Answered step by step

Verified Expert Solution

Question

1 Approved Answer

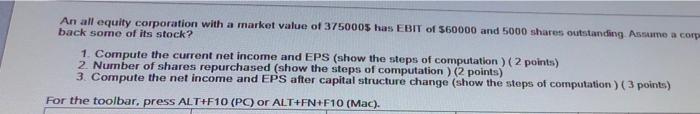

An all equity corporation with a market value of 3750005 has EBIT of $60000 and 5000 shares outstanding. Assume a corp back some of

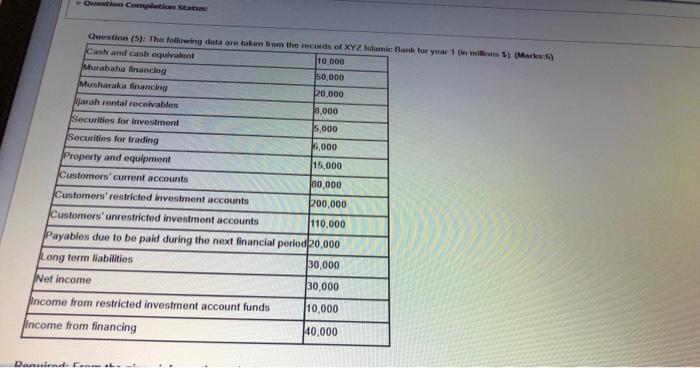

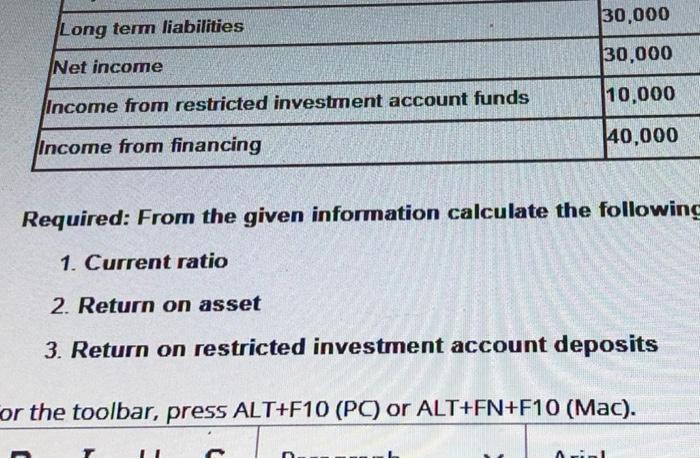

An all equity corporation with a market value of 3750005 has EBIT of $60000 and 5000 shares outstanding. Assume a corp back some of its stock? 1. Compute the current net income and EPS (show the steps of computation) (2 points) 2. Number of shares repurchased (show the steps of computation) (2 points) 3. Compute the net income and EPS after capital structure change (show the steps of computation) (3 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). Question Completion Status: Question (5): The following data are taken from the records of XYZ Islamic Bank for year 1 (in millions $). (Marks:6) Cash and cash equivalent 10,000 Murabaha financing 50,000 Musharaka financing 20,000 jarah rental receivables 8,000 Securities for investment 5,000 Securities for trading 6,000 Property and equipment 15,000 Customers' current accounts 80,000 Customers' restricted investment accounts 200,000 Customers' unrestricted investment accounts 110,000 Payables due to be paid during the next financial period 20,000 Long term liabilities 30,000 Net income 30,000 Income from restricted investment account funds 10,000 Income from financing 40,000 Danuirads from th Long term liabilities Net income Income from restricted investment account funds Income from financing 30,000 30,000 10,000 40,000 Required: From the given information calculate the following 1. Current ratio 2. Return on asset 3. Return on restricted investment account deposits or the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). An all equity corporation with a market value of 3750005 has EBIT of $60000 and 5000 shares outstanding. Assume a corp back some of its stock? 1. Compute the current net income and EPS (show the steps of computation) (2 points) 2. Number of shares repurchased (show the steps of computation) (2 points) 3. Compute the net income and EPS after capital structure change (show the steps of computation) (3 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). Question Completion Status: Question (5): The following data are taken from the records of XYZ Islamic Bank for year 1 (in millions $). (Marks:6) Cash and cash equivalent 10,000 Murabaha financing 50,000 Musharaka financing 20,000 jarah rental receivables 8,000 Securities for investment 5,000 Securities for trading 6,000 Property and equipment 15,000 Customers' current accounts 80,000 Customers' restricted investment accounts 200,000 Customers' unrestricted investment accounts 110,000 Payables due to be paid during the next financial period 20,000 Long term liabilities 30,000 Net income 30,000 Income from restricted investment account funds 10,000 Income from financing 40,000 Danuirads from th Long term liabilities Net income Income from restricted investment account funds Income from financing 30,000 30,000 10,000 40,000 Required: From the given information calculate the following 1. Current ratio 2. Return on asset 3. Return on restricted investment account deposits or the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

i Claculation of current net income EPS Net Income EBIT 1tax rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started