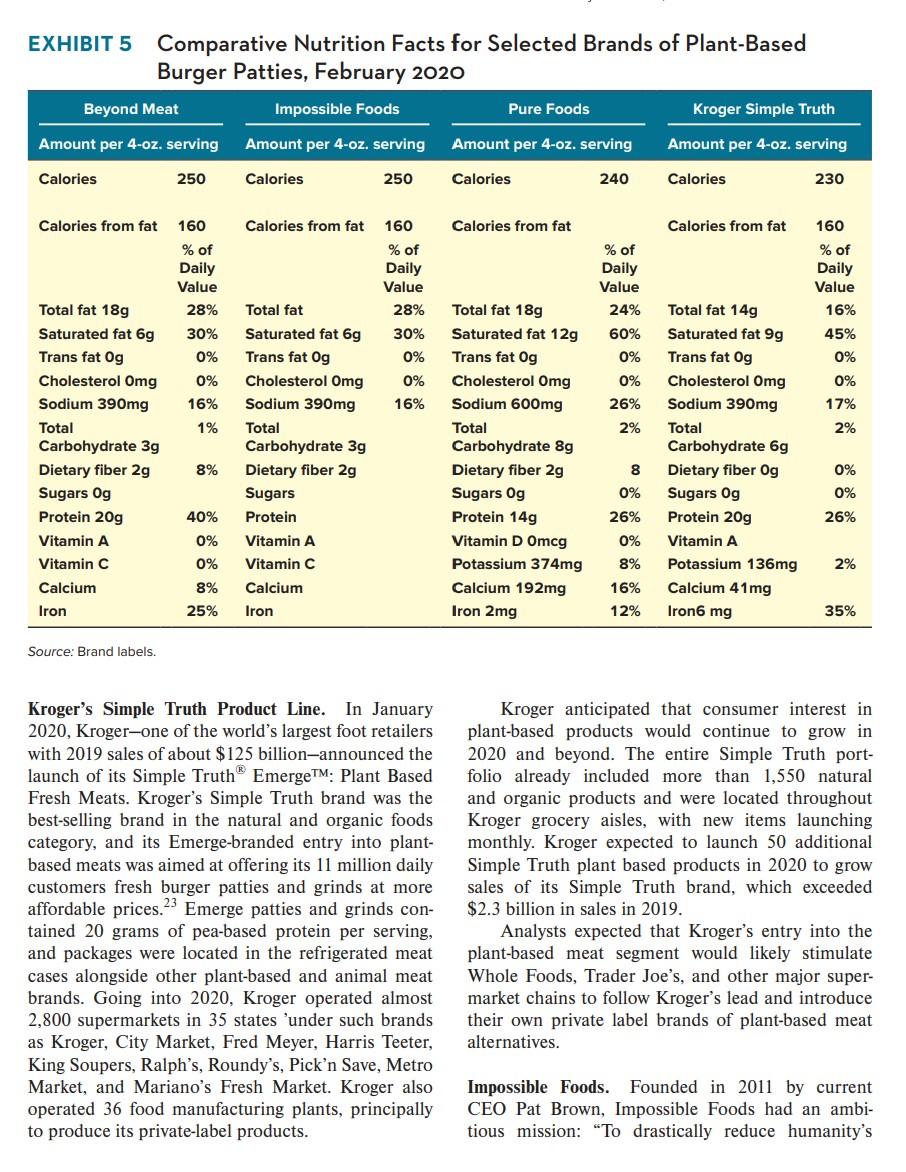

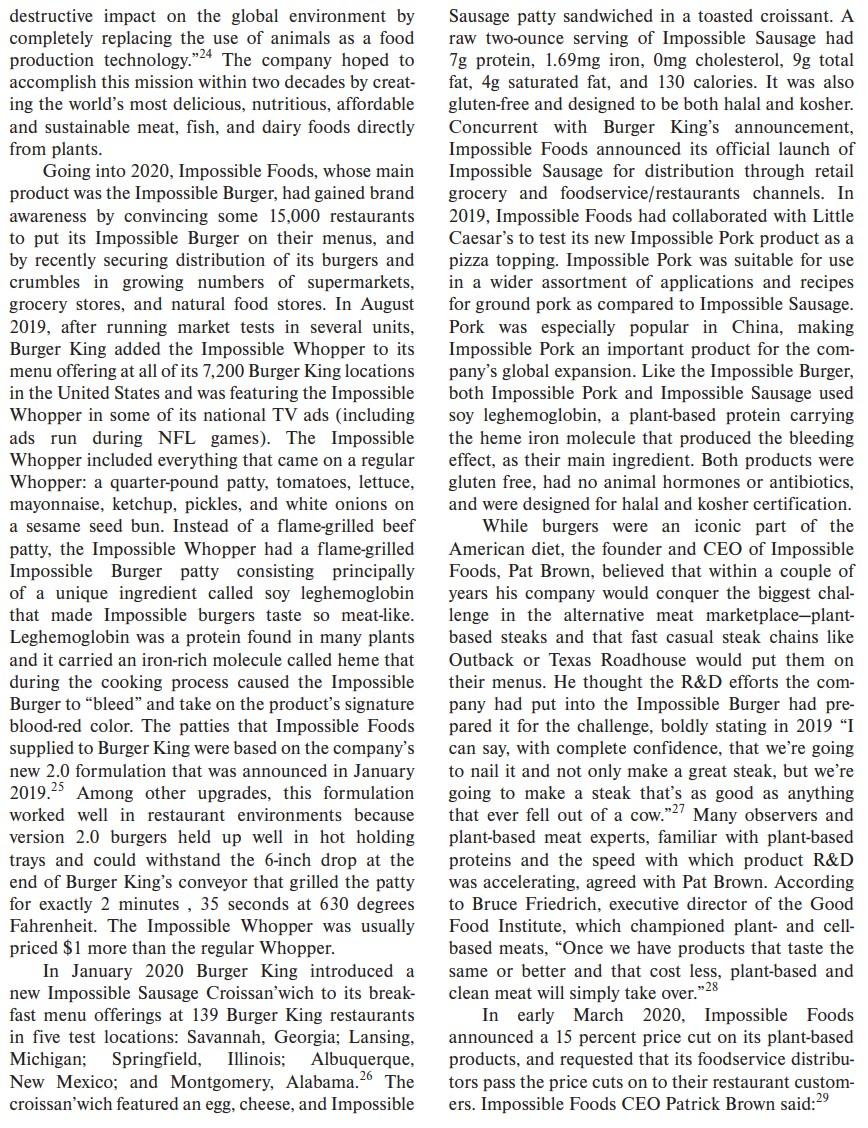

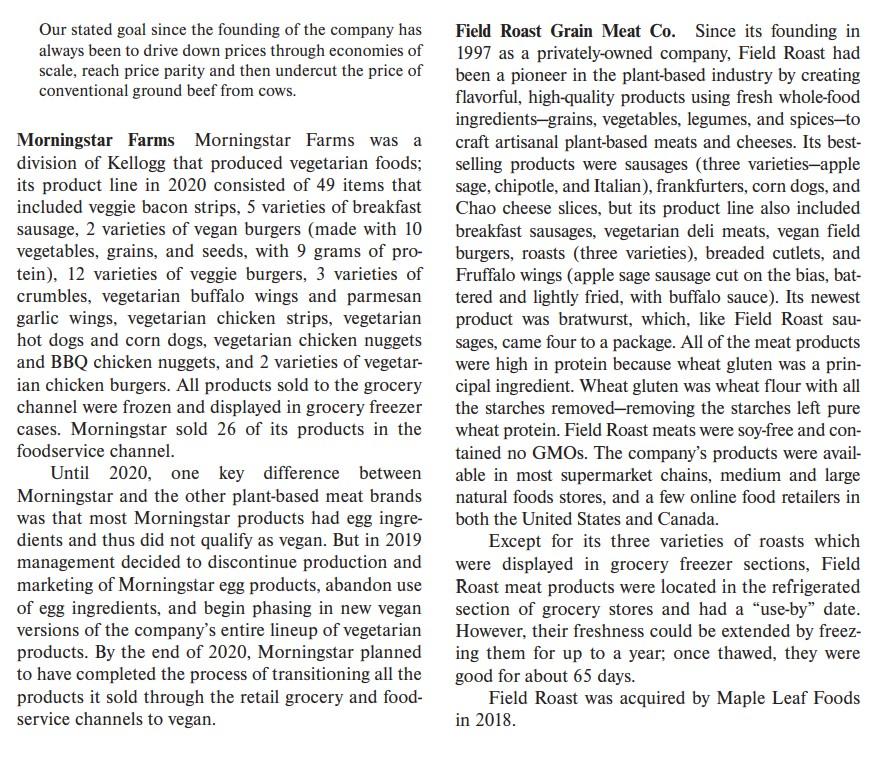

oing into 2020, Beyond Meat, a producer March 31, 2020, the company's fresh and frozen and marketer of plant-based protein products plant-based protein products were being sold at some intended as a substitute for animal-based meat 94,000 grocery stores, restaurants, hotels, and other products, had evolved into one of the fastest growing foodservice outlets in more than 65 countries worldfood companies in the United States. Company wide, up from 77,000 at year-end 2019. revenues had increased from $8.8 million in 2015 to $32.6 million in 2017 to $88 million in 2018 to $298 million in 2019 , equal to a compound annual COMPANY BACKGROUND growth rate of 102 percent. Its portfolio of plant-based Beyond Meat was founded in 2009 by Ethan Brown, meats had expanded from just plant-based burger and then later incorporated in Delaware in April patties to include several varieties of Beyond Sausages, 2011 under the name "J Green Natural Foods Co. Beyond Breakfast Sausage, one-pound packages In October 2011, the company changed its corporate of ground Beyond Beef, and two flavors of Beyond name to "Savage River, Inc.," with "Beyond Meat" Beef crumbles found on the frozen meat aisle at being its "doing business as" name. In September 2018, supermarkets. The company's Beyond Chicken frozen the corporate name was changed to "Beyond Meat, grilled chicken strips, introduced in 2018, generated Inc." Beyond Meat's principal executive offices were only modest customer acceptance and was quietly located in El Segundo, California. Ethan Brown was discontinued; however, the company immediately President and Chief Executive Officer of Beyond Meat put a team of chefs and scientists to work on getting and had served in this capacity throughout all of the a better, tastier version of a Beyond Chicken product corporate transitions since the original company was back on retail shelves and restaurant menus. In August founded. Brown grew up on a family farm in Maryland 2019 Beyond Meat partnered with KFC, to conduct a that specialized in dairy operations and became fascione-day test of new "Beyond Fried Chicken" at a single nated with animal agriculture, meat-raising practices, Atlanta location. This taste test of what KFC advertised and animal protein consumption. But he also started as "a Kentucky Fried Miracle" attracted so many to wrestle with a question that continued to nag him for customers that the store sold out of the faux chicken many years to come: Do we need animals to produce in less than five hours. 1 As of May 2020, Beyond Meat meat? During the course of his business and industry had not introduced a second version of its Beyond career, Brown held a variety of positions in the energy Chicken product. business that provided him with growing familiarity Beyond Meat's brand commitment, "Eat What about clean energy technologies, the impacts of animal You Love," reflected a belief that by eating its plant- meat consumption on human health, and the effects of based meat offerings, consumers could enjoy more livestock on greenhouse gas emissions, along with the of their favorite protein dishes while helping address related burdens on land, energy, and water. concerns related to human health, animal welfare, resource conservation, and climate change. As of Copyright 2021 by Arthur A. Thompson. All rights reserved. These experiences expanded his understanding of kitchen in Maryland to develop and test recipes for animal meat. The key understanding he learned was plant-based meat products using (1) proteins from that it was not necessary to limit the definition of meat peas, mung beans, fava beans, brown rice, and sunto just cows, pigs, and poultry; rather, meat could just flower seeds, (2) various fats (cocoa butter, cocoas accurately be defined in terms of its composition nut oil, sunflower oil, and canola oil), (3) such and structure-amino acids, lipids, trace minerals, minerals as calcium, iron, salt, and potassium chlovitamins, and water woven together in the assembly ride, and (4) beet juice extract, apple extract, and of muscle (or meat). None of these core elements of assorted other natural flavors. Ethan Brown began meat was exclusive to animals; they were abundant in working extensively with two researchers at the the plant kingdom. While animals served as a bioreac- University of Missouri's Bioengineering and Food tor, consuming vegetation and water and using their Science Department and faculty and students in the digestive system to organize these inputs into meat, University of Maryland's Nutrition \& Food Science it was equally feasible to take the constituent parts of Department. Ultimately, the company ultimately meat from plants and, together with water, organize licensed a process developed by the researchers that them into the same basic architecture as animal-based combined proteins from plants into a basic structure meat, thereby bypassing the need for animals and the resembling animal muscle, or meat, and used this cholesterol associated with consuming animal meat. as an initial foundation for Beyond Meat products. 4 Then, as climate change issues moved into the With this basic protein platform and an understandpublic spotlight, Brown became increasingly troubled ing that the balance of parts of meat, namely lipids, by studies reporting that the livestock industry was esti- trace minerals, and water, were also present in abunmated to contribute 18 to 51 percent of global green- dance outside the animal, it became clear that with house gas emissions, depending on the methodology appropriate resources, building meat from plants was used. And there were numerous studies in the medical indeed possible. journals about the adverse impacts of eating red meat on The young company began selling an early planthuman health, which heightened his concerns about sat- based product to Whole Foods Markets in the Midisfying his children's protein requirements totally with Atlantic region. It quickly discovered that traditional animal meat. In 2009, driven by the health and environ- veggie burgers and soy-based meat had limited appeal mental implications of intensive animal protein produc- to traditional meat eaters, who commonly criticized tion and consumption, Brown decided to found Beyond their inferior taste. 5 Its own market research with Meat and begin the process of producing and marketing consumers revealed that, when choosing among nutritious and good-tasting plant-based meat products. plant-based meat options, taste was definitely the sinBrown's vision for Beyond Meat was to perfectly build a gle most important product attribute for plant-based plant-based meat. Believing that there was a better way foods. Legacy vegetarian brands typically aimed to to feed the planet than by relying so heavily on animal compensate for poor taste appeal by positioning their meat, Brown's mission for Beyond Meat was "to create products as a noble sacrifice-something consumers The Future of Protein 8 - delicious plant-based burgers, should do for the benefit of their health, the environbeef, sausage, crumbles, and more."' The goal was "to ment, and/or animal welfare. deliver a consumer experience that is indistinguishable A "The Future of Protein" marketing campaign from that provided by animal-based meats." .3 Brown was launched in the summer of 2015 . 