Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi I need these answers urgently. thank u 1. 2. 3. 4. Question 47 (1 point) Which of the following is TRUE regarding Principal Protected

Hi I need these answers urgently. thank u

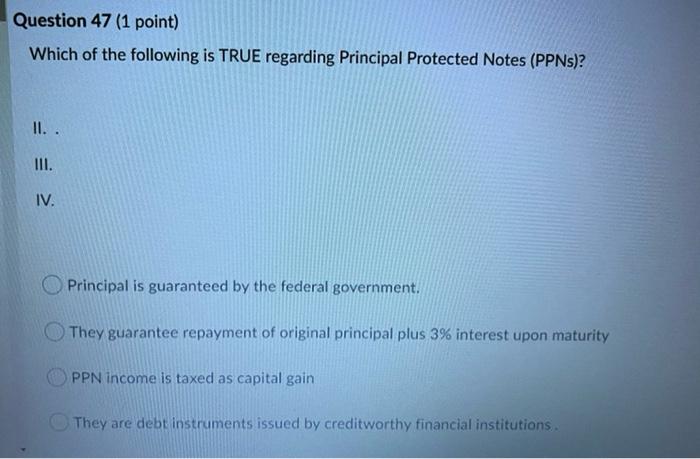

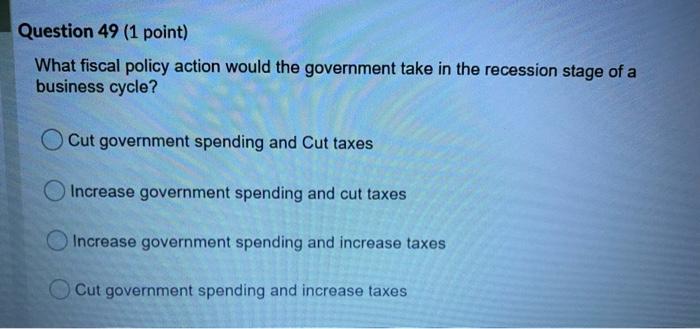

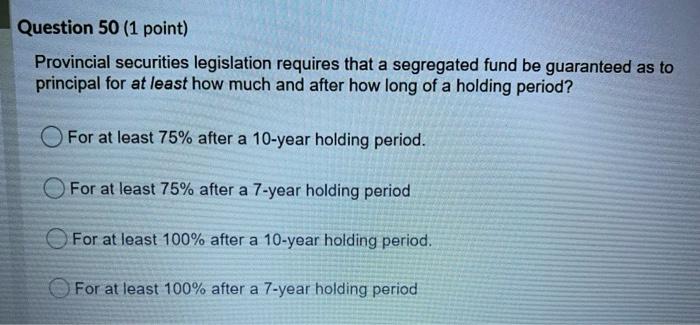

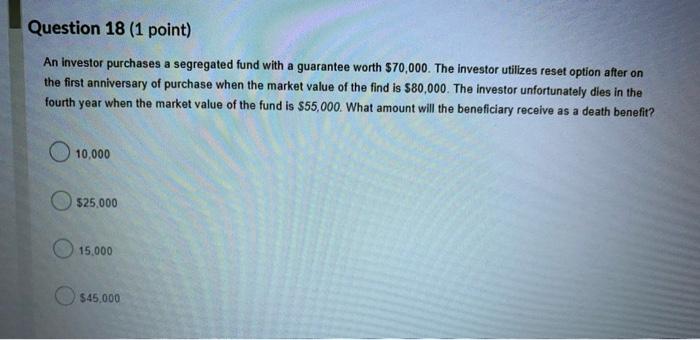

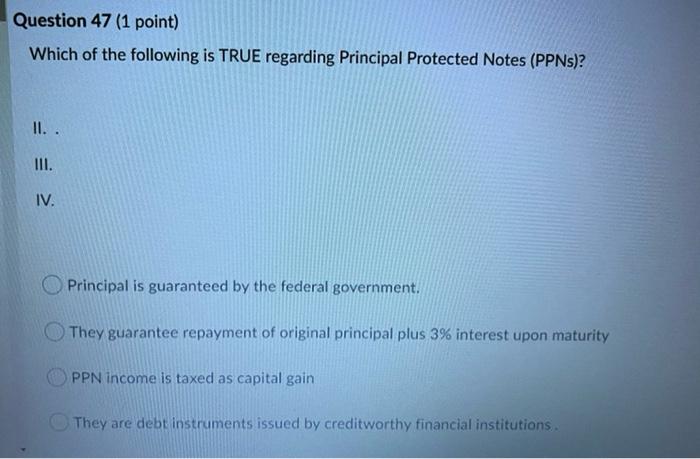

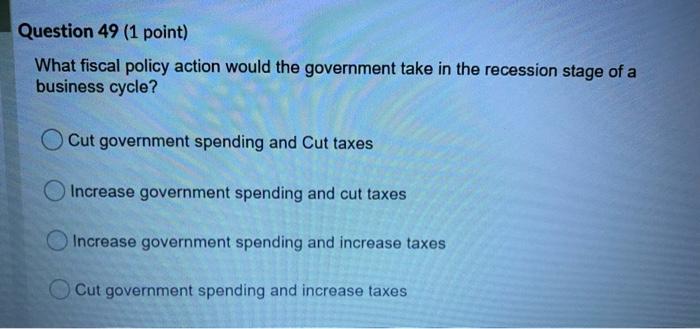

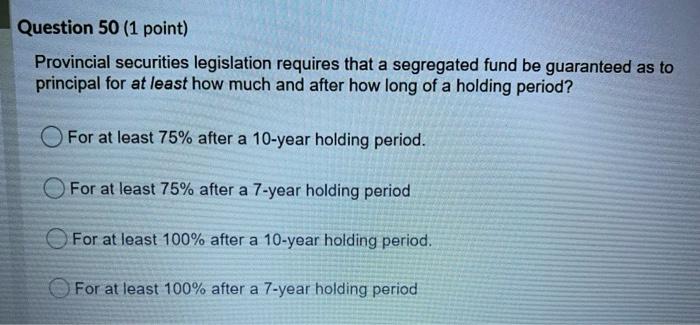

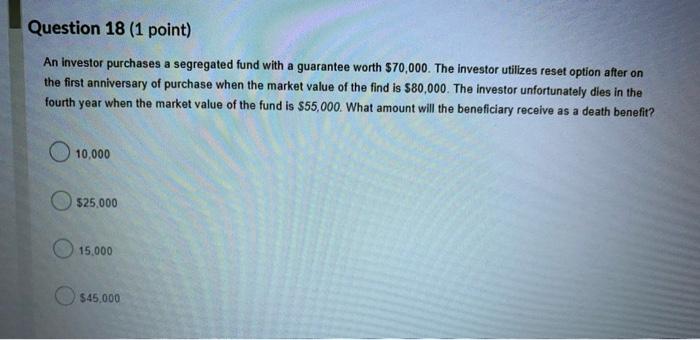

Question 47 (1 point) Which of the following is TRUE regarding Principal Protected Notes (PPNs)? II.. III. IV. Principal is guaranteed by the federal government. They guarantee repayment of original principal plus 3% interest upon maturity PPN income is taxed as capital gain They are debt instruments issued by creditworthy financial institutions Question 49 (1 point) What fiscal policy action would the government take in the recession stage of a business cycle? Cut government spending and Cut taxes Increase government spending and cut taxes Increase government spending and increase taxes Cut government spending and increase taxes Question 50 (1 point) Provincial securities legislation requires that a segregated fund be guaranteed as to principal for at least how much and after how long of a holding period? For at least 75% after a 10-year holding period. For at least 75% after a 7-year holding period For at least 100% after a 10-year holding period. For at least 100% after a 7-year holding period Question 18 (1 point) An investor purchases a segregated fund with a guarantee worth $70,000. The investor utilizes reset option after on the first anniversary of purchase when the market value of the find is $80,000. The investor unfortunately dies in the fourth year when the market value of the fund is $55,000. What amount will the beneficiary receive as a death benefit? 10,000 $25.000 15,000 $45,000 1.

2.

3.

4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started