Question

Hi I need help with the following question: Australia tax return. Question 4Dave Banks, a resident taxpayer aged 58, was employed by Cool Brick Ice

Hi

I need help with the following question: Australia tax return.

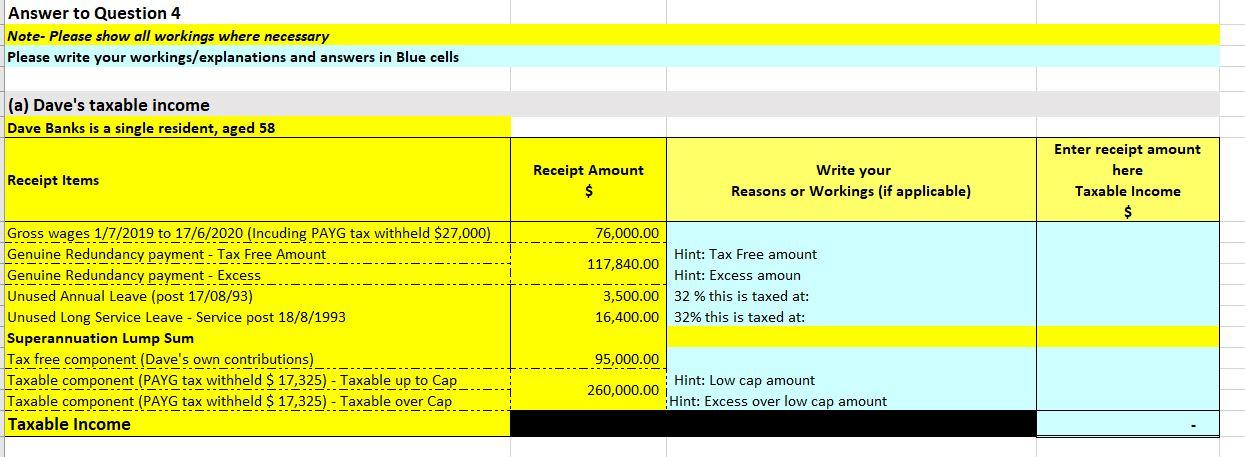

Question 4Dave Banks, a resident taxpayer aged 58, was employed by Cool Brick Ice Creamery until 17 June 2020, when his position became redundant. Dave had total employment with the company of 20 years and 11 months. Upon receiving the redundancy, Dave notified his superannuation fund that he intended to retire and drew his entire superannuation entitlement as a lump sum. Amounts received by Dave from Cool Brick Ice Creamery for the year included: Gross wages 1/7/2019 to 17/6/2020 (Including PAYG tax withheld $27,000)$ 76,000Redundancy payment$ 117,840Unused annual leave (all post 18/8/1993)$ 3,500Unused long service leave-Service post 18/8/1993$ 16,400Amounts received from his superannuation fund included: Superannuation Lump SumTax free component (Dave's own contributions)$ 95,000Taxable component (element taxed in the fund, PAYG tax withheld $ 17,325)$ 260,000

Answer to Question 4 Note- Please show all workings where necessary Please write your workings/explanations and answers in Blue cells (a) Dave's taxable income Dave Banks is a single resident, aged 58 Receipt Items Receipt Amount $ Write your Reasons or Workings (if applicable) Enter receipt amount here Taxable income $ 76,000.00 Hint: Tax Free amount 117,840.00 Hint: Excess amoun 3,500.00 32 % this is taxed at: 16,400.00 32% this is taxed at: Gross wages 1/7/2019 to 17/6/2020 (Incuding PAYG tax withheld $27,000) Genuine Redundancy payment - Tax Free! - Tax Free Amount Genuine Redundancy payment - Excess Unused Annual Leave (post 17/08/93) Unused Long Service Leave - Service post 18/8/1993 Superannuation Lump Sum Tax free component (Dave's own contributions) Taxable ble component (PAYG tax withheld $ 17,325) - Taxable up to Cap Taxable component (PAYG tax withheld $ 17,325) - Taxable over Cap Taxable Income 95,000.00 Hint: Low cap amount 260,000.00 Hint: Excess over low cap amount Answer to Question 4 Note- Please show all workings where necessary Please write your workings/explanations and answers in Blue cells (a) Dave's taxable income Dave Banks is a single resident, aged 58 Receipt Items Receipt Amount $ Write your Reasons or Workings (if applicable) Enter receipt amount here Taxable income $ 76,000.00 Hint: Tax Free amount 117,840.00 Hint: Excess amoun 3,500.00 32 % this is taxed at: 16,400.00 32% this is taxed at: Gross wages 1/7/2019 to 17/6/2020 (Incuding PAYG tax withheld $27,000) Genuine Redundancy payment - Tax Free! - Tax Free Amount Genuine Redundancy payment - Excess Unused Annual Leave (post 17/08/93) Unused Long Service Leave - Service post 18/8/1993 Superannuation Lump Sum Tax free component (Dave's own contributions) Taxable ble component (PAYG tax withheld $ 17,325) - Taxable up to Cap Taxable component (PAYG tax withheld $ 17,325) - Taxable over Cap Taxable Income 95,000.00 Hint: Low cap amount 260,000.00 Hint: Excess over low cap amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started