Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! I need help with this please! Nov. 1 Bob Hafner contributed $32,000 and a truck, with a market value of $4,000, to the business

Hi! I need help with this please!

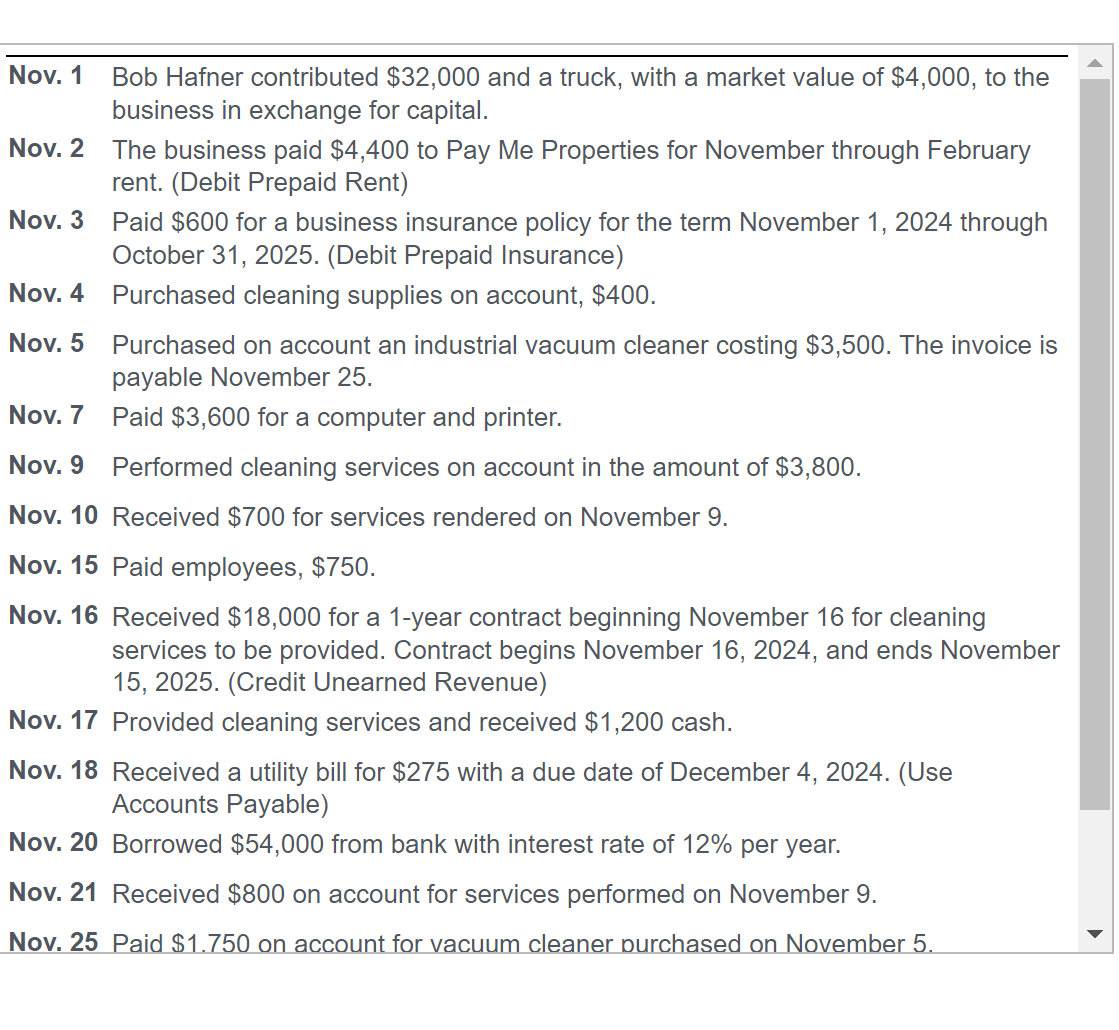

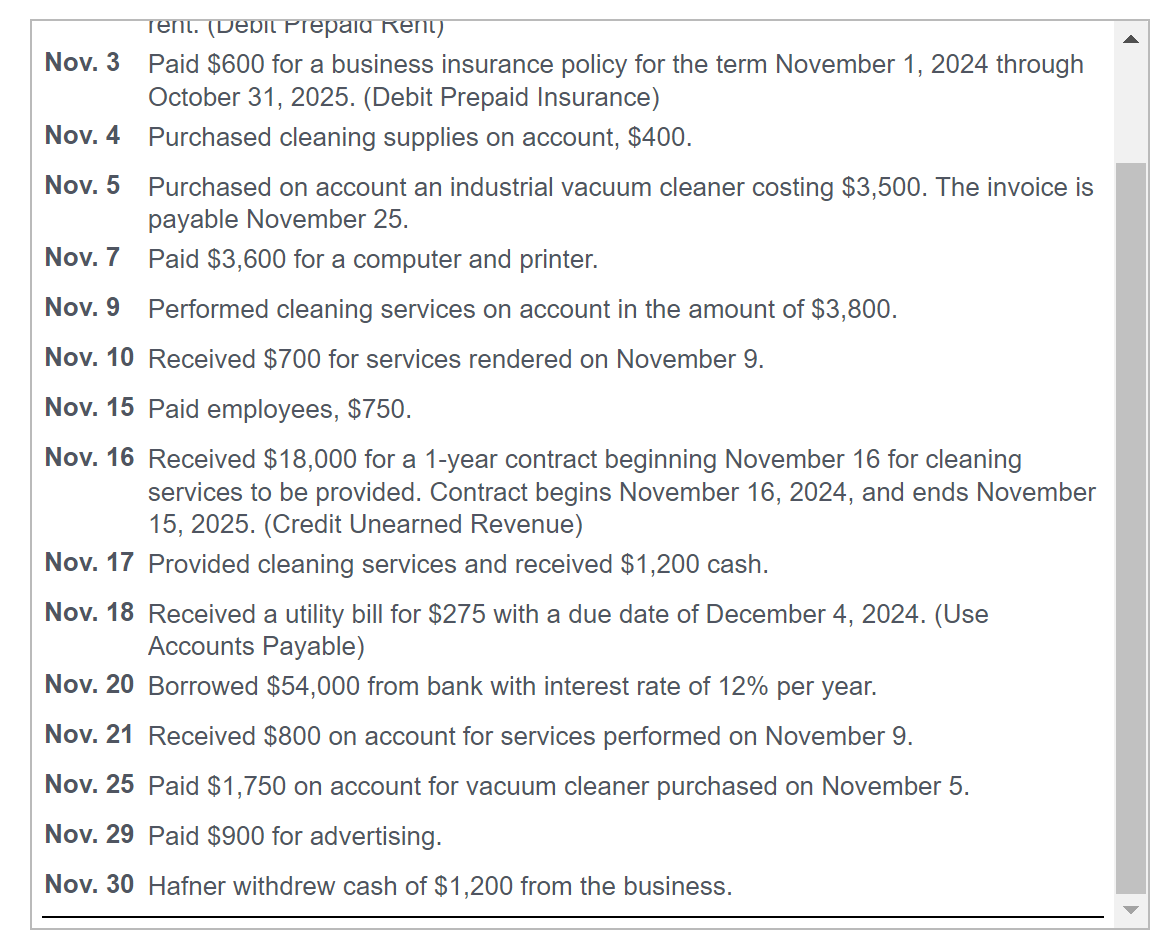

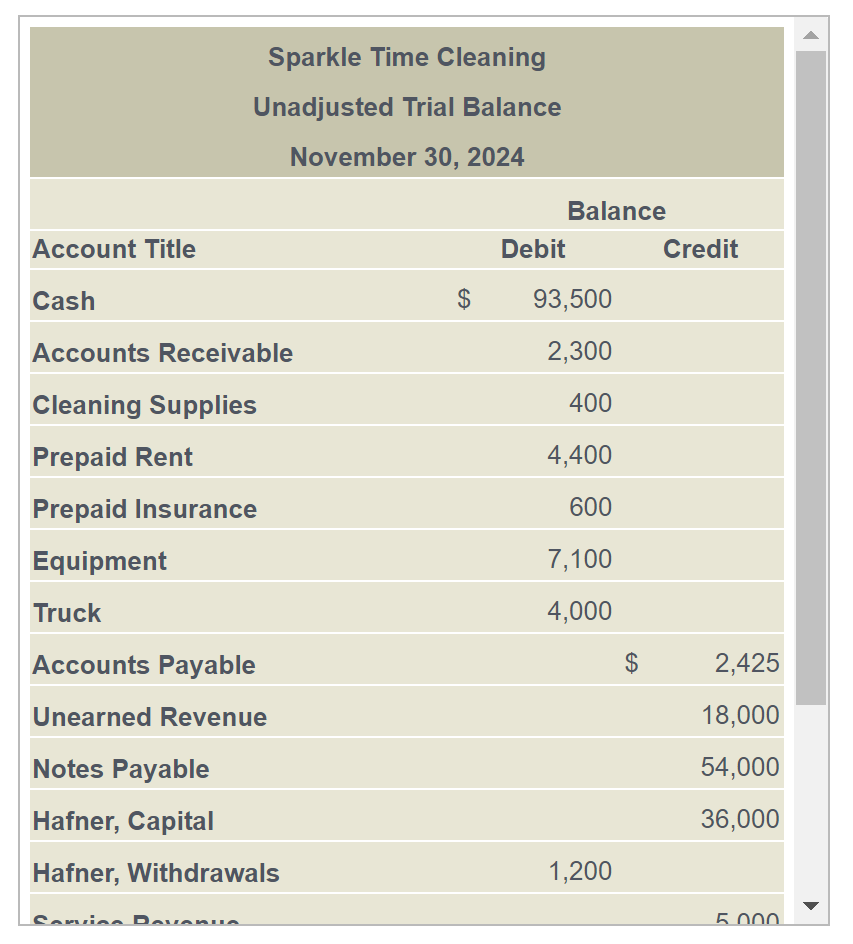

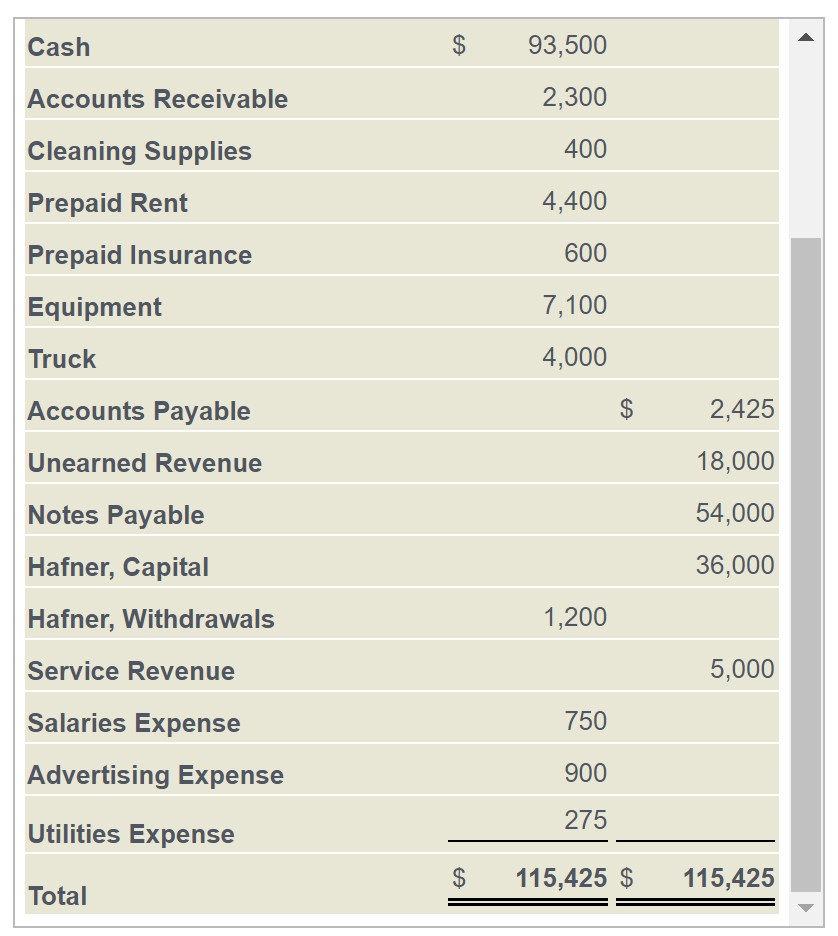

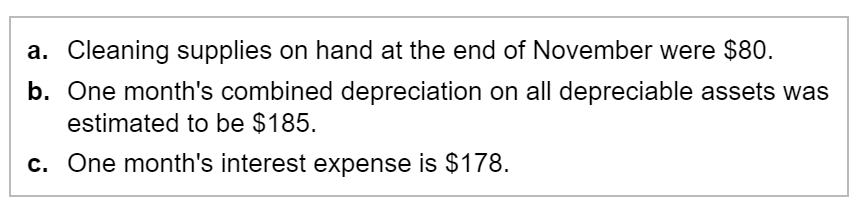

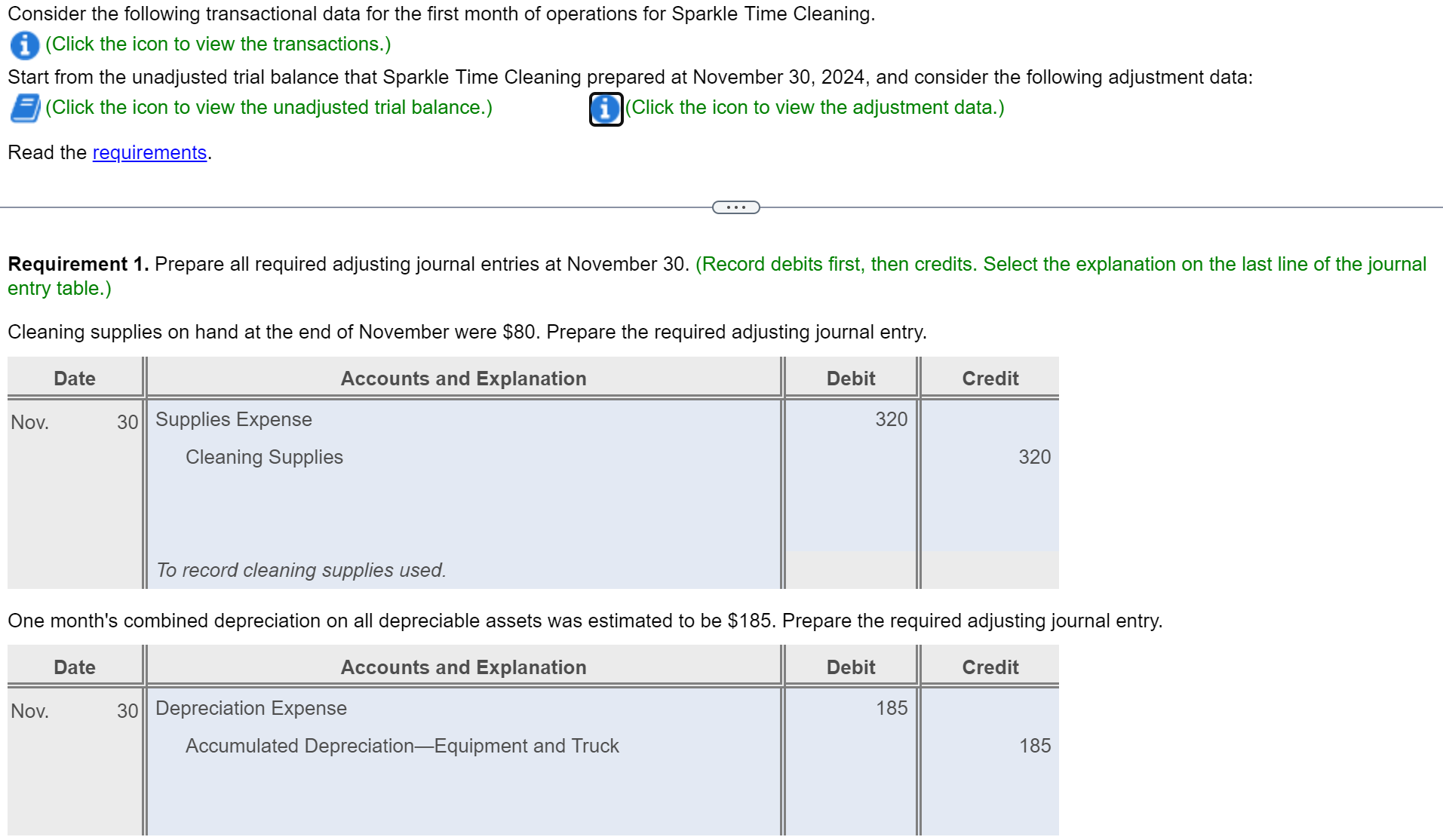

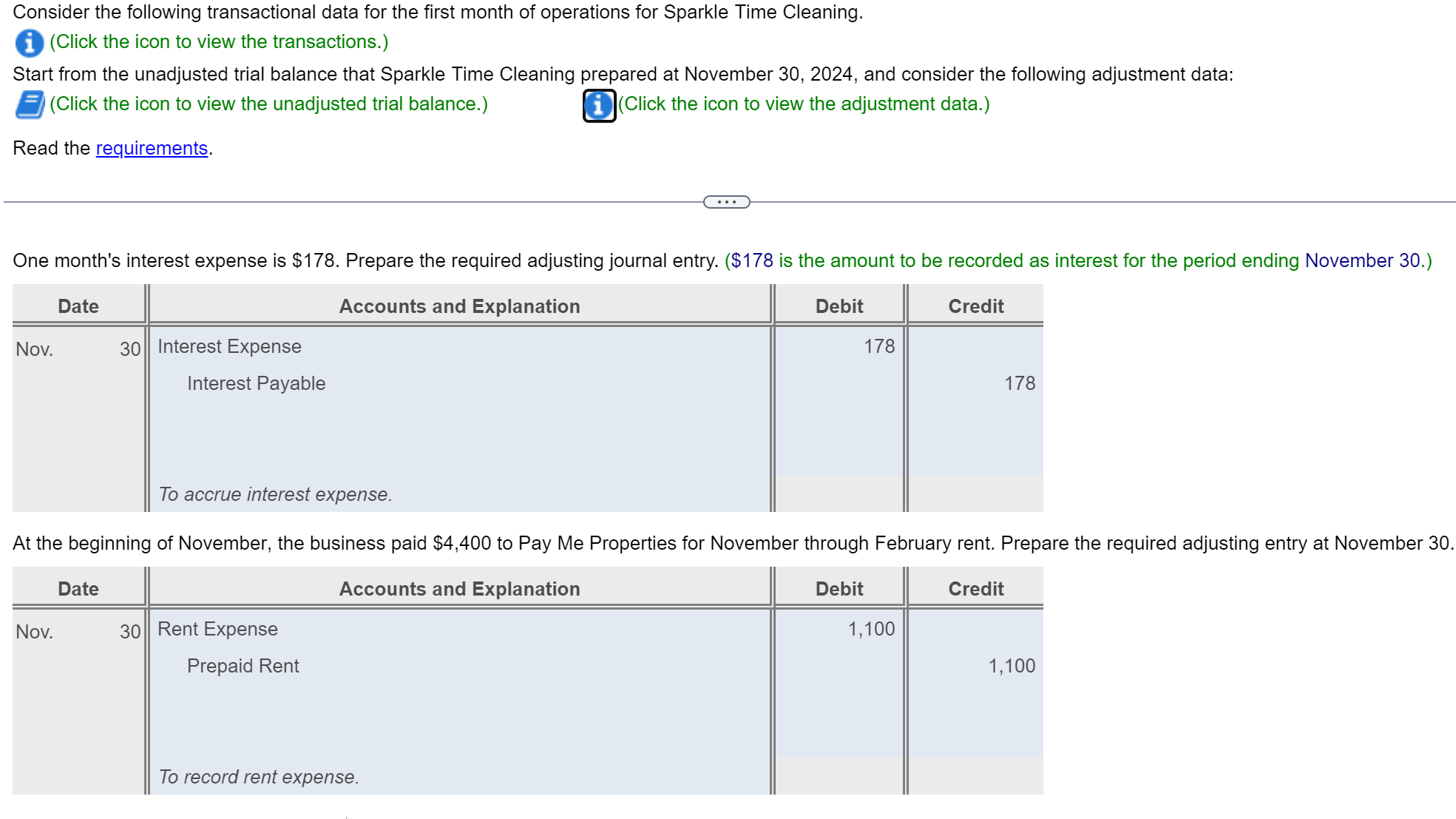

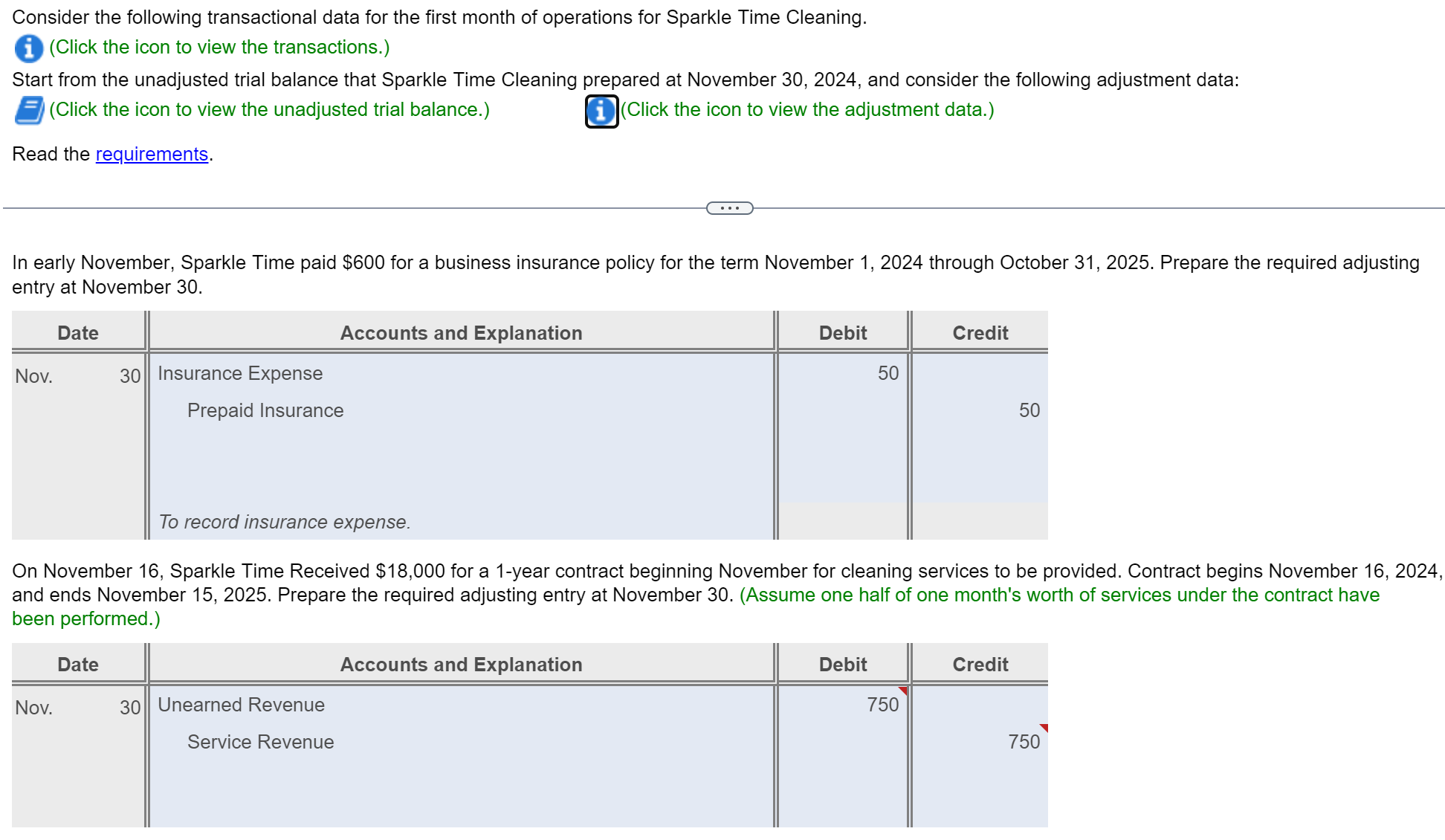

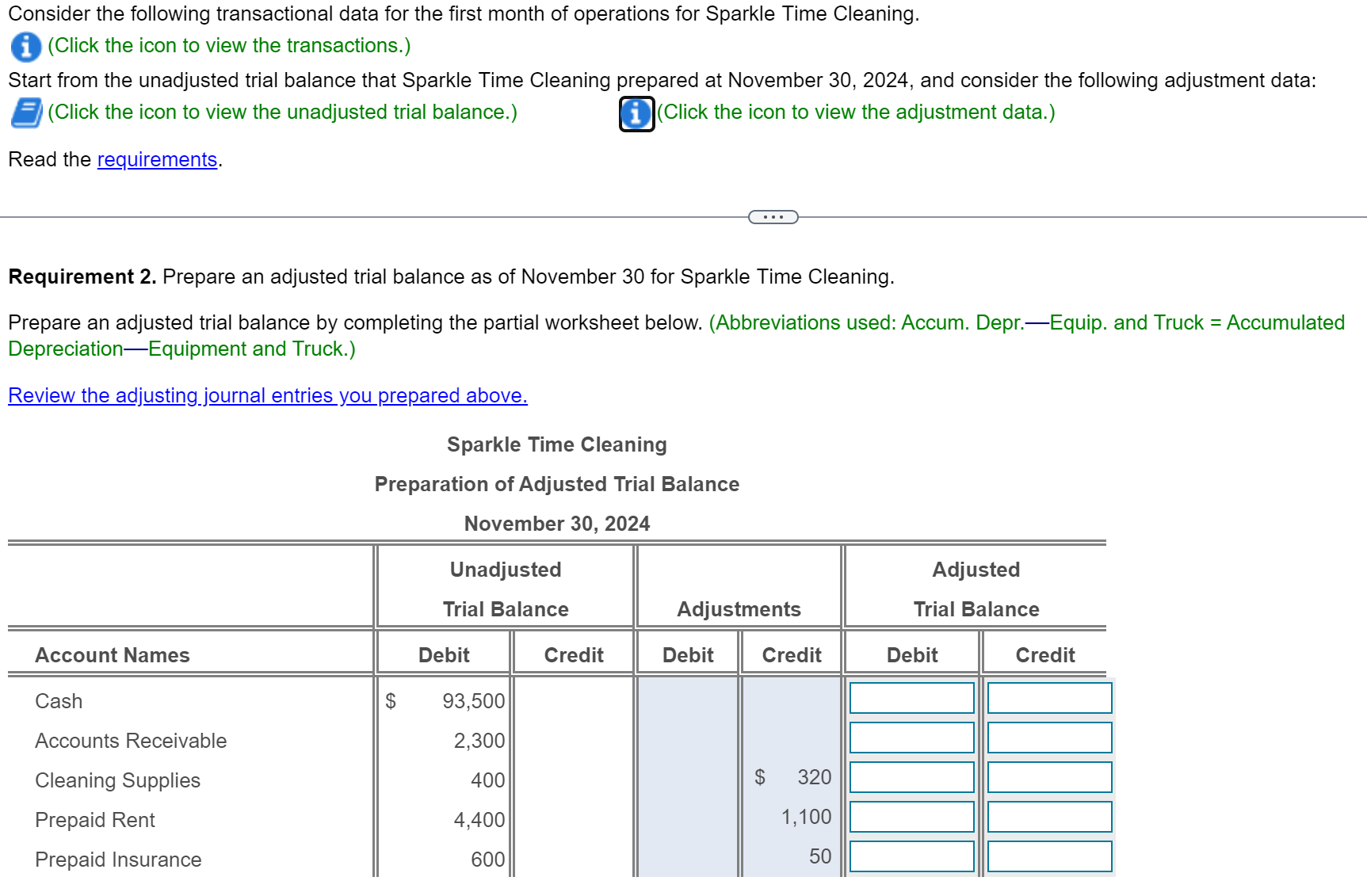

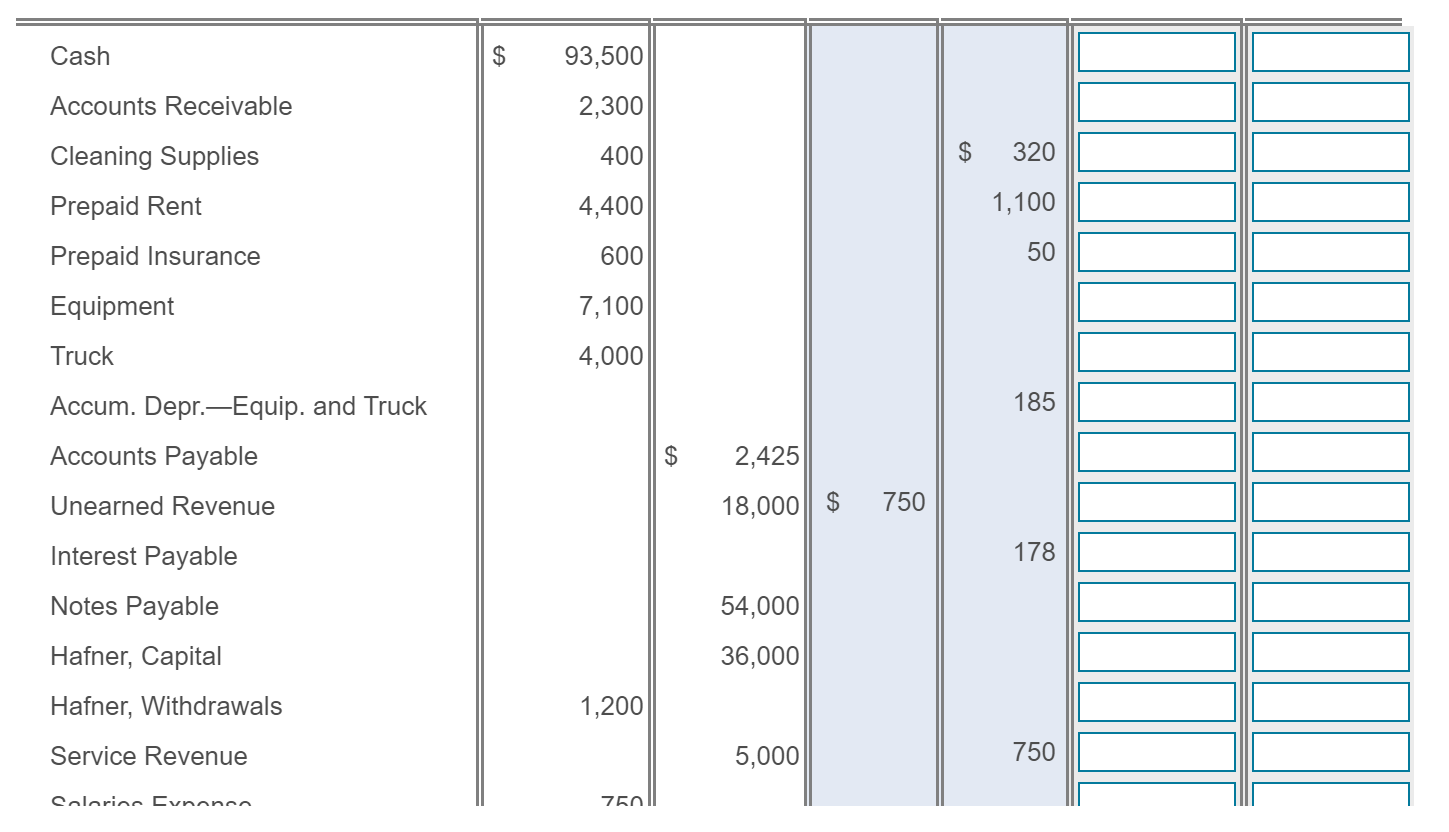

Nov. 1 Bob Hafner contributed $32,000 and a truck, with a market value of $4,000, to the business in exchange for capital. Nov. 2 The business paid $4,400 to Pay Me Properties for November through February rent. (Debit Prepaid Rent) Nov. 3 Paid $600 for a business insurance policy for the term November 1, 2024 through October 31, 2025. (Debit Prepaid Insurance) Nov. 4 Purchased cleaning supplies on account, $400. Nov. 5 Purchased on account an industrial vacuum cleaner costing $3,500. The invoice is payable November 25. Nov. 7 Paid $3,600 for a computer and printer. Nov. 9 Performed cleaning services on account in the amount of $3,800. Nov. 10 Received $700 for services rendered on November 9 . Nov. 15 Paid employees, $750. Nov. 16 Received $18,000 for a 1-year contract beginning November 