Question

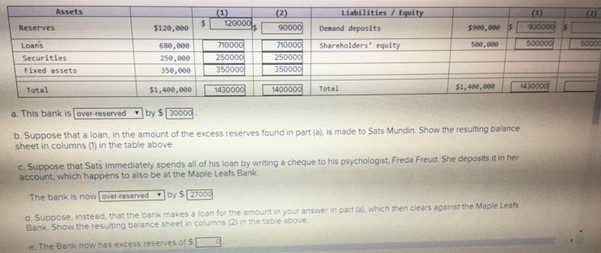

Hi I need help with is Question please. The table below is the current balance sheet for the Maple Leafs Bank. Answer the following questions

Hi I need help with is Question please.

The table below is the current balance sheet for the Maple Leafs Bank. Answer the following questions assuming that the banks target reserve ratio is 10%.

C = 27000

Loan (1) (2)= 710000

Reserves(2)= 90000

demand deposits(1)= 930000

For table 1 I need help with , Demand deposits (2)

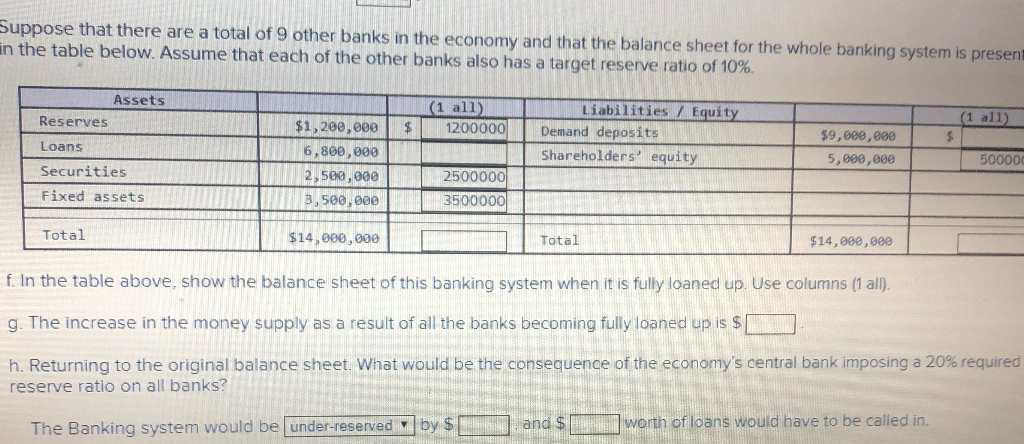

Suppose that there are a total of 9 other banks in the economy and that the balance sheet for the whole banking system is presented in the table below. Assume that each of the other banks also has a target reserve ratio of 10%.

For table 2, I need help with (1 all) ,Loan , demand deposits , f, g ,h.

Thank You.

Liabilities / Equity Assets (1) 120000 (2) (1) 930000 90000 $900, 000 Reserves $120,000 Deeand deposits 500000 s0000 710000 250000 Shareholders' equity Loans 710000 see, o00 680,000 250000 350000 250.000 Securities 350000 Fixed assets 350,000 1430000 1430000 $1, 400,000 1400000 Total Total $1,400,000 a. This bank is over-reserved by $30000 b. Suppose that a loan, in the amount of the excess reserves found in part (a), is made to Sats Mundin. Show the resulting balance sheet in columns () in the table above. c. Suppose that Sats immediately spends all of his loan by writing a cheque to his psychologist. Freda Freud account, which happens to also be at the Mapie Leafs Bank She deposits it in her by $25000 The bank is now overreserved d. Suppose, instead, that the bank makes a loan for the amount in your answer in part (a), which then clears against the Maple Leafs Bank. Show the resulting balance sheet in columns (2) in the table above e. The Bank now has excess reserves of $ Suppose that there are a total of 9 other banks in the economy and that the balance sheet for the whole banking system is present in the table below. Assume that each of the other banks also has a target reserve ratio of 10% Assets (1 all) Liabilities / Equity (1 all) Reserves $1,200,000 $ 1200000 Demand deposits $9,000,000 $ Loans 6,800,000 Shareholders' equity 5,000,000 500000 Securities 2,500,000 2500000 Fixed assets 3500000 3,500,000 Total $14,000,000 Total $14,000,000 f. In the table above, show the balance sheet of this banking system when it is fully loaned up. Use columns (1 all) g. The increase in the money supply as a result of all the banks becoming fully loaned up is $ h. Returning to the original balance sheet. What would be the consequence of the economy's central bank imposing a 20% required reserve ratio on all banks? worth of loans would have to be called in. and $ The Banking system would be under-reserved by $ Liabilities / Equity Assets (1) 120000 (2) (1) 930000 90000 $900, 000 Reserves $120,000 Deeand deposits 500000 s0000 710000 250000 Shareholders' equity Loans 710000 see, o00 680,000 250000 350000 250.000 Securities 350000 Fixed assets 350,000 1430000 1430000 $1, 400,000 1400000 Total Total $1,400,000 a. This bank is over-reserved by $30000 b. Suppose that a loan, in the amount of the excess reserves found in part (a), is made to Sats Mundin. Show the resulting balance sheet in columns () in the table above. c. Suppose that Sats immediately spends all of his loan by writing a cheque to his psychologist. Freda Freud account, which happens to also be at the Mapie Leafs Bank She deposits it in her by $25000 The bank is now overreserved d. Suppose, instead, that the bank makes a loan for the amount in your answer in part (a), which then clears against the Maple Leafs Bank. Show the resulting balance sheet in columns (2) in the table above e. The Bank now has excess reserves of $ Suppose that there are a total of 9 other banks in the economy and that the balance sheet for the whole banking system is present in the table below. Assume that each of the other banks also has a target reserve ratio of 10% Assets (1 all) Liabilities / Equity (1 all) Reserves $1,200,000 $ 1200000 Demand deposits $9,000,000 $ Loans 6,800,000 Shareholders' equity 5,000,000 500000 Securities 2,500,000 2500000 Fixed assets 3500000 3,500,000 Total $14,000,000 Total $14,000,000 f. In the table above, show the balance sheet of this banking system when it is fully loaned up. Use columns (1 all) g. The increase in the money supply as a result of all the banks becoming fully loaned up is $ h. Returning to the original balance sheet. What would be the consequence of the economy's central bank imposing a 20% required reserve ratio on all banks? worth of loans would have to be called in. and $ The Banking system would be under-reserved by $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started