Hi, i need to complete this excel sheet and to make cash flow diagram . I need to know what formula to use and what are the steps . This is engineering economic analysis

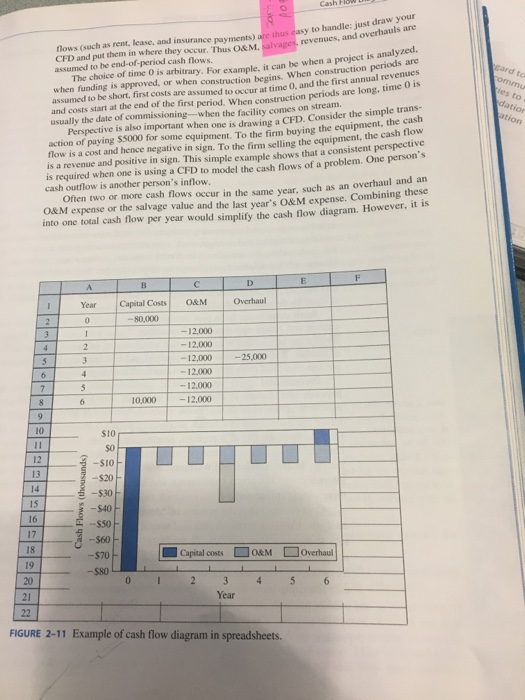

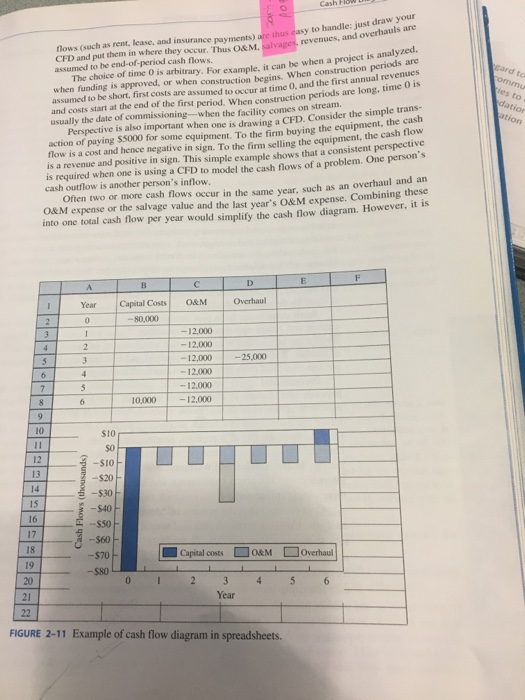

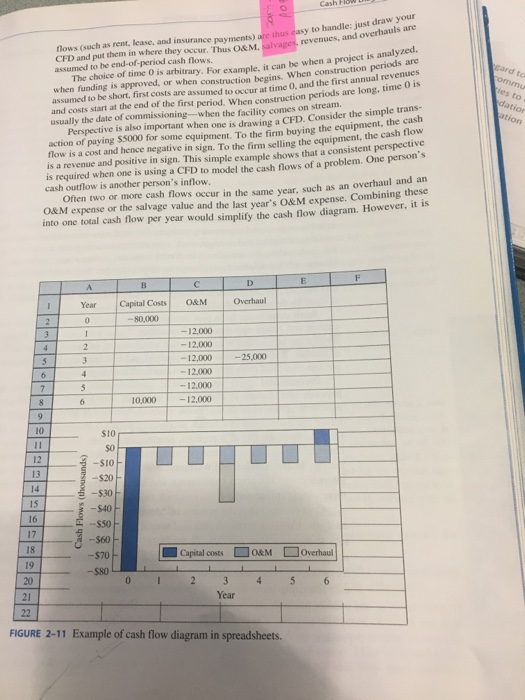

flows (such as rent. lease, and insurance payments) are thus CFD and put them in where they occur. Thus O&M. sa assumed to be end-of-period cash flows easy to handle: just draw your venues, and overhauls are nalyze The choice of time O is arbitrary. For example, it can he wicn periods are when a project is an construction periods are are assumed to occur at time 0, and the first annual revenues when funding is approved, or whe n construction begins. When ard to assumed to be short, first costs and costs start at the end of the first period. When construction periods are long. t usually the date of commissioning-when the facility comes on stream Perspective is also important when one is drawing a CFD. Cons action of paying $5000 for some equipment. To the firm buyi flow is a cost and hence negative in sign. To the firm selling the equip is a revenue and positive in sign. This simple example shows that a consistent perspecti ider the simple trans g the equipment, the cash ment, the cash flow ve is required when one is using a CFD to model the cash flows of a problem. One person's cash outflow is another person's inflow. Often two or more cash flows occur in the same year, such as an overhaul and an these O&M expense or the salvage value and the last year's O&M expense. Combining into one total cash flow per year would simplify the cash flow diagram. However, t Year Capital Cost O&M Overhaul -80,000 -12,000 -12,000 -12,000 | -25,000 -12.000 -12,000 12,000 10,000 -si $20 13 14 15 16 17 18 $40 $50 $60 -$70 $80 Capital costs O&M Overhau 19 21 Year FIGURE 2-11 Example of cash flow diagram in spreadsheets. flows (such as rent. lease, and insurance payments) are thus CFD and put them in where they occur. Thus O&M. sa assumed to be end-of-period cash flows easy to handle: just draw your venues, and overhauls are nalyze The choice of time O is arbitrary. For example, it can he wicn periods are when a project is an construction periods are are assumed to occur at time 0, and the first annual revenues when funding is approved, or whe n construction begins. When ard to assumed to be short, first costs and costs start at the end of the first period. When construction periods are long. t usually the date of commissioning-when the facility comes on stream Perspective is also important when one is drawing a CFD. Cons action of paying $5000 for some equipment. To the firm buyi flow is a cost and hence negative in sign. To the firm selling the equip is a revenue and positive in sign. This simple example shows that a consistent perspecti ider the simple trans g the equipment, the cash ment, the cash flow ve is required when one is using a CFD to model the cash flows of a problem. One person's cash outflow is another person's inflow. Often two or more cash flows occur in the same year, such as an overhaul and an these O&M expense or the salvage value and the last year's O&M expense. Combining into one total cash flow per year would simplify the cash flow diagram. However, t Year Capital Cost O&M Overhaul -80,000 -12,000 -12,000 -12,000 | -25,000 -12.000 -12,000 12,000 10,000 -si $20 13 14 15 16 17 18 $40 $50 $60 -$70 $80 Capital costs O&M Overhau 19 21 Year FIGURE 2-11 Example of cash flow diagram in spreadsheets