Answered step by step

Verified Expert Solution

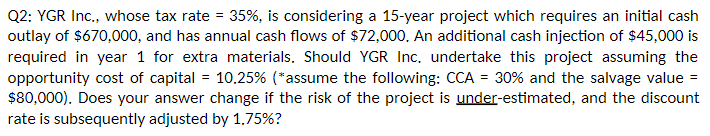

Question

1 Approved Answer

Hi , I question similar to this has been answered already. However, this specific iteration includes an additional cashflow in year 1 . I would

Hi I question similar to this has been answered already. However, this specific iteration includes an additional cashflow in year I would appreciate some assistance very much! I have also provided the professor's final answer. I am not sure how to get the same answer that he got. Thank you so much! Q: YGR Inc., whose tax rate is considering a year project which requires an initial cash

outlay of $ and has annual cash flows of $ An additional cash injection of $ is

required in year for extra materials. Should YGR Inc. undertake this project assuming the

opportunity cost of capital assume the following: CCA and the salvage value

$ Does your answer change if the risk of the project is underestimated, and the discount

rate is subsequently adjusted by

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started