Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I need help with solving this problem! How can I solve this problem with using a FINANCIAL calculator? Thank you in advance! Hi, Could

Hi,

I need help with solving this problem! How can I solve this problem with using a FINANCIAL calculator? Thank you in advance!

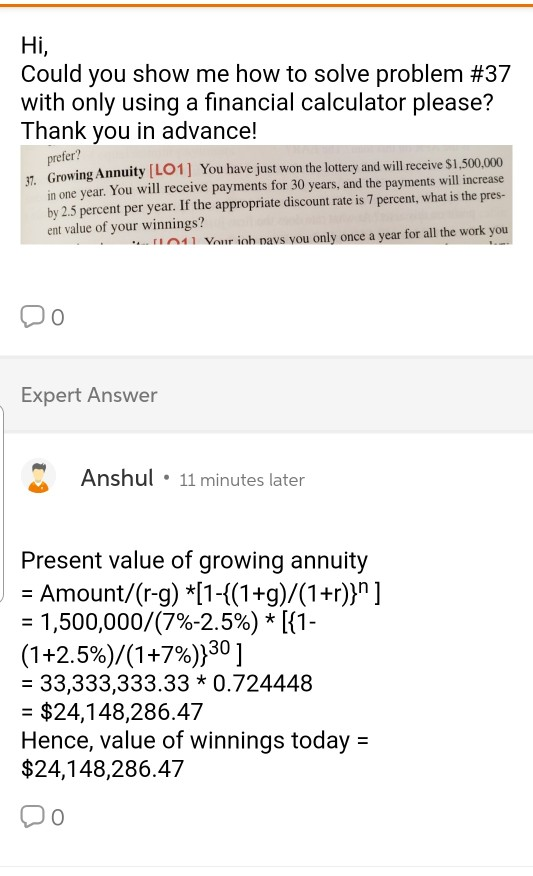

Hi, Could you show me how to solve problem #37 with only using a financial calculator please? Thank you in advance! prefer? Crowing Annuity (LO1) You have just won the lottery and will receive $1.500.000 in one year. You will receive payments for 30 years, and the payments will increase by 2.5 percent per year. If the appropriate discount rate is 7 percent, what is the pres- ent value of your winnings? 11 Vaurioh navs you only once a year for all the work you Do Expert Answer Anshul. 11 minutes later Present value of growing annuity = Amount/(r-g) *[1-{(1+9)/(1+r)}" ] = 1,500,000/(7%-2.5%) * [{1- (1+2.5%)/(1+7%)}30 ] = 33,333,333.33 * 0.724448 = $24,148,286.47 Hence, value of winnings today = $24,148,286.47 DoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started