6 The goal saw four socially beneficial outcomes associated with was to mobilize brand ambassadors to help raise Beyond Meat's efforts to try to shift a significant por- brand awareness and make Beyond Meat products tion of the world's protein requirements from animal to aspirational. A joint announcement with Leonardo plant-based meat: improving human health, positively DiCaprio about his becoming a Beyond Meat impacting climate change, addressing global resource brand ambassador in October 2017 generated over constraints, and improving animal welfare. 378 million earned media impressions, including a Beyond Meat's Early Successes viral video that drew more than 8.5 million views. Beyond Meat launched its flagship Beyond Burger cious tasting plant-based meat, Brown opened the for a vegetarian meat product. 7 Instead of marketing company's first operation in a small commercial and merchandising The Beyond Burger to vegans and vegetarians (who represented less than five percent service distributors were delivering the Beyond Burger of the population in the United States), the company to approximately 11,000 restaurant and foodservice requested that the product be sold in the meat case at outlets in the United States. The Beyond Burger grocery retailers where meat-loving consumers were launched in Europe in August 2018 through contracts accustomed to shopping for center-of-plate proteins. with three major distributors, with strong expressions In May 2016, the Rocky Mountain Division of Whole of interest from some of Europe's largest grocery Foods Market became the first grocery chain to place and restaurant chains. Beyond Meat's revenues from The Beyond Burger in its meat section alongside ani- international markets (excluding Canada) represented mal-based equivalents; soon other Whole Foods Market 13 percent of net revenues in the first half of 2019, regions followed. In April 2017, Safeway of Northern up from 2 percent in the first half of 2018. The comCalifornia and several Kroger divisions began to do the pany expected to begin production of its plant-based same. In the Southern California division of Ralph's, a products in Europe in 2020 at a new co-manufacturing Kroger subsidiary, The Beyond Burger was the number facility constructed in the Netherlands by Zandbergen one selling packaged burger patty by unit in the meat World's Finest Meat. In 2018, Zandbergen started discase for the 12-week period ending August 4, 2018. tributing Beyond Meat's products throughout Europe Marketing personnel at Beyond Meat believed mer- across both foodservice and retail grocery channels. chandising in the meat case in the retail channel had For several years, Beyond Meat had maintained a preshelped drive greater brand awareness with consumers. ence and generated brand awareness in Asia through a During 2017-2019, many restaurant, hotel, and local distributor in Hong Kong. Further expansion in other foodservice customers choose to prominently Asia was expected in 2020 and beyond. feature the Beyond Meat/Beyond Burger name on their Throughout 2017-18 and continuing into 2019, menu and within item descriptions, in addition to dis- Beyond Meat relied primarily on its growing number of playing Beyond Meat branded signage. Beyond Meat brand ambassadors (celebrities and influencers), free used its sales to foodservice businesses as a form of sampling of its products from food trucks at over 300 spepaid trial for its products to help drive additional retail cial events, a digital newsletter (with over 200,000 subdemand and create greater brand awareness for Beyond scribers as of Sept 2018), visits to the company's website, Meat through the on-menu and in-store publicity it strong social marketing, and consumer word-of-mouth as received. 8 Top executives believed that Beyond Meat the cornerstones of a campaign to promote greater conhad established its brand as one with "halo" benefits sumer awareness of the Beyond Meat brand name. As of to its partners as evidenced by the speed of adoption by Spring 2019, the company's website had drawn approxikey partners. For example, Beyond Meat was the fastest mately 5 million visitors; the website featured packages new-product launch in the history of TGI Friday's and of the company's products, provided information on A\&W Canada (more than 90,000 patties were sold in where they could be purchased, highlighted nutritional the first three days). In January 2018, A\&W conducted facts and news about the company, and offered an assortconcept and focus group testing to gauge consumers' ment of recipes for using the products. appetite for The Beyond Burger. The results of the con- Meanwhile, Beyond Meat continued to invest heavsumer testing were very positive, indicating that the con- ily in research, development, and innovation-spendcept of a plant-based burger that tasted like real meat, ing about 10.9 percent of net revenue of R\&D in fiscal but without its health baggage, held strong appeal. In year 2019 and 6.9 percent in fiscal 2019.10 In 2018, the taste testing, Beyond Meat's burger received high the company opened its state-of-the-art 30,000 squaremarks from surprised consumers. A\&W CEO, Susan foot Manhattan Beach Project Innovation Center as a Senecal commented, "We were blown away by the fla- part of its world headquarters complex in El Segundo, vor and taste and delicious 'burgerness' of Beyond."" California. The Innovation Center included 5 laboraOn the strength of these results and reports from store tories, a pilot plant, and a test kitchen, staffed with a managers that guest counts were up, A\&W Canada team of scientists, engineers, and cooking specialists began investing significant amounts of money across focused on improving the company's existing products television, digital media and press to promote the addi- and developing new products that better replicated the tion of The Beyond Burger to its menu. sensory experience of animal meats-from the look of By late 2018, the Beyond Burger was being mer- the package to the sizzle on grills and in skillets, and chandised in approximately 17,000 supermarkets and the satisfaction of eating one of the company's prodretail groceries across the United States, and food ucts. A second-version plant-based chicken product was the top new product priority following the market in November 2018 seeking approval to conduct an testing at the Atlanta KFC unit in August 2019. initial public offering of its common stock. On May As of 2018, Beyond Meat operated approximately 1, 2019, the company announced (1) the pricing 100,000 square feet of production space in two of its initial public offering of 9,625,000 shares of facilities in Columbia, Missouri, where it manufactured common stock at a price to the public of $25.00 per the woven protein that was the key ingredient of its share and (2) the company's decision to grant the underproducts. This woven protein was then converted writers a 30 -day option to purchase up to 1,443,750 addiaccording to the company's proprietary formulas tional shares of common stock to cover over-allotments, and specifications into a packaged product, either at if any, at the initial public offering price less underwriting the facilities in Columbia, Missouri, or by a network discounts and commissions. Beyond Meat shares began of co-manufacturers. All third-party co-manufacturers trading on the Nasdaq Global Select Market on May 2, signed non-disclosure agreements to ensure that 2019, under the ticker symbol "BYND." The opening Beyond Meat's proprietary intellectual property and trade for the stock was $46.00 and trading on the first trade secrets were protected. Management believed that day closed at $65.75, 163 percent above the IPO price. the partnering with co-manufacturers (who produced Buoyed by investor enthusiasm over the company's longBeyond Meat products in facilities alongside their own term