Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I would really appreciate some help on this particular question. This is all the information that I have been provided. Thank you! Problem 12-89B

Hi, I would really appreciate some help on this particular question. This is all the information that I have been provided. Thank you!

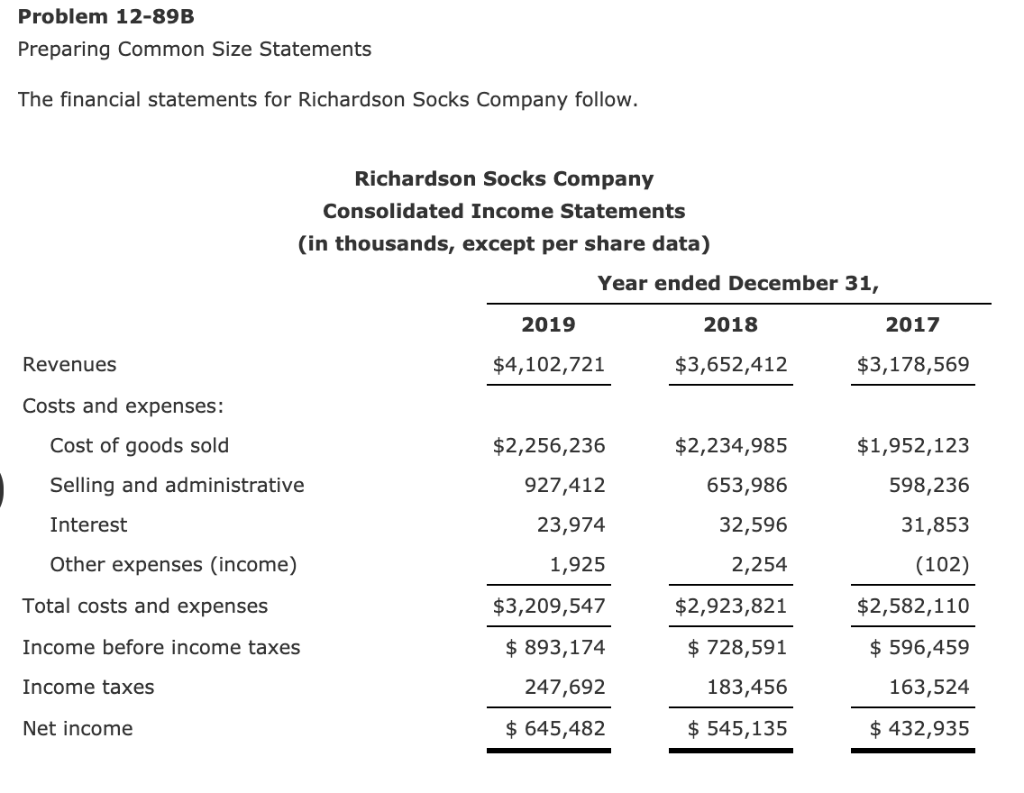

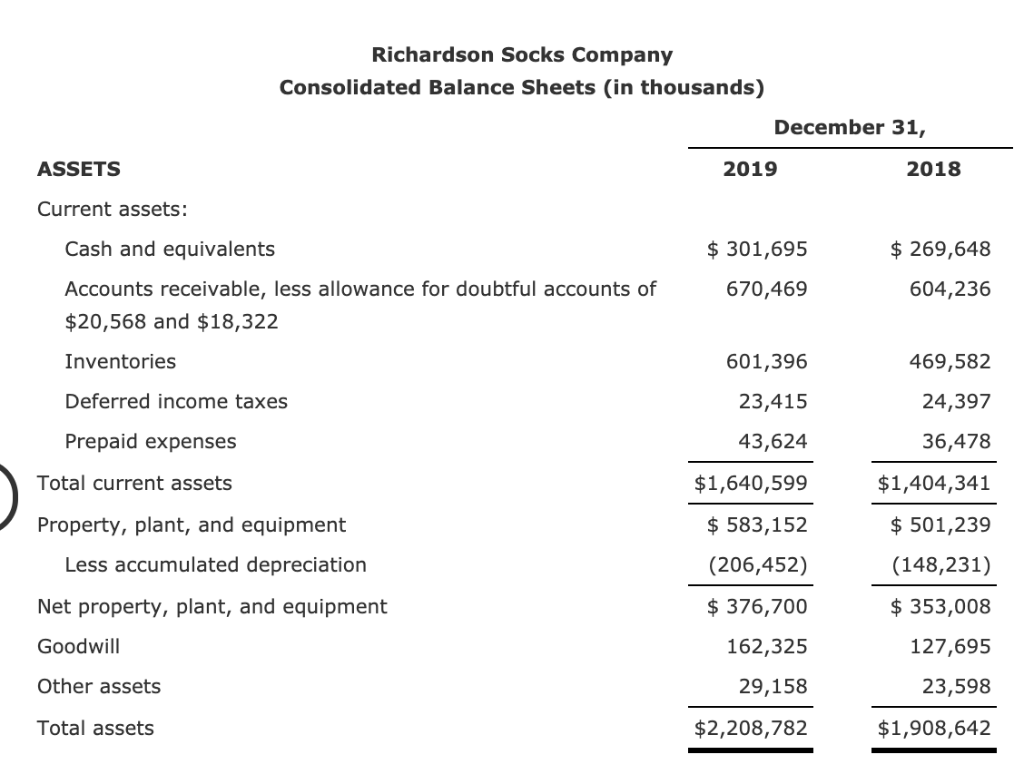

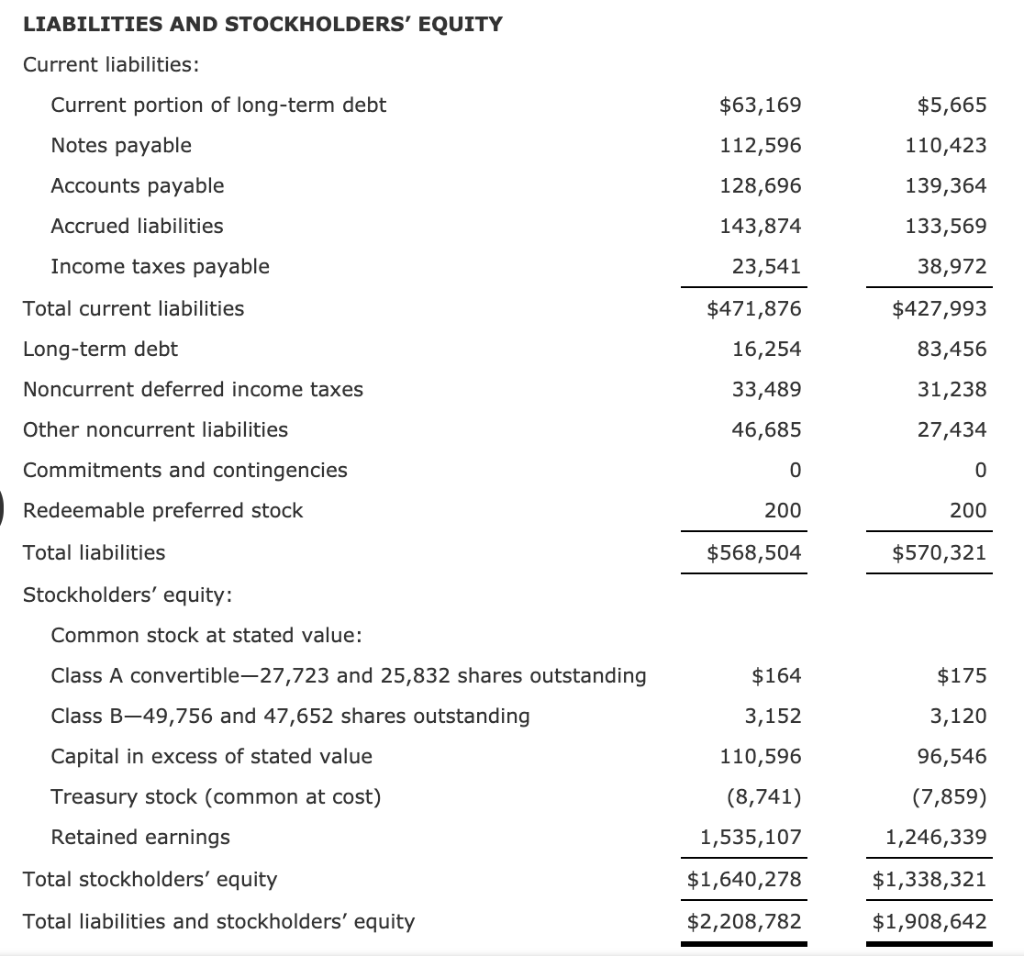

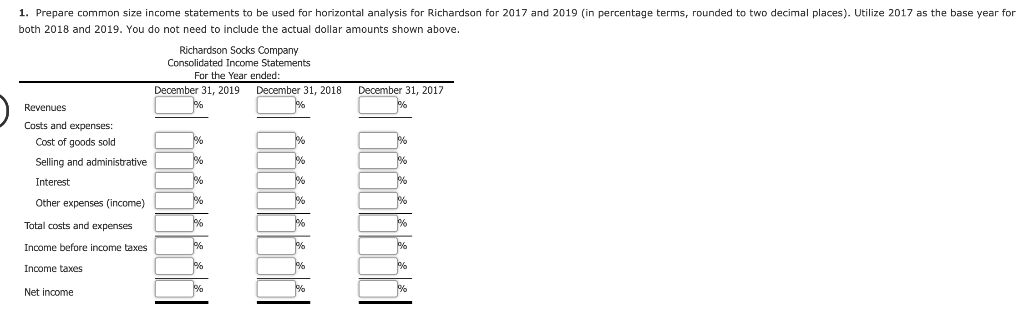

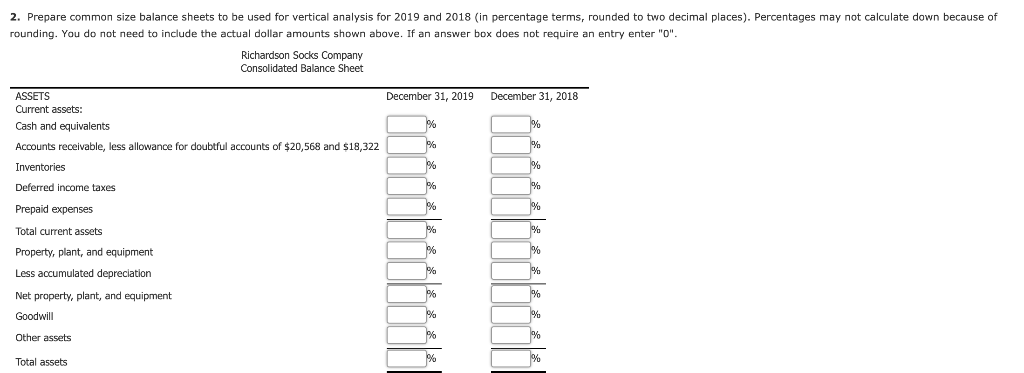

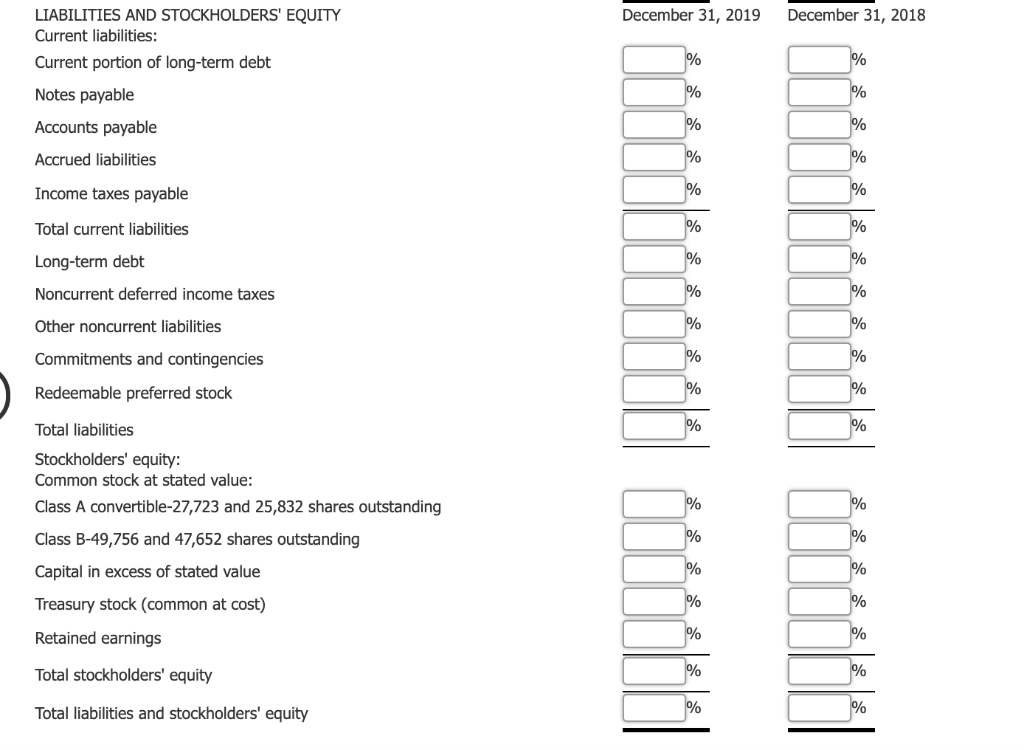

Problem 12-89B Preparing Common Size Statements The financial statements for Richardson Socks Company follow Richardson Socks Company Consolidated Income Statements (in thousands, except per share data) Year ended December 31, 2018 $3,652,412 2019 2017 Revenues $4,102,721 $3,178,569 Costs and expenses: Cost of goods sold Selling and administrative Interest Other expenses (income) $2,256,236 927,412 23,974 1,925 $3,209,547 $893,174 247,692 645,482 $2,234,985 653,986 32,596 2,254 $2,923,821 $728,591 183,456 $545,135 $1,952,123 598,236 31,853 (102) $2,582,110 $596,459 163,524 432,935 Total costs and expenses Income before income taxes Income taxes Net