Hi, i need the complete answer of this question. Please read the question and all the requiermnets carefully and answer the question completely. Thanks.

Hi, i need the complete answer of this question. Please read the question and all the requiermnets carefully and answer the question completely. Thanks.

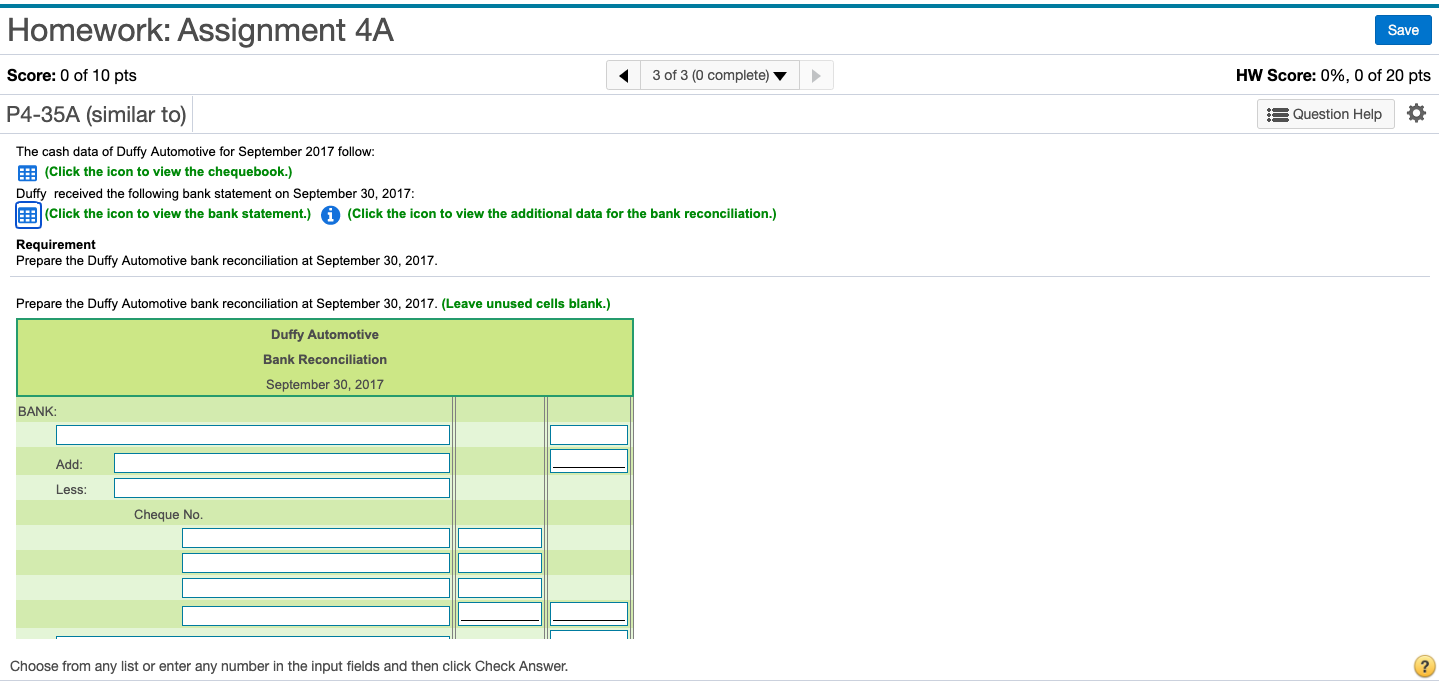

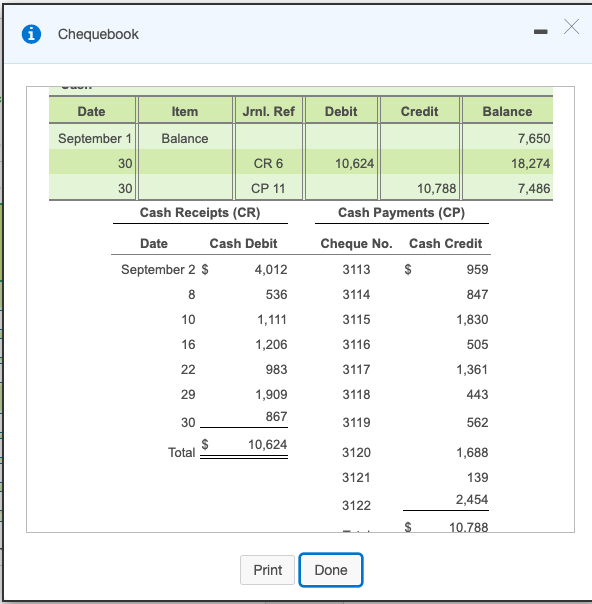

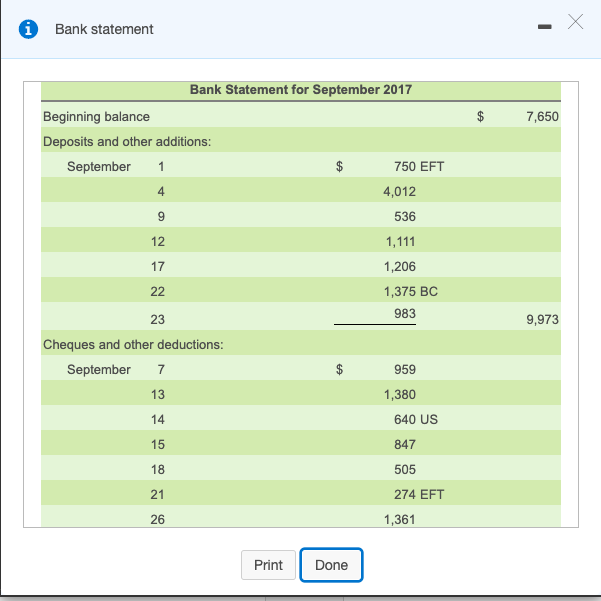

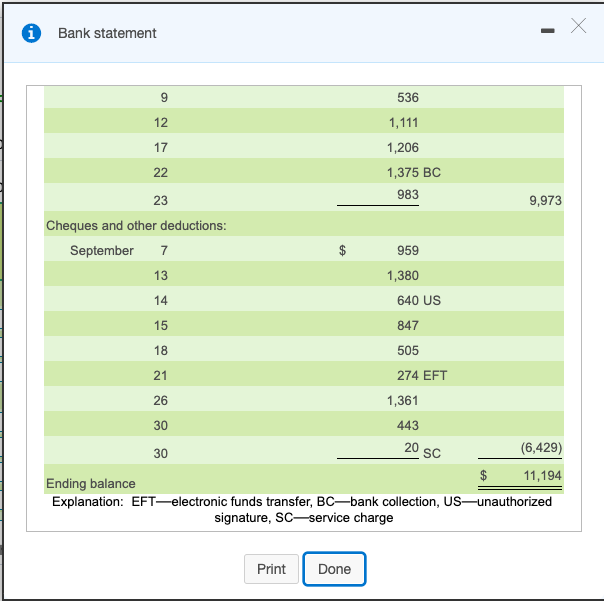

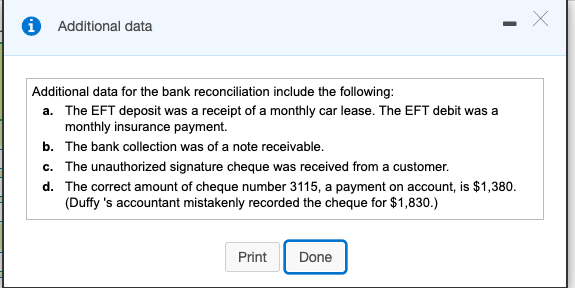

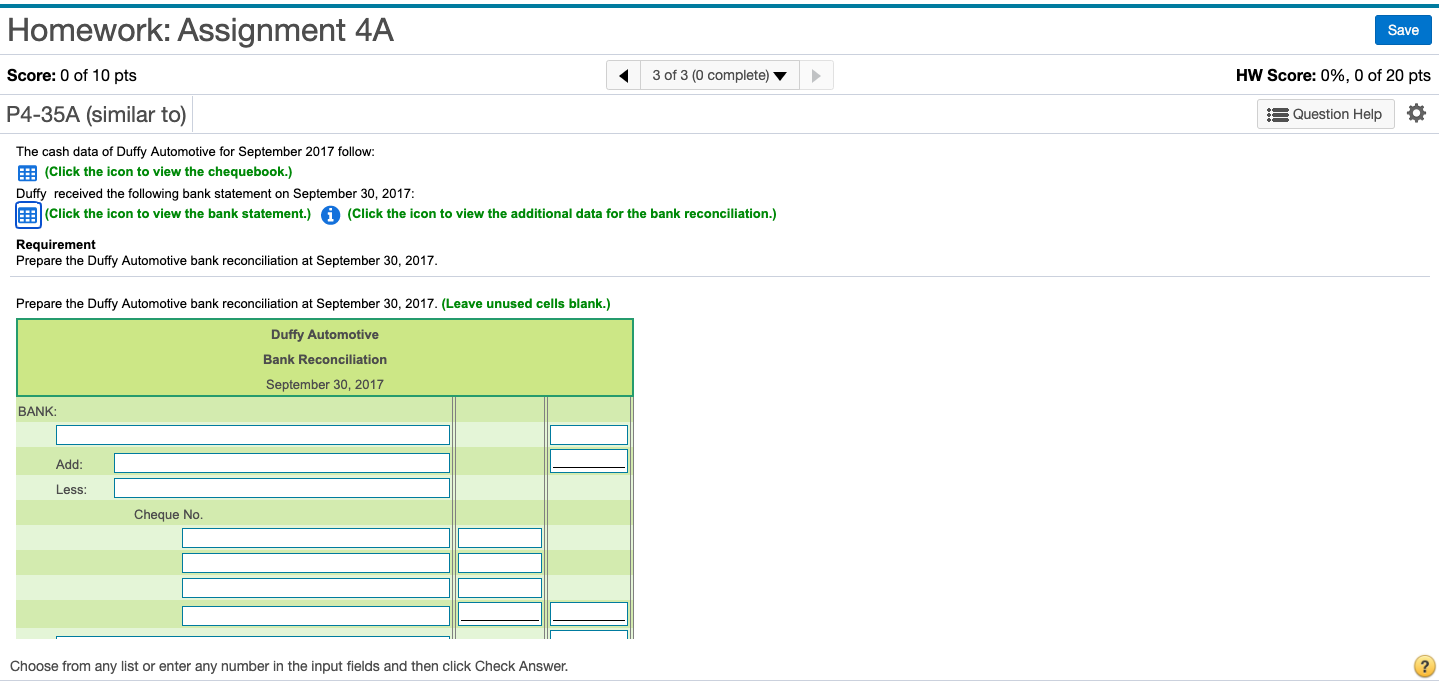

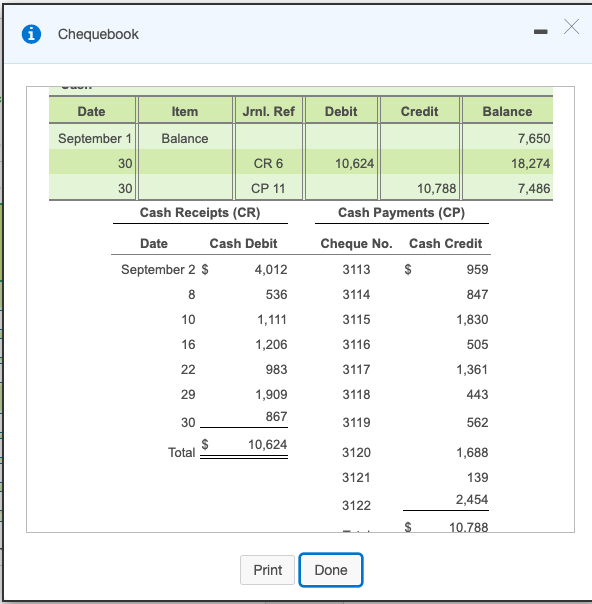

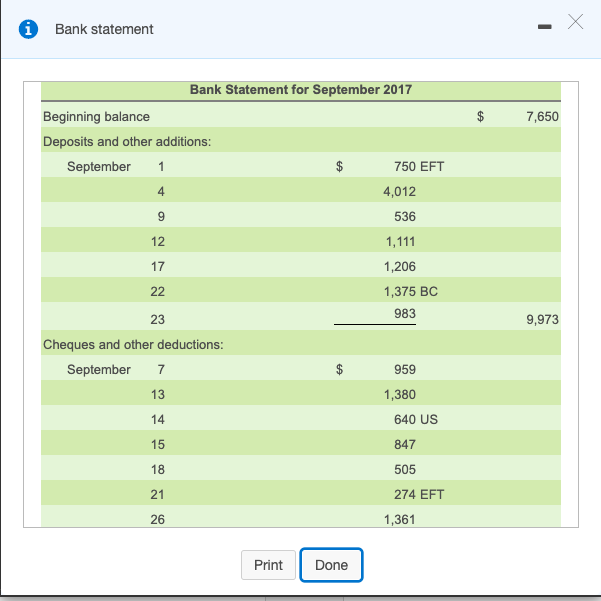

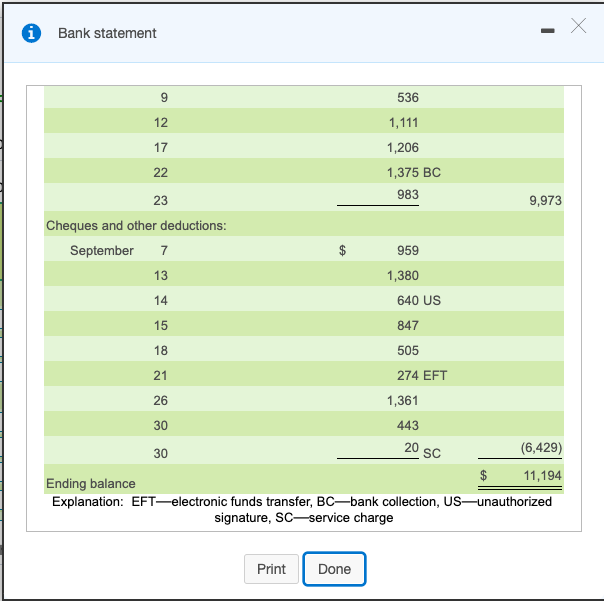

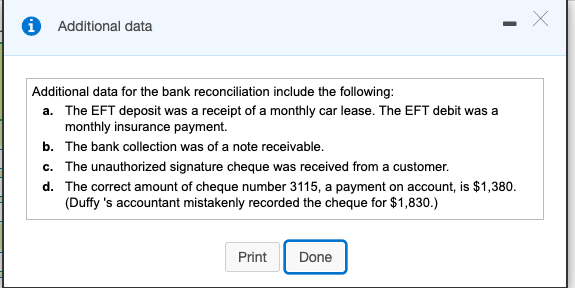

