hi i really need help finishing this problem thank you!

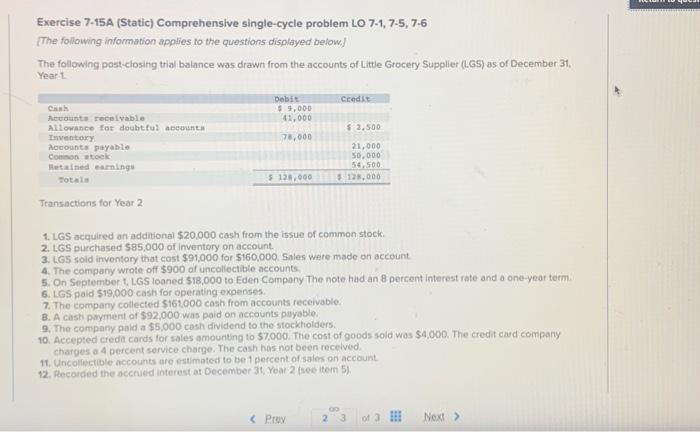

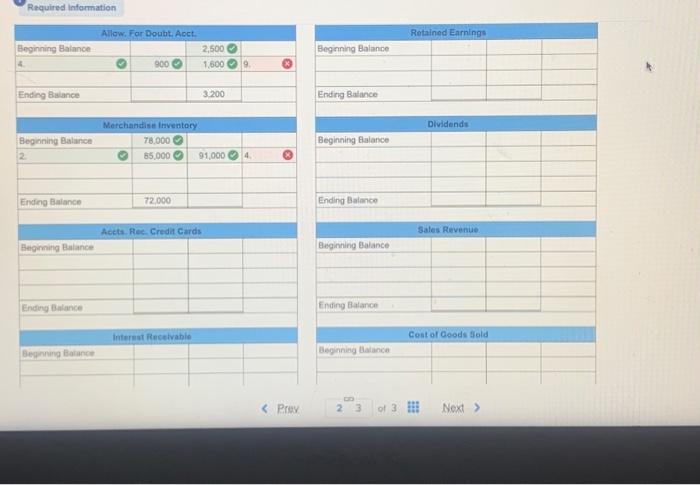

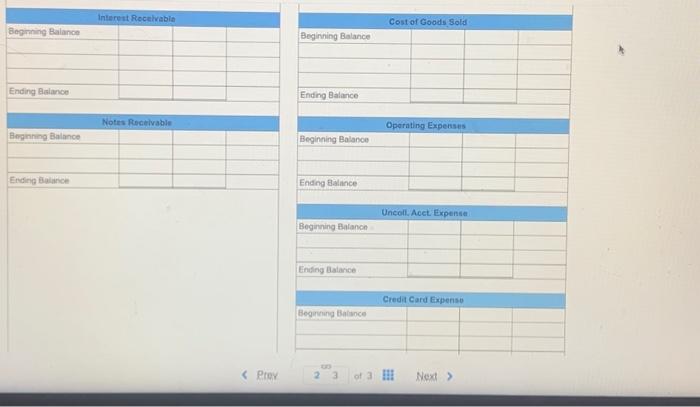

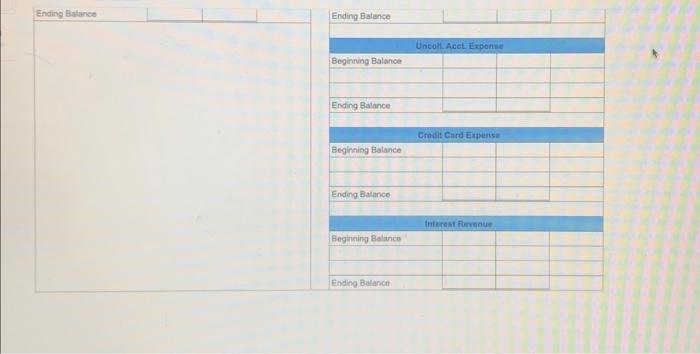

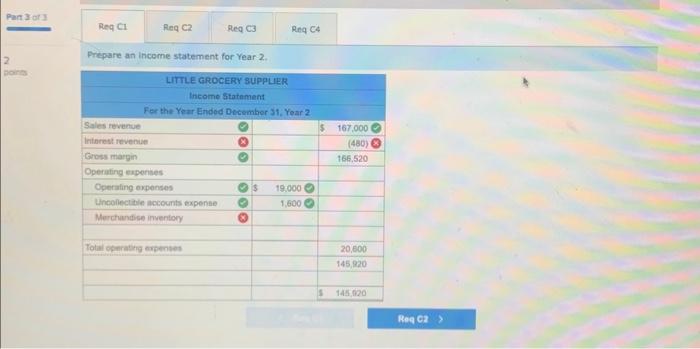

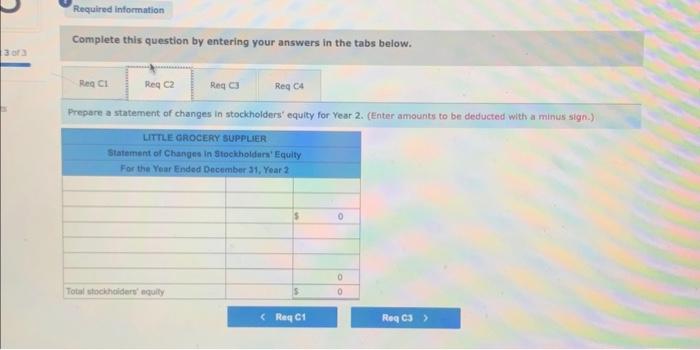

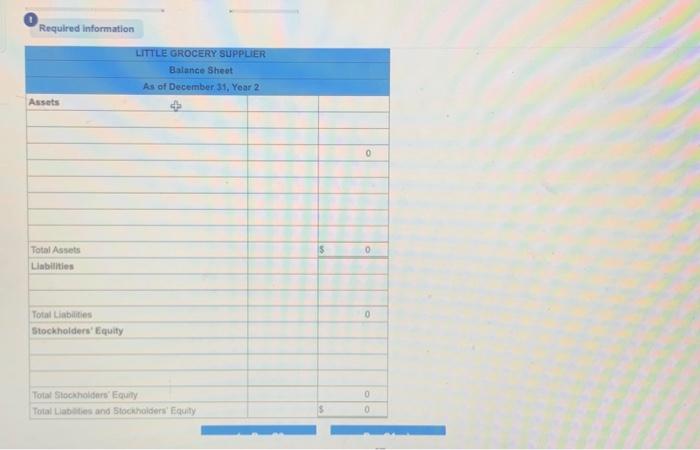

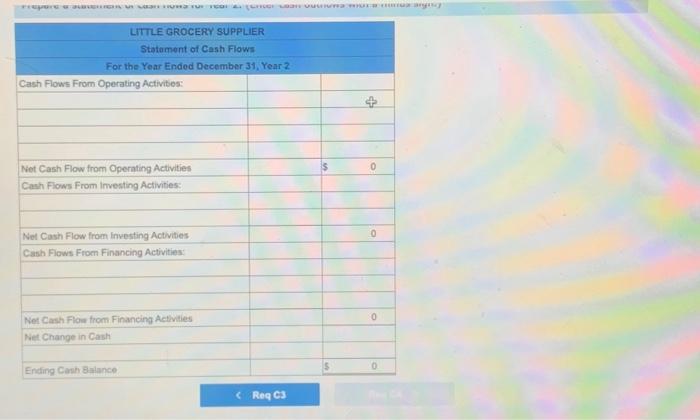

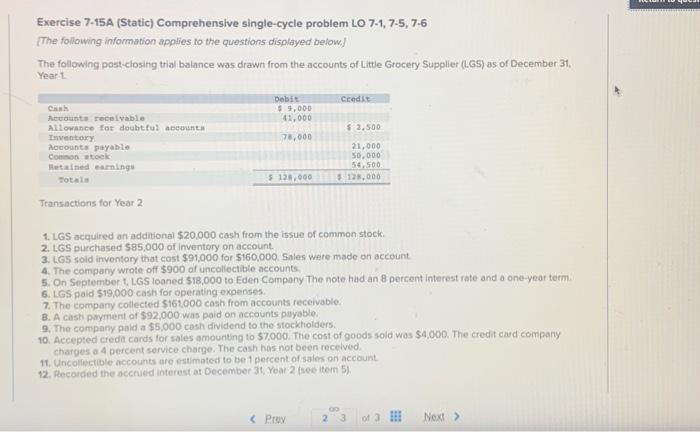

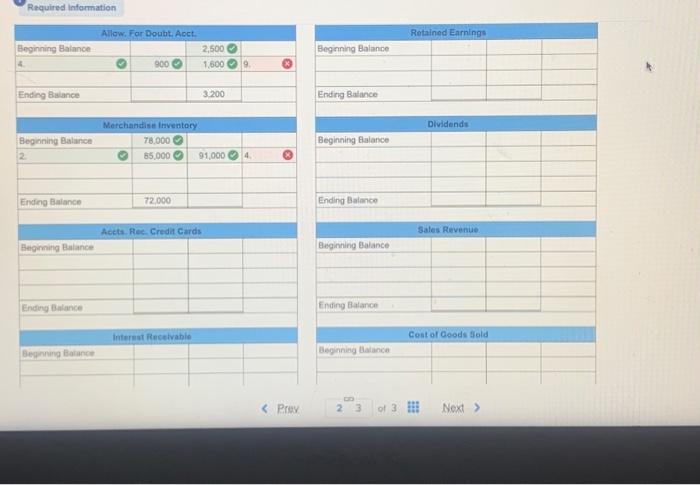

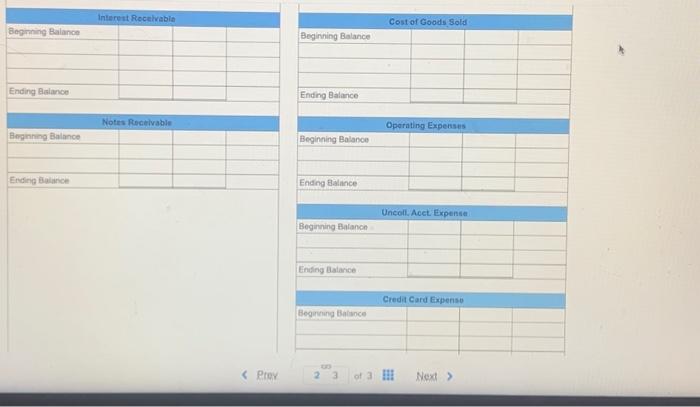

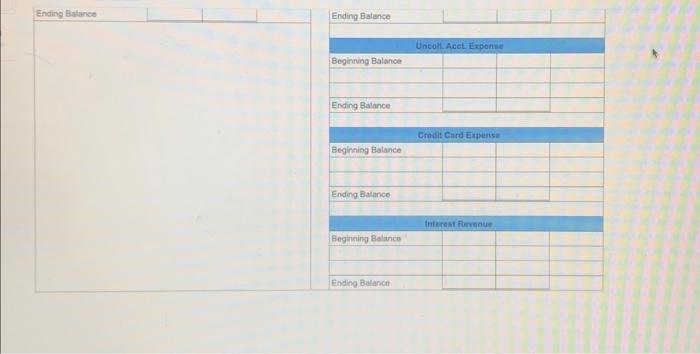

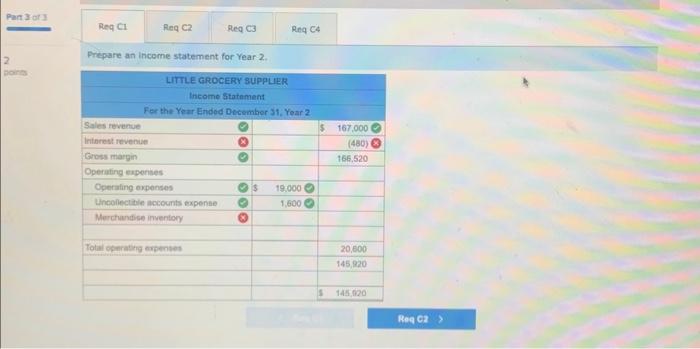

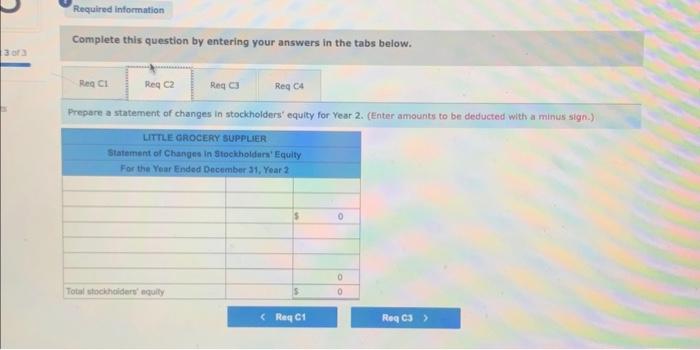

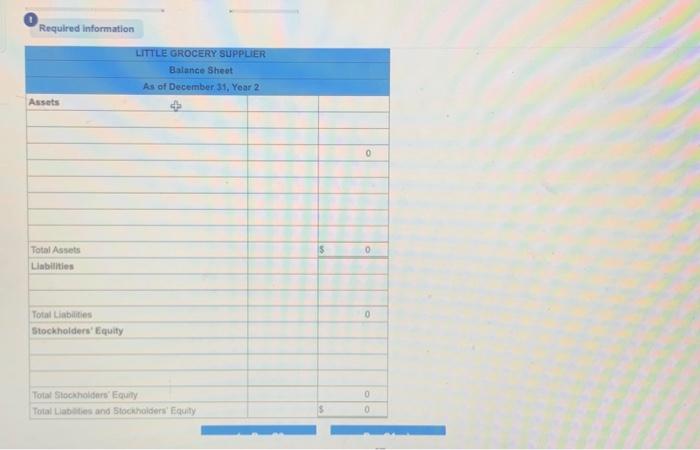

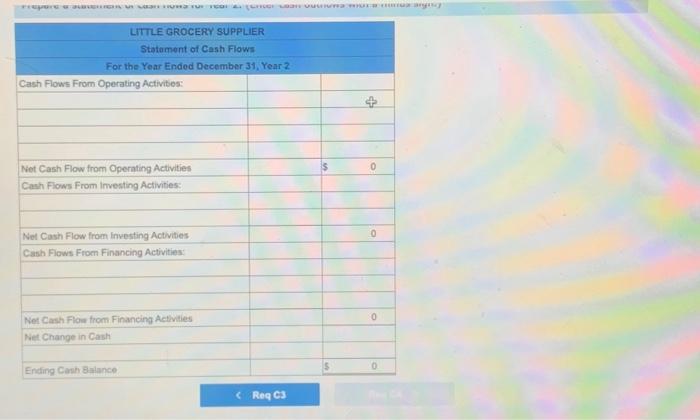

Prepare an income statement for Yaar-2. Ending Balance Ending Balunce. Untoll. Acet Exponse Beginring Balance Ending Balance Crndit Card Expense Beginning Balance Ending Balance. Complete this question by entering your answers in the tabs below. Prepare a statement of changes in stockholders' equity