Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I would like the answer of the question, not a solution. I am in a hurry, so quick response will be appreciated. Thank you.

Hi, I would like the answer of the question, not a solution. I am in a hurry, so quick response will be appreciated. Thank you.

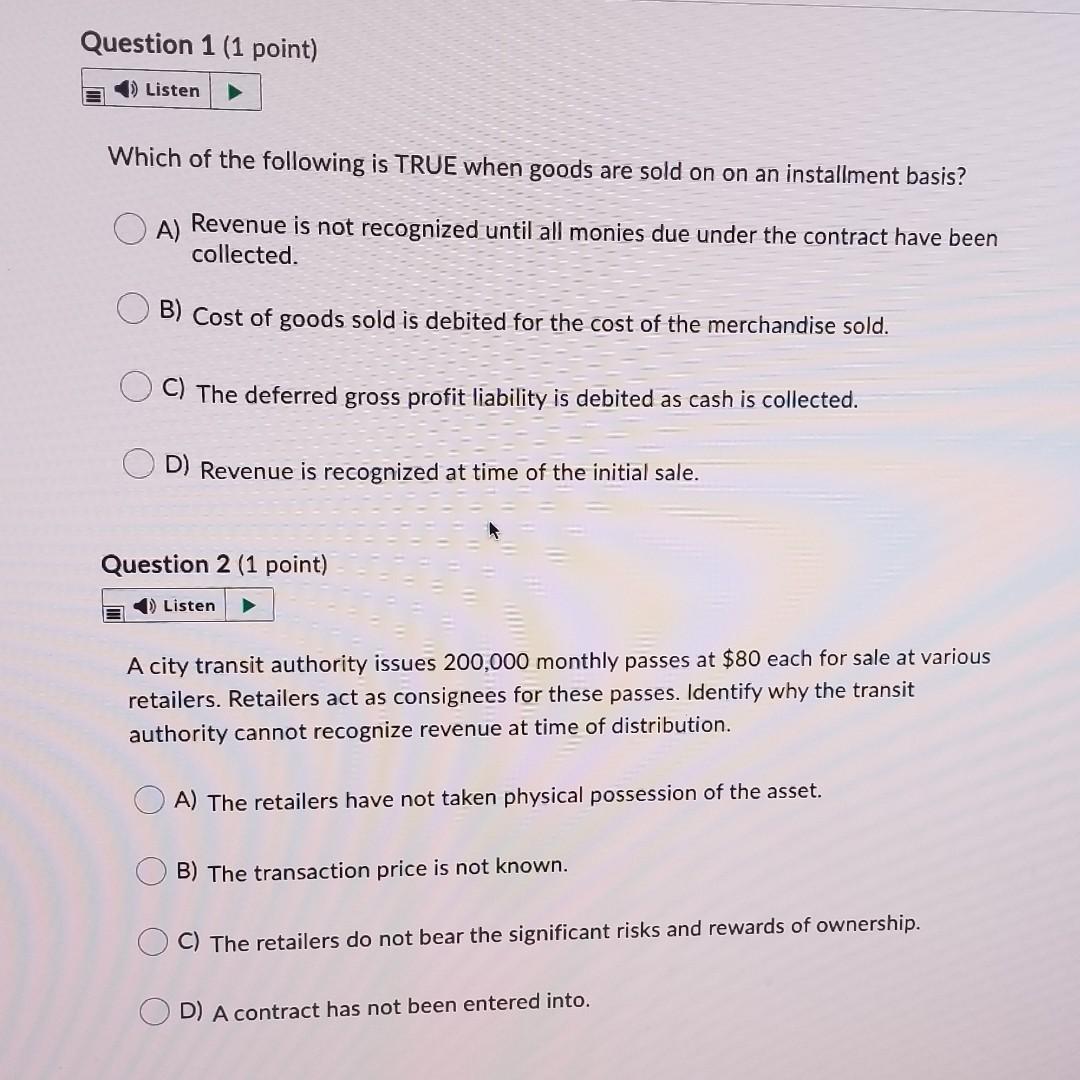

Question 1 (1 point) Listen Which of the following is TRUE when goods are sold on on an installment basis? A) Revenue is not recognized until all monies due under the contract have been collected B) Cost of goods sold is debited for the cost of the merchandise sold. C) The deferred gross profit liability is debited as cash is collected. D) Revenue is recognized at time of the initial sale. Question 2 (1 point) Listen A city transit authority issues 200,000 monthly passes at $80 each for sale at various retailers. Retailers act as consignees for these passes. Identify why the transit authority cannot recognize revenue at time of distribution. A) The retailers have not taken physical possession of the asset. B) The transaction price is not known. C) The retailers do not bear the significant risks and rewards of ownership. D) A contract has not been entered into

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started