Question

Hi, I'm stuck on two adjusting entries. The problem gives me an unadjusted trial balance and I have to calculate net income using the additional

Hi, I'm stuck on two adjusting entries. The problem gives me an unadjusted trial balance and I have to calculate net income using the additional data they give me. I figured out the AJEs for transactions A, B, and E, but I need help with transactions B and C. I'm confused because for transaction C I debited insurance expense of 1,800 and credited prepaid insurance of 1,800 (which seems to be a deferred expense) and for transaction D I debited cash of 1,000 and credited unearned revenue of 1,000 (a deferred revenue). Am I supposed to debit a liability and credit a revenue instead? I still get a wrong answer when I do that. When I calculate my net income, I keep on getting 14,720 which isn't an answer.

Just a brief overview, this chapter is over income measurement and accrual accounting, and I have a test approaching real soon so I would really appreciate it if you could get back to me as soon as possible!

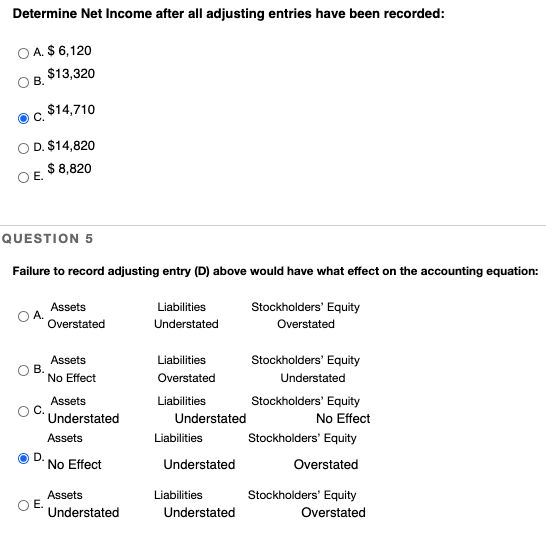

Also, for the second question, as long as I know the AJE for transaction D I'll be able to answer the question.

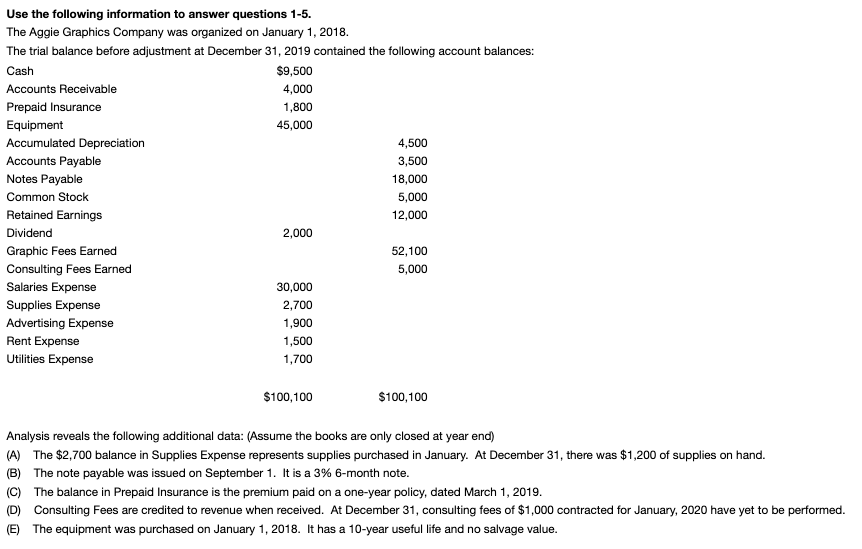

Use the following information to answer questions 1-5. The Aggie Graphics Company was organized on January 1, 2018. The trial balance before adjustment at December 31, 2019 contained the following account balances: Cash $9,500 Accounts Receivable 4,000 Prepaid Insurance 1,800 Equipment 45,000 Accumulated Depreciation 4,500 Accounts Payable 3,500 Notes Payable 18,000 Common Stock 5,000 Retained Earnings 12,000 Dividend 2,000 Graphic Fees Earned 52,100 Consulting Fees Earned 5,000 Salaries Expense 30,000 Supplies Expense 2,700 Advertising Expense 1,900 Rent Expense 1,500 Utilities Expense 1,700 $100,100 $100,100 Analysis reveals the following additional data: (Assume the books are only closed at year end) (A) The $2,700 balance in Supplies Expense represents supplies purchased in January. At December 31, there was $1,200 of supplies on hand. (B) The note payable was issued on September 1. It is a 3% 6-month note. (C) The balance in Prepaid Insurance is the premium paid on a one-year policy, dated March 1, 2019. (D) Consulting Fees are credited to revenue when received. At December 31, consulting fees of $1,000 contracted for January, 2020 have yet to be performed. (E) The equipment was purchased on January 1, 2018. It has a 10-year useful life and no salvage value. Determine Net Income after all adjusting entries have been recorded: OA. $ 6,120 $13,320 OB. $14,710 OC D. $14,820 $ 8,820 QUESTION 5 Failure to record adjusting entry (D) above would have what effect on the accounting equation: Assets Overstated Liabilities Understated Stockholders' Equity Overstated Assets No Effect Assets Understated Liabilities Stockholders' Equity Overstated Understated Liabilities Stockholders' Equity Understated No Effect Liabilities Stockholders' Equity Understated Overstated Assets OD No Effect Assets O E. Understated Liabilities Understated Stockholders' Equity OverstatedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started