Answered step by step

Verified Expert Solution

Question

1 Approved Answer

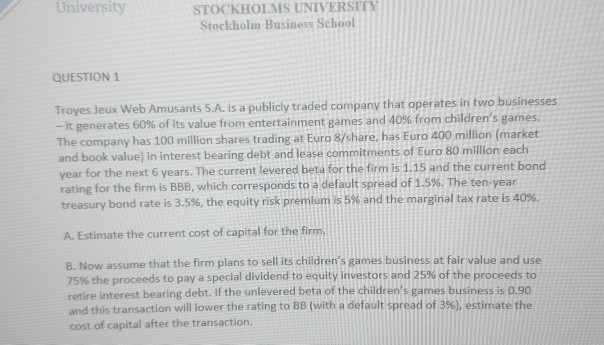

hi i need help with B please explain how its solved University STOCKHOLMS UNIVERSITY Stockholm Business School QUESTION 1 Troyes Jeux Web Amusants S.A. is

hi i need help with B please explain how its solved

University STOCKHOLMS UNIVERSITY Stockholm Business School QUESTION 1 Troyes Jeux Web Amusants S.A. is a publicly traded company that operates in two businesses - it generates 60% of its value from entertainment games and 40% from children's games. The company has 100 million shares trading at Euro 8/share, has Euro 400 million (market and book value)in interest bearing debt and lease commitments of Euro 80 million each year for the next 6 years. The current levered beta for the firm is 1.15 and the current bond rating for the firm is BBB, which corresponds to a default spread of 1.5%. The ten year treasury bond rate is 3.5%, the equity risk premium is 5% and the marginal tax rate is 40%. A. Estimate the current cost of capital for the firm. B. Now assume that the firm plans to sell its children's games business at fair value and use 75% the proceeds to pay a special dividend to equity investors and 25% of the proceeds to retire interest bearing debt. If the unlevered beta of the children's games business is 0.90 and this transaction will lower the rating to BB (with a default spread of 396), estimate the cost of capital after the transactionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started