Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! I really need your help from the required 4 to the required 9. Thanks so much See the next tab for the beginning trial

Hi! I really need your help from the required 4 to the required 9. Thanks so much

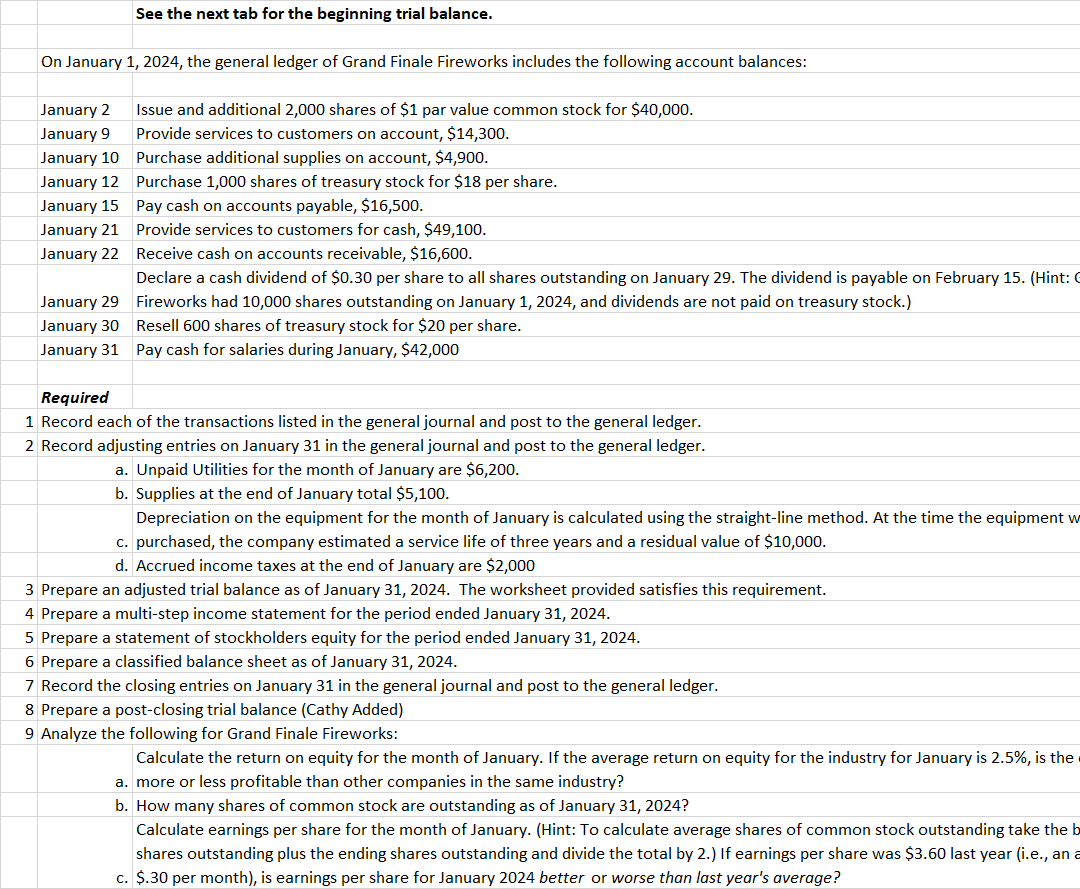

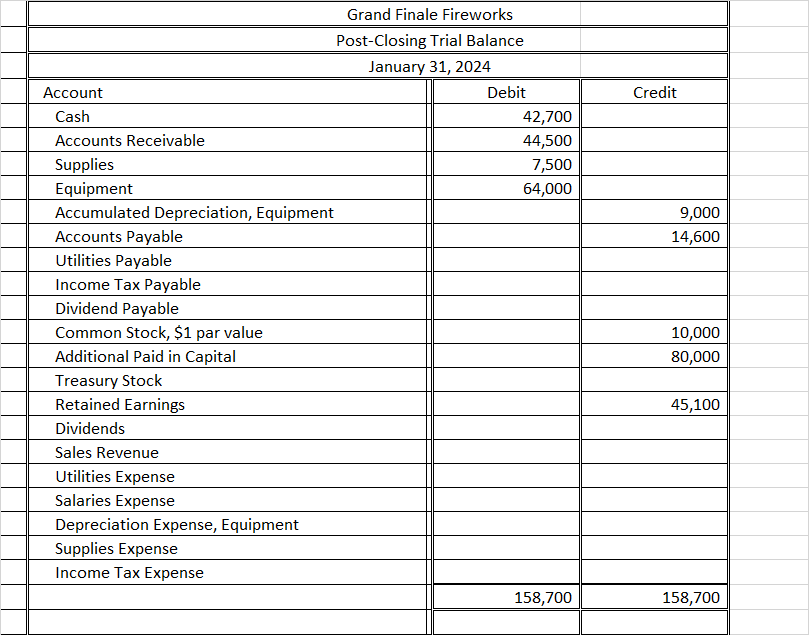

See the next tab for the beginning trial balance. On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: January 2 Issue and additional 2,000 shares of $1 par value common stock for $40,000. January 9 Provide services to customers on account, $14,300. January 10 Purchase additional supplies on account, $4,900. January 12 Purchase 1,000 shares of treasury stock for $18 per share. January 15 Pay cash on accounts payable, $16,500. Provide services to customers for cash, $49,100. January 21 January 22 Receive cash on accounts receivable, $16,600. Declare a cash dividend of $0.30 per share to all shares outstanding on January 29. The dividend is payable on February 15. (Hint: Fireworks had 10,000 shares outstanding on January 1, 2024, and dividends are not paid on treasury stock.) January 29 Resell 600 shares of treasury stock for $20 per share. January 30 January 31 Pay cash for salaries during January, $42,000 Required 1 Record each of the transactions listed in the general journal and post to the general ledger. 2 Record adjusting entries on January 31 in the general journal and post to the general ledger. a. Unpaid Utilities for the month of January are $6,200. b. Supplies at the end of January total $5,100. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment w c. purchased, the company estimated a service life of three years and a residual value of $10,000. d. Accrued income taxes at the end of January are $2,000 3 Prepare an adjusted trial balance as of January 31, 2024. The worksheet provided satisfies this requirement. 