Question

I have a partially correct answer, but it is still missing something, and I need help identifying and correcting the missing piece. Answers need to

I have a partially correct answer, but it is still missing something, and I need help identifying and correcting the missing piece. Answers need to address the following: 1) Which financial statement affected, 2) within that Finacial statement which accounts are affected, 3) how the account is affected (over/understatement).

Here is my current answer:

Cost of Goods Sold would be understated on the income statement due to manufacturing overhead not being hit. This then means that the income tax expense is understated, and consequently, the net income is understated on the income statement. The glue is an indirect material; therefore, it should be recorded as part of the Manufacturing Overhead. The Work in process inventory will be overstated because this transaction will be recorded in its actual amount directly to the WIP. Also, the error causes underapplied overhead to be understated or overapplied overhead to be overstated on the balance sheet. This affects the Cost of Goods Sold since the over-or underapplied balance is closed out to the Cost of Goods Sold.

Here is the Professor's feedback:

If COGS is incorrect, as you correctly stated, then Net Income is not correct on the I/S. What impact does this have on the B/S (hint: the closing process of temporary accounts on the I/S to the B/S)?

When payroll is processed, there are 4 accounts used. For factory wages, they are: Wages Expense, Factory Wages Payable, Employer Tax Expense, and Employer Taxes Payable. You did not discuss all of them. Factory wages are a product cost and affect certain accounts presented on the financial statements. Inventory is reported at the aggregate amount of RM, WIP, FG. The errors offset in this entry and do not affect Inventory on the B/S. Assume the units in WIP were sold. What impact does this incorrect entry have on the I/S and subsequently the B/S (hint: the closing process of temporary accounts on the I/S to the B/S)?

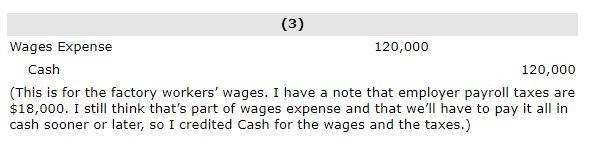

(3) Wages Expense 120,000 Cash 120,000 (This is for the factory workers' wages. I have a note that employer payroll taxes are $18,000. I still think that's part of wages expense and that we'll have to pay it all in cash sooner or later, so I credited Cash for the wages and the taxes.) Your answer has been saved and sent to the instructor. See Gradebook for score details. If the entry (3) was not corrected, which financial statements (income statement or balance sheet) would be affected? What balances would be overstated or understated? (3) Wages Expense 120,000 Cash 120,000 (This is for the factory workers' wages. I have a note that employer payroll taxes are $18,000. I still think that's part of wages expense and that we'll have to pay it all in cash sooner or later, so I credited Cash for the wages and the taxes.) Your answer has been saved and sent to the instructor. See Gradebook for score details. If the entry (3) was not corrected, which financial statements (income statement or balance sheet) would be affected? What balances would be overstated or understatedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started