16 for cleaning services to be provided. Contract begins November 16, 2024, and ends November 15, 2025. (Credit Unearned Revenue) Nov. 17 Provided cleaning services and received $1,200 cash. Nov. 18 Received a utility bill for $275 with a due date of December 4,2024 . (Use Accounts Payable) Nov. 20 Borrowed $54,000 from bank with interest rate of 12% per year. Nov. 21 Received $800 on account for services performed on November 9 . Nov. 25 Paid $1.750 on account for vacuum cleaner purchased on November 5 . Nov. 3 Paid $600 for a business insurance policy for the term November 1, 2024 through October 31, 2025. (Debit Prepaid Insurance) Nov. 4 Purchased cleaning supplies on account, $400. Nov. 5 Purchased on account an industrial vacuum cleaner costing $3,500. The invoice is payable November 25. Nov. 7 Paid $3,600 for a computer and printer. Nov. 9 Performed cleaning services on account in the amount of $3,800. Nov. 10 Received $700 for services rendered on November 9 . Nov. 15 Paid employees, $750. Nov. 16 Received $18,000 for a 1-year contract beginning November 16 for cleaning services to be provided. Contract begins November 16, 2024, and ends November 15, 2025. (Credit Unearned Revenue) Nov. 17 Provided cleaning services and received $1,200 cash. Nov. 18 Received a utility bill for $275 with a due date of December 4 , 2024. (Use Accounts Payable) Nov. 20 Borrowed $54,000 from bank with interest rate of 12% per