income Richardson Socks Company Consolidated Balance Sheets (in thousands) December 31, ASSETS 2018 2019 Current assets: $301,69!5 670,469 Cash and equivalents Accounts receivable, less allowance for doubtful accounts of $20,568 and $18,322 Inventories Deferred income taxes Prepaid expenses $269,648 604,236 601,396 23,415 43,624 $1,640,599 $ 583,15:2 (206,452) $376,700 162,325 29,158 $2,208,782 469,582 24,397 36,478 $1,404,341 $501,239 (148,231) $353,008 127,695 23,598 $1,908,642 Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: $5,665 110,423 139,364 133,569 38,972 $427,993 83,456 31,238 27,434 0 200 $570,321 Current portion of long-term debt $63,169 112,596 128,696 143,874 23,541 $471,876 16,254 33,489 46,685 Notes payable Accounts payable Accrued liabilities Income taxes payable Total current liabilities Long-term debt Noncurrent deferred income taxes Other noncurrent liabilities Commitments and contingencies Redeemable preferred stock Total liabilities Stockholders' equity: 200 $568,504 Common stock at stated value: Class A convertible-27,723 and 25,832 shares outstanding Class B-49,756 and 47,652 shares outstanding Capital in excess of stated value Treasury stock (common at cost) Retained earnings $164 3,152 110,596 (8,741) 1,535,107 $1,640,278 $2,208,782 $175 3,120 96,546 (7,859) 1,246,339 $1,338,321 $1,908,642 Total stockholders' equity Total liabilities and stockholders' equity 1. Prepare common size income statements to be used for horizontal analysis for Richardson for 2017 and 2019 (in percentage terms, rounded to two decimal places). Utilize 2017 as the base year for both 2018 and 2019. You do not need to include the actual dollar amounts shown above Richardson Socks Company Consolidated Income Statements For the Year ended: December 31, 2019 Deoember 31, 2018 December 31, 2017 Revenues Costs and expenses: Cost of goods sold Selling and administrative Interest Other expenses (income) Total costs and expenses Income before income taxes Income taxes Net income 2. Prepare common size balance sheets to be used for vertical analysis for 2019 and 2018 (in percentage terms, rounded to two decimal places). Percentages may not calculate down because of rounding. You do not need to include the actual dollar amounts shown above. If an answer box does not require an entry enter "o" any Richardson Socks Compa Consolidated Balance Sheet ASSETS Current assets: Cash and equivalents Accounts receivable, less allowance for doubtful accounts of $20,568 and $18,322 Inventories Deferred income taxes December 31, 2019 December 31, 2018 Prepaid expenses Total current assets Property, plant, and equipment Less accumulated depreclation Net property, plant, and equipment Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY December 31, 2019 December 31, 2018 Current liabilities: Current portion of long-term debt Notes payable Accounts payable Accrued liabilities Income taxes payable Total current liabilities Long-term debt Noncurrent deferred income taxes Other noncurrent liabilities Commitments and contingencies Redeemable preferred stock Total liabilities Stockholders' equity Common stock at stated value: Class A convertible-27,723 and 25,832 shares outstanding Class B-49,756 and 47,652 shares outstanding Capital in excess of stated value Treasury stock (common at cost) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 3. Determine whether the proportion of dollars invested in the various categories of assets has changed significantly between 2018 and 2019 4. Determine whether the proportion of capital raised from the various liability categories and common stockholders' equity has changed significantly between 2018 and 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started