Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi I nees to know If I did this right If not what did I do wrong ..please help with math calculations Assume Postage People

hi I nees to know If I did this right If not what did I do wrong ..please help with math calculations

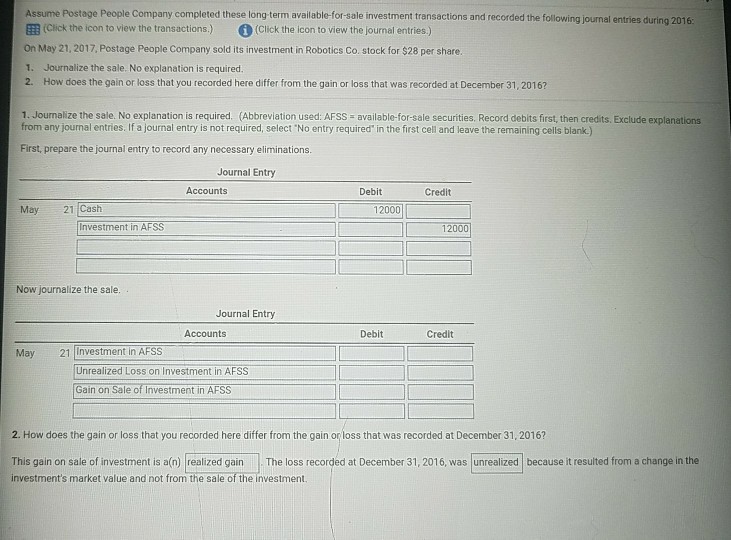

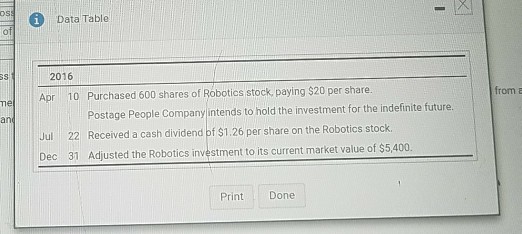

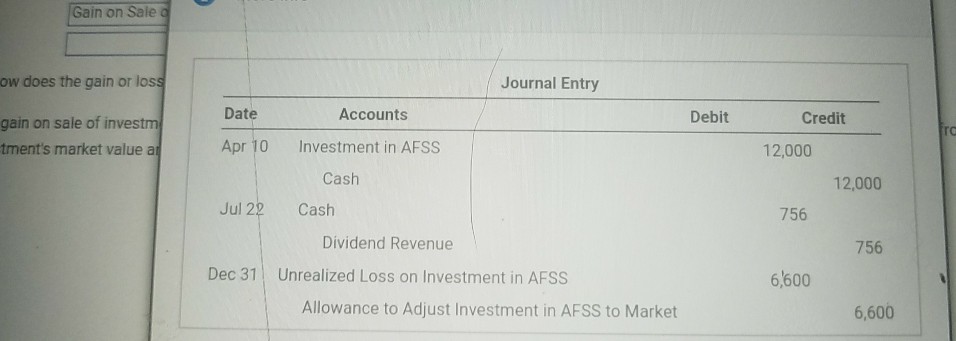

Assume Postage People Company completed these long-term available-for-sale investment transactions and recorded the following journal entries during 2016: EEB (Click the icon to view the transactions.) (Click the icon to view the journal entries) On May 21, 2017, Postage People Company sold its investment in Robotics Co. stock for $28 per share. 1. Journalize the sale. No explanation is required. 2. How does the gain or loss that you recorded here differ from the gain or loss that was recorded at December 31,2016? 1. Journalize the sale. No explanation is required. (Abbreviation used: AFSS available-for-sale securities. Record debits first, then credits. Exclude explanations from any journal entries. If a journal entry is not required, select No entry required in the first cell and leave the remaining cells blank.) First, prepare the journal entry to record any necessary eliminations. Journal Entry Accounts Debit Credit May 21 Cash 12000 12000 Now journalize the sale. Journal Entry Accounts Debit Credit May 21 Investment in AFsS Unrealized Loss on Investment in AFSS Gain on Sale of Investment in AFSS 2. How does the gain or loss that you recorded here differ from the gain or loss that was recorded at December 31,2016? because it resulted from a change in the This gain on sale of investment is a(n) realized gain The loss recorded at December 31, 2016, was unrealized investment's market value and not from the sale of the investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started