Hi, I need some help with this question

Thank you

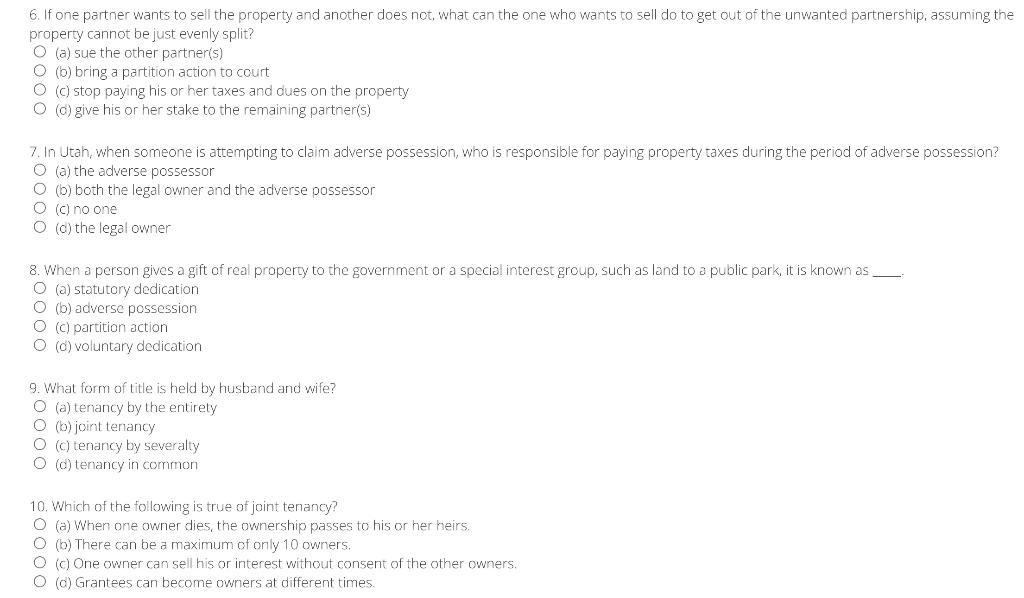

6. If one partner wants to sell the property and another does not, what can the one who wants to sell do to get out of the unwanted partnership, assuming the property cannot be just evenly split? O (a) sue the other partner(s) O (b) bring a partition action to court O (c) stop paying his or her taxes and dues on the property O (d) give his or her stake to the remaining partner(s) 7. In Utah, when someone is attempting to claim adverse possession, who is responsible for paying property taxes during the period of adverse possession? O (a) the adverse possessor O (b) both the legal owner and the adverse possessor O (c) no one O (d) the legal owner 8. When a person gives a gift of real property to the government or a special interest group, such as land to a public park, it is known as O (a) statutory dedication O (b) adverse possession O (c) partition action (d) voluntary dedication 9. What form of title is held by husband and wife? O(a) tenancy by the entirety O (b) joint tenancy O (c) tenancy by severalty O (d) tenancy in common 10. Which of the following is true of joint tenancy? O (a) When one owner dies, the ownership passes to his or her heirs. O (b) There can be a maximum of only 10 owners. O (c) One owner can sell his or interest without consent of the other owners. O (d) Grantees can become owners at different times. 6. If one partner wants to sell the property and another does not, what can the one who wants to sell do to get out of the unwanted partnership, assuming the property cannot be just evenly split? O (a) sue the other partner(s) O (b) bring a partition action to court O (c) stop paying his or her taxes and dues on the property O (d) give his or her stake to the remaining partner(s) 7. In Utah, when someone is attempting to claim adverse possession, who is responsible for paying property taxes during the period of adverse possession? O (a) the adverse possessor O (b) both the legal owner and the adverse possessor O (c) no one O (d) the legal owner 8. When a person gives a gift of real property to the government or a special interest group, such as land to a public park, it is known as O (a) statutory dedication O (b) adverse possession O (c) partition action (d) voluntary dedication 9. What form of title is held by husband and wife? O(a) tenancy by the entirety O (b) joint tenancy O (c) tenancy by severalty O (d) tenancy in common 10. Which of the following is true of joint tenancy? O (a) When one owner dies, the ownership passes to his or her heirs. O (b) There can be a maximum of only 10 owners. O (c) One owner can sell his or interest without consent of the other owners. O (d) Grantees can become owners at different times