4 Prepare a multi-step income statement for the period ended January 31, 2024. 5 Prepare a statement of stockholders equity for the period ended January 31, 2024. 6 Prepare a classified balance sheet as of January 31, 2024. 7 Record the closing entries on January 31 in the general journal and post to the general ledger. 8 Prepare a post-closing trial balance (Cathy Added) 9 Analyze the following for Grand Finale Fireworks: Calculate the return on equity for the month of January. If the average return on equity for the industry for January is 2.5%, is the a. more or less profitable than other companies in the same industry? b. How many shares of common stock are outstanding as of January 31, 2024? Calculate earnings per share for the month of January. (Hint: To calculate average shares of common stock outstanding take the b shares outstanding plus the ending shares outstanding and divide the total by 2.) If earnings per share was $3.60 last year (i.e., an a c. $.30 per month), is earnings per share for January 2024 better or worse than last year's average? Grand Finale Fireworks Post-Closing Trial Balance January 31, 2024 Debit Account Cash Accounts Receivable Supplies Equipment Accumulated Depreciation, Equipment Accounts Payable Utilities Payable Income Tax Payable Dividend Payable Common Stock, $1 par value Additional Paid in Capital Treasury Stock Retained Earnings Dividends Sales Revenue Utilities Expense Salaries Expense Depreciation Expense, Equipment Supplies Expense Income Tax Expense 42,700 44,500 7,500 64,000 158,700 Credit 9,000 14,600 10,000 80,000 45,100 158,700Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started