Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi. i need the answer for question 1, 2 and 8. thank you this is for the table to question 8 1. Assume you buy

hi. i need the answer for question 1, 2 and 8. thank you

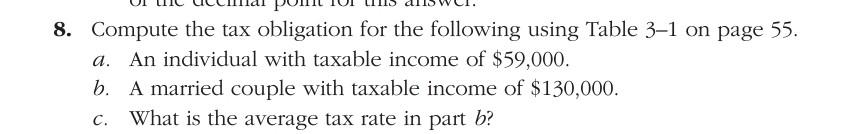

this is for the table to question 8

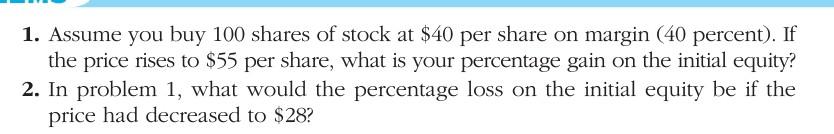

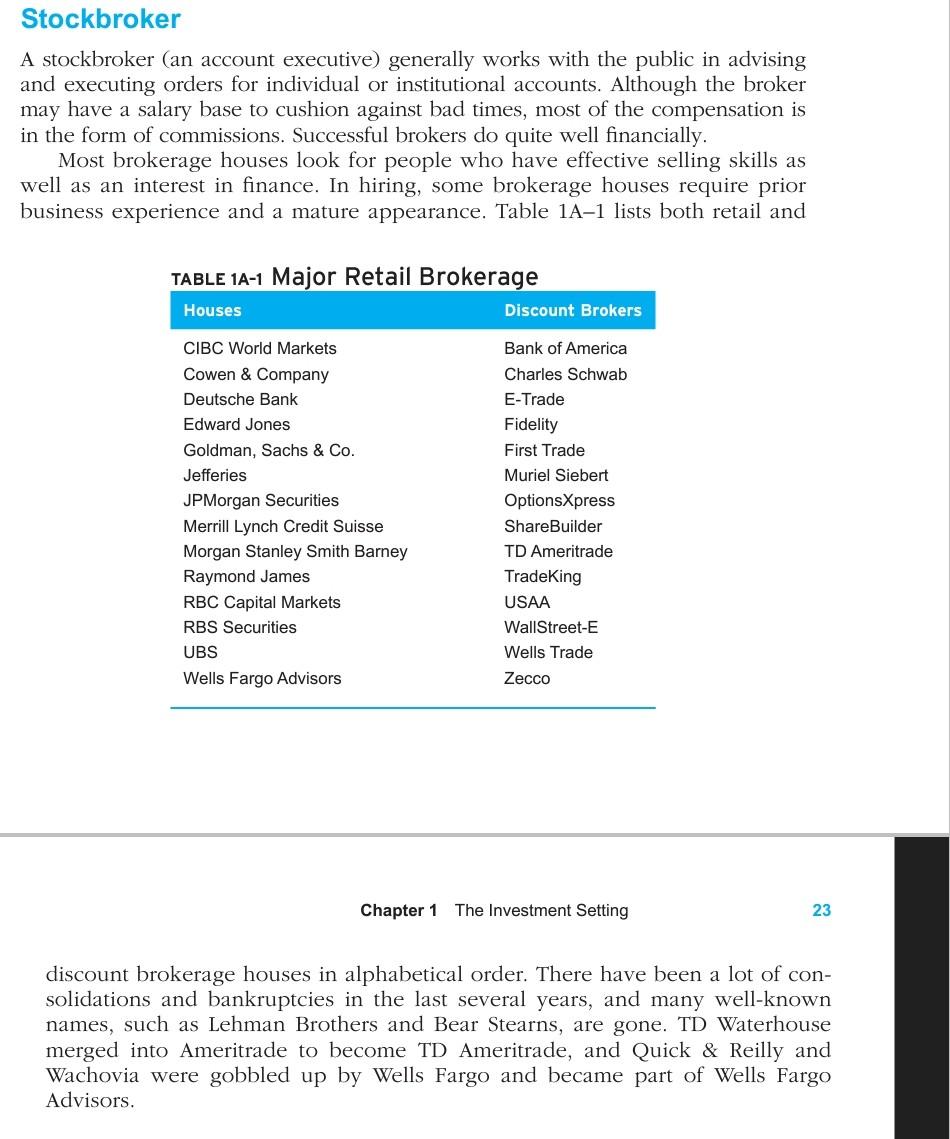

1. Assume you buy 100 shares of stock at $40 per share on margin ( 40 percent). If the price rises to $55 per share, what is your percentage gain on the initial equity? 2. In problem 1, what would the percentage loss on the initial equity be if the price had decreased to $28 ? 8. Compute the tax obligation for the following using Table 31 on page 55 . a. An individual with taxable income of $59,000. b. A married couple with taxable income of $130,000. c. What is the average tax rate in part b ? Stockbroker A stockbroker (an account executive) generally works with the public in advising and executing orders for individual or institutional accounts. Although the broker may have a salary base to cushion against bad times, most of the compensation is in the form of commissions. Successful brokers do quite well financially. Most brokerage houses look for people who have effective selling skills as well as an interest in finance. In hiring, some brokerage houses require prior business experience and a mature appearance. Table 1A1 lists both retail and Chapter 1 The Investment Setting 23 discount brokerage houses in alphabetical order. There have been a lot of consolidations and bankruptcies in the last several years, and many well-known names, such as Lehman Brothers and Bear Stearns, are gone. TD Waterhouse merged into Ameritrade to become TD Ameritrade, and Quick \& Reilly and Wachovia were gobbled up by Wells Fargo and became part of Wells Fargo AdvisorsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started