year. Nov. 21 Received $800 on account for services performed on November 9 . Nov. 25 Paid $1,750 on account for vacuum cleaner purchased on November 5. Nov. 29 Paid $900 for advertising. Nov. 30 Hafner withdrew cash of $1,200 from the business. a. Cleaning supplies on hand at the end of November were $80. b. One month's combined depreciation on all depreciable assets was estimated to be $185. c. One month's interest expense is $178. Consider the following transactional data for the first month of operations for Sparkle Time Cleaning. (Click the icon to view the transactions.) Start from the unadjusted trial balance that Sparkle Time Cleaning prepared at November 30, 2024, and consider the following adjustment data: (Click the icon to view the unadjusted trial balance.) 'Click the icon to view the adjustment data.) Read the requirements. Requirement 1. Prepare all required adjusting journal entries at November 30 . (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Cleaning supplies on hand at the end of November were $80. Prepare the required adjusting journal entry. Consider the following transactional data for the first month of operations for Sparkle Time Cleaning. (Click the icon to view the transactions.) Start from the unadjusted trial balance that Sparkle Time Cleaning prepared at November 30, 2024, and consider the following adjustment data: (Click the icon to view the unadjusted trial balance.) (Click the icon to view the adjustment data.) Read the requirements. Consider the following transactional data for the first month of operations for Sparkle Time Cleaning. (Click the icon to view the transactions.) Start from the unadjusted trial balance that Sparkle Time Cleaning prepared at November 30, 2024, and consider the following adjustment data: (Click the icon to view the unadjusted trial balance.) (Click the icon to view the adjustment data.) Read the requirements. In early November, Sparkle Time paid $600 for a business insurance policy for the term November 1,2024 through October 31,2025 . Prepare the required adjusting entry at November 30 . On November 16, Sparkle Time Received $18,000 for a 1-year contract beginning November for cleaning services to be provided. Contract begins November 16,2024 and ends November 15, 2025. Prepare the required adjusting entry at November 30 . (Assume one half of one month's worth of services under the contract have been performed.) Consider the following transactional data for the first month of operations for Sparkle Time Cleaning. (Click the icon to view the transactions.) Start from the unadjusted trial balance that Sparkle Time Cleaning prepared at November 30, 2024, and consider the following adjustment data: (Click the icon to view the unadjusted trial balance.) (Click the icon to view the adjustment data.) Read the requirements. Requirement 2. Prepare an adjusted trial balance as of November 30 for Sparkle Time Cleaning. Prepare an adjusted trial balance by completing the partial worksheet below. (Abbreviations used: Accum. Depr.