Answered step by step

Verified Expert Solution

Question

1 Approved Answer

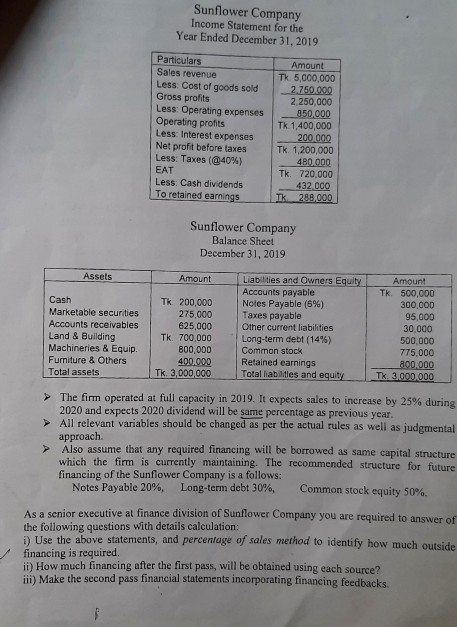

Sunflower Company Income Statement for the Year Ended December 31, 2019 Particulars Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Operating

Sunflower Company Income Statement for the Year Ended December 31, 2019 Particulars Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Operating profits Less: Interest expenses Net profit before taxes Less: Taxes (40%) EAT Less: Cash dividends To retained earnings Amount TK 5,000,000 2.750.000 2.250,000 850,000 Tk. 1,400,000 200.000 Tk. 1,200,000 480.000 Tk. 720.000 432.000 Tk 288.000 Sunflower Company Balance Sheet December 31, 2019 Assets Amount Cash Marketable securities Accounts receivables Land & Building Machineries & Equip. Furniture & Others Total assets TK. 200,000 275,000 625,000 Tk. 700,000 800,000 400.000 Tk. 3,000,000 Liabilities and Owners Equity Accounts payable Notes Payable (6%) Taxes payable Other current liabilities Long-term debt (14%) Common stock Retained earnings Total liabilities and equity Amount Tk. 500,000 300,000 95,000 30,000 500,000 775,000 _800.000 Tk. 3.000.000 The firm operated at full capacity in 2019. It expects sales to increase by 25% during 2020 and expects 2020 dividend will be same percentage as previous year. All relevant variables should be changed as per the actual rules as well as judgmental approach Also assume that any required financing will be borrowed as same capital structure which the firm is currently maintaining. The recommended structure for future financing of the Sunflower Company is a follows: Notes Payable 20%, Long-term debt 30%, Common stock equity 50%. As a senior executive at finance division of Sunflower Company you are required to answer of the following questions with details calculation: Use the above statements, and percentage of sales method to identify how much outside financing is required. in) How much financing after the first pass, will be obtained using each source iii) Make the second pass financial statements incorporating financing feedbacks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started