prospects, the stock price climbed steadily higher products) was a capital efficient production model that in the ensuing weeks and months, reaching a peak of allowed Beyond Meat to scale production more quickly $234.90 on July 22,2019 . Various analysts estimated that and costeffectively to supply the rapidly increasing the market for plant-based protein products could reach demand for its products. Plans called for the company $85 billion in sales by 2030 . But investor excitement and to continue expanding its internal production facilities aggressive buying of Beyond Meat stock started cooling domestically and abroad to produce the needed volume off as scrappy rival Impossible Foods announced major of woven protein while forming additional strategic new grocery and restaurant chain customers for its plantrelationships with co-manufacturers to complete the based Impossible Burger and as major meat producers production of the items comprising Beyond Meat's Tyson Foods, Smithfield Foods, Perdue Farms, Nestl, product line. Hormel Foods, and Maple Leaf Foods all announced In 2018, the United Nations officially called atten- introductions of variously-formulated plant-based meat tion to the trailblazing accomplishments of Beyond alternatives and began shipping an array of plant-based Meat and Ethan Brown, awarding them its highest burgers, ground meat, sausage, and chicken products to environmental accolade, "Champion of the Earth." their supermarket customers for display in both fresh and frozen meat sections. By late October 2019, Beyond Beyond Meat Becomes Meat's stock price had plummeted to the low 80 s and by aPublicCompanyExhibit1showstherapidgrowthofBeyondDecember2019wastradinginthemid-70s. Shortly after the corporate name change to Beyond Meat's quarterly revenues from 2017 forward to Q2 Meat in September 2018, the company filed Form of 2020. Exhibit 2 shows the company's recent finanS-1 with the Securities and Exchange Commission cial performance. EXHIBIT 1 Beyond Meat's Quarterly Net Revenues, 2017 through Q2 2020 BEYOND MEAT'S STRATEGY merchandise its products and additional foodservice firms (chiefly restaurants) to include its Beyond ing additional retail grocery customers to stock and two 4-ounce patties per package, and the typical retail price was about $5.99. A marbled, meatier- TGI Friday's, BurgerFi, Tim Horton's, Chronic tasting burger patty was introduced in June 2019, Tacos, Hello Fresh, Bareburger, WhiteSpot, A\&W, replacing two earlier versions. Starting in 2020 eight- Cinemark Theaters, Disney World, Marriott and patty packages were available for $14.99. The com- Hilton hotels, and foodservice distributor Sysco. The pany's second biggest seller was Beyond Sausage, company was aggressively developing more relationintroduced in 2018, which was available in two ships with international partners; current customers varieties, Bratwurst and Italian; four-link packages included grocery chains Tesco (Great Britain and 6 were normally priced at $8.99. Frozen Beyond Beef other countries in Central Europe and Asia), Kesko Crumbles, available in two flavors-Beefy and Feisty, (Finland), Edeka (Germany), Lidl (28 European became widely available in early 2018 and retailed countries), Albert (Netherlands), Coles (Australia), for about $5.99 per 10-ounce package; these crum- and Ahold Delhaize (Netherlands, Belgium, 5 other bles could be used in chili, tacos, spaghetti, lasagna, European countries, Greece, Indonesia). pizza toppings, and other recipes calling for ground meat. In mid-2019, the company introduced a one- McDonald's Begins Experimenting with Plant-Based pound plastic-sealed package of ground plant-based Burgers Starting in 2017, McDonald's began offerbeef that could be used in any ground beef recipe, ing McVegan (8) burgers, a soy-based sandwich creincluding chili, spaghetti sauce, meatballs, burgers, ated with Swedish vegan food company Anamma, and tacos. This product was very similar in appear- at its restaurants in Sweden and Finland; in these ance to the branded one-pound ground beef pack- two countries, vegetarianism was well entrenched, as ages found in the fresh meat cases at supermarkets many consumers shunned meat due to high prices and grocery stores. The company's Beyond Breakfast and concerns about climate change. In April 2019, Sausage patties began hitting retail grocery shelves in McDonalds introduced a Big Vegan (burger, a soy March 2020. Beyond Meat's next-version plant-based and wheat patty colored with beet juice, intended chicken product was expected to be introduced some- as a permanent addition to its menu offerings, at all time in 2020. 1,500 locations in Germany. The Big Vegan utilized a plant-based "Incredible Burger" made by Nestl, Growth Strategy the world's largest food and beverage company, headGoing into 2020, Beyond Meat executives believed quartered in Switzerland. In late September 2019, in collaboration with there was significant opportunity to expand beyond Beyond Meat, McDonald's began a test run of a plantthe company's current market footprint in the retail based burger called the Beyond Meat P.L.T., short for grocery and foodservice channels, both domestic- plant, lettuce, and tomato, at 28 Canada locations; ally and internationally. As of March 31, 2020, the McDonald's described the P.L.T. as "juicy, delicious, company had secured 94,000 points of distribution perfectly dressed;" it contained no artificial colors, worldwide, including 25,000 stores in the grocery flavors, or preservatives. Beyond Meat's CEO and channel across the United States, 34,000 foodservice Founder, Ethan Brown, said in a statement: "Being of outlets (chiefly restaurants), in the United States, service to McDonald's has been a central and definand 18,000 outlets in the international retail grocery ing goal of mine since founding Beyond Meat over a channel, and 17,000 international foodservice out- decade ago. It comes after a long and productive collets. Major supermarket chains marketing Beyond laboration to make a delicious plant-based patty that Meat products in 2019-2020 included Kroger/City fits seamlessly into McDonald's menu. ..."11 Market, Albertson's, Publix, Whole Foods Market, In January 2020, McDonald's expanded its Target, Walmart, Costco, Giant, Hannaford, Stop test run of the P.L.T. to 52 Canadian locations for a \& Shop, Safeway, Harris Teeter, Natural Grocers, 12-week period starting January 14, 2020. Industry Jewel-Osco, Food Lion, Ralph's, Wegmans, Sprouts observers believed this more extensive market test Farmer's Market, The Fresh Market, Mariano's, would provide management with a clearer picture of Loblaws, and Sobeys. Restaurant and foodservice whether the addition of a Beyond Meat plant-based outlets offering Beyond Meat products in North burger to its menu offering would catch on suffiAmerica included Denny's, Dunkin Brands, Subway, ciently with customers to increase store traffic and Del Taco, Carl's Jr. (approximately 1,100 units), drive sales growth. McDonald's announcement of the expanded test with Beyond Meat prompted man- and international grocery and foodservice channels in agement at rival Impossible Foods to discontinue 2020 and beyond. However, because the United States efforts to persuade McDonald's to conduct a market had the highest level of animal meat consumption trial of its plant-based Impossible Burger. News of per person of any country in the world, management the bigger test also prompted investors to bid up the considered the United States as the company's core price of Beyond Meat common stock by 25 percent. target market from a geographical standpoint and In late January 2020, Denny's Corp. announced believed that over time plant-based meats could it would give away free Beyond Meat Burgers, become a $35 billion food category. 