Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi , i need the answers in 3.5 hours The Textbook: Margin Calls & Short Selling Assignment and the Textbook: Pro Forma Financial Statements Assignment

hi , i need the answers in 3.5 hours

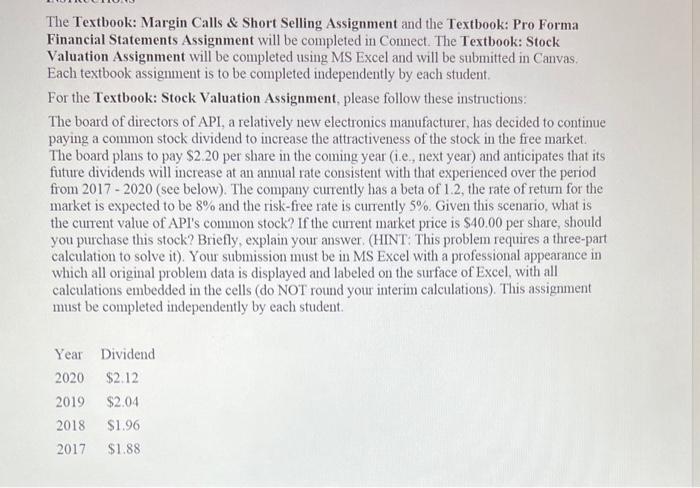

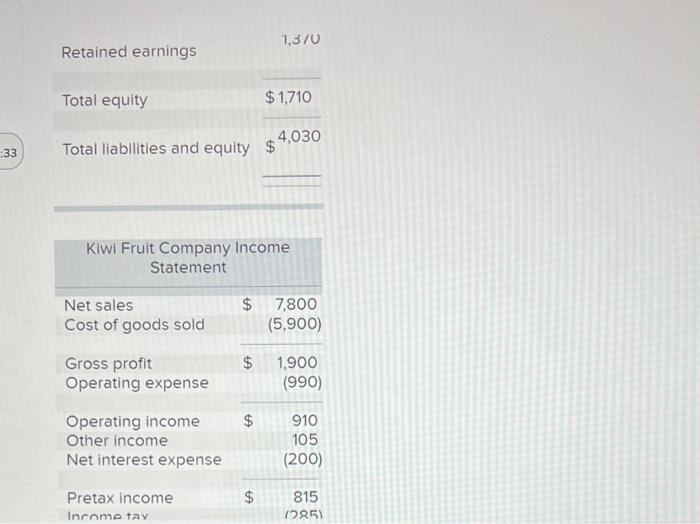

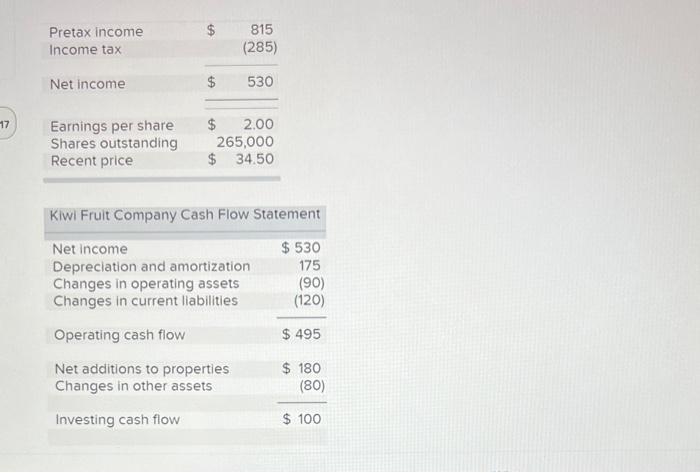

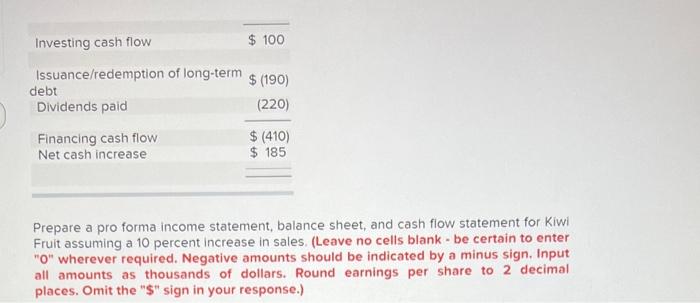

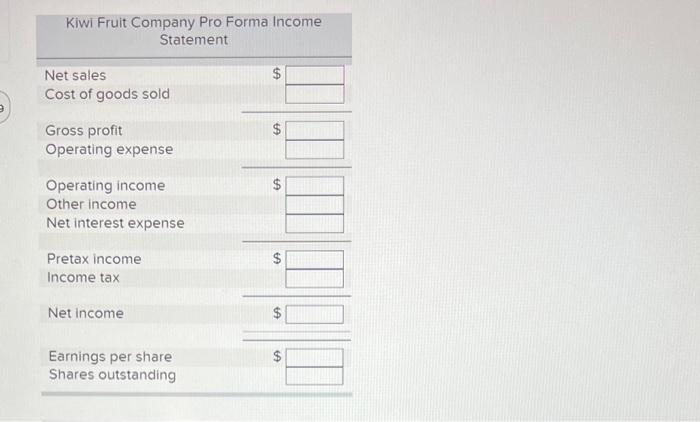

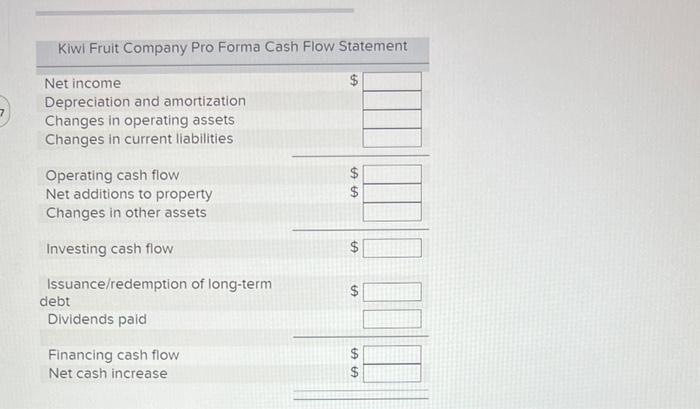

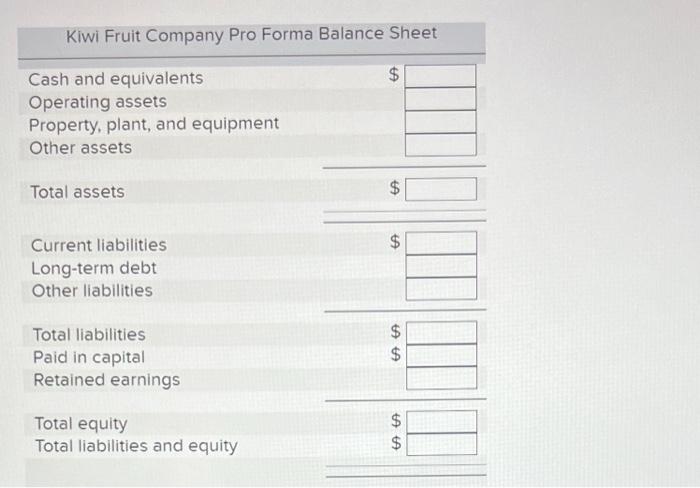

The Textbook: Margin Calls \& Short Selling Assignment and the Textbook: Pro Forma Financial Statements Assignment will be completed in Connect. The Textbook: Stock Valuation Assignment will be completed using MS Excel and will be submitted in Canvas. Each textbook assignment is to be completed independently by each student. For the Textbook: Stock Valuation Assignment, please follow these instructions: The board of directors of API, a relatively new electronics manufacturer, has decided to continue paying a common stock dividend to increase the attractiveness of the stock in the free market. The board plans to pay $2.20 per share in the coming year (i.e., next year) and anticipates that its future dividends will increase at an anmual rate consistent with that experienced over the period from 2017 - 2020 (see below). The company currently has a beta of 1.2, the rate of return for the market is expected to be 8% and the risk-free rate is currently 5%. Given this scenario, what is the current value of API's common stock? If the current market price is $40.00 per share, should you purchase this stock? Briefly, explain your answer. (HINT: This problem requires a three-part calculation to solve it). Your submission must be in MS Excel with a professional appearance in which all original problem data is displayed and labeled on the surface of Excel, with all calculations embedded in the cells (do