Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, Is it possible to have some help on that question Thanks a. A silver futures contract requires the seller to deliver 5,000 Troy ounces

Hi,

Is it possible to have some help on that question

Thanks

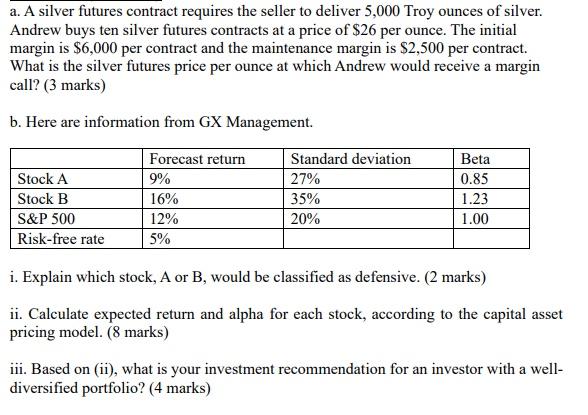

a. A silver futures contract requires the seller to deliver 5,000 Troy ounces of silver. Andrew buys ten silver futures contracts at a price of $26 per ounce. The initial margin is $6,000 per contract and the maintenance margin is $2,500 per contract. What is the silver futures price per ounce at which Andrew would receive a margin call? (3 marks) b. Here are information from GX Management. Stock A Stock B S&P 500 Risk-free rate Forecast return 9% 16% 12% Standard deviation 27% 35% 20% Beta 0.85 1.23 1.00 5% i. Explain which stock, A or B, would be classified as defensive. (2 marks) ii. Calculate expected return and alpha for each stock, according to the capital asset pricing model. (8 marks) iii. Based on (ii), what is your investment recommendation for an investor with a well- diversified portfolio? (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started