Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, just a reminder that I need all of these answers solved as someone didn't answer four of them instead the person did only one.

Hi, just a reminder that I need all of these answers solved as someone didn't answer four of them instead the person did only one. As cheggs rule in one paper you can answer four. Thank you, much appreciated.

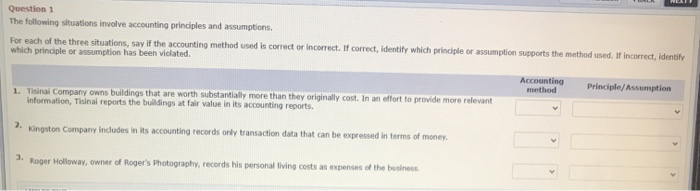

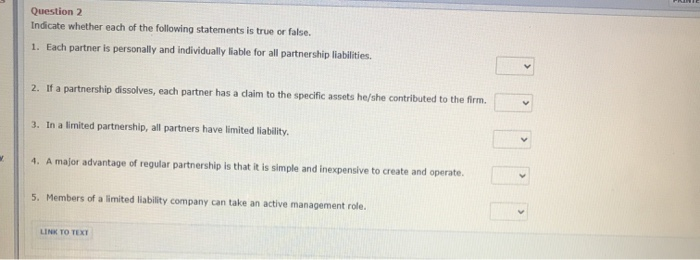

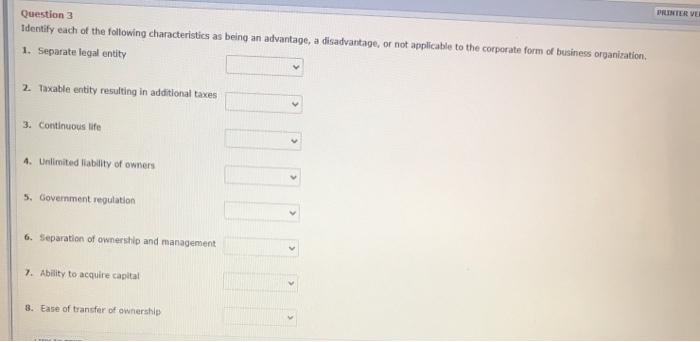

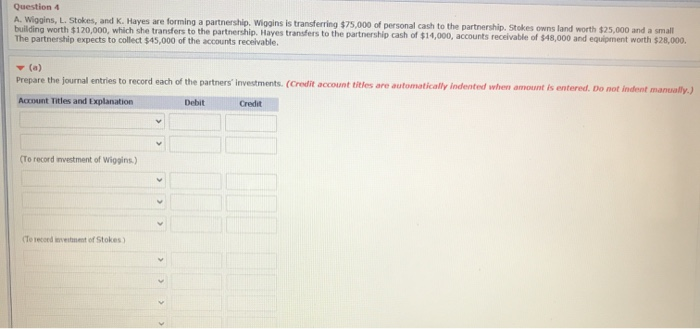

NET Question 1 The following situations involve accounting principles and assumptions. For each of the three situations, say if the accounting method used is correct or incorrect. If correct, Identify which principle or assumption supports the method used. If incorrect, identify which principle or assumption has been violated. Accounting method Principle/Assumption 1. Tisina Company owns buildings that are worth substantially more than the originally cost. In an effort to provide more relevant information, Tisinal reports the buildings at fair value in its accounting reports. 2. Kingston Company includes in its accounting records only transaction data that can be expressed in terms of money. Roger Holloway, owner of Roger's Photography, records his personal living costs as expenses of the business Question 2 Indicate whether each of the following statements is true or false. 1. Each partner is personally and individually liable for all partnership liabilities. 2. If a partnership dissolves, each partner has a claim to the specific assets he/she contributed to the firm. C 3. In a limited partnership, all partners have limited liability. 5. Members of a limited liability company can take an active management role. LINK TO TEXT PRINTER VED Question 3 Identify each of the following characteristics as being an advantage, a disadvantage, or not applicable to the corporate form of business organization. 1. Separate legal entity 2. Taxable entity resulting in additional taxes 3. Continuous life 4. Unlimited liability of owners 5. Government regulation 6. Separation of ownership and management 7. Ability to acquire capital 3. Ease of transfer of ownership Question 4 A. Wiggins, L. Stokes, and K. Hayes are forming a partnership. Wiggins is transferring $75,000 of personal cash to the partnership. Stokes owns land worth $25,000 and a small building worth $120,000, which she transfers to the partnership. Hayes transfers to the partnership cash of $14,000, accounts receivable of $48,000 and equipment worth $28,000. The partnership expects to collect $45,000 of the accounts receivable. (a) Prepare the journal entries to record each of the partners investments. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Credit Account Titles and Explanation Debit (To record investment of Wiggins.) (To record of Stokes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started