Homework: Assignment 4A Save Score: 0 of 10 pts 3 of 3 (0 complete) HW Score: 0%, 0 of 20 pts P4-35A (similar to) A Question Help The cash data of Duffy Automotive for September 2017 follow: (Click the icon to view the chequebook.) Duffy received the following bank statement on September 30, 2017: (Click the icon to view the bank statement.) A (Click the icon to view the additional data for the bank reconciliation.) Requirement Prepare the Duffy Automotive bank reconciliation at September 30, 2017. Prepare the Duffy Automotive bank reconciliation at September 30, 2017. (Leave unused cells blank.) Duffy Automotive Bank Reconciliation September 30, 2017 BANK: Add: Less: Cheque No. Choose from any list or enter any number in the input fields and then click Check Answer. ? i Chequebook Debit Credit Balance 7,650 Date Item Jrnl. Ref September 1 Balance 30 CR 6 30 CP 11 Cash Receipts (CR) 18,274 7,486 Date 10,624 10,788 Cash Payments (CP) Cheque No. Cash Credit 959 3114 847 3115 1,830 3116 505 3117 1,361 3118 443 3113 Cash Debit September 2 $ 4,012 8 536 10 1,111 16 1,206 22 983 29 1,909 867 30 3119 562 $ $ 10,624 Total 3120 1,688 3121 139 2,454 3122 $ 10.788 Print Done i Bank statement - $ 7,650 4 17 Bank Statement for September 2017 Beginning balance Deposits and other additions: September 1 750 EFT 4,012 9 536 12 1,111 1,206 22 1,375 BC 23 983 Cheques and other deductions: September 7 959 13 1,380 14 640 US 15 847 18 505 21 274 EFT 26 1,361 9,973 Print Done i Bank statement 9 536 12 1,111 17 1,206 22 1,375 BC 23 983 9,973 Cheques and other deductions: September 7 959 13 1,380 14 640 US 15 847 18 505 21 274 EFT 26 1,361 30 443 30 (6,429) Ending balance 11,194 Explanation: EFT-electronic funds transfer, BCbank collection, USunauthorized signature, SC-service charge 20 SC $ Print Done i Additional data Additional data for the bank reconciliation include the following: a. The EFT deposit was a receipt of a monthly car lease. The EFT debit was a monthly insurance payment. b. The bank collection was of a note receivable. c. The unauthorized signature cheque was received from a customer. d. The correct amount of cheque number 3115, a payment on account, is $1,380. (Duffy's accountant mistakenly recorded the cheque for $1,830.) Print Done

Hi, i need the complete answer of this question. Please read the question and all the requiermnets carefully and answer the question completely. Thanks.

Hi, i need the complete answer of this question. Please read the question and all the requiermnets carefully and answer the question completely. Thanks.