13 Market research dressed with sliced tomatoes, lettuce, onions, pick- firm CFRA forecasted that the global alternative meat les, All-American sauce, and American cheese on a industry would grow to $100 billion in sales by 2030 , multi-grain bun, with the purchase of any beverage up from about $19 billion in 2018.14 As of October on January 30 from 11am to 10pm while supplies 2019, analysts had estimated that sales of plant-based lasted. The promotion, following on the heels of a meat products in the United States were only about highly successful market test of the Beyond Burger \$2.4 billion. in Denny's restaurants in Los Angeles, served to In the grocery channel, Beyond Meat's strategic launch the Beyond Burger menu item nationwide at objective was to capitalize on the company's success all 1,700-plus Denny's locations in the United States as the first plant-based protein offering in supermarand Canada. Denny's announcement triggered a rush ket meat cases not only by growing the number of on the part of investors to purchase Beyond Meat grocery stores carrying Beyond Meat's products but shares, driving the stock price up another 8 percent also by (1) adding more plant-based meat products to $129 per share. to its offerings in supermarket fresh and frozen meat In April 2020, Starbucks debuted a new menu cases and (2) helping drive increases in the overall in its 4,200 stores in China that included Beyond size of the plant-based protein category, as more conMeat's plant-based beef products in pasta and lasa- sumers shifted their diets away from animal-based gna selections. proteins. At the same time, it was strategically important for Beyond Meat to further disrupt the meat offerings in the restaurant channel by getting its prodDistribution Strategy ucts on more restaurant menus across an ever wider Meat was the largest category in food. The size geographic area and in more dishes on these menus. of the global meat category was estimated to be This meant devoting more resources to outcompeting $1.4 trillion in 2019; the estimated size of the market rival Impossible Meats and other new entrants in the for meat in the United States was \$270 billion. The plant-based meat category in convincing restaurants most common sources of meat were domesticated to use its branded products in their plant-based meat animal species such as cattle, pigs, poultry, and, to offerings rather than the brands of other makers of a lesser extent, buffaloes, sheep, and goats. In some plant-based meats. regions of the world, other animal species such as Growing penetration of the foodservice chancamels, yaks, horses, ostriches and game animals, nel was yet another component of Beyond Meat's crocodiles, snakes, and lizards were also eaten as strategy; this channel included food distributors who meat. Pork was the most widely eaten meat in the supplied food products to the food operations at hosworld accounting for roughly 36 percent of the world pitals, schools, hotels, entertainment and hospitality meat intake, followed by poultry and beef with about vendors, country clubs, banquet facilities, sporting 35 percent and 22 percent respectively. 12 events, and other such venues where food was served. Because the market for meat was so large, In 2019-20, having received significant interest from company executives saw ample room for Beyond Meat several prominent foodservice enterprises, Beyond to become and remain the major disruptor in the Meat was aggressively working to expand its distribumeat category worldwide for some years to come. To tion through foodservice enterprises and food distribachieve this role as a major disruptor and change agent utors in a number of different geographic locations in the market for meat, it was essential for Beyond across the world, particularly Europe, Australia, New Meat to sustain its efforts and successes in securing Zealand, Israel, South Korea, Taiwan, South Africa, additional distribution points in the North American and parts of the Middle East. The company had recently increased its staffing America, for the pea protein that was the main ingreof experienced employees in sales and marketing to dient in all of its products. 15 achieve its distribution objectives in the grocery and Since opening the new 30,000 square foot foodservice channels. Manhattan Beach Project Innovation Center in El Shipping Retail products sold in the grocery fresh Segundo, California, which was ten times the size meat sections as part of Beyond Meat's "fresh" of the company's previous lab space, Beyond Meat platform, such as The Beyond Burger and Beyond has increased its pipeline of products and product Sausage, were shipped to the customer frozen. improvements in development and become more Foodservice customers were provided instructions proficient in shortening the time it took to transion 'slacking,' which was typically done by moving fro- tion its laboratory findings, test kitchen results, and zen products to a refrigerator to allow them to slowly pilot plant operations into scaled production. As the and safely thaw before being cooked. Retail grocery company's knowledge and expertise had deepened, stores merchandising burgers and sausage in refriger- its pace of innovation had accelerated, allowing for ated fresh meat cases had to apply a "use by date" reduced time between new product launches. After sticker of seven days for Beyond Sausage or ten days taking multiple years to develop the first Beyond for The Beyond Burger. In addition to or as a sub- Burger, it took less than a year to develop a second stitute for their fresh meat displays of Beyond Meat version with improved taste, texture and aroma attriproducts, some supermarkets and smaller grocer- butes and still fewer months to develop an even beties sold Beyond Burger patties and Beyond Sausage ter third version. Management expected that this products in their frozen meat cases alongside various faster pace of product introductions and meaningful branded packages of frozen chicken and animal meat enhancements to existing products would continue patties; this was done partly (sometimes mainly) to as ongoing R\&D efforts at the Manhattan Beach avoidspoilagelossesofunsoldproducts-thefrozenInnovationCenterstrengthenedthecompanysinno-vationcapabilities. Production Strategy R\&D Strategy The core of Beyond Meat's production strategy was Beyond Meat had invested significant resources in to invest in state-of-the art domestic and international building its capabilities to develop plant-based meat production facilities and expand the capacity of these alternatives to popular animal-based meat products. as needed to supply all of the company's requireIn 2020, the company's innovation team consisted of ments for woven protein, the principal ingredient of about 40 scientists from such disciplines as chemis- its plant-based products. Self-manufacture of woven try, biology, materials, food science, and biophysics protein allowed the company to keep the details of who collaborated with process engineers and culi- its manufacturing process for woven protein proprinary specialists in developing and testing improved etary, thereby making it harder for rival makers of versions of existing products with better taste, tex- plant-based protein products to replicate the meat-like ture, and aroma and also discovering ways to make texture of Beyond Meat's products. The remainder of new plant-based meat products. New learning about the manufacturing process was done by partnering taste, texture, and aroma