Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I would like you to help me with the solutions for attached document that is shown below. Thank you very much. Chapter 7 UniSuper

Hi, I would like you to help me with the solutions for attached document that is shown below. Thank you very much.

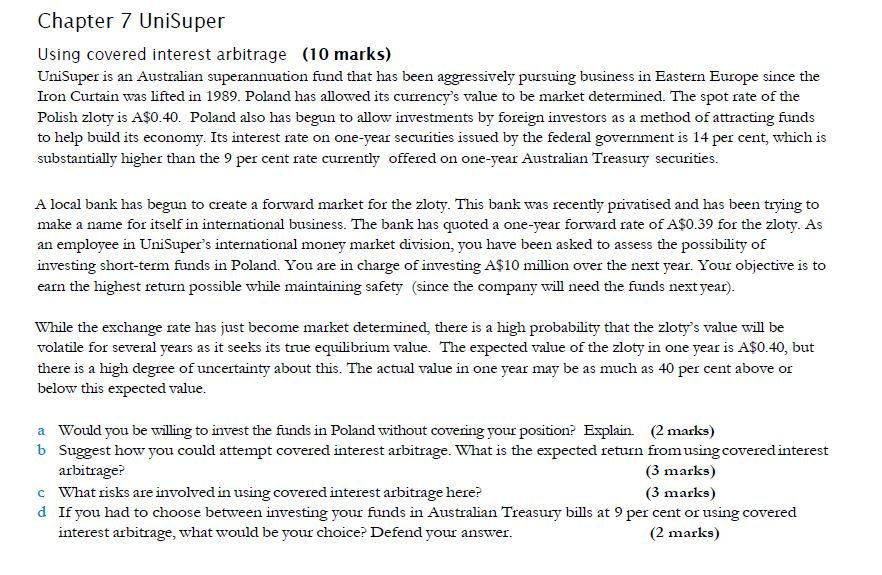

Chapter 7 UniSuper Using covered interest arbitrage (10 marks) UniSuper is an Australian superannuation fund that has been aggressively pursuing business in Eastern Europe since the Iron Curtain was lifted in 1989. Poland has allowed its currency's value to be market determined. The spot rate of the Polish zloty is A$0.40. Poland also has begun to allow investments by foreign investors as a method of attracting funds to help build its economy. Its interest rate on one-year securities issued by the federal government is 14 per cent, which is substantially higher than the 9 per cent rate currently offered on one-year Australian Treasury securities. A local bank has begun to create a forward market for the zloty. This bank was recently privatised and has been trying to make a name for itself in international business. The bank has quoted a one-year forward rate of AS0.39 for the zloty. As an employee in UniSuper's international money market division, you have been asked to assess the possibility of investing short-term funds in Poland. You are in charge of investing A$10 million over the next year. Your objective is to earn the highest return possible while maintaining safety (since the company will need the funds next year) While the exchange rate has just become market determined, there is a high probability that the zloty's value will be volatle for several years as it seeks its true equilibrium value. The expected value of the zloty in one year is A$0.40, but there is a high degree of uncertainty about this. The actual value in one year may be as much as 40 per cent above or below this expected value a Would you be willing to invest the funds in Poland without covening your position? Explain. (2 marks) b Suggest how you could attempt covered interest arbitrage. What is the expected return fromusing covered interest arbitrage? What risks are involve If you had to choose between investing your funds in Australian Treasury bills at 9 per cent or using covered interest arbitrage, what would be marks c din using covered interest arbitrage here? 3 marks d your choice? Defend your answer. marks Chapter 7 UniSuper Using covered interest arbitrage (10 marks) UniSuper is an Australian superannuation fund that has been aggressively pursuing business in Eastern Europe since the Iron Curtain was lifted in 1989. Poland has allowed its currency's value to be market determined. The spot rate of the Polish zloty is A$0.40. Poland also has begun to allow investments by foreign investors as a method of attracting funds to help build its economy. Its interest rate on one-year securities issued by the federal government is 14 per cent, which is substantially higher than the 9 per cent rate currently offered on one-year Australian Treasury securities. A local bank has begun to create a forward market for the zloty. This bank was recently privatised and has been trying to make a name for itself in international business. The bank has quoted a one-year forward rate of AS0.39 for the zloty. As an employee in UniSuper's international money market division, you have been asked to assess the possibility of investing short-term funds in Poland. You are in charge of investing A$10 million over the next year. Your objective is to earn the highest return possible while maintaining safety (since the company will need the funds next year) While the exchange rate has just become market determined, there is a high probability that the zloty's value will be volatle for several years as it seeks its true equilibrium value. The expected value of the zloty in one year is A$0.40, but there is a high degree of uncertainty about this. The actual value in one year may be as much as 40 per cent above or below this expected value a Would you be willing to invest the funds in Poland without covening your position? Explain. (2 marks) b Suggest how you could attempt covered interest arbitrage. What is the expected return fromusing covered interest arbitrage? What risks are involve If you had to choose between investing your funds in Australian Treasury bills at 9 per cent or using covered interest arbitrage, what would be marks c din using covered interest arbitrage here? 3 marks d your choice? Defend your answer. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started