Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, i need the complete answer of the requierment. please read the question and answer it carefully.thanks Orange Construction Inc. has poor internal control. Recently,

hi, i need the complete answer of the requierment. please read the question and answer it carefully.thanks

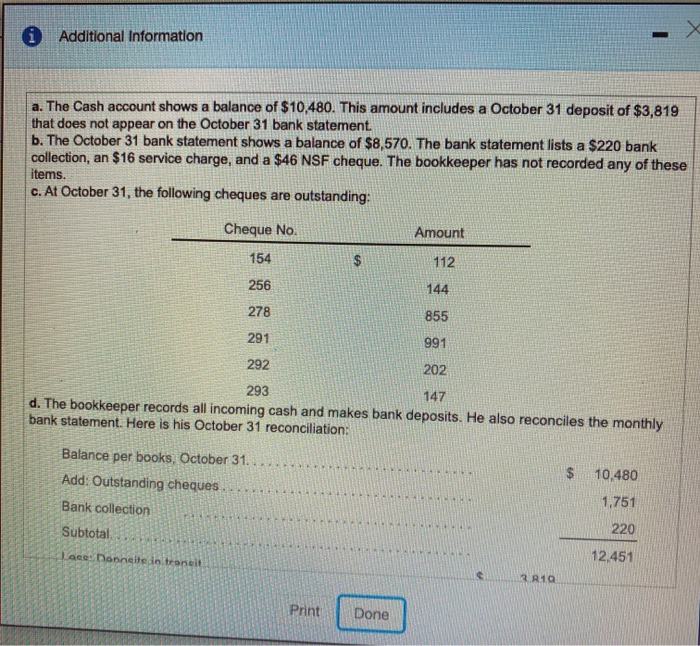

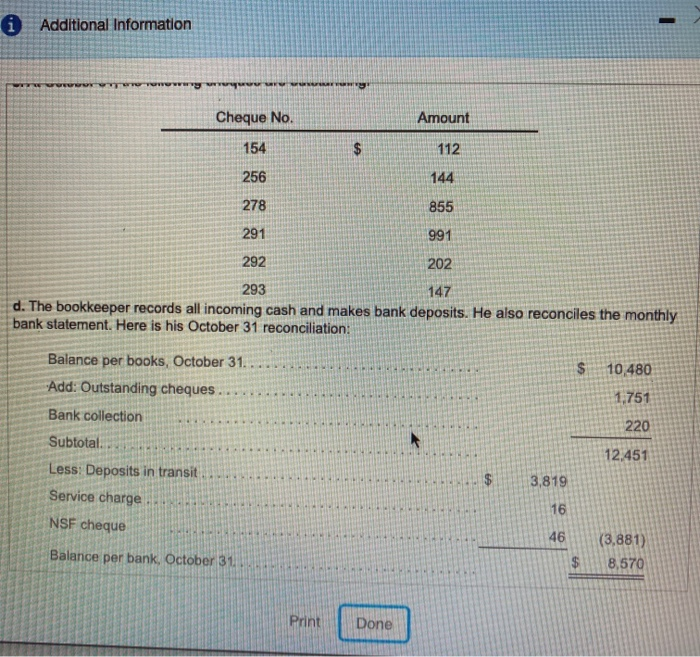

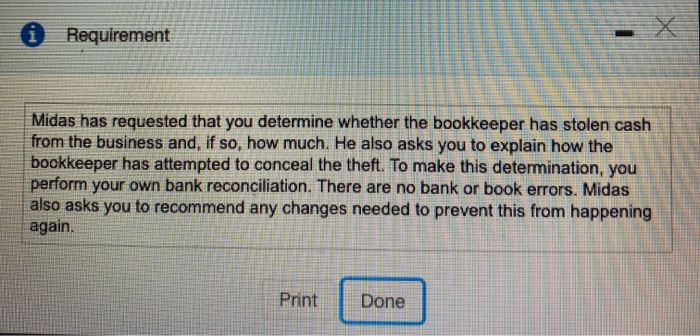

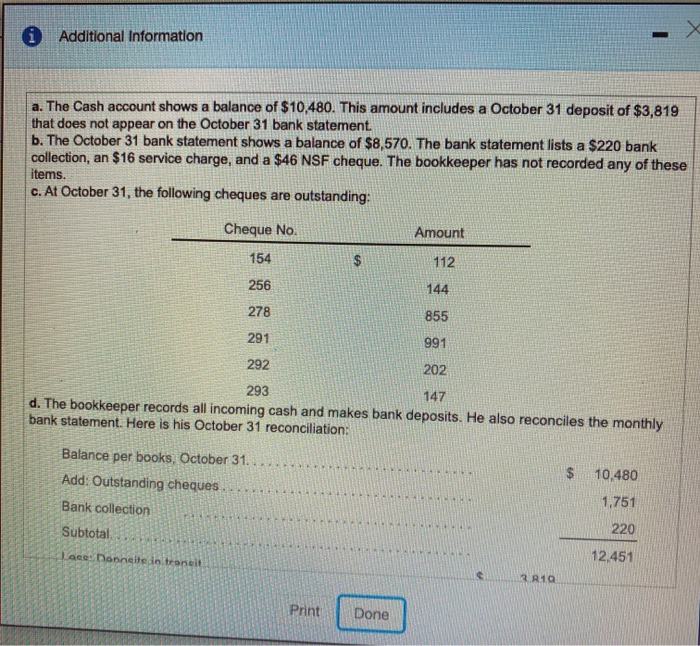

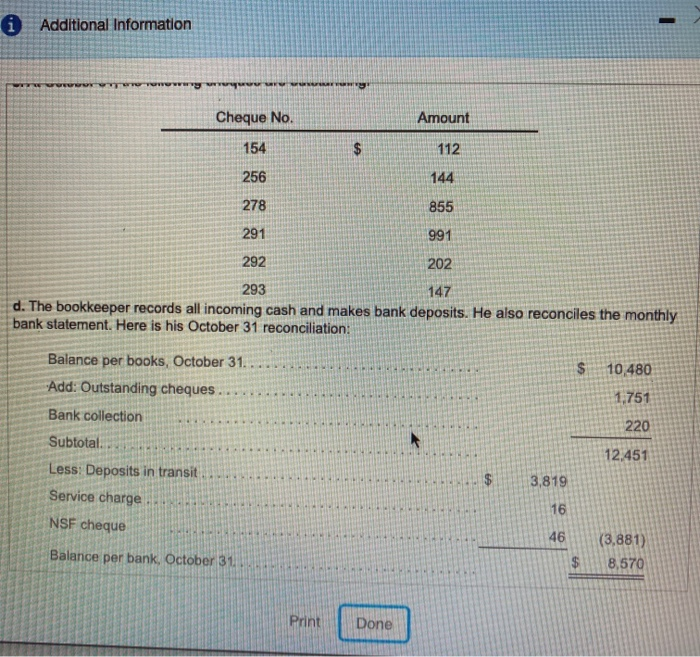

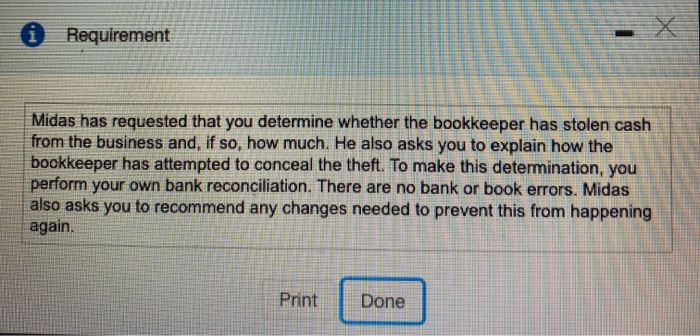

Orange Construction Inc. has poor internal control. Recently, Jim Midas, the owner, has suspected the bookkeeper of stealing. Here are some details of the business's cash position at October 31, 2017 (Click on the icon to view additional Information) Requiremen Begin by preparing the bank section of the bank reconciliation. Then, continue with the book section of the bank reconciliation Leave unused calls blank.) Orange Construction Inc. Bank Reconciliation October 31, 2017 BANK Add Less i Additional Information a. The Cash account shows a balance of $10,480. This amount includes a October 31 deposit of $3,819 that does not appear on the October 31 bank statement. b. The October 31 bank statement shows a balance of $8,570. The bank statement lists a $220 bank collection, an $16 service charge, and a $46 NSF cheque. The bookkeeper