for one product was quickly with "co-manufacturers" to complete the production applied to the formulations of other existing product process in facilities they operated. While the company offerings and tested for use in new products under completed the manufacture of Beyond Burger patties development. In addition, the innovation team that it sold to the foodservice channel at its production devoted time and effort to exploring and testing the facilities in Columbia, it depended on its co-manufacuse of additional plant protein options, searching turing partners to complete the production process for ingredients that could be sourced more easily or for Beyond Burger patties sold through retail grocery more cheaply than current plant ingredients and that channels and for all of its other products at facilities would retain and build upon the quality and appeal operated by the co-manufacturers. All third-party coof current product offerings. The company sourced manufacturers signed non-disclosure agreements to plant ingredients from a variety of vendors, but was ensure that Beyond Meat's proprietary intellectual heavily dependent on a single supplier, Roquette property and trade secrets were protected. In the first quarter of 2019, Beyond Meat's inter- (short for "define, measure, analyze, improve and nal monthly production capacity was triple what control") that served to "improve, optimize, and stait had been in the second quarter of 2018. Further bilize" its product formulation and production proincreases in production capacity occurred in the cesses. In-process quality checks were performed remainder of 2019 and in early 2020. The com- throughout the manufacturing process, includpany had ongoing efforts underway to evaluate and ing temperature, physical dimension, and weight. improve the company's supply chain processes for Specific instructions were provided to foodservice woven protein and to collaborate closely with the vendors and restaurants for storing and cooking the growing number of its co-manufacturing partners company's products. Cooking instructions for froto increase manufacturing efficiencies and product zen Beyond Beef Crumbles, which were intended quality, while reducing overall production costs. to be prepared from their frozen state, were on the Beyond Meat's manufacturing process for woven packaging. protein is displayed in Exhibit 3. A dry blend containing pea protein was mixed in the company's manufacturing facility in Columbia, Missouri. The dry blend Supply Chain Practices then entered an extruder, where both water and Raw Material Procurement Beyond Meat's prodsteam were added. A combination of heating, cool- ucts had about 20 ingredients (the Beyond Beef ing, and variations of pressure were used to weave burger had 22)-these included pea protein isolate, together the pea protein into formed woven protein, canola oil, coconut oil, amino acids, lipids, trace which was used as the basis for all of the company's minerals, vitamins, salt, methylcellulose (a binding products. agent), and assorted flavorings. The company pro- The formed woven protein not used to produce cured raw materials for woven protein that were readBeyond Meat patties for foodservice customers in ily available from a number of different suppliers, North America was then cut into smaller pieces to except for pea protein, which in the United States as expedite the freezing process, and the frozen woven of 2018 was available only from a single supplier. A protein was shipped via third-party logistic provid- second supplier in Canada supplied yellow peas for ers to cold storage facilities or directly to production Beyond Beef Crumbles. facilities operated by the company's co-manufac-_ All flavorings in the company's products were turers. At a co-manufacturer's production facility, developed at the company's Innovation Center in thawed woven protein was further processed by add- collaboration with the suppliers chosen to produce ing other ingredients and flavorings, after which the the flavors, and all these flavorings were produced final product was packaged and then shipped frozen exclusively for use by Beyond Meat. Flavoring ingreto retail grocery stores and foodservice distributors. dients considered for use were qualified through To control the quality of its products throughout the trials at Beyond Meat's Innovation Center to ensure production process, the company utilized a type of manufacturability. The Innovation Center staff, using Six Sigma quality control process called DMAIC only ingredients deemed manufacturable, created a EXHIBIT 3 Beyond Meat's Manufacturing Process number of alternative formulas for each of the fla- available in the market from many suppliers, the comvors being considered for use in one or more prod- pany believed it could obtain needed supplies from ucts. Each formula was extensively tested to identify other vendors in the event of supply interruptions the specific flavoring formula and the specific com- from the ingredient vendors it typically used. It was bination of flavorings that best impacted the final the company's practice to maintain a 20-week supproduct's taste, texture, and appearance. While sup- ply of flavoring ingredients that would ultimately be plies of each ingredient in a flavoring were obtained shipped to producers of its flavorings. 16 directly by the supplier producing a specific flavor- Packaging supplies were sourced in the United ing for Beyond Meat, as new ingredient shipments States with the exception of the Beyond Sausage tray arrived at a flavoring supplier's production facilities, which was sourced from China. The company mainthe supplier was required to submit a Certificate of tained approximately 10 weeks of inventory of sauAnalysis to Beyond Meat to confirm that the ingredi- sage trays to mitigate the risk of supply interruptions. ent quality and flavoring formula used in production The trays used for burgers sold through grocery chanruns met the quality control standards previously nels were slotted for two 4-ounce patties. Packaging established at the Innovation Center. specifications for all products were clearly defined Shipping Retail products sold in grocery store meat and provided to all packaging suppliers. cases as part of Beyond Meat's "fresh" platform, such as The Beyond Burger and Beyond Sausage, HEALTH AND were shipped to the customer frozen. Retail grocery ENVIRONMENTAL IMPACTS stores merchandising burgers and sausage in meat cases as part of Beyond Meat's OF ANIMAL-BASED MEAT of seven days for Beyond Sausage or ten days for The Beyond Burger; at the end of the use-by date, unsold Consumer interest in plant-based proteins, particupackages in fresh meat cases had to be discarded. In larly among millennials and younger generations, addition to or as a substitute for their fresh meat dis- had been driven in part by growing awareness of the plays of Beyond Meat products, some supermarkets health and environmental impact of animal-based and smaller groceries kept incoming shipments of meat consumption. The Internet and social media frozen Beyond Burger patties and Beyond Sausage channels provided consumers with easy access to products in a frozen state and placed the packages voluminous amounts of information about nutrition, in their frozen meat cases alongside various branded the pros and cons of eating various food products, packages of frozen chicken and animal meat patties; climate change, resource scarcity, and the assortthis was done partly (often mainly) to avoid spoilage ment of health and environmental issues surroundlosses of fresh products-the frozen versions required ing the consumption of