Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, it will be my pleasure if you can step by step to help me complete a to c. A1 M N K J H

Hi, it will be my pleasure if you can step by step to help me complete a to c.

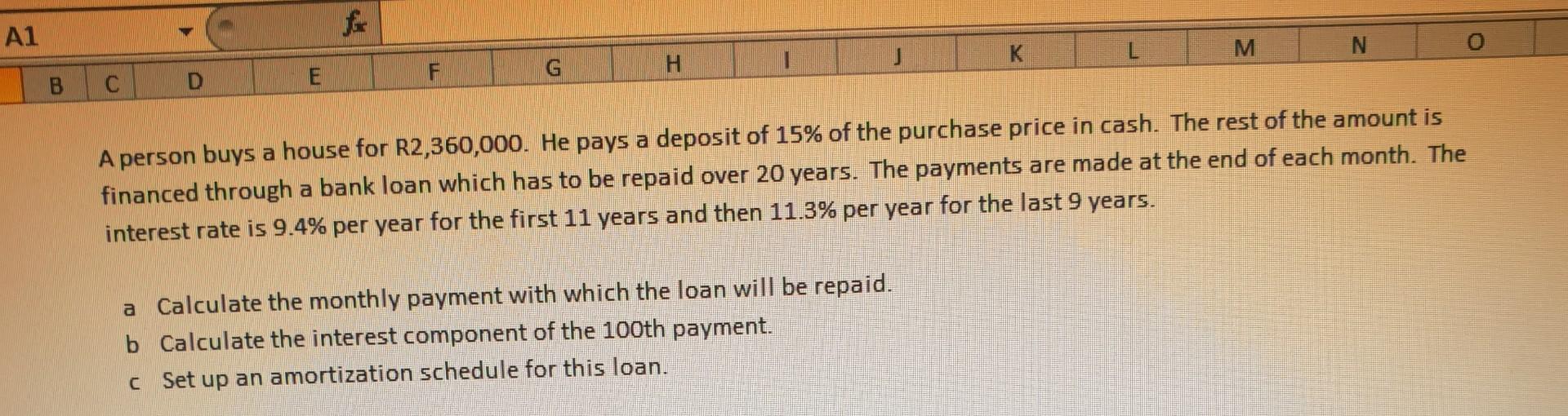

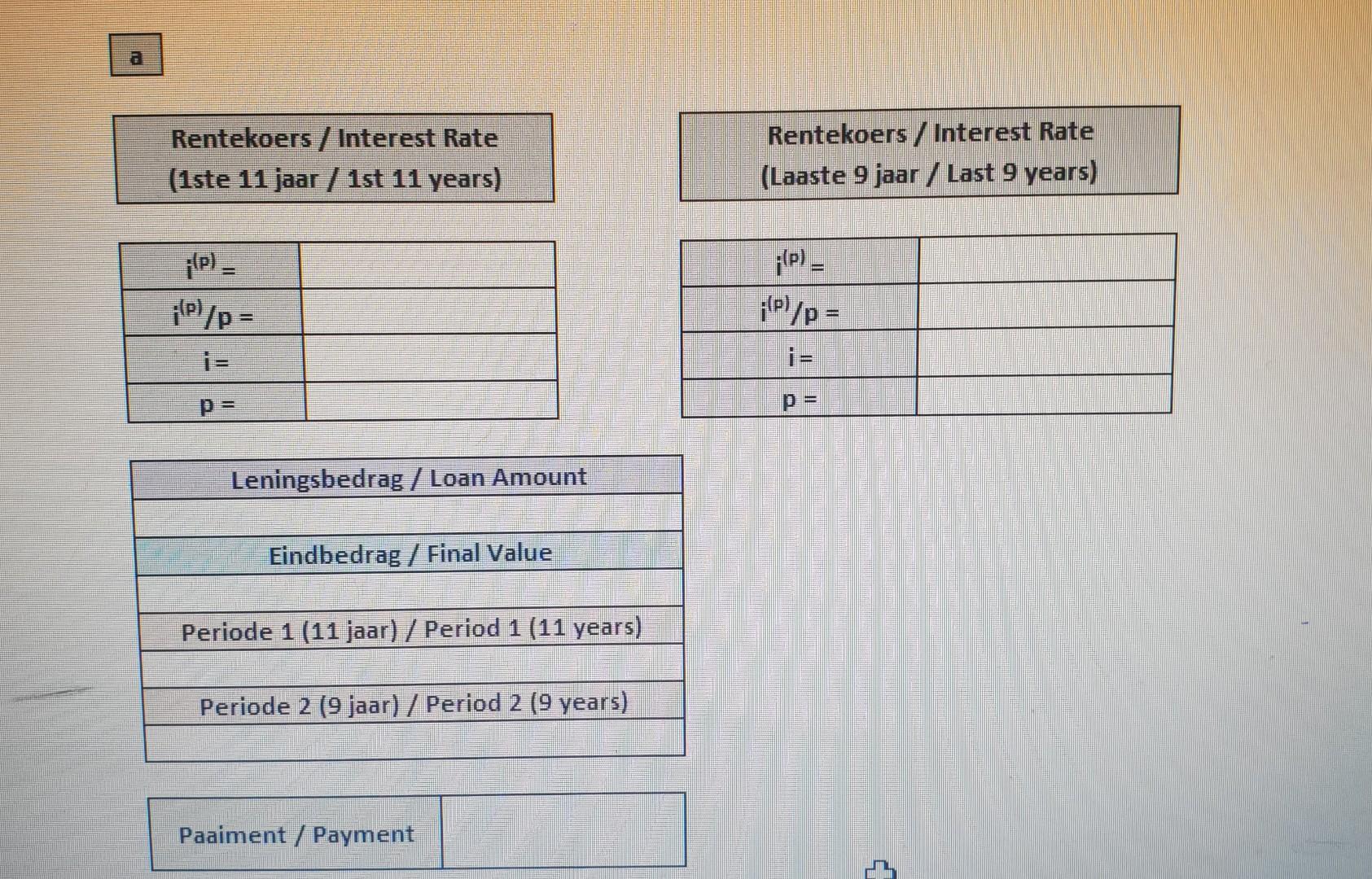

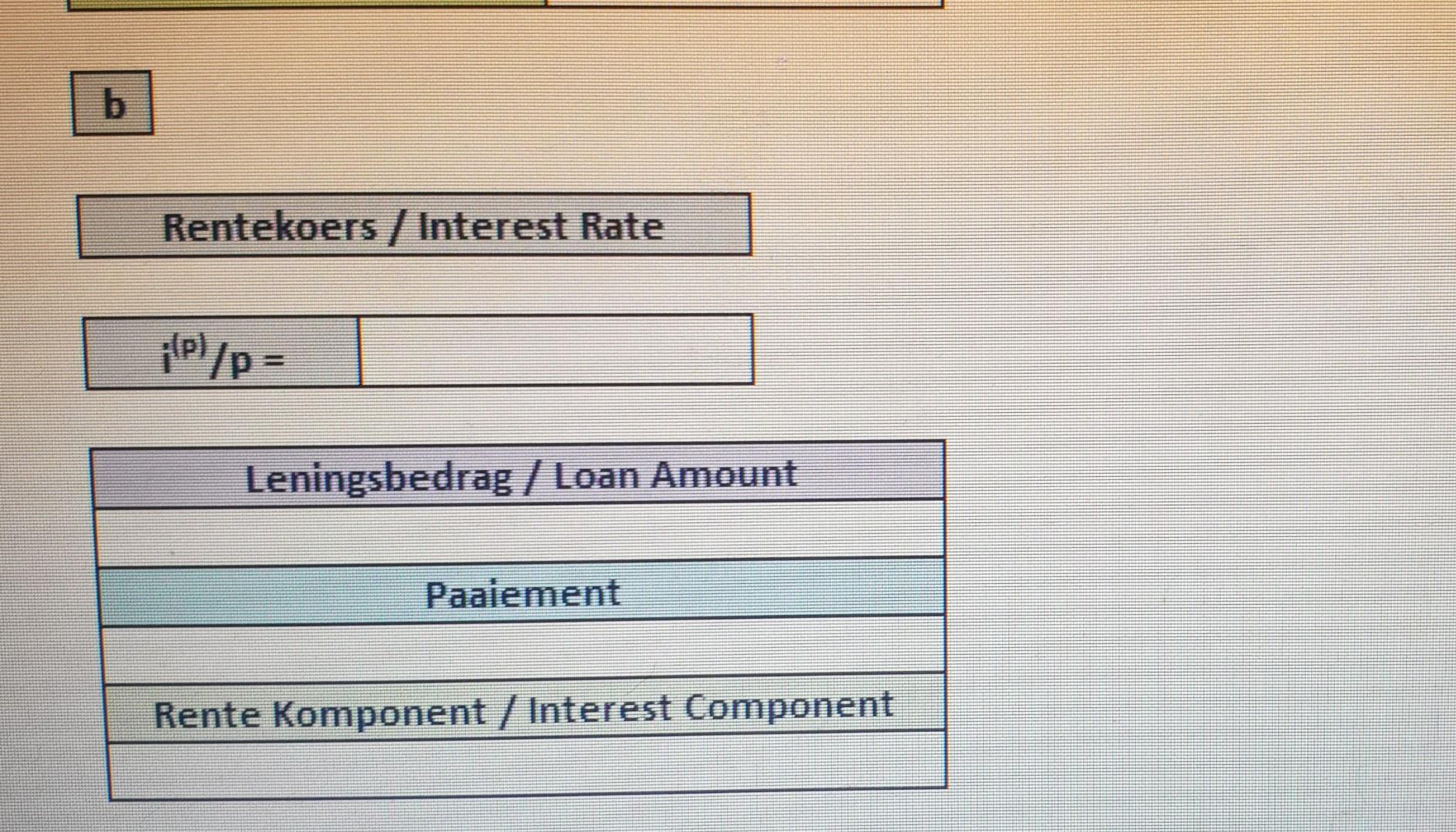

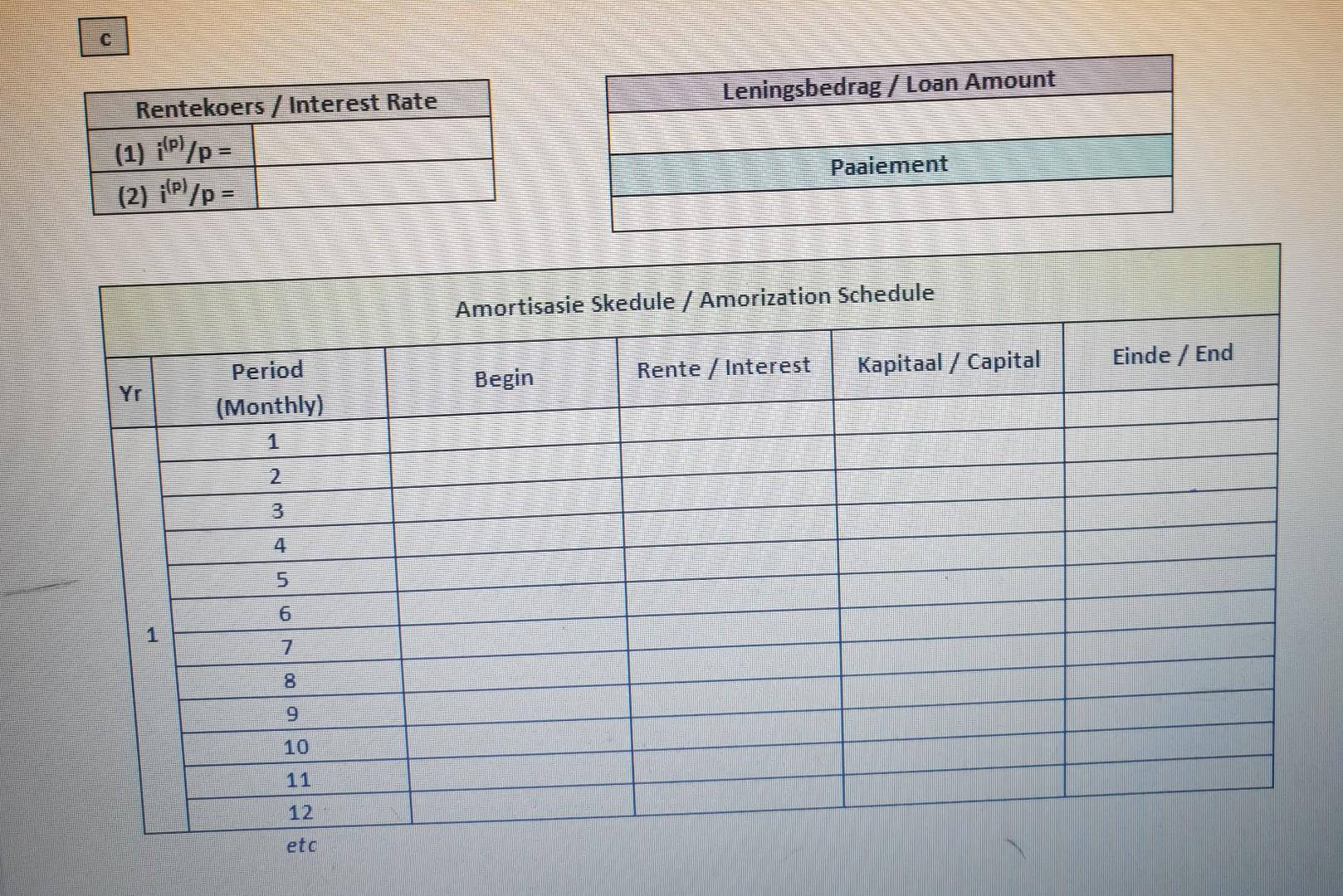

A1 M N K J H 1 F G E D B A person buys a house for R2,360,000. He pays a deposit of 15% of the purchase price in cash. The rest of the amount is financed through a bank loan which has to be repaid over 20 years. The payments are made at the end of each month. The interest rate is 9.4% per year for the first 11 years and then 11.3% per year for the last 9 years. a Calculate the monthly payment with which the loan will be repaid. b Calculate the interest component of the 100th payment. c Set up an amortization schedule for this loan. Rentekoers / Interest Rate (1ste 11 jaar / 1st 11 years) Rentekoers / Interest Rate (Laaste 9 jaar / Last 9 years) (P) - ;P)/p - P)/p = Leningsbedrag / Loan Amount Eindbedrag / Final Value Periode 1 (11 jaar) / Period 1 (11 years) Periode 2 (9 jaar) / Period 2 (9 years) Paaiment / Payment Rentekoers / Interest Rate P/p = Leningsbedrag / Loan Amount Paaiement Rente Komponent / Interest Component Leningsbedrag / Loan Amount Rentekoers / Interest Rate (1) Pl/p = (2) iPl/p= Paaiement Amortisasie Skedule / Amorization Schedule Einde / End Begin Rente / Interest Kapitaal / Capital Period (Monthly) Yr 3 4 5 6 1 8 9 10 11 12 etc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started