has not recorded any of these items. c. At October 31, the following cheques are outstanding: Cheque No. Amount 154 112 256 144 278 855 291 991 292 202 293 147 d. The bookkeeper records all incoming cash and makes bank deposits. He also reconciles the monthly bank statement. Here is his October 31 reconciliation: $ 10,480 Balance per books. October 31. Add: Outstanding cheques. Bank collection Subtotal 1,751 220 ee: Donite in tranet 12.451 2 R10 Print Done i Additional Information - wwwww You Cheque No. Amount 154 $ 112 256 144 278 855 291 991 292 202 293 147 d. The bookkeeper records all incoming cash and makes bank deposits. He also reconciles the monthly bank statement. Here is his October 31 reconciliation: $ 10,480 1,751 220 Balance per books, October 31. Add: Outstanding cheques Bank collection Subtotal. Less: Deposits in transit Service charge NSF cheque 12,451 3,819 16 46 Balance per bank, October 31 (3,881) 8,570 $ Print Done 0 Requirement Midas has requested that you determine whether the bookkeeper has stolen cash from the business and, if so, how much. He also asks you to explain how the bookkeeper has attempted to conceal the theft. To make this determination, you perform your own bank reconciliation. There are no bank or book errors. Midas also asks you to recommend any changes needed to prevent this from happening again. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started