animal meats. Management no use-by dates. at Beyond Meat expected heightened global aware- Foodservice customers receiving shipments of ness of and concerns about these issues to have a frozen Beyond Meat products were provided instruc- positive impact on consumer demand for the comtions on 'slacking,' which was typically done by mov- pany's products. ing frozen packages to a refrigerator to allow them to slowly and safely thaw before cooking. Health Impacts Supplier Selection Practices Beyond Meat did not The negative impact on health caused by certain have long-term supply agreements with most of its sup- meats has been well publicized in recent years. In pliers; this included raw materials suppliers, suppliers 2004, the World Health Organization highlighted making flavorings, and co-manufacturers. Most all a paper indicating that dietary factors, including supplies of raw materials, flavorings, and final prod- consumption of certain meats, accounted for at least ucts produced and shipped by co-manufacturers were 30 percent of most cancers in developed countries obtained on a purchase order basis. Because most and up to 20 percent in developing countries. The of the ingredients used in its flavorings were readily WHO had since added processed meats such as hot dogs, ham, bacon, and sausage to its Group 1 category occupied 30 percent of the planet's land surface of carcinogens. A similar conclusion was presented at and accounted for 78 percent of all agricultural land the American Heart Association, where researchers use. 19 A report by the World Resources Institute conducting a 2017 dietary study of over 15,000 adults (WRI) indicated that 29 percent of agriculturebetween 2003 and 2013 highlighted that people who related water use was directly or indirectly used for ate mostly a plant-based diet were associated with animal production. 20 The WRI also concluded that a 42 percent reduced risk of developing heart meat consumption was environmentally burdenfailure. Additionally, animals and livestock were some from the standpoint of production inputs. also susceptible to various diseases such as Mad According to the same WRI report, beef was highly Cow (beef), Swine Flu (pork), and Avian Influenza inefficient to produce because only 1 percent of the (poultry) that may cause further health risks from feed consumed by cattle was converted to calories consuming potentially infected animal meats. As an that people consumed from eating beef, while pork example of the nutritional benefits of plant-based converted approximately 10 percent and poultry meats, Beyond Breakfast Sausage patties had 11 grams converted approximately 11 percent of their feed of protein per serving with 50 percent less total fat, 35 to human-edible calories. During 2017 and 2018, percent less saturated fat and sodium, and 33 percent Beyond Meat engaged the University of Michigan to fewer calories than a leading brand of pork sausage conduct a peer-reviewed, third-party-led Life Cycle patties, plus it was made without any genetically Assessment comparing the environmental impacts modified ingredients, soy, gluten, or artificially associated with producing a quarter-pound Beyond produced ingredients. Burger versus a quarter-pound, standard 80 percent lean/20 percent fat beef burger. 21 The study showed Climate Impacts that compared to the beef burger, The Beyond Burger A number of research studies had indicated that the generated 90 percent less greenhouse gas emissions, global livestock-industry was required 46 percent less energy, had 99 percent less impact on water scarcity, and 93 percent less impact one-third of global methane emissions, with animal on land use. manure accounting for perhaps 10 percent of global nitrous oxide (carbon dioxide) emissions. According Animal Welfare to a series of reports by the Intergovernmental Panel Worldwide, it was estimated in 2017 that about the United Nations which periodically compiles com- annually; with two out of every three being facprehensive "assessment reports" of published stud- tory farmed. 22 Over the past decade, animal welies concerning climate change, its causes, potential fare groups had publicized a range of investigations impacts, and response options), there was mounting highlighting the issues related to safety, welfare, and consensus among climate scientists that greenhouse well-being of animals caused by mass livestock prospread, and irreversible impacts" on the natural envi- duction, which Beyond Meat's management believed ronment unless carbon emissions were rapidly and had prompted a consumer shift toward more plantsharply reduced. 17 Several studies had concluded that behavioral changes, including such dietary changes as eating less animal meat, could have a significant COMPETITORS role in cutting carbon emissions. Beyond Meat operated in a highly competitive environment that included both animal protein suppliers Environmental Impacts and plant-based meat suppliers. In North America, According to the Food and Agricultural Organization the leading suppliers of fresh meats (beef, pork, (FAO) of the United Nations, rising global meat and poultry) and assorted branded meat products consumption and livestock production had adverse included: impacts on the world's land and water resources. 18 - The world's largest meat supplier, JBS, a company According to the FAO, livestock-raising activities headquartered in Brazil whose meat portfolio consisted of Swift (2) beef and pork products, 19 and ground meat were pea protein, coconut oil, brands of fresh beef and hamburger, Butterball and beet powder. Lightlife's other products were brand turkey, and Pilgrim's Pride chicken. plant-based chicken nuggets (a menu offering at Tyson Foods, a global supplier of meats with 2019 all A\&W locations in Canada), chicken tenders, sales of more than $42 billion and a meat portfolio hot dogs, bacon, sausages, and tempeh. that consisted of Tyson fresh and frozen chicken There were significant variations among the Park , Wright , Aidells , IBP , and State Fair . products regarding calorie count, total fat grams, Tyson's plant-based meat brand, Raised \& Rooted, saturated fat grams, protein grams, cholesterol, milwas available in 7,000 stores as of November ligrams of sodium, carbohydrates, dietary fiber, and 2019. As of early 2020, Tyson's Raised \& Rooted other nutritional measures-see Exhibit 4. product line consisted of (1) frozen Nuggets-a In addition to the above animal-protein battered chicken-like dish made of pea protein, companies, Beyond Meat confronted competition bamboo fiber, egg whites, and golden flaxseed from a number of plant-based protein brands, and (2) The Blend-burgers patties blended with including Kroger's Simple Truth brand of plant-based Angus Beef, pea protein, dried egg white solids, products, Impossible Foods, Boca Foods, Field Roast and assorted flavorings and seasonings that were Grain Meat Co., Gardein, Lightlife, Morningstar displayed in grocery fresh meat cases. Farms, and Tofurky. The products of these China-based WH Group, whose North American companies were commonly available throughout the brands included Smithfield pork products, supermarket and grocery store channel, including Eckrich , Nathan' , Farmland , John Morrell , most national and regional supermarket chains, Armour (B, Gwaltney B, and Cook's (8) hams. specialty grocer Trader Joe's, such natural foods and Farmland was marketing its plant-based meat health food chains as Whole Foods, Natural Grocers, under the Pure brand. Sprouts Farmer Markets, Fresh Market, and Earth Cargill, one of the world's biggest global suppli- Fare, plus thousands of mostly local natural/health ers