NOT round your interim calculations). This assignment must be completed independently by each student. \begin{tabular}{lcr} Pretax income Income tax & $ & 815 (285) \\ \cline { 2 - 3 } Net income & $ & 530 \\ \cline { 2 } Earnings per share & $2.00 \\ Shares outstanding & 265,000 \\ Recent price & $34.50 \\ \hline \end{tabular} Kiwi Fruit Company Cash Flow Statement \begin{tabular}{lr} Net income & $530 \\ Depreclation and amortization & 175 \\ Changes in operating assets & (90) \\ Changes in current llabilities & (120) \\ \cline { 2 } & $495 \\ Operating cash flow & $180 \\ Net additions to properties & (80) \\ Changes in other assets & $100 \end{tabular} Prepare a pro forma income statement, balance sheet, and cash flow statement for Kiwi Fruit assuming a 10 percent increase in sales, (Leave no cells blank - be certain to enter "O" wherever required. Negative amounts should be indicated by a minus sign. Input all amounts as thousands of dollars. Round earnings per share to 2 decimal places. Omit the " $ " sign in your response.) Kiwi Fruit Company Pro Forma Income Statement Net sales Cost of goods sold Gross profit Operating expense Operating income Other income Net interest expense Pretax income Income tax Net income Earnings per share Shares outstanding Kiwi Fruit Company Pro Forma Cash Flow Statement Net income Depreciation and amortization Changes in operating assets Changes in current liabilities Operating cash flow Net additions to property Changes in other assets Investing cash flow Issuance/redemption of long-term debt Dividends paid Financing cash flow Net cash increase Kiwi Fruit Company Pro Forma Balance Sheet Cash and equivalents Operating assets Property, plant, and equipment Other assets Total assets Current liabilities Long-term debt Other liabilities Total liabilities Paid in capital Retained earnings Total equity Total liabilities and equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started