-Equip. and Truck = Accumulated Depreciation-Equipment and Truck.) Sparkle Time Cleaning Preparation of Adjusted Trial Balance

Nov. 1 Bob Hafner contributed $32,000 and a truck, with a market value of $4,000, to the business in exchange for capital. Nov. 2 The business paid $4,400 to Pay Me Properties for November through February rent. (Debit Prepaid Rent) Nov. 3 Paid $600 for a business insurance policy for the term November 1, 2024 through October 31, 2025. (Debit Prepaid Insurance) Nov. 4 Purchased cleaning supplies on account, $400. Nov. 5 Purchased on account an industrial vacuum cleaner costing $3,500. The invoice is payable November 25. Nov. 7 Paid $3,600 for a computer and printer. Nov. 9 Performed cleaning services on account in the amount of $3,800. Nov. 10 Received $700 for services rendered on November 9 . Nov. 15 Paid employees, $750. Nov. 16 Received $18,000 for a 1-year contract beginning November 16 for cleaning services to be provided. Contract begins November 16, 2024, and ends November 15, 2025. (Credit Unearned Revenue) Nov. 17 Provided cleaning services and received $1,200 cash. Nov. 18 Received a utility bill for $275 with a due date of December 4,2024 . (Use Accounts Payable) Nov. 20 Borrowed $54,000 from bank with interest rate of 