of fresh beef and poultry products with 2019 food stores. sales of over $113 billion. In April 2020, Cargill The different brands of plant-based meat prodannounced it would begin selling a complete line ucts used soy protein or pea protein or potato protein of plant-based meat products, including ham- or wheat protein, or other grains as the main ingremeat. Shortly thereaf- dient; lesser ingredients could include coconut oil, three-day test of a plant-based fried chicken nugget etable oil, binding agents (food starch, potato starch, methylcellulose, xanthan gum), yeast extract, maltoHormel, a well-known dextrin, beet juice extract, salt, water, and a varying assortment of spices, vitamins (C, B6, B12, niacin, and chili, Applegate (bacon (bam, phosphorus), and natural flavorings. There breakfast and dinner sausage, chicken burgers and were sometimes significant variations from brandstrips, hot dogs, frozen beef and turkey burgers), to-brand and product-to-product regarding calorie Jennie- O turkey, and Columbus deli meats. count, total fat grams, saturated fat grams, protein Maple Leaf Foods, a Canadian consumer pack- grams, cholesterol, milligrams of sodium, carbohyaged meat company with 2019 sales of about drates, dietary fiber, and other nutritional measures$3.5 billion, whose brands included Maple Leaf, see Exhibit 5, Most plant-based meats had protein Maple Leaf Prime, Schneiders, Greenfield, Swift, levels comparable to their animal counterparts, Field Roast Grain Meat, and Lightlife. Field Roast but had lower cholesterol, less saturated fat, higher and Lightlife specialized in plant-based meat dietary fiber, and no antibiotics or hormones. Both substitutes. Field Roast's product offerings were 4-ounce plant burger patties and 4-ounce animal largely made of wheat and other grains; the main burger patties typically contained about 20 grams of ingredients in Lightlife's plant-based burger patties protein. EXHIBIT 4 Comparative Nutrition Facts for Selected Brands of Animal Beef Buraer Patties. Februarv 2020 Source: Brand labels. Competition revolved around a host of factors: - Advertising/media spending - Taste, meat-like appearance, and texture -Abilitytosecureintellectualpropertyprotectiononproducts(toaidinblockingrivalseffortsto - Ingredients (being gluten-free and avoiding use of produce and market copycat products) genetically modified ingredients) and nutritional profile (protein, carbohydrates, sugar, and fiber) While Beyond Meat and other companies offer- - Distribution capabilities (being able to secure a ing plant-based meat products were alert to all of strong presence in both the retail grocery channel these competitive elements, most all companies and the restaurant/foodservice channels, includ- in the animal meat sector had substantially greater ing favorable shelf and display locations in the financial resources, more comprehensive product grocery channel and menu offerings in the restau- lines, broader market presence, longer standing rant/foodservice channel relationships with distributors and suppliers, longer - Breadth of product offerings operating histories, greater production and distribu- - Competitive production costs and product prices tion capabilities, stronger brand recognition, and - Brand awarenessand custer marketing resources than any plant-based - Brand awareness and customer loyalty. meat company. EXHIBIT 5 Comparative Nutrition Facts for Selected Brands of Plant-Based Burger Patties, February 2020 Source: Brand labels. Kroger's Simple Truth Product Line. In January Kroger anticipated that consumer interest in 2020, Kroger-one of the world's largest foot retailers plant-based products would continue to grow in with 2019 sales of about $125 billion-announced the 2020 and beyond. The entire Simple Truth portlaunch of its Simple Truth Emerge TM : Plant Based folio already included more than 1,550 natural Fresh Meats. Kroger's Simple Truth brand was the and organic products and were located throughout best-selling brand in the natural and organic foods Kroger grocery aisles, with new items launching category, and its Emerge-branded entry into plant- monthly. Kroger expected to launch 50 additional based meats was aimed at offering its 11 million daily Simple Truth plant based products in 2020 to grow customers fresh burger patties and grinds at more sales of its Simple Truth brand, which exceeded affordable prices. 23 Emerge patties and grinds con- $2.3 billion in sales in 2019. tained 20 grams of pea-based protein per serving, Analysts expected that Kroger's entry into the and packages were located in the refrigerated meat plant-based meat segment would likely stimulate cases alongside other plant-based and animal meat Whole Foods, Trader Joe's, and other major superbrands. Going into 2020, Kroger operated almost market chains to follow Kroger's lead and introduce 2,800 supermarkets in 35 states 'under such brands their own private label brands of plant-based meat as Kroger, City Market, Fred Meyer, Harris Teeter, alternatives. King Soupers, Ralph's, Roundy's, Pick'n Save, Metro Market, and Mariano's Fresh Market. Kroger also Impossible Foods. Founded in 2011 by current operated 36 food manufacturing plants, principally CEO Pat Brown, Impossible Foods had an ambito produce its private-label products. tious mission: "To drastically reduce humanity's EXHIBIT 5 Comparative Nutrition Facts for Selected Brands of Plant-Based Burger Patties, February 2020 Source: Brand labels. Kroger's Simple Truth Product Line. In January Kroger anticipated that consumer interest in 2020, Kroger-one of the world's largest foot retailers plant-based products would continue to grow in with 2019 sales of about $125 billion-announced the 2020 and beyond. The entire Simple Truth portlaunch of its Simple Truth Emerge TM : Plant Based folio already included more than 1,550 natural Fresh Meats. Kroger's Simple Truth brand was the and organic products and were located throughout best-selling brand in the natural and organic foods Kroger grocery aisles, with new items launching category, and its Emerge-branded entry into plant- monthly. Kroger expected to launch 50 additional based meats was aimed at offering its 11 million daily Simple Truth plant based products in 2020 to grow customers fresh burger patties and grinds at more sales of its Simple Truth brand, which exceeded affordable prices. 23 Emerge patties and grinds con- $2.3 billion in sales in 2019. tained 20 grams of pea-based protein per serving, Analysts expected that Kroger's entry into the and packages were located in the refrigerated meat plant-based meat segment would likely stimulate cases alongside other plant-based and animal meat Whole Foods, Trader Joe's, and other major superbrands. Going into 2020, Kroger operated almost market chains to follow Kroger's lead and introduce 2,800 supermarkets in 35 states 'under such brands their own private label brands of plant-based meat as Kroger, City Market, Fred Meyer, Harris Teeter, alternatives. King Soupers, Ralph's, Roundy's, Pick'n Save, Metro Market, and Mariano's Fresh Market. Kroger also Impossible Foods. Founded in 2011 by current operated 36 food manufacturing plants, principally CEO Pat Brown, Impossible Foods had an ambito produce its private-label products. tious mission: "To drastically reduce humanity's destructive impact on the global environment by Sausage patty sandwiched in a toasted croissant. A completely replacing the use of animals as a food raw two-ounce serving of Impossible Sausage had production technology.,24 The company hoped to 7g protein, 1.69mg iron, 0mg cholesterol, 9g total accomplish this mission within two decades by creat- fat, 4g saturated fat, and 130 calories. It was also ing the world's most delicious, nutritious, affordable gluten-free and designed to be both halal and kosher. and sustainable meat, fish, and dairy foods directly Concurrent with Burger King's announcement, from plants. Impossible Foods announced its official launch of Going into 2020, Impossible Foods, whose main Impossible Sausage for distribution through retail product was the Impossible Burger, had gained brand grocery and foodservice/restaurants channels. In awareness by convincing some 15,000 restaurants 2019, Impossible Foods had collaborated with Little to put its Impossible Burger on their menus, and Caesar's to test its new Impossible Pork product as a by recently securing distribution of its burgers and pizza topping. Impossible Pork was suitable for use crumbles in growing numbers of supermarkets, in a wider assortment of applications and recipes grocery stores, and natural food stores. In August for ground pork as compared to Impossible Sausage. 