Answered step by step

Verified Expert Solution

Question

1 Approved Answer

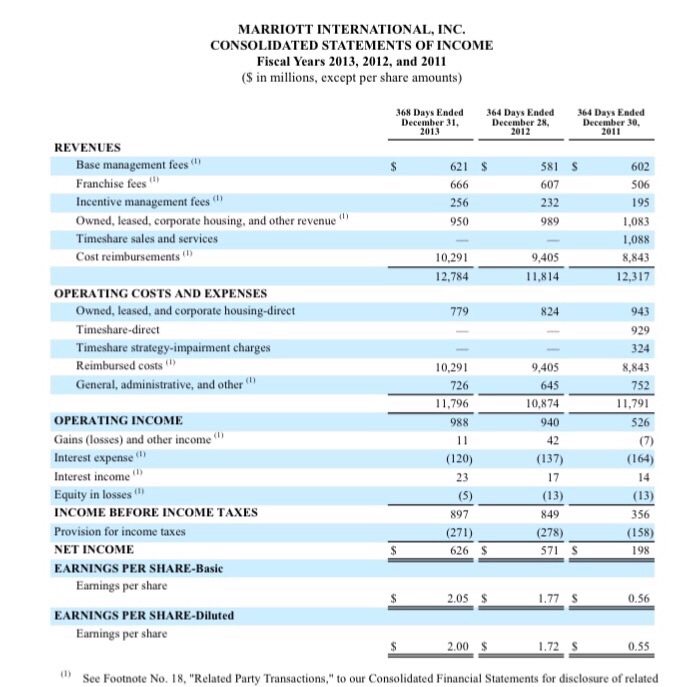

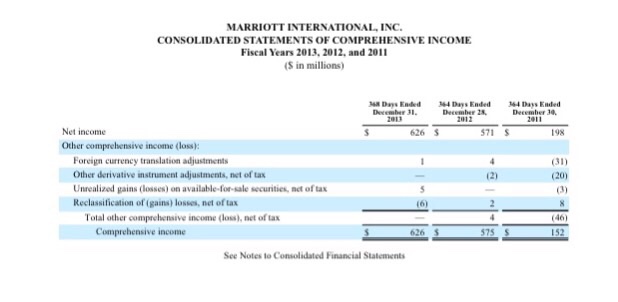

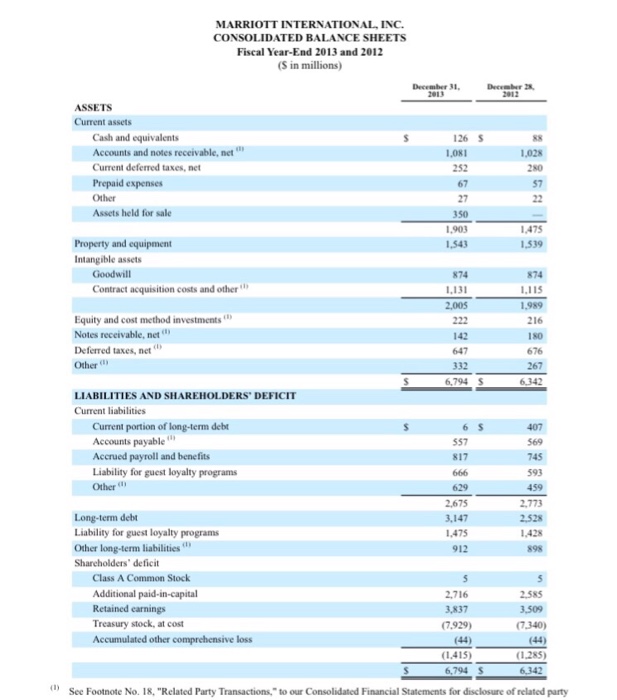

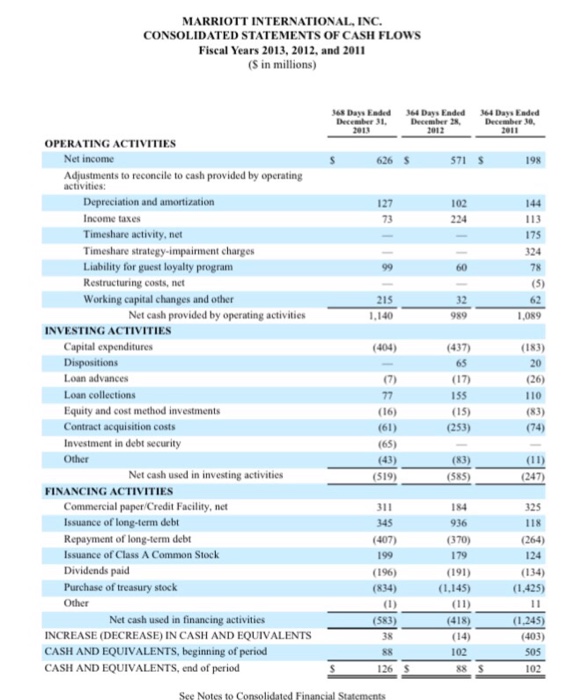

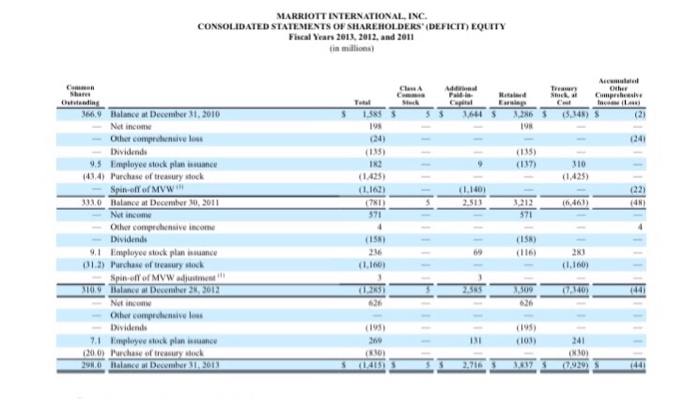

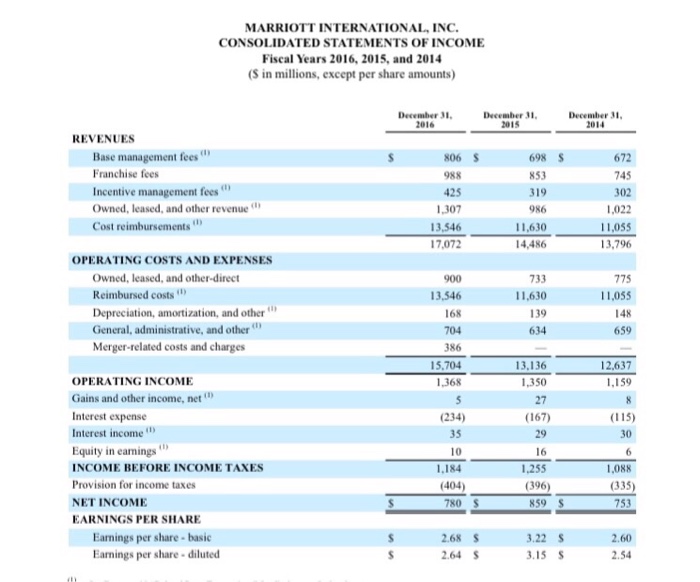

