Question

Hi, I'm working on a problem for absorption and variable costing and I need help on problem 3 and 4. So far I have.. 1a.

Hi, I'm working on a problem for absorption and variable costing and I need help on problem 3 and 4. So far I have..

1a. Absorption Costing Income Statement For the month July Sales 104000 Less: Cost of Goods sold 79040 =97280/6400*5200 Gross margin 24960 Less: Selling and administrative expenses 16120 Net operating income 8840 1b. Absorption Costing Income Statement For the month August Sales 104000 Less: Cost of Goods sold 84800 =(97280/6400)*1200+66560 Gross margin 19200 Less: Selling and administrative expenses 16120 Net operating income 3080 2a. Variable Costing Income Statement For the month July Sales 104000 Less: Variable manufacturing costs 66560 =(47360+22400+12160)/6400*5200 37440 Less: Variable Selling and administrative expenses 10920 Contribution Margin 26520 Fixed expenses: Manufacturing cost 15360 Selling and administrative expenses 5200 Net operating income 5960 2b. Variable Costing Income Statement For the month August Sales 104000 Less: Variable manufacturing costs 66560 =(29600+14000+7600)+(47360+22400+12160)/6400*1200 37440 Less: Variable Selling and administrative expenses 10920 Contribution Margin 26520 Fixed expenses: Manufacturing cost 15360 Selling and administrative expenses 5200 Net operating income 5960

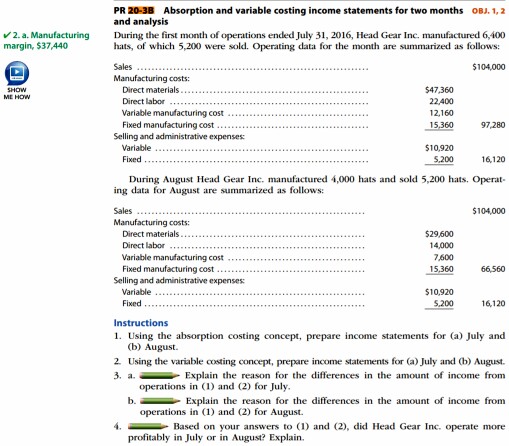

PR 203B Absorption and variable costing income statements for two months OBJ, 1.2 and analysis v 2.a. Manufacturing During the first month of operations ended July 31, 2016, Head Gear Inc. manufactured 6400 margin, $37,440 hats, of which 5,200 were sold. Ope data for the month are summarized as follows: rating Sales $104.000 Manufacturing costs: Direct materials $47,360 Direct labor Variable manufacturing cost 12,160 Fixed manufacturing cost 15,360 97,280 Selling and administrative expenses: Variable $10,920 Fixed S 200 6,120 During August Head Gear Inc. manufactured i,000 hats and sold 5,200 hats. opera ing data for August are summarized as follows: Sales $104.000 Manufacturing costs: Direct materials $29600 Direct labor 14,000 Variable manufacturing cost 7600 Fixed manufacturing cost 15,360 66560 Selling and administrative expenses: Variable $10,920 Fixed S 200 16,120 nstructions 1. Using the absorption costing concept, prepare income statements for Ca July and 2. Using the variable costing concept, prepare income statements for Ca July and Ch) August. 3. a. Expl the reason for the differences in the amount of income from ain operations in (1) and (2) for July. b. Explain the reason for the differences in the amount of income from operations in (1) and (2) for August. Based on your answers to (1) and (2), did Head Gear Inc. operate more profitably in July or in August? ExplainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started