2019, after running market tests in several units, Pork was especially popular in China, making Burger King added the Impossible Whopper to its Impossible Pork an important product for the commenu offering at all of its 7,200 Burger King locations pany's global expansion. Like the Impossible Burger, in the United States and was featuring the Impossible both Impossible Pork and Impossible Sausage used Whopper in some of its national TV ads (including soy leghemoglobin, a plant-based protein carrying ads run during NFL games). The Impossible the heme iron molecule that produced the bleeding Whopper included everything that came on a regular effect, as their main ingredient. Both products were Whopper: a quarter-pound patty, tomatoes, lettuce, gluten free, had no animal hormones or antibiotics, mayonnaise, ketchup, pickles, and white onions on and were designed for halal and kosher certification. a sesame seed bun. Instead of a flame-grilled beef While burgers were an iconic part of the patty, the Impossible Whopper had a flame-grilled American diet, the founder and CEO of Impossible Impossible Burger patty consisting principally Foods, Pat Brown, believed that within a couple of of a unique ingredient called soy leghemoglobin years his company would conquer the biggest chalthat made Impossible burgers taste so meat-like. lenge in the alternative meat marketplace-plantLeghemoglobin was a protein found in many plants based steaks and that fast casual steak chains like and it carried an iron-rich molecule called heme that Outback or Texas Roadhouse would put them on during the cooking process caused the Impossible their menus. He thought the R\&D efforts the comBurger to "bleed" and take on the product's signature pany had put into the Impossible Burger had preblood-red color. The patties that Impossible Foods pared it for the challenge, boldly stating in 2019 "I supplied to Burger King were based on the company's can say, with complete confidence, that we're going new 2.0 formulation that was announced in January to nail it and not only make a great steak, but we're 2019. 25 Among other upgrades, this formulation going to make a steak that's as good as anything worked well in restaurant environments because that ever fell out of a cow."27 Many observers and version 2.0 burgers held up well in hot holding plant-based meat experts, familiar with plant-based trays and could withstand the 6-inch drop at the proteins and the speed with which product R\&D end of Burger King's conveyor that grilled the patty was accelerating, agreed with Pat Brown. According for exactly 2 minutes, 35 seconds at 630 degrees to Bruce Friedrich, executive director of the Good Fahrenheit. The Impossible Whopper was usually Food Institute, which championed plant- and cellpriced \$1 more than the regular Whopper. based meats, "Once we have products that taste the In January 2020 Burger King introduced a same or better and that cost less, plant-based and new Impossible Sausage Croissan'wich to its break- clean meat will simply take over." 28 fast menu offerings at 139 Burger King restaurants In early March 2020, Impossible Foods in five test locations: Savannah, Georgia; Lansing, announced a 15 percent price cut on its plant-based Michigan; Springfield, Illinois; Albuquerque, products, and requested that its foodservice distribuNew Mexico; and Montgomery, Alabama. 26 The tors pass the price cuts on to their restaurant customcroissan'wich featured an egg, cheese, and Impossible ers. Impossible Foods CEO Patrick Brown said. 29 Our stated goal since the founding of the company has Field Roast Grain Meat Co. Since its founding in always been to drive down prices through economies of 1997 as a privately-owned company, Field Roast had scale, reach price parity and then undercut the price of been a pioneer in the plant-based industry by creating conventional ground beef from cows. flavorful, high-quality products using fresh whole-food ingredients-grains, vegetables, legumes, and spices-to Morningstar Farms Morningstar Farms was a craft artisanal plant-based meats and cheeses. Its bestdivision of Kellogg that produced vegetarian foods; selling products were sausages (three varieties-apple its product line in 2020 consisted of 49 items that sage, chipotle, and Italian), frankfurters, corn dogs, and included veggie bacon strips, 5 varieties of breakfast Chao cheese slices, but its product line also included sausage, 2 varieties of vegan burgers (made with 10 breakfast sausages, vegetarian deli meats, vegan field vegetables, grains, and seeds, with 9 grams of pro- burgers, roasts (three varieties), breaded cutlets, and tein), 12 varieties of veggie burgers, 3 varieties of Fruffalo wings (apple sage sausage cut on the bias, batcrumbles, vegetarian buffalo wings and parmesan tered and lightly fried, with buffalo sauce). Its newest garlic wings, vegetarian chicken strips, vegetarian product was bratwurst, which, like Field Roast sauhot dogs and corn dogs, vegetarian chicken nuggets sages, came four to a package. All of the meat products and BBQ chicken nuggets, and 2 varieties of vegetar- were high in protein because wheat gluten was a prinian chicken burgers. All products sold to the grocery cipal ingredient. Wheat gluten was wheat flour with all channel were frozen and displayed in grocery freezer the starches removed-removing the starches left pure cases. Morningstar sold 26 of its products in the wheat protein. Field Roast meats were soy-free and confoodservice channel. tained no GMOs. The company's products were avail- Until 2020, one key difference between able in most supermarket chains, medium and large Morningstar and the other plant-based meat brands natural foods stores, and a few online food retailers in was that most Morningstar products had egg ingre- both the United States and Canada. dients and thus did not qualify as vegan. But in 2019 Except for its three varieties of roasts which management decided to discontinue production and were displayed in grocery freezer sections, Field marketing of Morningstar egg products, abandon use Roast meat products were located in the refrigerated of egg ingredients, and begin phasing in new vegan section of grocery stores and had a "use-by" date. versions of the company's entire lineup of vegetarian However, their freshness could be extended by freezproducts. By the end of 2020, Morningstar planned ing them for up to a year; once thawed, they were to have completed the process of transitioning all the good for about 65 days. products it sold through the retail grocery and food- Field Roast was acquired by Maple Leaf Foods service channels to vegan. in 2018