Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I need help with these questions. Thanks Secure https:// suffolku black boa rd.com /bboswebdav/pid-1397725-dt- content-rid-5476226 2/courses/17SP-FIN-H200- AVCase%20for9%20Chapter%207.pdf Case for Chapter 7.pdf Stock Valuation at

Hi, I need help with these questions.

Hi, I need help with these questions.

Thanks

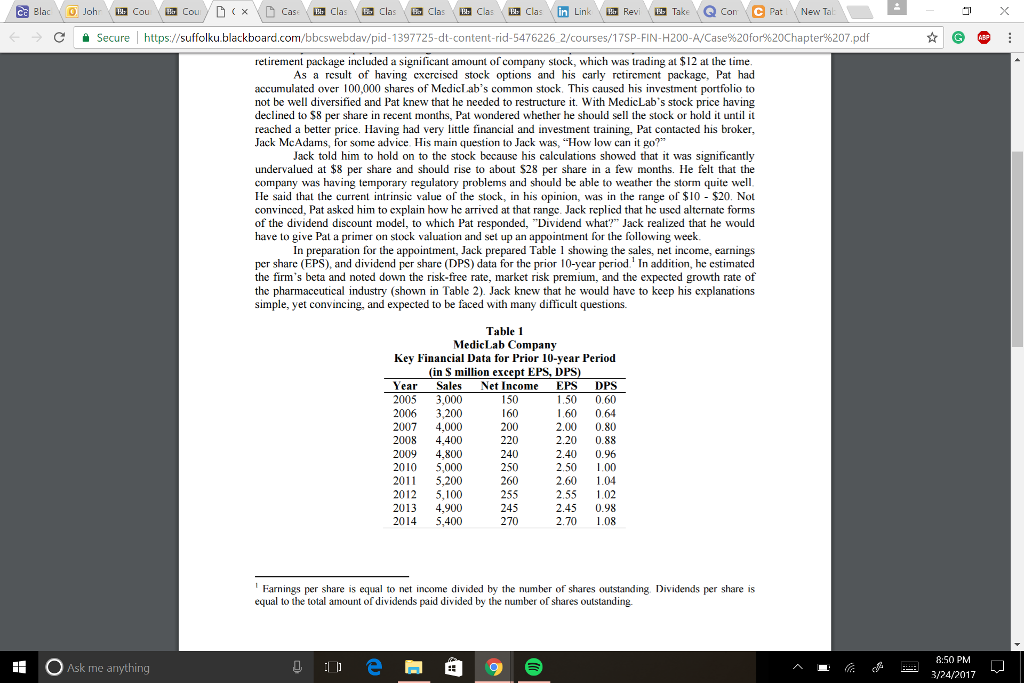

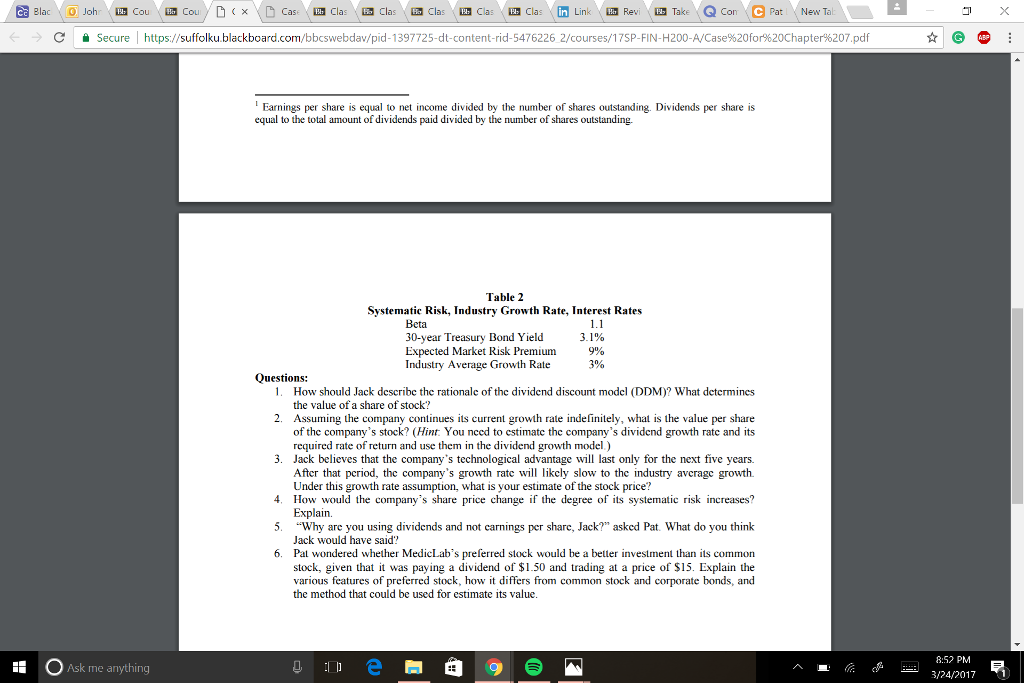

Secure https:// suffolku black boa rd.com /bboswebdav/pid-1397725-dt- content-rid-5476226 2/courses/17SP-FIN-H200- AVCase%20for9%20Chapter%207.pdf Case for Chapter 7.pdf Stock Valuation at MedicLab Company Pat Lawrence, aged 58, had joined the Mediclab Company (MIC) approximately thirty years ago, as a post-doctoral researcher in the field of immunology. His strong ethic and knowledge of science enablcd him to progrcss stcadily along thc rcscarch track of thc company. Pat was givcn stock options as part of his remuneration package over years of his employment. For a while shares of MedicLab were trading at S30 per share. However, about 3 years ago, the firm sumered a few setbacks. The firm's sales began to suffer and profits began to shrink sending its stock pricc into a downward spiral About a year later, Pat was offered the option to take carly retiremen The severance package offered by the company was too good to turn down so Pat opted for early retirement. Part of the retirement package included a significant amount of company stock, which was trading at $12 at the time. As a result of having exercised stock options and his early retirement package, Pat had accumulated over 100,000 shares of Mediclab's common stock, This caused his investment portfolio to not be well diversified and Pat knew that he needed to restructure it. With MedicLab's stock price having declined to S8 por sharc in reccnt months, Pat wondcrcd whcthcr hc should sc c stock or hold it until it reached a better price. Having had very little financial and investment training, Pat contacted his broker Jack McAdams, for some advice. His main question to Jack was, "How low can it go? Jack told him to hold on to the stock because his calculations showed that it was significantly undervalued at $8 per share and should rise to about S28 per share in a few months. He felt that the company was having temporary regulatory problems and should be able to weather the storm quite well He said that the current intrinsic value of the stock, in his opinion, was in the range of $10 $20. Not convinced, Pat asked him to explain how he arrived at that range. Jack replied that he used alternate forms of the dividend discount model, to which Pat responded, "Dividend what?" Jack realized that he would have to give Pat a primer on stock valuation and set up an appointment for the following week In preparation for thc appointment, Jack prcparcd Table 1 showing the salcs, nct income, carnings per share (EPS), and dividend per share (DPS) data for the prior 10-year period. In addition, he estimated the firm's beta and noted down the risk-free rate, market risk premium, and the expected growth rate of the pharmaceutical industry (shown in Table 2). Jack knew that he would have to keep his explanations simple, yet convincing, and expected to be faced with many difficult questions. Table 1 MedicLab Company Key Financial Data for Prior 10-year Period (in S million except EPS, DPS) Ask me anything 8:50 PM 3/24/2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started