for Year 2. (Enter amounts to be deducted with a minus sign.) \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Interest Recelvabio } \\ \hline Beginning Balance & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} LITLE GROCERY SUPPLIER Statoment of Cash Flows For the Year Ended December 31, Year2 \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Cash Flows From Operating Activities: } \\ \hline & & 4 \\ \hline & & \\ \hline Net Cash Flow from Opernting Activities & s & 0 \\ \hline \multicolumn{3}{|l|}{ Cash Flows From Investing Activities: } \\ \hline & & \\ \hline Net Cash Flow from Investing Activities & & 0 \\ \hline \multicolumn{3}{|l|}{ Cash Flows From Financing Activities: } \\ \hline & & \\ \hline & & \\ \hline Net Cash Flow from Financing Activties & & 0 \\ \hline \multicolumn{3}{|l|}{ Net Change in Cash } \\ \hline & & \\ \hline Ending Canh Balance & 5 & 0 \\ \hline \end{tabular} Reg C3 Exercise 7-15A (Static) Comprehensive single-cycle problem LO 7-1, 7-5, 7.6 [The following information applies to the questions displayed below.) The following post-closing trial balance was drawn from the accounts of Little Grocery Supplier (L.GS) as of December 31 , Year 1 . Transiactions for Year 2 1. LGS acquired an additional $20,000 cash from the issue of common stock. 2. LGS purchased $85,000 of inventary on account. 3. t.65 sold invontory thut cost $91,000 for $160,000 snles were made on account 4. The company wrote off $900 of uncollectible accounts. 5. On September t, LGS loaned $18,000 to Eden Company The note had an 8 percent interest rate and a one-year term. 6. LGS paid $19,000 cash for operating expenses. 7. The company cotlected $161000 cash from accounts receivable. 8. A cast piryment of $92,000 was paid on accounts payable. 9. The company paid a $5,000 cash dividend to the stockholders. 10. Accepted credit cards for sales amounting to $7,000. The cost of goods sold wos $4,000. The credit card company charges a 4 percent service charge. The cash has not been recelved. 11. Uncolfertiole nccounts are estimated to be 1 percent of sales on account. (1) Required information Required information \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Allow, For Doubt. Aoct. } \\ \hline Beginning Balance & & 2,5000 & \\ \hline 0 & 9000 & 1.600 & \\ \hline 3 & & & \\ \hline Ending Bialance & & 3.200 & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline \multicolumn{3}{|c|}{ Dividends } \\ \hline Beginning Balance & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Ending Balance & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Acets. Rec-Credit Cards } \\ \hline Begiming Bulance & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending Balance & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline \multicolumn{3}{|c|}{ Interat Receivabie } \\ \hline Beginning Batance & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Sales Revenue } & \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{3}{|c|}{ Cont of Coods Sold } \\ \hline Beginning blatance & \\ \hline & \end{tabular} 23 Next