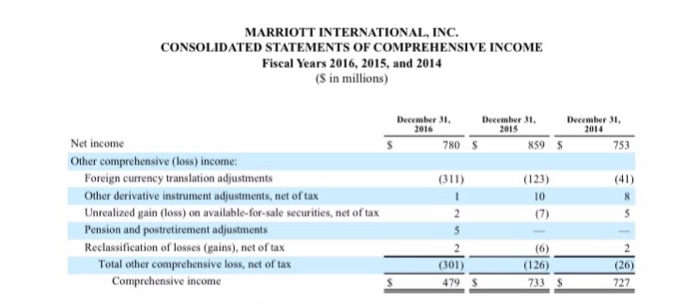

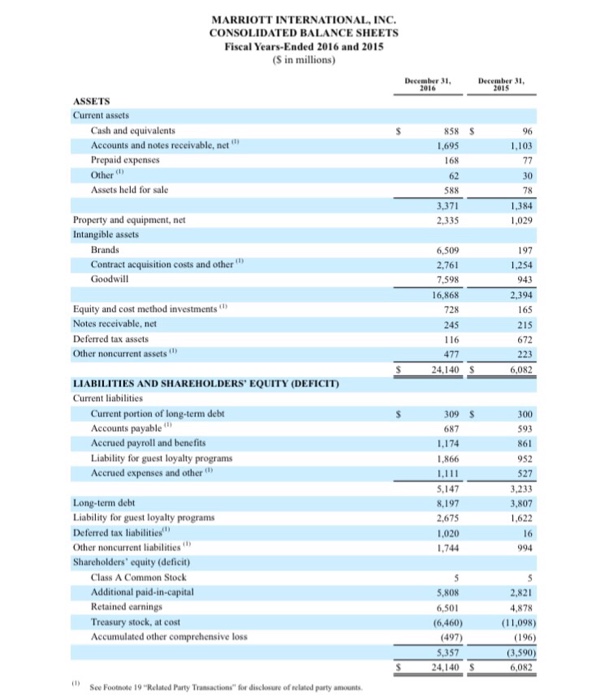

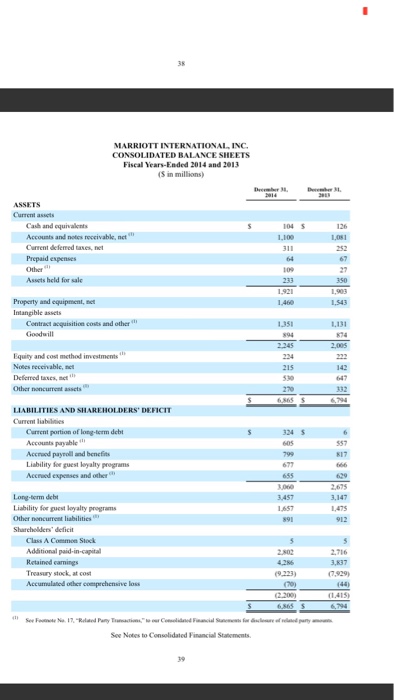

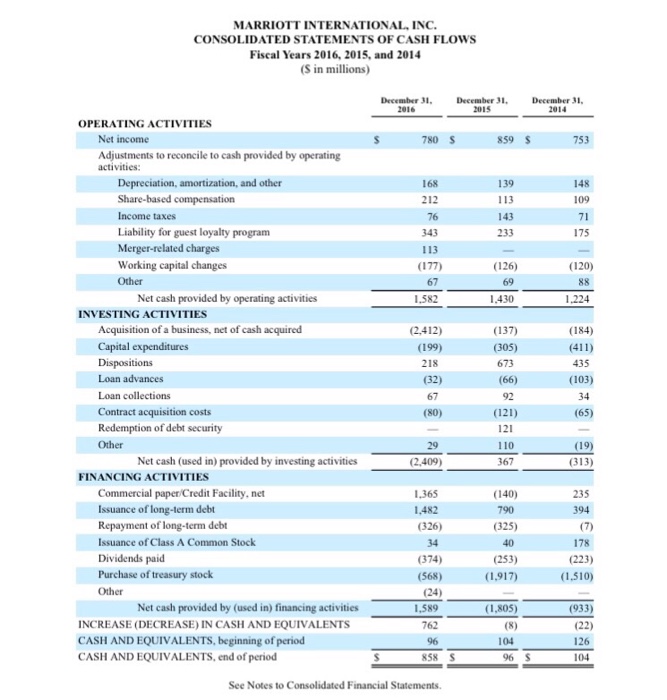

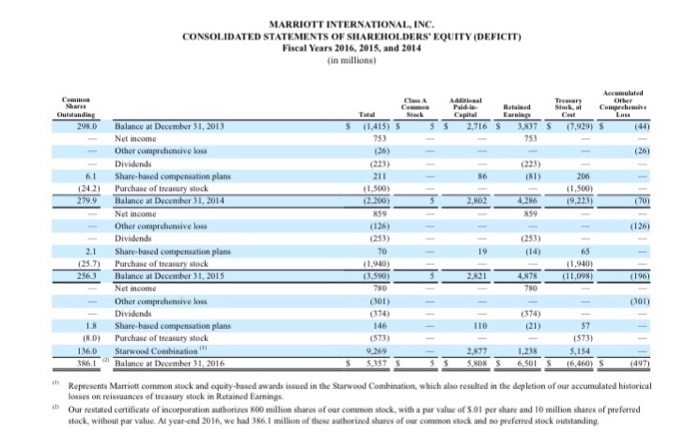

Hi i need to calculate the vertical analysis with the annual statements of the marriot from 2012 up to 2016, being 2012 the base year.

Hi i need to calculate the vertical analysis with the annual statements of the marriot from 2012 up to 2016, being 2012 the base year. Thank you. I would appreciate a brief description of how was calculated everything to understand the exercise.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started