12% per year. Nov. 21 Received $800 on account for services performed on November 9 . Nov. 25 Paid $1.750 on account for vacuum cleaner purchased on November 5 . Nov. 3 Paid $600 for a business insurance policy for the term November 1, 2024 through October 31, 2025. (Debit Prepaid Insurance) Nov. 4 Purchased cleaning supplies on account, $400. Nov. 5 Purchased on account an industrial vacuum cleaner costing $3,500. The invoice is payable November 25. Nov. 7 Paid $3,600 for a computer and printer. Nov. 9 Performed cleaning services on account in the amount of $3,800. Nov. 10 Received $700 for services rendered on November 9 . Nov. 15 Paid employees, $750. Nov. 16 Received $18,000 for a 1-year contract beginning November 16 for cleaning services to be provided. Contract begins November 16, 2024, and ends November 15, 2025. (Credit Unearned Revenue) Nov. 17 Provided cleaning services and received $1,200 cash. Nov. 18 Received a utility bill for $275 with a due date of December 4 , 2024. (Use Accounts Payable) Nov. 20 Borrowed $54,000 from bank with interest rate of 12% per year. Nov. 21 Received $800 on account for services performed on November 9 . Nov. 25 Paid $1,750 on account for vacuum cleaner purchased on November 5. Nov. 29 Paid $900 for advertising. Nov. 30 Hafner withdrew cash of $1,200 from the business. a. Cleaning supplies on hand at the end of November were $80. b. One month's combined depreciation on all depreciable assets was estimated to be $185. c. One month's interest expense is $178. Consider the following transactional data for the first month of operations for Sparkle Time Cleaning. (Click the icon to view the transactions.) Start from the unadjusted trial balance that Sparkle Time Cleaning prepared at November 30, 2024, and consider the following adjustment data: (Click the icon to view the unadjusted trial balance.) 'Click the icon to view the adjustment data.) Read the requirements. Requirement 1. Prepare all required adjusting journal entries at November 30 . (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Cleaning supplies on hand at the end of November were $80. Prepare the required adjusting journal entry. Consider the following transactional data for the first month of operations for Sparkle Time Cleaning. (Click the icon to view the transactions.) Start from the unadjusted trial balance that Sparkle Time Cleaning prepared at November 30, 2024, and consider the following adjustment data: (Click the icon to view the unadjusted trial balance.) (Click the icon to view the adjustment data.) Read the requirements. Consider the following transactional data for the first month of operations for Sparkle Time Cleaning. (Click the icon to view the transactions.) Start from the unadjusted trial balance that Sparkle Time Cleaning prepared at November 30, 2024, and consider the following adjustment data: (Click the icon to view the unadjusted trial balance.) (Click the icon to view the adjustment data.) Read the requirements. In early November, Sparkle Time paid $600 for a business insurance policy for the term November 1,2024 through October 31,2025 . Prepare the required adjusting entry at November 30 . On November 16, Sparkle Time Received $18,000 for a 1-year contract beginning November for cleaning services to be provided. Contract begins November 16,2024 and ends November 15, 2025. Prepare the required adjusting entry at November 30 . (Assume one half of one month's worth of services under the contract have been performed.) Consider the following transactional data for the first month of operations for Sparkle Time Cleaning. (Click the icon to view the transactions.) Start from the unadjusted trial balance that Sparkle Time Cleaning prepared at November 30, 2024, and consider the following adjustment data: (Click the icon to view the unadjusted trial balance.) (Click the icon to view the adjustment data.) Read the requirements. Requirement 2. Prepare an adjusted trial balance as of November 30 for Sparkle Time Cleaning. Prepare an adjusted trial balance by completing the partial worksheet below. (Abbreviations used: Accum. Depr.-Equip. and Truck = Accumulated Depreciation-Equipment and Truck.) Sparkle Time Cleaning Preparation of Adjusted Trial Balance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started